Interest Rate Cuts Delayed: Analyzing The Fed's Strategy Under Powell And Trump's Criticism

Table of Contents

The Fed's Cautious Approach Under Jerome Powell

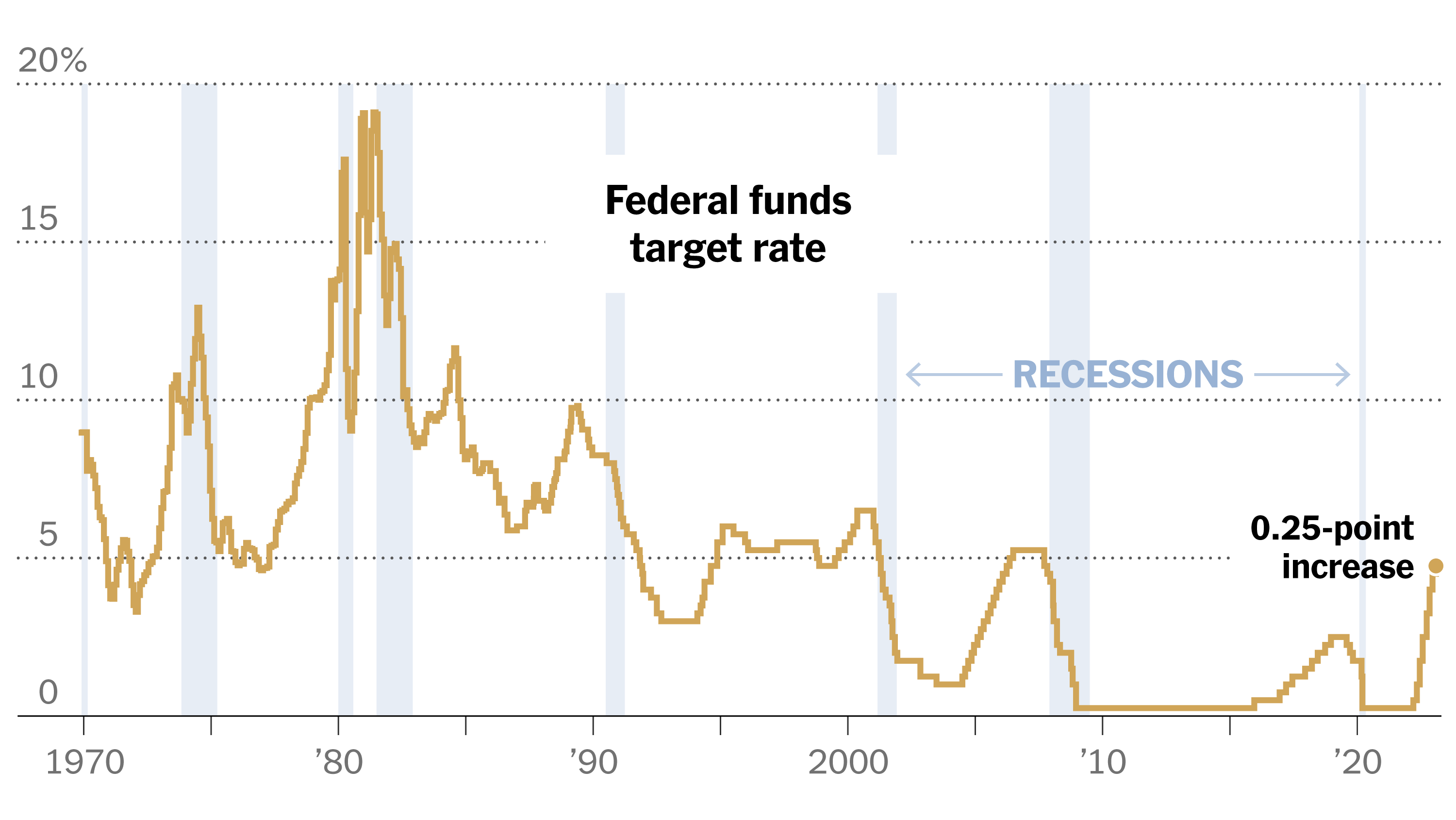

The Federal Reserve, under Chairman Jerome Powell, is adopting a cautious approach to interest rate cuts, primarily driven by a careful analysis of key economic indicators and a desire to maintain a delicate balance between economic growth and inflation control.

Economic Indicators and Data Analysis

The Fed's monetary policy decisions are heavily influenced by a range of economic indicators. These include:

- Inflation: The Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) index are closely monitored to gauge inflationary pressures. Currently, inflation remains relatively subdued, providing some room for maneuver.

- Unemployment Rate: The unemployment rate, currently near historic lows, indicates a strong labor market. However, the Fed is also watching for signs of wage inflation, which could fuel broader price increases.

- GDP Growth: GDP growth provides an indication of the overall health of the economy. While growth has been relatively steady, concerns remain about potential slowdowns both domestically and internationally.

Recent data releases paint a mixed picture. While the unemployment rate remains low, there are some signs of slowing GDP growth, and inflation remains below the Fed's target. This ambiguity is a key factor in the delay of interest rate cuts.

Balancing Economic Growth and Inflation

The Fed's dual mandate is to maintain price stability and full employment. This necessitates a delicate balancing act. Stimulating economic growth through interest rate cuts can risk fueling inflation if the economy is already operating near full capacity.

- Past Trade-offs: The Fed's experience during the 2008 financial crisis demonstrates the challenges of managing this balance. Aggressive rate cuts were necessary to stimulate the economy, but this eventually led to concerns about rising inflation.

- Current Situation: Currently, the Fed is prioritizing avoiding runaway inflation while supporting sustainable economic growth. This cautious approach explains the delay in interest rate cuts.

Global Economic Uncertainty and its Influence

Global economic uncertainty significantly impacts the Fed's decision-making. Trade wars, Brexit, and other geopolitical risks can significantly affect the US economy.

- Trade Wars: The ongoing trade disputes have created uncertainty and impacted business investment.

- Brexit: The uncertainty surrounding Brexit continues to weigh on global markets and could further dampen economic growth.

- Interconnectedness: The interconnected nature of global markets means that events abroad can have a direct impact on the US economy, making the Fed's job even more challenging.

President Trump's Criticism and Political Pressure

President Trump's repeated calls for interest rate cuts have raised concerns about the potential for political interference in the Fed's decision-making process.

Trump's Public Statements and their Impact

President Trump's public criticism of the Fed's monetary policy has been consistent and vocal. For example, he has frequently stated that the Fed should lower interest rates to boost economic growth. Such statements can:

- Impact Market Confidence: They can create uncertainty in the markets, leading to increased volatility.

- Challenge Fed Independence: These actions directly challenge the long-standing principle of central bank independence.

The Debate on Central Bank Independence

Central bank independence is crucial for maintaining the credibility and effectiveness of monetary policy. Politicizing monetary policy decisions can lead to:

- Short-Term Gains, Long-Term Losses: Politically motivated rate cuts might provide short-term economic boosts but could lead to long-term inflation and instability.

- Erosion of Trust: Interference undermines public trust in the central bank's ability to make objective decisions in the best interests of the economy.

Potential Scenarios and Future Outlook for Interest Rates

The future path of interest rates remains uncertain, with several possible scenarios depending on how economic indicators evolve.

Forecasting Future Rate Changes

Several scenarios are possible:

- Scenario 1 (Most Likely): A gradual decline in interest rates, contingent on further signs of economic slowdown and subdued inflation.

- Scenario 2: No further rate cuts if economic indicators show resilience and inflation begins to pick up.

- Scenario 3 (Least Likely): More aggressive rate cuts if a significant economic downturn occurs.

The timing and magnitude of any future rate changes will depend on the evolving economic data and the Fed's assessment of the risks.

Market Reactions and Investor Sentiment

Markets have reacted cautiously to the delay in interest rate cuts. Investor sentiment remains somewhat subdued, reflecting the uncertainty surrounding the future economic outlook.

- Stock Market: The stock market has shown some volatility in response to the Fed's announcements and President Trump's statements.

- Bond Market: Bond yields have generally reflected expectations of lower future interest rates, but the uncertainty has resulted in fluctuating prices.

Conclusion: Understanding the Implications of Delayed Interest Rate Cuts

The delay in interest rate cuts reflects the complex challenges facing the Fed, including balancing economic growth with inflation control, navigating global uncertainty, and managing political pressure. Understanding the economic indicators driving the Fed's decisions and the ongoing debate on central bank independence are crucial for interpreting current market conditions and anticipating future interest rate movements. Stay informed about the latest developments on interest rate cuts and the evolving economic landscape by subscribing to our newsletter or following us on social media.

Featured Posts

-

Blowout Loss Perspective What History Teaches The Golden State Warriors

May 07, 2025

Blowout Loss Perspective What History Teaches The Golden State Warriors

May 07, 2025 -

Palantir Stock Valuation A Deep Dive Into Its History Of Financial Performance

May 07, 2025

Palantir Stock Valuation A Deep Dive Into Its History Of Financial Performance

May 07, 2025 -

Could Nintendo Direct March 2025 Feature Ps 5 Ps 4 Games An Analysis

May 07, 2025

Could Nintendo Direct March 2025 Feature Ps 5 Ps 4 Games An Analysis

May 07, 2025 -

Diamondbacks Comeback Win Against Athletics Highlights Big League Weekend

May 07, 2025

Diamondbacks Comeback Win Against Athletics Highlights Big League Weekend

May 07, 2025 -

Ssc Chsl Final Result 2025 Announced How To Check And Download

May 07, 2025

Ssc Chsl Final Result 2025 Announced How To Check And Download

May 07, 2025

Latest Posts

-

Supermans Struggle Sneak Peek Highlights Kryptos Aggression

May 08, 2025

Supermans Struggle Sneak Peek Highlights Kryptos Aggression

May 08, 2025 -

Kryptos Betrayal Superman Sneak Peek Offers A Glimpse

May 08, 2025

Kryptos Betrayal Superman Sneak Peek Offers A Glimpse

May 08, 2025 -

A Wounded Superman Sneak Peek Features Kryptos Violence

May 08, 2025

A Wounded Superman Sneak Peek Features Kryptos Violence

May 08, 2025 -

Revealed Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025

Revealed Superman Sneak Peek Shows Kryptos Brutal Attack

May 08, 2025 -

Superman Sneak Peek Krypto Turns Against The Man Of Steel

May 08, 2025

Superman Sneak Peek Krypto Turns Against The Man Of Steel

May 08, 2025