Climate Change: A Growing Factor In Home Loan Approvals

Table of Contents

Increased Risk Assessments & Due Diligence

Lenders are increasingly incorporating climate risk into their assessments, shifting from a purely financial evaluation to a more holistic approach that considers environmental factors. This heightened due diligence aims to minimize potential losses from climate-related events.

-

Flood risk assessments: Lenders now rely on updated flood maps and sophisticated hydrological models to accurately assess the flood risk of properties. These models often incorporate projections of future sea-level rise and increased rainfall intensity. Properties located in high-risk flood zones face stricter lending criteria or higher interest rates.

-

Wildfire risk analysis: The proximity of a property to high-risk wildfire zones is becoming a critical factor in loan approvals. Lenders utilize advanced mapping tools and fire history data to determine the risk of wildfire damage. Properties located in or near high-risk areas may require additional mitigation measures or face higher premiums on homeowner's insurance, potentially impacting loan-to-value ratios (LTV).

-

Extreme weather event scrutiny: Properties situated in areas prone to hurricanes, droughts, tornadoes, or other severe weather events are subjected to more rigorous scrutiny. Lenders assess the historical frequency and intensity of these events, considering the potential for property damage and the resulting financial implications.

-

Homeowner's insurance premiums: The escalating costs of homeowner's insurance in high-risk areas due to climate change are impacting loan approvals. Lenders often require proof of adequate insurance coverage, and the high premiums can affect the borrower's ability to secure a loan. This creates a significant barrier for homebuyers in climate-vulnerable locations. The impact on loan approval rates and LTV in high-risk areas is substantial, with many lenders tightening their lending criteria or refusing loans altogether.

Property Values and Depreciation

Climate change is significantly affecting property values, particularly in areas frequently impacted by natural disasters. This depreciation presents challenges for both homeowners and lenders.

-

Decreased property values: Properties located in floodplains, wildfire-prone areas, or regions susceptible to extreme weather events are experiencing a decline in value. The perception of increased risk deters potential buyers and impacts property appraisals.

-

Difficult sales: Selling properties in high-risk zones has become increasingly difficult. Buyers are more hesitant to purchase homes with significant climate-related risks, leading to longer sales periods and lower sale prices.

-

Climate-related damage impact on appraisals: Property appraisals now factor in the potential for future climate-related damage. This means that properties with a high risk of flooding, wildfire damage, or other climate-related threats receive lower appraisals, potentially affecting loan amounts and LTV ratios.

-

Real estate market stability: Climate change is introducing uncertainty and instability into the real estate market, making it more challenging for lenders to assess risk and make informed lending decisions. The overall stability of the market is increasingly linked to climate resilience. This uncertainty directly impacts lenders' willingness to provide loans, particularly in high-risk areas.

Government Regulations and Disclosure Requirements

Governments worldwide are increasingly recognizing the importance of climate risk disclosure and are implementing regulations to address this issue. These regulations are changing the landscape of home loan approvals.

-

Mandatory climate risk disclosures: Many jurisdictions are introducing mandatory climate risk disclosures for both lenders and borrowers, requiring transparent communication about the potential risks associated with a property's location and susceptibility to climate-related hazards.

-

Stricter building codes and regulations: New building codes and stricter regulations are being implemented for construction in high-risk areas, promoting climate resilience and reducing future damage. These measures may impact construction costs and loan amounts.

-

Government initiatives for climate resilience: Various government initiatives are emerging to support climate resilience in the housing sector, including financial incentives for climate adaptation measures and investments in infrastructure upgrades.

-

Impact on loan application processes: These regulations are influencing loan application processes and approvals. Lenders are now required to collect and assess climate-related information, increasing the complexity and length of the loan approval process. The future of home loan approvals will be significantly shaped by these regulatory changes, pushing towards a more climate-conscious lending environment.

Opportunities for Green Mortgages and Sustainable Housing

The growing awareness of climate change is driving increased demand for green mortgages and sustainable housing, creating new opportunities within the mortgage industry.

-

Lower interest rates for energy-efficient homes: Many lenders offer lower interest rates for energy-efficient homes, incentivizing borrowers to choose sustainable housing options.

-

Government grants and subsidies: Government grants and subsidies are available for sustainable home improvements, making eco-friendly upgrades more accessible and affordable.

-

Increased demand for green certifications: The demand for green certifications, such as LEED (Leadership in Energy and Environmental Design) certification, is growing, reflecting a preference for sustainable and environmentally responsible housing.

-

Higher property values in green communities: Properties located in green and sustainable communities are likely to maintain or increase their value over time, due to the growing demand for environmentally conscious living. These initiatives are not only promoting sustainability but also influencing loan approvals and the overall housing market, making green mortgages increasingly prevalent.

Conclusion

Climate change is undeniably influencing home loan approvals, impacting risk assessments, property values, and regulatory landscapes. Lenders are adopting more stringent due diligence practices, incorporating climate-related risks into their evaluations. Property values are affected by climate vulnerability, and government regulations are pushing for increased transparency and climate-conscious lending. However, opportunities also exist through green mortgages and incentives for sustainable housing. Understanding the impact of climate change on home loan approvals is crucial for making informed decisions about your future home. Research climate risks in your area and explore options for green mortgages to ensure a secure and sustainable future. Learn more about how climate change affects your home loan approval process and make responsible choices for a resilient future.

Featured Posts

-

Maltraitance Et Abus Sexuels Presumes La Fieldview Care Home Au C Ur D Une Controverse

May 20, 2025

Maltraitance Et Abus Sexuels Presumes La Fieldview Care Home Au C Ur D Une Controverse

May 20, 2025 -

Michael Schumacher Helicoptero Mallorca Suiza Y Una Visita Especial

May 20, 2025

Michael Schumacher Helicoptero Mallorca Suiza Y Una Visita Especial

May 20, 2025 -

Ihyae Ajatha Krysty Aldhkae Alastnaey Walktabt Alibdaeyt

May 20, 2025

Ihyae Ajatha Krysty Aldhkae Alastnaey Walktabt Alibdaeyt

May 20, 2025 -

Jennifer Lawrence Moeder Voor De Tweede Keer

May 20, 2025

Jennifer Lawrence Moeder Voor De Tweede Keer

May 20, 2025 -

March 22 Nyt Mini Crossword Complete Solutions

May 20, 2025

March 22 Nyt Mini Crossword Complete Solutions

May 20, 2025

Latest Posts

-

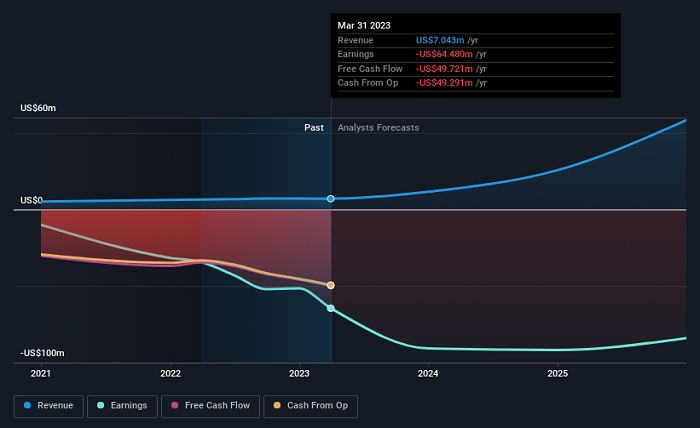

Understanding The 2025 Market Downturn For D Wave Quantum Inc Qbts

May 20, 2025

Understanding The 2025 Market Downturn For D Wave Quantum Inc Qbts

May 20, 2025 -

D Wave Quantum Inc Qbts Deciphering The 2025 Stock Market Plunge

May 20, 2025

D Wave Quantum Inc Qbts Deciphering The 2025 Stock Market Plunge

May 20, 2025 -

Investigating The Reasons Behind D Wave Quantum Qbts S Monday Stock Decrease

May 20, 2025

Investigating The Reasons Behind D Wave Quantum Qbts S Monday Stock Decrease

May 20, 2025 -

The 2025 D Wave Quantum Qbts Stock Market Performance A Comprehensive Review

May 20, 2025

The 2025 D Wave Quantum Qbts Stock Market Performance A Comprehensive Review

May 20, 2025 -

Market Analysis D Wave Quantum Qbts Stocks Monday Performance

May 20, 2025

Market Analysis D Wave Quantum Qbts Stocks Monday Performance

May 20, 2025