Investing In Palantir Before May 5th: A Risk Assessment

Table of Contents

Palantir's Current Market Position and Recent Performance

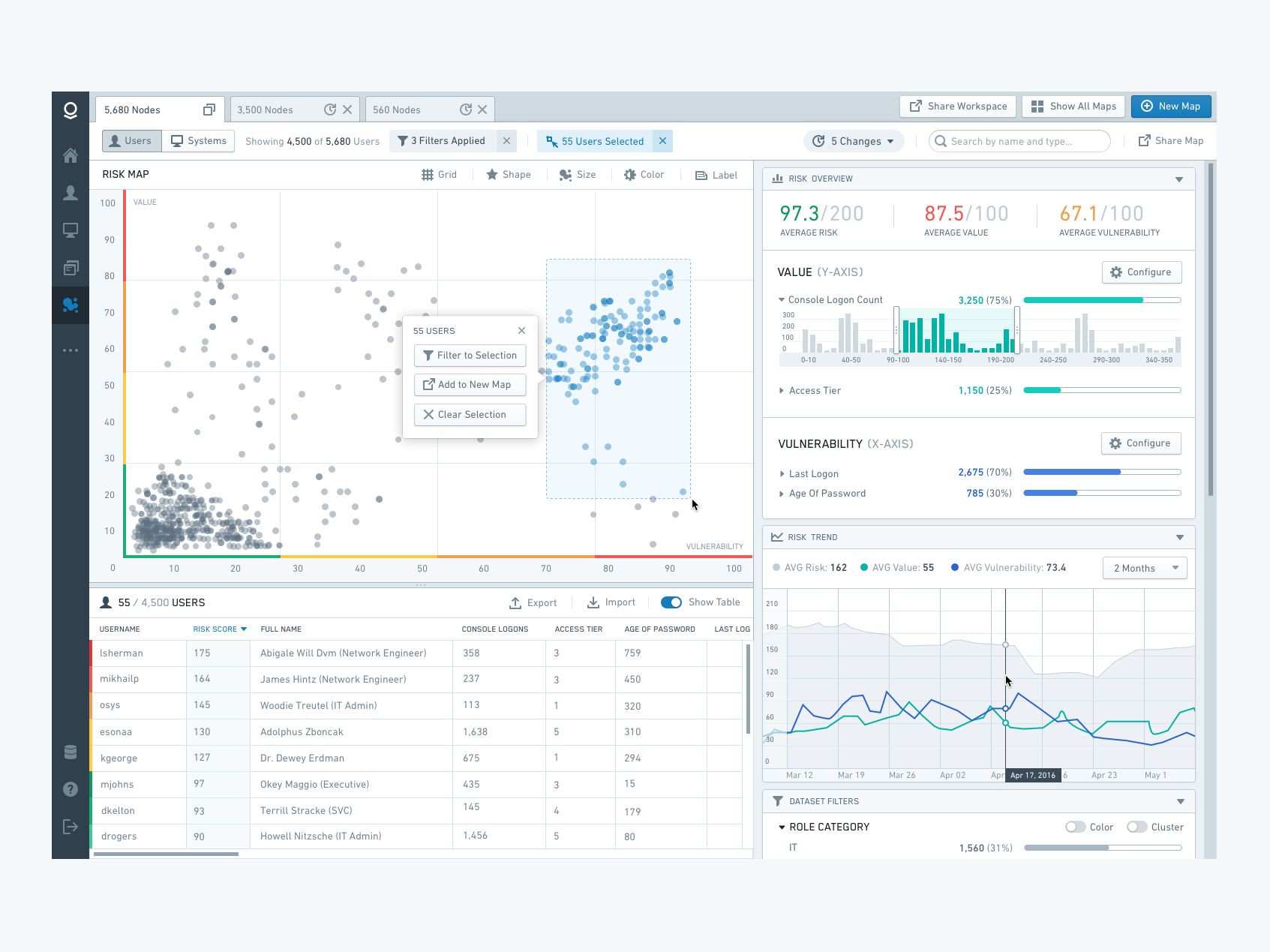

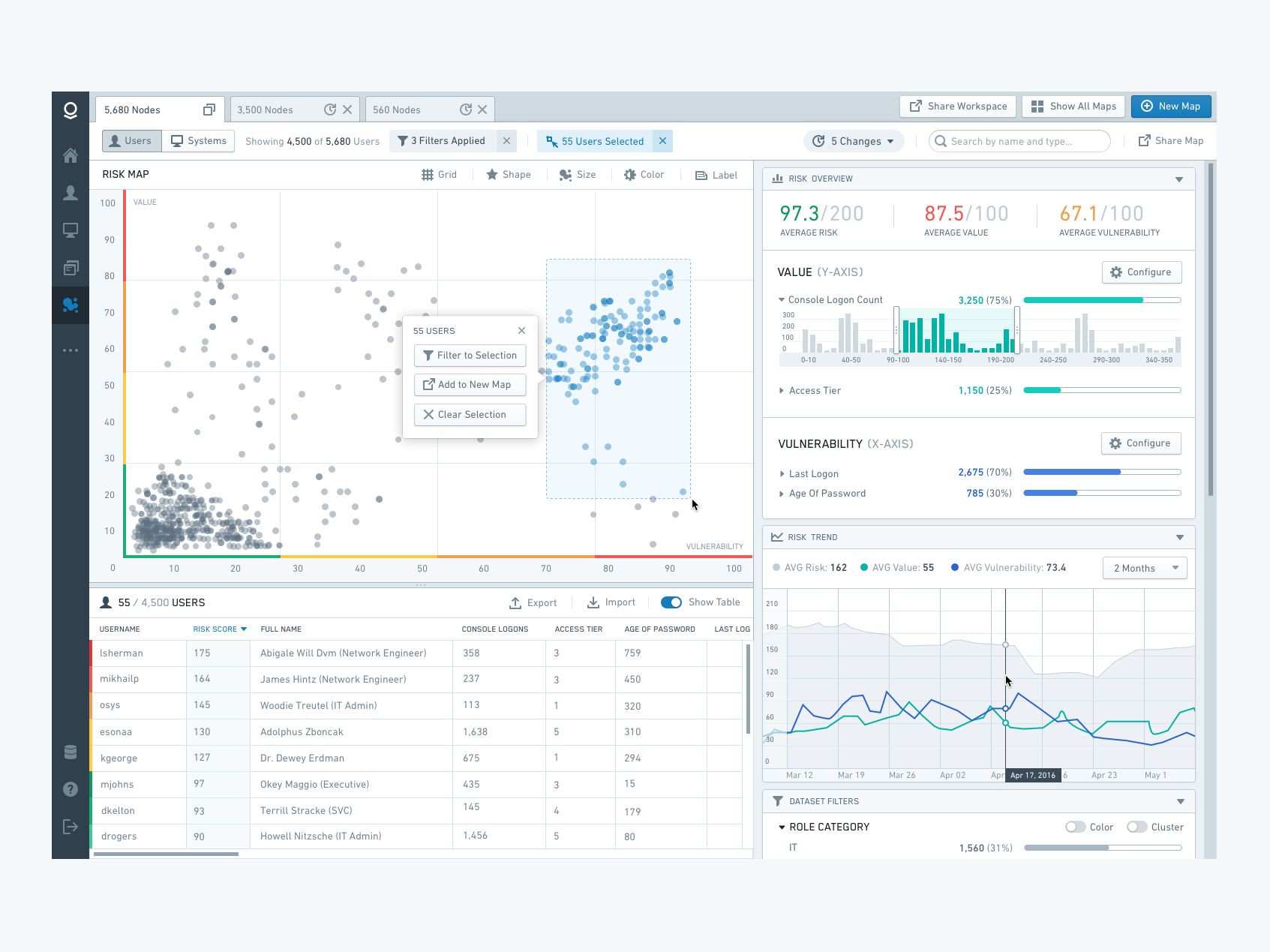

Palantir's stock price (PLTR) has seen considerable volatility. To properly assess the investment risk, we need to analyze Palantir's recent financial performance and market position.

-

Analyzing Palantir's Financials: Recent financial reports reveal insights into Palantir's revenue growth and profitability. While revenue has shown growth, profitability remains a key area of focus for investors. Examining the quarterly earnings calls and SEC filings provides a detailed understanding of the company's financial health. Growth in specific sectors, like commercial sales, offers clues about future performance.

-

Market Share and Competition: Palantir operates in the competitive data analytics and government contracting sectors. Analyzing its market share against competitors like AWS, Google Cloud, and Microsoft Azure is crucial. The company's success hinges on maintaining a strong competitive edge through innovation and strategic partnerships.

-

Impact of Recent News and Events: Recent news, such as new contract wins, product launches, or shifts in government policy, can significantly impact Palantir's stock price. Staying informed about relevant news and events is essential for informed investment decisions.

-

Analyst Ratings and Price Targets: Examining analyst ratings and price targets from reputable financial institutions offers another perspective on the potential future performance of PLTR stock. These predictions should be considered alongside your own research. Remember, these are opinions, not guarantees. A consensus among analysts may signal a stronger signal, but diversification of analysis is key.

Understanding the Risks Involved in Investing in Palantir

Investing in Palantir, like any stock, involves inherent risks. A thorough risk assessment is critical before committing capital.

-

Volatility of PLTR Stock: Palantir's stock price has demonstrated considerable volatility in the past. This means the price can fluctuate significantly in short periods, creating both opportunities and substantial risks for investors. Be prepared for significant price swings.

-

Competitive Landscape: The data analytics market is highly competitive. Palantir faces competition from established tech giants with deep pockets and extensive resources. Maintaining its competitive edge requires continuous innovation and strategic adaptations.

-

Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts. This dependence creates risks associated with government budget cuts, changing priorities, and potential regulatory hurdles. Diversification of revenue streams is crucial for future stability.

-

Financial Uncertainties: Like many growth companies, Palantir faces financial uncertainties, including the need for consistent growth to justify its valuation. Unexpected economic downturns or shifts in the market could negatively impact its financial performance.

Analyzing the Potential Upside of a Palantir Investment

Despite the risks, Palantir's potential upside is substantial due to its focus on crucial technologies and expansion into rapidly growing markets.

-

Growth Potential in Data Analytics: The data analytics market is experiencing explosive growth, and Palantir is well-positioned to benefit from this trend. The company’s platform offers solutions to a wide range of industries, providing opportunities for growth in both the public and private sectors.

-

Innovative Technologies: Palantir's innovative technologies, including its artificial intelligence capabilities, offer the potential to disrupt the data analytics industry. Continuous innovation is essential for maintaining a strong competitive edge in this rapidly evolving landscape.

-

Increased Government Spending: Increased government spending on defense and intelligence could positively impact Palantir's revenue. This is a significant factor to consider in assessing its long-term growth trajectory.

-

Expansion into New Markets: Palantir has the potential to expand into new markets and sectors, further diversifying its revenue streams and reducing its reliance on any single market segment. This strategy mitigates risks while creating new growth opportunities.

The Significance of the May 5th Date (and Beyond)

While May 5th itself might not be a specific event, it serves as a reminder that the market is dynamic. Investors should always consider the broader context of their investment decisions.

-

Upcoming News and Events: Keep an eye out for any upcoming news or events that might influence Palantir's stock price. This could include earnings reports, product announcements, or changes in the regulatory environment. Any announcements regarding new partnerships or large-scale contract wins will impact investor sentiment.

-

Macroeconomic Factors: Broader macroeconomic factors, such as interest rate hikes, inflation, or global economic uncertainty, can significantly influence the stock market and affect Palantir's stock price. Understanding these trends is vital.

-

Geopolitical Events and Regulatory Changes: Geopolitical events and potential regulatory changes can also impact Palantir's stock price. This requires continuous monitoring of both the domestic and international political landscape.

Conclusion

Investing in Palantir before May 5th, or any time, requires careful consideration of the risks and rewards. While the company possesses significant growth potential in the rapidly expanding data analytics market, its stock price volatility, dependence on government contracts, and intense competition present considerable challenges. Conducting thorough research, understanding the intricacies of the PLTR stock, and perhaps consulting with a financial advisor are crucial steps before making any investment decisions. Make an informed decision about your Palantir investment today!

Featured Posts

-

Melanie Griffith And Dakota Johnson At The Materialists Film Premiere

May 09, 2025

Melanie Griffith And Dakota Johnson At The Materialists Film Premiere

May 09, 2025 -

Sensex Live Market Soars Nifty Reclaims 23 800 Sector Wise Analysis

May 09, 2025

Sensex Live Market Soars Nifty Reclaims 23 800 Sector Wise Analysis

May 09, 2025 -

Snegopad V Sverdlovskoy Oblasti 45 Tysyach Chelovek Bez Sveta

May 09, 2025

Snegopad V Sverdlovskoy Oblasti 45 Tysyach Chelovek Bez Sveta

May 09, 2025 -

Rio Ferdinands Champions League Prediction Who Wins

May 09, 2025

Rio Ferdinands Champions League Prediction Who Wins

May 09, 2025 -

Elon Musks Net Worth Below 300 Billion After Tesla And Tariff Setbacks

May 09, 2025

Elon Musks Net Worth Below 300 Billion After Tesla And Tariff Setbacks

May 09, 2025