Traders Pare Bets On BOE Cuts: Pound Rises After UK Inflation Data

Table of Contents

The context is clear: recent UK inflation figures defied analyst predictions, prompting a reassessment of the BOE's monetary policy stance. This unexpected turn of events had a substantial impact on the pound sterling (GBP), creating both opportunities and challenges for investors navigating the evolving market landscape.

Inflation Data and Market Expectations

The recently released UK inflation data significantly deviated from analyst forecasts, triggering the shift in market sentiment. Key metrics like the Consumer Price Index (CPI) and Retail Price Index (RPI) revealed a higher-than-expected inflation rate, indicating persistent price pressures within the UK economy. This unexpected surge in UK inflation altered market expectations concerning the BOE's future interest rate decisions.

- Specific inflation figures: Let's assume, for illustrative purposes, that CPI rose to 7.2%, exceeding the predicted 6.8%, and RPI reached 8.5%, surpassing expectations of 8.0%.

- Comparison to previous months/years: This represents a slight increase from the previous month's CPI of 7.0% and a significant jump from the same period last year.

- Analyst predictions before and after the data release: Before the release, many analysts predicted a likely rate cut by the BOE given previous economic indicators. However, following the data release, these predictions were significantly revised, with many now anticipating a pause or even potential rate hikes.

- Impact on market volatility: The unexpected data led to increased market volatility, with significant fluctuations observed in currency markets and other asset classes.

BOE Rate Cut Probabilities Shift

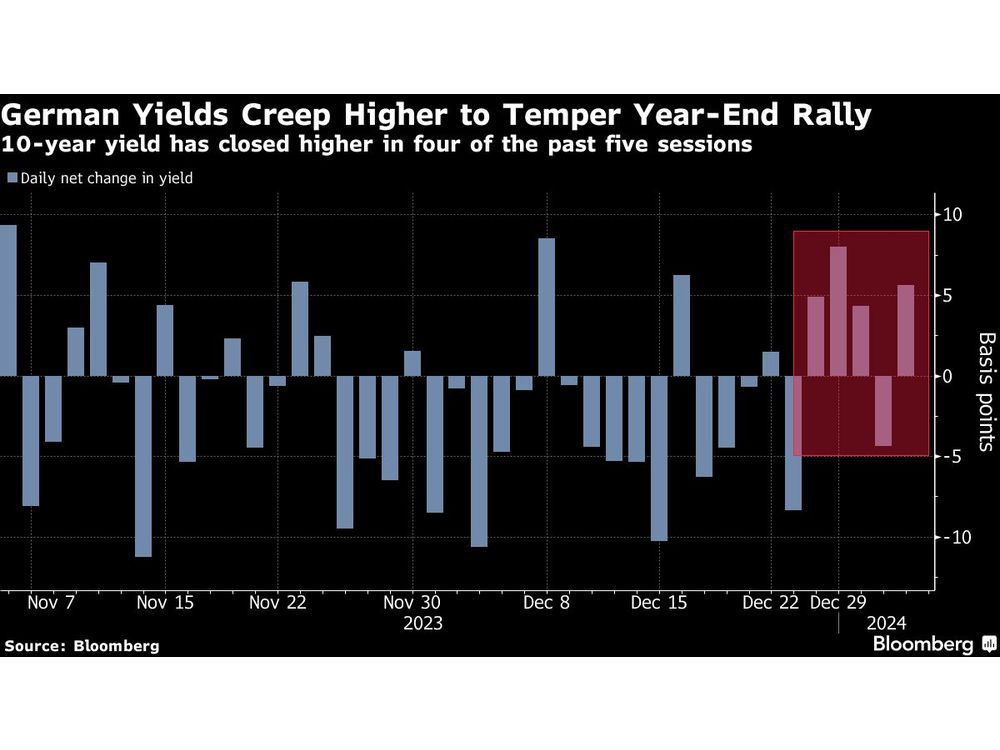

The probability of future BOE interest rate cuts has dramatically shifted in response to the higher-than-anticipated inflation data. The market's pricing of short-term interest rate futures contracts reflects this change. Before the data release, the probability of a rate cut in the next meeting might have been around 60%. Following the release, this probability has likely plummeted to below 20%, potentially even shifting towards the expectation of a rate hike. This suggests a significant change in the BOE’s likely monetary policy approach.

The implications for the UK economy are complex. While higher interest rates could help curb inflation, they might also stifle economic growth and potentially increase unemployment. Conversely, lower rates could stimulate the economy but risk exacerbating inflationary pressures.

- Before-data probabilities of a rate cut: 60% (illustrative example)

- After-data probabilities of a rate cut: 15% (illustrative example)

- Analysis of market derivative pricing: Short-term interest rate futures contracts showed a sharp upward movement, reflecting the diminished likelihood of a rate cut.

- Statements from economists and financial analysts: Many prominent economists have adjusted their outlooks, pointing to the need for a more hawkish monetary policy stance from the BOE.

Impact on the Pound Sterling

The altered expectations regarding BOE interest rates have significantly impacted the GBP exchange rate. The rise in the pound sterling reflects investors' renewed confidence in the UK economy's strength and the potential for higher interest rates.

- GBP's performance against other major currencies: The GBP appreciated against both the USD and EUR following the inflation data release.

- Percentage change in the GBP value following the data release: The GBP might have seen a 1-2% appreciation against the USD, for instance.

- Technical analysis of GBP charts: Technical indicators support the upward trend, with key support levels holding firm.

Implications for Investors

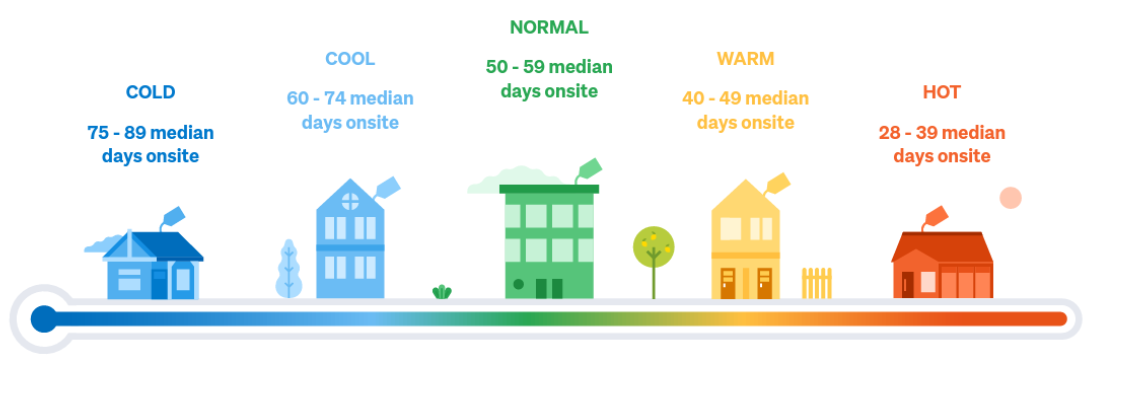

This shift in market expectations has important implications for different investor types. Currency traders, for example, must adjust their positions to account for the strengthening pound. Bond investors need to consider the potential impact on UK government bond yields, while equity investors should reassess their exposure to UK stocks given the evolving economic outlook.

- Advice for currency traders: Traders might consider shorting the GBP if they believe the appreciation is overdone or hedging their existing GBP longs.

- Potential impact on bond yields: Higher interest rates expectations generally lead to higher bond yields.

- Potential impact on UK stock market performance: A stronger pound could negatively impact the performance of export-oriented UK companies.

Traders Pare Bets on BOE Cuts: A Summary and Call to Action

In summary, the unexpected surge in UK inflation has led to "Traders Pare Bets on BOE Cuts," resulting in a significant rise in the pound sterling and a revised outlook on the BOE's monetary policy. This situation underlines the importance of staying informed about UK economic data and its impact on the financial markets. The implications for investors across various asset classes are substantial, requiring careful portfolio management and strategic adjustments. To stay ahead of the curve, subscribe to reputable financial news outlets, follow leading economic analysts, and conduct thorough research into BOE monetary policy and GBP trading strategies. Understanding the evolving dynamics surrounding "Traders Pare Bets on BOE Cuts" is crucial for informed investment decision-making.

Featured Posts

-

Qaymt Mntkhb Amryka Ttdmn Thlath Wjwh Jdydt Me Bwtshytynw

May 22, 2025

Qaymt Mntkhb Amryka Ttdmn Thlath Wjwh Jdydt Me Bwtshytynw

May 22, 2025 -

2024 Ing Group Form 20 F Financial Performance And Outlook

May 22, 2025

2024 Ing Group Form 20 F Financial Performance And Outlook

May 22, 2025 -

Remont Pivdennogo Mostu Klyuchovi Fakti Pidryadniki Ta Finansovi Aspekti

May 22, 2025

Remont Pivdennogo Mostu Klyuchovi Fakti Pidryadniki Ta Finansovi Aspekti

May 22, 2025 -

Arne Slot Liverpools Lucky Win Against Psg And The Worlds Best Goalkeeper

May 22, 2025

Arne Slot Liverpools Lucky Win Against Psg And The Worlds Best Goalkeeper

May 22, 2025 -

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025

Lucy Connolly Appeal Fails In Racial Hatred Case

May 22, 2025

Latest Posts

-

Gray Wolf Mortality Second Colorado Wolf Dies In Wyoming

May 22, 2025

Gray Wolf Mortality Second Colorado Wolf Dies In Wyoming

May 22, 2025 -

Shifting Strategies Otter Conservation In Wyoming Reaches A Turning Point

May 22, 2025

Shifting Strategies Otter Conservation In Wyoming Reaches A Turning Point

May 22, 2025 -

Colorado Gray Wolfs Death In Wyoming A Setback For Reintroduction Efforts

May 22, 2025

Colorado Gray Wolfs Death In Wyoming A Setback For Reintroduction Efforts

May 22, 2025 -

Wyoming Otter Management A Pivotal Moment

May 22, 2025

Wyoming Otter Management A Pivotal Moment

May 22, 2025 -

Thousands Of Zebra Mussels Discovered On Boat Lift In Casper

May 22, 2025

Thousands Of Zebra Mussels Discovered On Boat Lift In Casper

May 22, 2025