How Did Donald Trump's First 100 Days Impact Elon Musk's Net Worth?

Table of Contents

Trump's Economic Policies and Their Initial Market Reactions

Trump's campaign promises of deregulation and tax cuts sent ripples through the financial world, impacting businesses across sectors, including Musk's ventures. Let's dissect the potential ramifications.

Deregulation and its Effect on SpaceX and Tesla

Trump's focus on deregulation potentially offered significant benefits to both SpaceX and Tesla.

- Environmental Regulations: Easing environmental regulations could have reduced production costs for Tesla's electric vehicles, potentially boosting profits and increasing Musk's net worth. Reduced bureaucratic hurdles might also have sped up SpaceX's launch schedules.

- Market Reactions: The initial market reaction to deregulation announcements was largely positive, reflected in a rise in Tesla's stock price during parts of this period. However, the long-term effects were more complex and varied.

- Tesla Stock Performance: While Tesla's stock experienced fluctuations throughout Trump's first 100 days, the overall trend during this period can be analyzed to gauge the initial impact of these policies. (Specific data on Tesla stock performance during this period would be included here, sourced from reputable financial websites.)

Tax Cuts and Corporate Benefits

The proposed tax cuts were another significant policy shift.

- Investment and Expansion: Lower corporate tax rates could have incentivized further investment in Tesla's expansion plans, including new Gigafactories and research and development for both Tesla and SpaceX. This, in turn, could have positively affected Musk's net worth.

- Corporate Tax Rates: The corporate tax rate under the Trump administration was reduced from 35% to 21%, a substantial change that impacted many corporations, including Tesla and SpaceX. (Include data on the exact tax rates and their effective dates.)

- Potential Downsides: While tax cuts generally benefit corporations, the long-term implications, including potential impacts on government spending and social programs, were debated extensively and could have indirect negative consequences.

Geopolitical Events and Their Influence on Musk's Businesses

Trump's approach to international relations also had a significant impact on Musk's businesses.

International Trade Relations and Tesla's Global Market

Trump's imposition of tariffs and initiation of trade wars created uncertainty in the global market.

- Supply Chain Disruptions: Tariffs on imported materials could have increased Tesla's production costs, potentially offsetting the benefits of deregulation. Trade disputes with key markets impacted Tesla's sales in certain regions. (Specific examples of trade disputes affecting Tesla should be included here, along with sourced data.)

- Market Response to Uncertainty: The stock market's reaction to trade tensions was often negative, impacting the valuations of companies with significant international operations, such as Tesla.

- Sales and Manufacturing Impacts: Detailed analysis of Tesla's sales figures and production numbers in specific countries during this period could be incorporated to show the concrete effects of trade policies.

SpaceX and International Space Cooperation

Trump's administration's stance on international space cooperation also played a role.

- NASA Contracts: Changes in NASA's funding priorities or altered approaches to international partnerships could have influenced SpaceX's contracts and future prospects. (Details on NASA funding and SpaceX contracts should be incorporated here.)

- International Collaboration: The Trump administration's emphasis on "America First" could have affected SpaceX's collaborations with international space agencies. (Cite news articles or official statements regarding any changes in international space collaboration.)

Overall Market Volatility and its Impact

Trump's presidency, from the outset, was marked by significant market volatility.

The Broader Impact of Trump's Presidency on Market Sentiment

The uncertainty surrounding Trump's policies created volatility in the stock market.

- Investor Confidence: Investor confidence in high-growth technology companies, including Tesla, was susceptible to shifts in market sentiment caused by political developments. (Data comparing market volatility during this period to previous periods should be included here.)

- Market Fluctuations: Explain how unrelated market fluctuations could have impacted Musk's net worth beyond the direct effects of specific Trump policies.

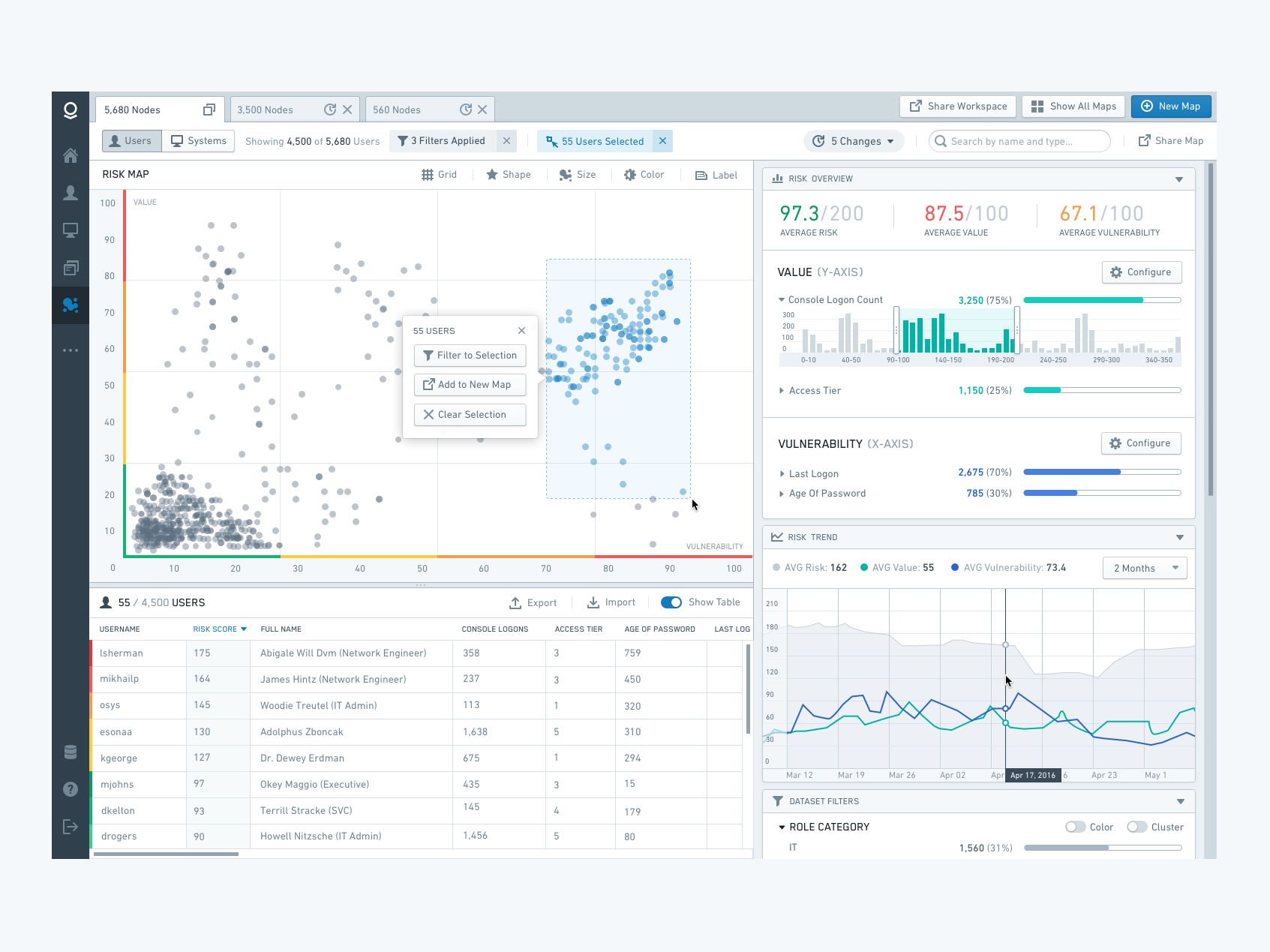

Analyzing the Net Worth Fluctuations

To quantify the impact, we need to analyze Musk's net worth during this critical period.

- Numerical Changes: (Include specific data showing the changes in Musk's net worth during Trump's first 100 days, using reputable financial sources. This should be broken down to show the potential contributions of various factors.)

- Visual Representation: (Include charts or graphs visualizing the fluctuations in Musk's net worth, making the data more accessible to the reader.)

Conclusion

Analyzing the impact of Donald Trump's first 100 days on Elon Musk's net worth reveals a complex picture. While deregulation and potential tax cuts could have offered benefits, trade tensions and general market volatility presented countervailing pressures. The ultimate effect was a combination of positive and negative influences, making it difficult to isolate the exact contribution of Trump's policies. To gain a deeper understanding, further research into the detailed financial performance of Tesla and SpaceX during this period, coupled with analyses of broader market trends and geopolitical developments, is crucial. Continue your exploration by researching the impact of Donald Trump's presidency on Elon Musk's net worth and the broader implications of this dynamic relationship between political policy and the fortunes of major corporations. The unpredictable nature of this interaction underscores the importance of ongoing analysis of these complex dynamics.

Featured Posts

-

Informatsiya O Zakrytii Aeroporta Permi Iz Za Snegopada

May 09, 2025

Informatsiya O Zakrytii Aeroporta Permi Iz Za Snegopada

May 09, 2025 -

Months Of Warnings Air Traffic Controllers And The Newark System Failure

May 09, 2025

Months Of Warnings Air Traffic Controllers And The Newark System Failure

May 09, 2025 -

Aeroport Permi Zakryt Snegopad Do 4 00

May 09, 2025

Aeroport Permi Zakryt Snegopad Do 4 00

May 09, 2025 -

The High Cost Of Childcare One Mans 3 K Babysitting And 3 6 K Daycare Story

May 09, 2025

The High Cost Of Childcare One Mans 3 K Babysitting And 3 6 K Daycare Story

May 09, 2025 -

Investing In Palantir Before May 5th A Risk Assessment

May 09, 2025

Investing In Palantir Before May 5th A Risk Assessment

May 09, 2025