Home Depot's Earnings: Disappointing Results, Tariff Guidance Remains

Table of Contents

Disappointing Financial Performance

Home Depot's Q[Quarter] earnings report painted a picture of a company facing headwinds in a changing market. The underwhelming results raise concerns about the overall health of the home improvement sector and the resilience of consumer spending.

Lower-Than-Expected Earnings Per Share (EPS)

Home Depot reported an EPS of [Insert Actual EPS Figure], significantly below the analyst consensus estimate of [Insert Analyst Estimate]. This represents a [Percentage] decrease compared to the same quarter last year and a [Percentage] decrease compared to the previous quarter. Several factors contributed to this shortfall:

- Decreased Consumer Spending: A slowdown in consumer discretionary spending, potentially driven by economic uncertainty and inflation, impacted sales across various product categories.

- Increased Competition: Intense competition from other home improvement retailers and online marketplaces continues to pressure profit margins.

- Supply Chain Disruptions: Ongoing supply chain challenges, including delays and increased costs for certain materials, negatively affected profitability.

- Underperformance in Specific Segments: [Mention specific product categories or departments that underperformed, e.g., lumber, appliances]. This suggests a need for a reassessment of inventory management and marketing strategies.

Revenue Growth Slowdown

Home Depot's revenue growth also fell short of expectations, reaching [Insert Actual Revenue Figure], compared to [Insert Previous Quarter/Year Revenue Figure]. This represents a growth rate of [Percentage], significantly lower than the anticipated [Percentage] growth. A closer look at the sales channels reveals:

- Online Sales Growth Slowdown: While online sales continue to contribute significantly, their growth rate has decelerated, indicating a potential saturation in the online market segment.

- In-Store Sales Decline: In-store sales experienced a notable decline, reflecting the changing shopping habits of consumers and the impact of e-commerce.

- Weak Sales in Key Product Categories: Sales in [Mention specific categories] underperformed, highlighting the challenges in specific market segments.

Impact of Tariffs and Trade Wars

The ongoing uncertainty surrounding tariffs and trade wars continues to significantly impact Home Depot's operations and financial performance.

Tariff Guidance and Uncertainty

Home Depot's management acknowledged the significant uncertainty surrounding tariffs and their potential impact on future earnings. The company stated that [Insert direct quote from management regarding tariffs and their strategy to mitigate the impact].

- Increased Input Costs: Tariffs on imported goods have led to increased input costs for various products, squeezing profit margins.

- Supply Chain Disruptions: Tariffs have exacerbated existing supply chain challenges, causing delays and shortages of certain products.

- Long-Term Uncertainty: The lack of clarity regarding future tariff policies creates significant uncertainty in planning and investment decisions.

Pricing Strategies and Consumer Behavior

In response to increased input costs resulting from tariffs, Home Depot has implemented [Mention specific price adjustment strategies]. This has led to:

- Price Increases: The company has adjusted prices on certain products to offset increased costs.

- Consumer Pushback: Consumers are reacting to price increases by delaying purchases or seeking cheaper alternatives, impacting sales volume.

- Reduced Profit Margins: Despite price adjustments, profit margins are still being squeezed due to higher input costs and increased competition.

Future Outlook and Stock Market Reaction

The disappointing Q[Quarter] results have raised concerns about Home Depot's future prospects.

Management Commentary and Guidance

Home Depot's management offered a cautiously optimistic outlook for the coming quarters, stating that [Insert direct quote from management regarding future prospects]. They anticipate [mention projected growth rate or specific plans].

- Revised Financial Guidance: The company has revised its financial guidance for the [mention timeframe], reflecting the challenges faced in the current market environment.

- Strategic Adjustments: Home Depot is exploring various strategic adjustments, including [mention any initiatives], to mitigate the impact of the headwinds and improve future performance.

Stock Market Response

The market reacted negatively to the earnings report, with Home Depot's stock price experiencing a [Percentage] decline on [Date]. This reflects investor concerns about the company's future performance and the ongoing challenges in the retail sector.

- Analyst Downgrades: Several analysts downgraded their ratings for Home Depot's stock following the release of the earnings report.

- Investor Sentiment: Investor sentiment towards Home Depot has turned cautious, reflecting the uncertainty surrounding the company's future prospects.

Conclusion

Home Depot's Q[Quarter] earnings report revealed disappointing results, marked by lower-than-expected EPS and slower revenue growth. The impact of tariffs, coupled with decreased consumer spending and increased competition, significantly contributed to this underperformance. While management expressed a cautiously optimistic outlook, the ongoing uncertainty surrounding tariffs and the broader economic climate poses significant challenges. To stay informed about Home Depot's financial performance and the evolving retail landscape, subscribe to our newsletter for further updates on Home Depot's future prospects and the impact of tariffs on Home Depot’s financial health.

Featured Posts

-

Abn Amro Analyse Van De Toename In Occasionverkoop En De Rol Van Autobezit

May 22, 2025

Abn Amro Analyse Van De Toename In Occasionverkoop En De Rol Van Autobezit

May 22, 2025 -

Traders Pare Bets On Boe Cuts Pound Rises After Uk Inflation Data

May 22, 2025

Traders Pare Bets On Boe Cuts Pound Rises After Uk Inflation Data

May 22, 2025 -

Jail Sentence For Mother Following Southport Stabbing Tweet No Home Release

May 22, 2025

Jail Sentence For Mother Following Southport Stabbing Tweet No Home Release

May 22, 2025 -

Marche Du Travail Des Cordistes A Nantes Analyse De La Croissance

May 22, 2025

Marche Du Travail Des Cordistes A Nantes Analyse De La Croissance

May 22, 2025 -

Analyse Abn Amro Heffingen Treffen Voedselexport Naar Verenigde Staten

May 22, 2025

Analyse Abn Amro Heffingen Treffen Voedselexport Naar Verenigde Staten

May 22, 2025

Latest Posts

-

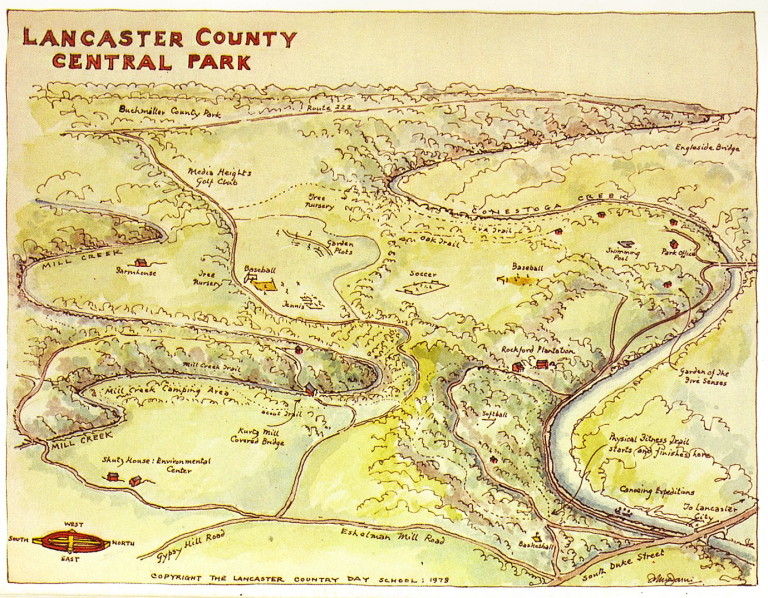

Report Two Cows Loose In Lancaster County Park

May 22, 2025

Report Two Cows Loose In Lancaster County Park

May 22, 2025 -

Lancaster County Crash Pilot And Son Released From Burn Center

May 22, 2025

Lancaster County Crash Pilot And Son Released From Burn Center

May 22, 2025 -

Pilot Son Severely Injured In Lancaster County Crash Released From Lehigh Valley Burn Center

May 22, 2025

Pilot Son Severely Injured In Lancaster County Crash Released From Lehigh Valley Burn Center

May 22, 2025 -

Lancaster County Park Cow Escape Location And Updates

May 22, 2025

Lancaster County Park Cow Escape Location And Updates

May 22, 2025 -

York County Pa Firefighters Battle Two Alarm Blaze Property Loss And Investigation

May 22, 2025

York County Pa Firefighters Battle Two Alarm Blaze Property Loss And Investigation

May 22, 2025