InterRent REIT: Executive Chair And Sovereign Wealth Fund Offer

Table of Contents

The real estate investment trust (REIT) sector has witnessed a significant development with a substantial offer for InterRent REIT involving its Executive Chair and a prominent Sovereign Wealth Fund. This strategic move promises to reshape InterRent REIT's future trajectory and presents intriguing implications for investors. This article delves into the details of this offer, analyzing its potential impact on the company's growth strategy and market position. Keywords: InterRent REIT, Executive Chair, Sovereign Wealth Fund, Investment Offer, REIT, Real Estate Investment Trust, acquisition, stock price, portfolio, growth strategy

The Offer Details

The offer involves a significant investment in InterRent REIT, potentially leading to a substantial expansion of the company’s portfolio and resources. While the exact nature of the transaction remains under wraps pending regulatory approvals, initial reports suggest a substantial acquisition or strategic investment. The Executive Chair of InterRent REIT plays a key role in facilitating this transaction, alongside a major Sovereign Wealth Fund (whose specific identity is currently undisclosed for confidentiality reasons). The financial terms are equally significant:

- Offer price per share: (Insert the actual offer price per share here when available. Placeholder: $X.XX)

- Total value of the transaction: (Insert the total value of the transaction here when available. Placeholder: $XXX Million)

- Premium offered compared to the current market price: (Insert the premium offered here when available. Placeholder: XX%)

- Timeline for the completion of the offer: (Insert the expected timeline here when available. Placeholder: Expected completion by Q[Quarter] [Year])

Executive Chair's Involvement

The Executive Chair's participation in this deal is a crucial element. Their extensive experience and deep understanding of InterRent REIT's operations are valuable assets in navigating this complex transaction. While the exact nature of their involvement is not fully public yet, initial indications suggest that the Chair is actively facilitating the deal, possibly including a personal investment. This highlights a strong belief in the future success of InterRent REIT under the proposed new strategic direction.

- History of the Executive Chair's involvement with InterRent REIT: (Insert details about the Executive Chair's tenure and contributions to InterRent REIT.)

- The Executive Chair's stake in the company before and after the offer: (Insert details about the Executive Chair's pre- and post-offer stake in the company.)

- Potential conflicts of interest and how they are being addressed: (Discuss any potential conflicts of interest and how the company is addressing them to maintain transparency and regulatory compliance.)

Sovereign Wealth Fund's Strategic Investment

The involvement of a Sovereign Wealth Fund signals a significant vote of confidence in InterRent REIT’s long-term prospects. These funds typically conduct rigorous due diligence before making such substantial investments, indicating a strong belief in the company’s potential for growth and profitability within the REIT sector. Their strategic interest likely stems from InterRent REIT’s strong portfolio and growth potential within the [mention specific real estate market segment, e.g., multifamily housing] sector.

- The Sovereign Wealth Fund's investment portfolio and previous real estate investments: (Discuss the Sovereign Wealth Fund's history of real estate investments and its investment philosophy.)

- The potential benefits for InterRent REIT from the Sovereign Wealth Fund's expertise and resources: (Highlight the potential benefits, such as access to capital, global network, and strategic expertise.)

- Potential synergies between InterRent REIT's business model and the Sovereign Wealth Fund's investment goals: (Discuss potential synergies and alignment of investment goals.)

Market Reaction and Future Outlook

The market's initial reaction to the offer has been largely positive, with InterRent REIT's stock price experiencing a [Insert percentage change and direction - e.g., "significant increase"] following the announcement. This positive sentiment reflects the market's confidence in the strategic value of the transaction. However, it is important to acknowledge that the long-term impact will depend on several factors, including successful integration of the investment and execution of the proposed growth strategies.

- Stock price performance before and after the announcement: (Provide data on stock price fluctuations before and after the announcement.)

- Analyst ratings and price targets for InterRent REIT: (Summarize analyst opinions and price targets for InterRent REIT.)

- Potential risks and challenges associated with the offer: (Discuss potential challenges and risks associated with the transaction, e.g., regulatory approvals, integration issues.)

- InterRent REIT’s long-term growth prospects following this investment: (Analyze the long-term prospects and growth potential of InterRent REIT after this significant investment.)

Conclusion

The offer for InterRent REIT involving its Executive Chair and a Sovereign Wealth Fund represents a significant turning point for the company. This strategic investment promises substantial growth opportunities, leveraging the expertise and resources of both the Executive Chair and the Sovereign Wealth Fund. While some risks and challenges remain, the overall outlook for InterRent REIT appears promising. The transaction highlights the attractiveness of the REIT market and the potential for significant returns in the real estate sector.

Stay updated on the future of InterRent REIT and other compelling REIT investment opportunities. Learn more about InterRent REIT's strategic moves and explore the potential returns from investing in the REIT market.

Featured Posts

-

Mother Sentenced For Trafficking Missing Child Body Parts Sold

May 29, 2025

Mother Sentenced For Trafficking Missing Child Body Parts Sold

May 29, 2025 -

How One Crypto Trader Shorted Trump And Won A White House Dinner

May 29, 2025

How One Crypto Trader Shorted Trump And Won A White House Dinner

May 29, 2025 -

Space X Falcon 9 Launches 28 Starlink Satellites Mission 28 A Success

May 29, 2025

Space X Falcon 9 Launches 28 Starlink Satellites Mission 28 A Success

May 29, 2025 -

Lidl Elkepeszto Gyujtoi Markak Akcios Aron Erdemes Sorba Allni

May 29, 2025

Lidl Elkepeszto Gyujtoi Markak Akcios Aron Erdemes Sorba Allni

May 29, 2025 -

The Impact Of Covid 19 Vaccines On Long Covid Incidence

May 29, 2025

The Impact Of Covid 19 Vaccines On Long Covid Incidence

May 29, 2025

Latest Posts

-

Beatles Casting Announcement Controversy Over White Boy Of The Month Selection

May 31, 2025

Beatles Casting Announcement Controversy Over White Boy Of The Month Selection

May 31, 2025 -

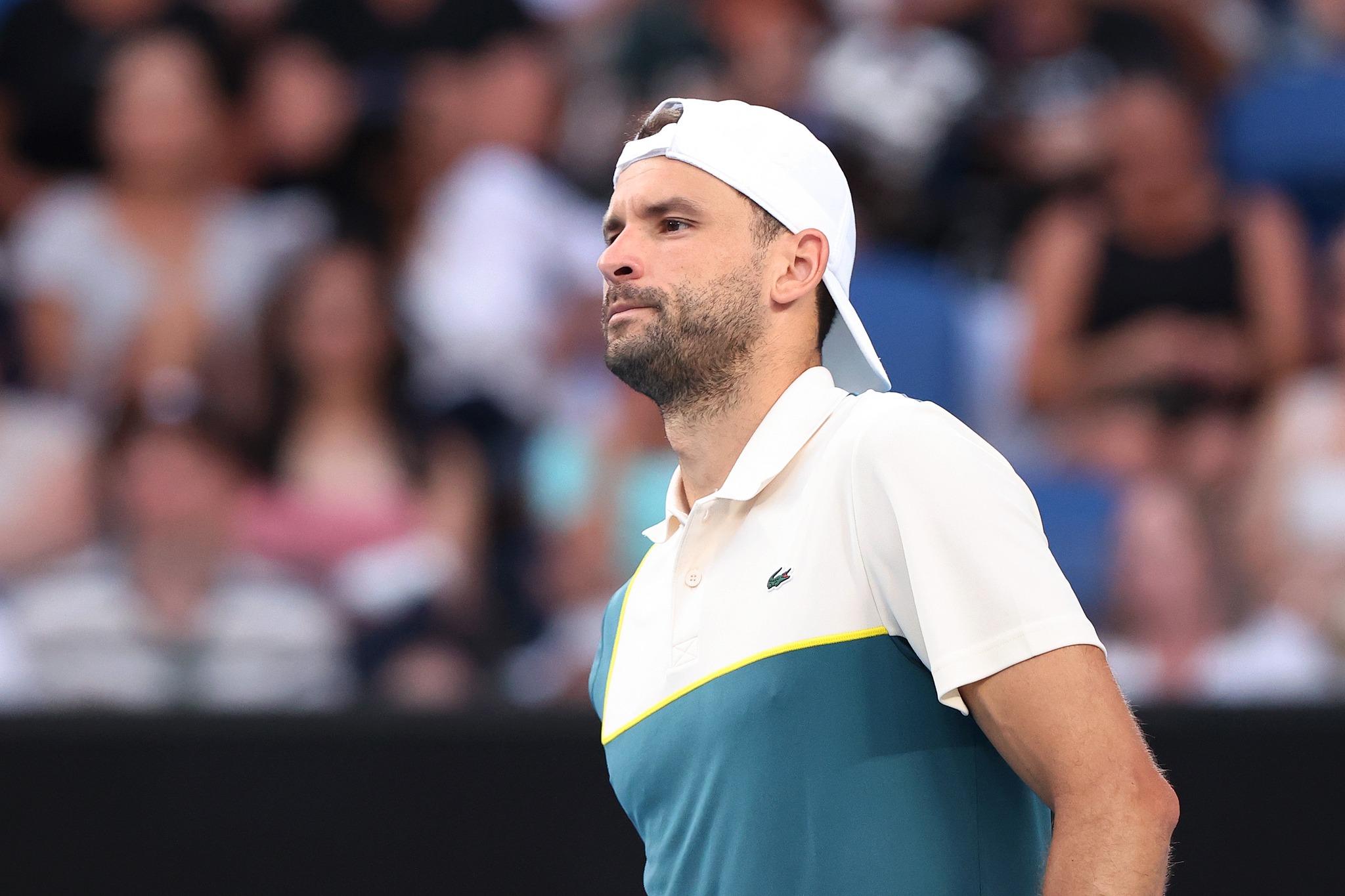

Posledni Novini Za Kontuziyata Na Grigor Dimitrov

May 31, 2025

Posledni Novini Za Kontuziyata Na Grigor Dimitrov

May 31, 2025 -

Trump And Musk A New Era Of Collaboration

May 31, 2025

Trump And Musk A New Era Of Collaboration

May 31, 2025 -

Podrobnosti Za Kontuziyata Na Grigor Dimitrov

May 31, 2025

Podrobnosti Za Kontuziyata Na Grigor Dimitrov

May 31, 2025 -

Kontuziyata Na Grigor Dimitrov Koga Sche Se Zavrne Na Korta

May 31, 2025

Kontuziyata Na Grigor Dimitrov Koga Sche Se Zavrne Na Korta

May 31, 2025