How Front-Loading Protects Malaysian Exporters From Ringgit (MYR) Volatility

Table of Contents

Understanding Ringgit (MYR) Volatility and its Impact on Exporters

The MYR exchange rate is influenced by a complex interplay of factors, including global economic conditions, political stability within Malaysia, and international interest rate differentials. A weakening Ringgit, for example, often follows periods of global economic uncertainty or domestic political instability. Conversely, strong global demand for Malaysian exports can strengthen the MYR.

MYR depreciation significantly impacts exporter revenue. When the MYR weakens against other major currencies, the MYR equivalent of foreign currency earnings decreases, reducing the exporter's profit margin. Conversely, MYR appreciation, while seemingly beneficial, can negatively impact exporter competitiveness by making Malaysian goods more expensive in international markets, potentially leading to a loss of market share.

- Impact of unexpected MYR fluctuations on export contracts: Unforeseen changes in the exchange rate can drastically alter the profitability of fixed-price export contracts.

- Difficulty in accurate financial forecasting for businesses reliant on exports: MYR volatility makes precise financial planning incredibly challenging, hindering strategic decision-making.

- Negative impact on profitability and potential losses: Unhedged exposure to currency fluctuations can lead to substantial financial losses, jeopardizing the long-term viability of export-oriented businesses.

What is Front-Loading in the Context of Exporting?

Front-loading, in the context of exporting, refers to securing foreign currency through forward contracts or other hedging mechanisms before the export transaction occurs. This proactive approach helps exporters lock in a favorable exchange rate, protecting them from adverse movements in the MYR. The process involves carefully identifying potential risks associated with MYR volatility, choosing appropriate hedging tools based on risk tolerance and export volume, and executing the strategy efficiently.

- Examples of hedging tools: Forward contracts are the most common, offering a fixed exchange rate for a future date. Options provide flexibility, allowing exporters to buy or sell currency at a predetermined rate if the market moves unfavorably. Futures contracts are similar to forwards but are traded on exchanges.

- Advantages of each hedging tool in managing MYR volatility: Forward contracts offer certainty; options offer flexibility; futures provide liquidity and transparency. The optimal choice depends on individual business needs and risk appetite.

- Importance of accurate forecasting and risk assessment: Effective front-loading requires a thorough understanding of the exporter's foreign exchange exposure and accurate forecasting of future exchange rate movements.

Practical Applications of Front-Loading for Malaysian Exporters

Many Malaysian businesses successfully utilize front-loading to mitigate MYR volatility. For instance, a palm oil exporter might enter into a forward contract to sell US dollars at a predetermined exchange rate three months in advance, locking in their revenue in MYR regardless of subsequent exchange rate fluctuations. Similarly, a technology firm exporting electronics to Europe could use options to protect against significant losses if the euro weakens against the MYR.

Determining the optimal level of front-loading involves considering factors like risk tolerance, export volume, and the company's overall financial position. Larger exporters with higher exposure to currency risk will typically hedge a greater proportion of their transactions.

- Steps involved in implementing a front-loading strategy: Identify currency risk, assess risk tolerance, choose hedging instruments, execute the transactions, and monitor market movements.

- Collaboration with financial institutions specializing in currency hedging: Banks and specialized financial institutions offer expertise and various hedging products tailored to exporters' specific needs.

- Monitoring and adjusting the strategy based on market conditions: Regularly reviewing and adjusting the front-loading strategy is crucial to maintain effectiveness in response to changing market conditions.

Minimizing Losses Through Effective Currency Risk Management

A comprehensive currency risk management plan is essential for Malaysian exporters. This goes beyond simply front-loading. Diversification strategies, such as expanding into multiple export markets to reduce reliance on any single currency, play a crucial role.

- Regular review and adjustment of the hedging strategy: The effectiveness of a hedging strategy needs to be constantly evaluated and adapted to changing market dynamics.

- Importance of accurate financial modeling and forecasting: Sophisticated financial models are needed to accurately assess risk and predict future exchange rate movements.

- The role of internal expertise or external consultants: Businesses may choose to develop in-house expertise or engage external consultants specializing in foreign exchange risk management.

Alternative Strategies to Complement Front-Loading

While front-loading is a vital tool, other risk mitigation techniques can complement it. Adjusting contract prices to reflect potential exchange rate fluctuations, diversifying invoice currencies, and establishing offshore accounts in foreign currencies can further minimize losses.

- Price adjustments in contracts to account for exchange rate fluctuations: Building exchange rate fluctuations into contract pricing can transfer some risk to the buyer.

- Invoice currency diversification: Invoicing in the buyer's currency can minimize exposure to exchange rate risks.

- Establishing offshore accounts in foreign currencies: Holding funds in foreign currency accounts can reduce the impact of exchange rate movements.

Conclusion

Front-loading offers Malaysian exporters a powerful tool to mitigate the risks associated with Ringgit (MYR) volatility. By securing foreign currency in advance, businesses can safeguard their profitability and ensure financial stability. However, a comprehensive currency risk management plan, incorporating front-loading alongside other strategies and expert advice, is crucial. Protect your export business from Ringgit (MYR) volatility. Learn more about effective front-loading strategies and secure your financial future. Contact a financial advisor specializing in currency hedging today to explore the best front-loading options for your business.

Featured Posts

-

Disha Patani Celebrates Jackie Chans Birthday With A Special Message

May 07, 2025

Disha Patani Celebrates Jackie Chans Birthday With A Special Message

May 07, 2025 -

John Wick 5 Can John Wick Really Return Even From The Dead

May 07, 2025

John Wick 5 Can John Wick Really Return Even From The Dead

May 07, 2025 -

Jenna Ortega Es A Szinesznoi Inspiracio

May 07, 2025

Jenna Ortega Es A Szinesznoi Inspiracio

May 07, 2025 -

Warriors Edge Rockets In Nail Biter Take 3 1 Series Lead

May 07, 2025

Warriors Edge Rockets In Nail Biter Take 3 1 Series Lead

May 07, 2025 -

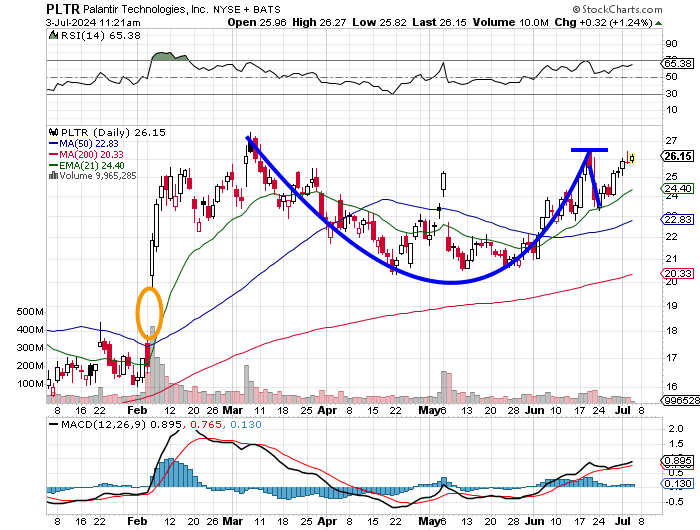

Is Palantirs High Stock Price Justified Despite Past Financial Blowouts

May 07, 2025

Is Palantirs High Stock Price Justified Despite Past Financial Blowouts

May 07, 2025

Latest Posts

-

76

May 08, 2025

76

May 08, 2025 -

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025 -

2 0 76

May 08, 2025

2 0 76

May 08, 2025 -

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025 -

76 2 0

May 08, 2025

76 2 0

May 08, 2025