Inflation And Your Finances: A Podcast On Navigating Low Inflation

Table of Contents

Understanding Low Inflationary Environments

Low inflation, often a desirable economic state, signifies a slow and steady increase in the general price level of goods and services. Typically, economists define low inflation as an annual inflation rate below 2%. It's important to distinguish low inflation from deflation (a decrease in prices) and disinflation (a slowing rate of inflation). Understanding these nuances is critical for making sound financial decisions.

- Low inflation: Price increases are below 2% annually. This generally indicates a healthy economy with stable growth.

- Deflation: Prices are decreasing. While seemingly beneficial, deflation can be harmful as it discourages spending and investment.

- Disinflation: The rate of inflation is slowing down. This is a transition phase, potentially moving toward low inflation or even deflation.

Understanding the subtle differences between these three economic conditions is paramount for effective financial planning and investment strategy. Failing to differentiate between them could lead to poor investment choices and missed opportunities.

Investing Strategies for Low Inflation

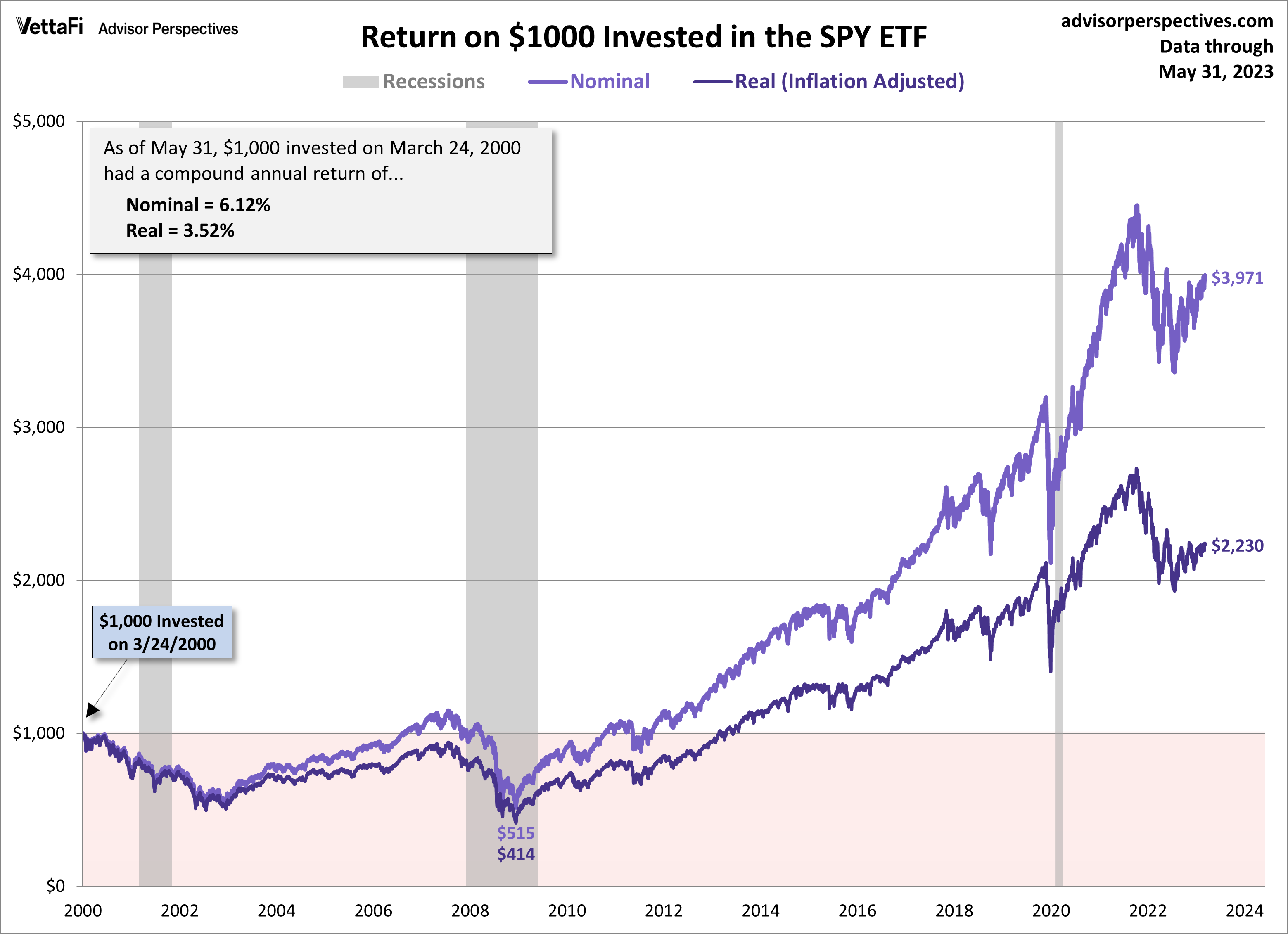

Investing in a low-inflation environment presents unique challenges. Traditional investment strategies that rely on high inflation to erode the value of debt may not be as effective. The key is to identify investments that offer the potential for growth even with modest price increases.

- Diversification: Spreading your investments across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk. Don't put all your eggs in one basket.

- Growth-oriented investments: Focus on investments with the potential for capital appreciation, such as stocks in growing companies or real estate in developing areas. These assets can outperform low inflation rates.

- Real Estate: Real estate can provide a hedge against inflation, even low inflation. Rental income can increase over time, keeping pace with – or even exceeding – modest price increases. However, careful market analysis is crucial, as low inflation might impact property values.

- Alternative Investments: Consider alternative investments like commodities (gold, for example, often acts as an inflation hedge) or certain types of bonds that offer a yield above the inflation rate.

Saving and Budgeting in a Low-Inflation Economy

While low inflation might seem less pressing than high inflation, smart budgeting and saving remain essential. Even with modest price increases, maintaining a healthy savings rate is crucial for future financial security and achieving long-term goals.

- Track your spending: Use budgeting apps or spreadsheets to monitor your income and expenses. Identify areas where you can cut back.

- High-yield savings accounts: Maximize your returns by exploring high-yield savings accounts or other interest-bearing accounts. While interest rates might be lower during low inflation, maximizing what you can earn is still essential.

- Debt reduction: Prioritize paying down high-interest debt to free up cash flow and improve your financial health. This is especially important when interest rates are low, allowing you to pay off debt more efficiently.

- Automate savings: Set up automatic transfers from your checking account to your savings account to ensure consistent contributions.

The Role of Debt in Low Inflation

Low interest rates often accompany low inflation. While this may seem beneficial for borrowing, careful debt management remains critical. Low interest rates can make debt cheaper in the short term, but neglecting debt management could still lead to long-term financial issues.

- Prioritize high-interest debt: Focus on paying down debt with the highest interest rates first to minimize the overall cost of borrowing.

- Refinancing options: Explore refinancing options to lower your interest rates if available. This can significantly reduce your debt burden over time.

- Avoid unnecessary debt: Be mindful of accumulating new debt, especially if you are already struggling with existing debt. Responsible borrowing is key, even in a low-inflation environment.

Protecting your Purchasing Power During Low Inflation

Even during low inflation, the value of your money can erode over time. It's essential to implement strategies to protect your purchasing power and ensure your investments outpace minimal price increases.

- Regular portfolio review: Regularly review and adjust your investment portfolio based on economic conditions and your financial goals.

- Inflation-protected securities: Consider investing in inflation-protected securities (TIPS) to safeguard against inflation risks, even at low levels.

- Stay informed: Stay updated on economic trends and market conditions to proactively adjust your financial plan as needed.

Conclusion

Navigating low inflation requires a proactive and informed approach to personal finance. By understanding the implications of a low-inflation environment and implementing strategies for smart saving, investing, and debt management, you can protect your financial well-being and ensure your money continues to grow, even in periods of modest price increases. Don't let low inflation catch you off guard; take control of your finances and plan for success in this economic climate. Listen to our podcast for more in-depth information on navigating low inflation and achieving your financial goals.

Featured Posts

-

Nemetskaya Pomosch Ukraine Andrey Sibiga O Gumanitarnoy Situatsii I Spasenii Zhizney

May 27, 2025

Nemetskaya Pomosch Ukraine Andrey Sibiga O Gumanitarnoy Situatsii I Spasenii Zhizney

May 27, 2025 -

Where To Watch Bad Moms Comedy Central Hd

May 27, 2025

Where To Watch Bad Moms Comedy Central Hd

May 27, 2025 -

Dow Jones And S And P 500 Stock Market Analysis For May 26

May 27, 2025

Dow Jones And S And P 500 Stock Market Analysis For May 26

May 27, 2025 -

Is Jennifer Lopez Hosting The American Music Awards In May

May 27, 2025

Is Jennifer Lopez Hosting The American Music Awards In May

May 27, 2025 -

Close Up Photos Of Taylor Swifts Eras Tour Outfits A Detailed Guide

May 27, 2025

Close Up Photos Of Taylor Swifts Eras Tour Outfits A Detailed Guide

May 27, 2025

Latest Posts

-

Andre Agassi De La Tenis La Pickleball Primul Meci

May 30, 2025

Andre Agassi De La Tenis La Pickleball Primul Meci

May 30, 2025 -

Was Passierte Am 10 April Ein Detaillierter Rueckblick

May 30, 2025

Was Passierte Am 10 April Ein Detaillierter Rueckblick

May 30, 2025 -

Revenirea Lui Andre Agassi Un Nou Capitol In Cariera Cu Pickleball

May 30, 2025

Revenirea Lui Andre Agassi Un Nou Capitol In Cariera Cu Pickleball

May 30, 2025 -

Legenda Tenisului Andre Agassi Juca Pickleball

May 30, 2025

Legenda Tenisului Andre Agassi Juca Pickleball

May 30, 2025 -

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025