India-Pakistan Tensions And Bajaj Losses Impact Stock Market: Sensex, Nifty 50 End Flat

Table of Contents

Geopolitical Uncertainty: India-Pakistan Tensions and Market Volatility

The current state of India-Pakistan relations remains a significant source of geopolitical uncertainty. Escalating tensions, often fueled by cross-border skirmishes or heightened rhetoric, can severely impact investor confidence. Such uncertainty often translates into market volatility, as investors exhibit risk aversion, preferring to stay on the sidelines or move their investments to safer havens. This risk aversion can lead to a sell-off, pushing down indices like the Sensex and Nifty 50.

- Increased defense spending: Heightened tensions necessitate increased defense spending, potentially diverting resources from other crucial sectors of the economy.

- Disruption to trade and business activities: Strained relations can disrupt trade routes and business operations, affecting various industries reliant on cross-border commerce.

- Foreign investor concerns and capital flight: Geopolitical instability can deter foreign investors, leading to capital flight and further depressing market performance.

- Historical precedents: History demonstrates a clear correlation between periods of heightened India-Pakistan tensions and negative impacts on the Indian stock market. Past instances of conflict have often resulted in significant market corrections.

Bajaj Auto's Losses: A Sectoral Impact on the Sensex and Nifty 50

Bajaj Auto, a significant player in the Indian automotive sector, recently reported substantial losses. While the exact reasons require detailed analysis, factors such as decreased sales, supply chain disruptions, and intense competition within the industry are likely contributing factors. These losses send ripples throughout the automotive sector and, by extension, the broader market. The impact on the Sensex and Nifty 50 is felt both directly, through Bajaj Auto's weight in the indices, and indirectly, through the dampening effect on investor confidence in the entire auto sector.

- Financial figures: A precise quantification of Bajaj Auto's losses, including the financial quarter and the extent of the decline in profits or revenue, is crucial for a complete understanding of the impact.

- Investor confidence: The losses erode investor confidence not just in Bajaj Auto but also in other auto companies, potentially leading to a broader sell-off in the sector.

- Performance of other auto companies: Analyzing the performance of other major players in the Indian automotive industry helps gauge the systemic nature of any sector-wide challenges.

- Correlation with market indices: A detailed correlation analysis between Bajaj Auto's stock price movements and the overall performance of the Sensex and Nifty 50 is essential to establish the extent of its influence.

Market Reactions: A Detailed Analysis of Sensex and Nifty 50 Performance

The surprisingly flat performance of the Sensex and Nifty 50, despite the negative news, demands further scrutiny. This resilience suggests the presence of counterbalancing factors that mitigated the negative impact of both the India-Pakistan tensions and Bajaj Auto's losses. Several factors could have played a role.

- Daily fluctuations: Examining the day-to-day fluctuations of the Sensex and Nifty 50 provides a nuanced understanding of the market's response to the news.

- Sectoral performance: Analyzing the performance of sectors beyond the automotive industry is crucial. Strong performance in other sectors might have offset the negative impact from the automotive sector.

- Role of FIIs: The actions of Foreign Institutional Investors (FIIs) – whether they were net buyers or sellers – played a crucial role in shaping market direction.

- Global market trends: Global market trends, such as positive news from other major economies, can influence investor sentiment in the Indian market.

Expert Opinions and Future Outlook: Predicting Market Behavior

Market experts offer varied perspectives on the future market trajectory. Some suggest that the flat market is a temporary phenomenon, masking underlying vulnerabilities that may surface later. Others view it as a sign of resilience, highlighting the strength of the Indian economy and its ability to absorb shocks.

- Expert views on India-Pakistan relations: Analysts’ predictions on the duration and intensity of the current geopolitical tensions are crucial for assessing future market risks.

- Bajaj Auto recovery projections: Experts' predictions on Bajaj Auto's recovery trajectory directly impact investor sentiment toward the automotive sector.

- Sensex and Nifty 50 outlook: Short-term and long-term forecasts for the Sensex and Nifty 50 are vital for investors in making strategic decisions.

- Investor recommendations: Informed recommendations based on expert analyses provide valuable guidance for investors navigating these uncertain times.

Conclusion: India-Pakistan Tensions and Bajaj Losses: Navigating Market Uncertainty

The recent flat performance of the Sensex and Nifty 50, despite significant geopolitical uncertainty and corporate setbacks like Bajaj Auto's losses, highlights the complex interplay of factors influencing the Indian stock market. The market's resilience is notable, but investors must understand that the situation remains dynamic. Monitoring the evolution of India-Pakistan tensions and the performance of key companies like Bajaj Auto remains crucial for making well-informed investment decisions. Stay informed about the impact of "India-Pakistan tensions and Bajaj losses on the stock market" by utilizing reputable financial news sources and market analysis services to navigate this evolving landscape effectively.

Featured Posts

-

The Current Life And Career Of Rakesh Sharma Indias First Astronaut

May 09, 2025

The Current Life And Career Of Rakesh Sharma Indias First Astronaut

May 09, 2025 -

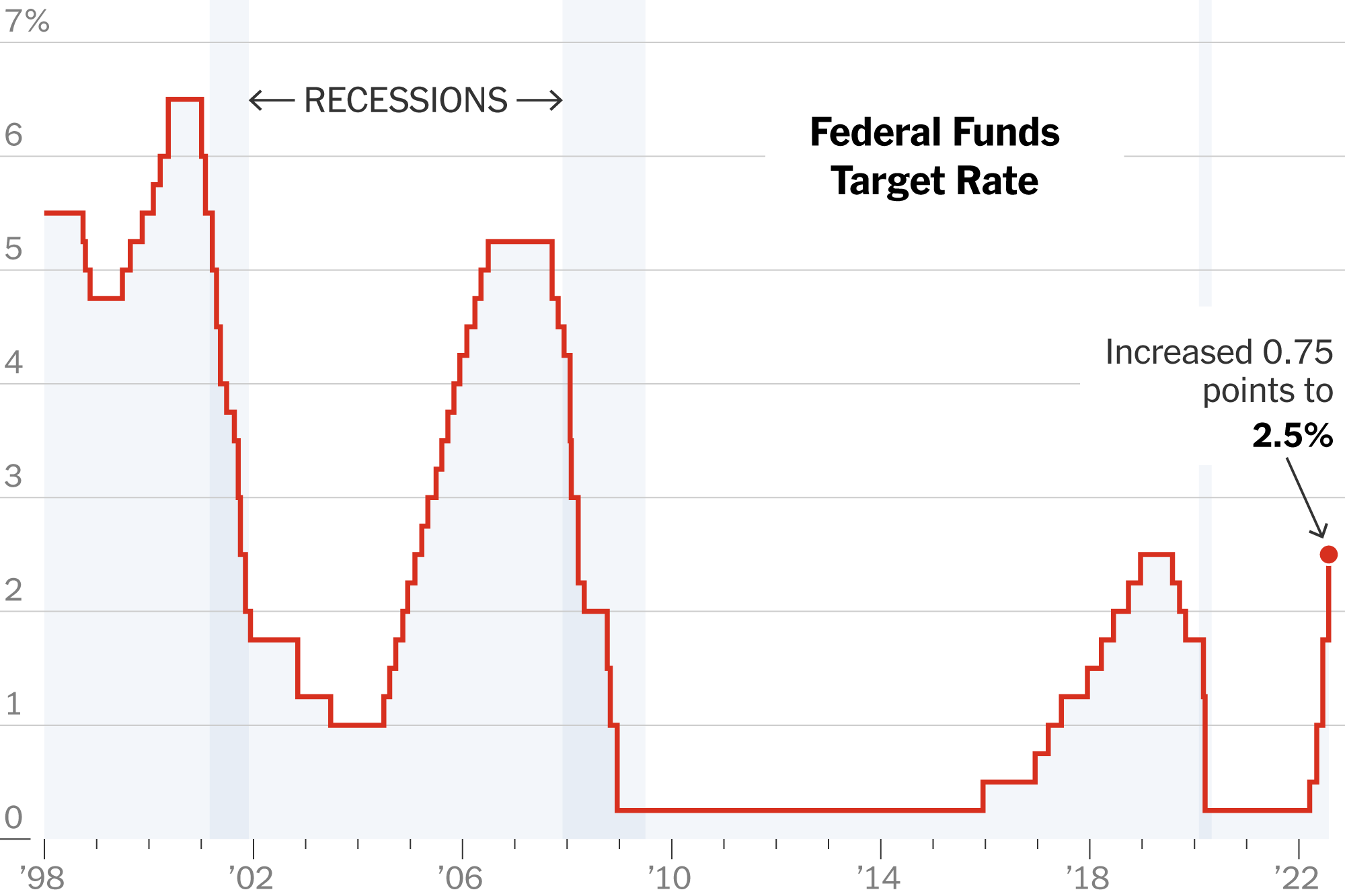

U S Federal Reserve Decision Inflation Unemployment Weigh On Rate Hike

May 09, 2025

U S Federal Reserve Decision Inflation Unemployment Weigh On Rate Hike

May 09, 2025 -

Analysis Williams Public Statement Regarding Doohan And Colapinto

May 09, 2025

Analysis Williams Public Statement Regarding Doohan And Colapinto

May 09, 2025 -

Nyt Strands Puzzle April 9 2025 Hints And Answers

May 09, 2025

Nyt Strands Puzzle April 9 2025 Hints And Answers

May 09, 2025 -

Golden Knights Hill Makes 27 Saves In Win Against Blue Jackets

May 09, 2025

Golden Knights Hill Makes 27 Saves In Win Against Blue Jackets

May 09, 2025