Investing In Elon Musk's Private Ventures: A Lucrative Side Hustle?

Table of Contents

The Allure and Risks of Investing in Private Companies

Investing in private companies, especially those associated with high-profile entrepreneurs like Elon Musk, presents a unique blend of immense potential and significant challenges. Understanding these dynamics is crucial before considering investing in Elon Musk's private ventures.

High-Potential Returns vs. Liquidity Challenges

The allure of investing in early-stage companies lies in the potential for exponential growth. A small investment today could yield substantial returns if the company achieves significant success. However, this high reward comes with a high degree of risk. Private investments are notoriously illiquid, meaning it can be extremely difficult to sell your shares quickly if you need to access your capital. Unlike publicly traded stocks, there's no readily available market to buy and sell shares. Furthermore, the significant risk of total loss is ever-present; many startups fail, resulting in the complete loss of invested capital.

- Successful Examples: Early investors in companies like Google or Facebook reaped enormous profits.

- Failed Examples: Countless startups fail each year, leaving investors with nothing.

Due Diligence and Access Barriers

Thorough due diligence is paramount when considering investing in Elon Musk's private ventures or any private company. This involves extensive research into the company's financials, business model, management team, and competitive landscape. However, accessing these opportunities is often challenging. Private investments typically require significant minimum investment amounts, often beyond the reach of average investors. Furthermore, many private placements are restricted to accredited investors, individuals meeting specific net worth or income requirements. Venture capital firms and angel investors typically dominate these investment rounds.

- Steps for Due Diligence:

- Analyze the company's business plan and market opportunity.

- Review financial statements and projections (if available).

- Assess the management team's experience and track record.

- Research the competitive landscape and identify potential risks.

- Seek professional financial advice.

Exploring Elon Musk's Portfolio: Potential Investment Avenues

Elon Musk's entrepreneurial endeavors span various sectors, each presenting unique investment prospects (though many are inaccessible to the average investor).

SpaceX Investment Opportunities (if any)

Direct investment in SpaceX is extremely limited. The company has primarily relied on private funding rounds and government contracts. Opportunities for individual investors are scarce, if they exist at all. SpaceX's long-term prospects are tied to the continued growth of the space exploration and commercial space industries. However, the inherent risks involved in space ventures, including technological challenges and regulatory hurdles, are substantial.

- Key Milestones: Successful Falcon 9 launches, Starlink satellite deployment.

- Potential Future Revenue Streams: Satellite internet services, space tourism, interplanetary transport.

Tesla (Public vs. Private Aspects)

It's crucial to differentiate between Tesla, a publicly traded company, and Elon Musk's private ventures. Investing in Tesla stock offers a relatively straightforward path to participate in the electric vehicle and renewable energy markets. However, this is not directly investing in Elon Musk's private companies. While Tesla has several subsidiaries and initiatives, direct investment in these private arms is usually not accessible to the public.

- Tesla's Public Market Performance: Monitor Tesla's stock price, earnings reports, and news for performance indicators.

The Boring Company and Other Ventures

The Boring Company, Neuralink, and other lesser-known Musk ventures represent higher-risk, higher-reward opportunities (though again, access is severely restricted). These companies are in early stages of development, facing technological hurdles and significant market uncertainties. The long-term prospects for these businesses remain unproven.

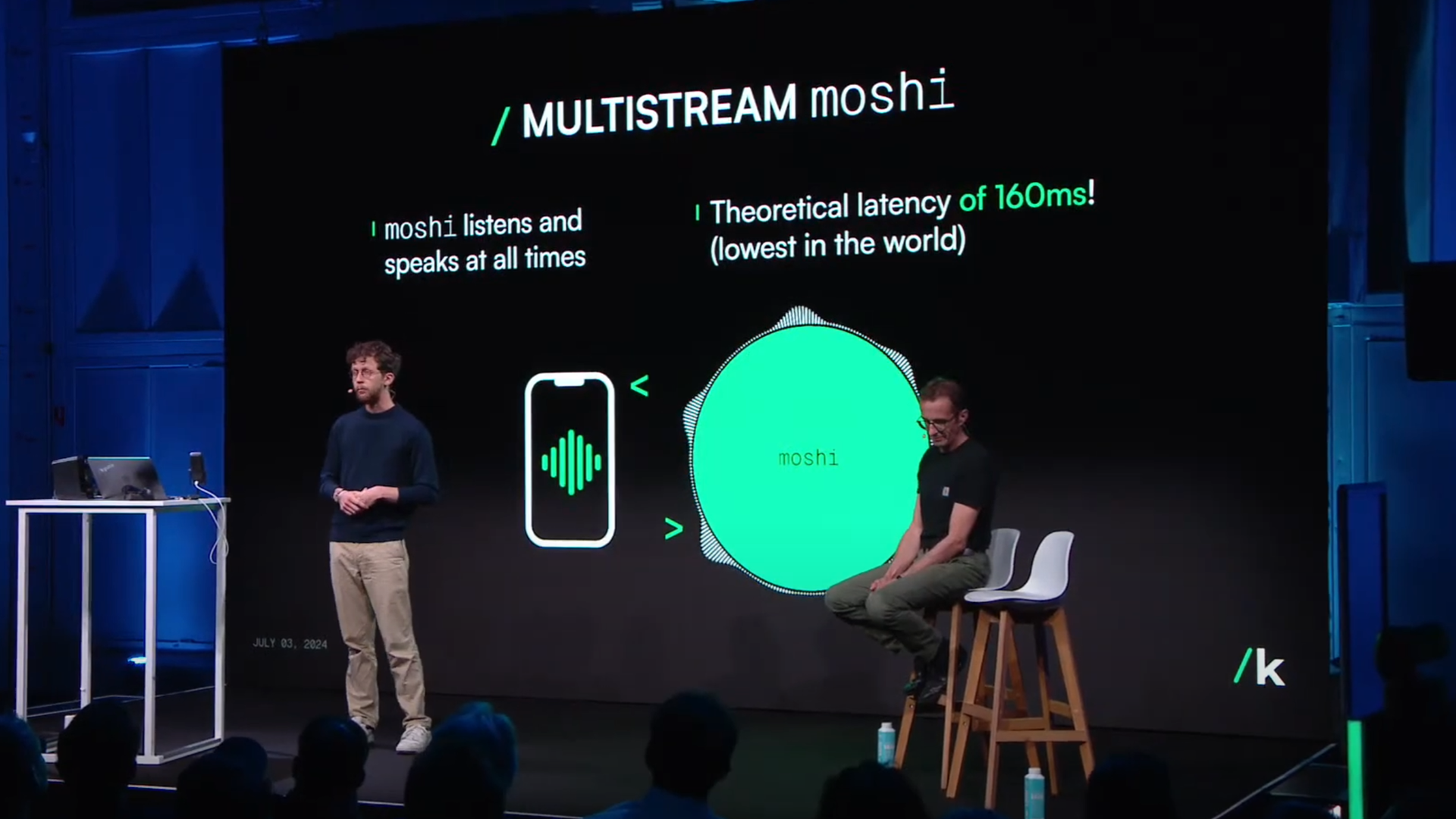

- Examples of Other Musk Ventures: Neuralink (brain-computer interfaces), xAI (artificial intelligence).

Alternative Strategies for Participating in Musk's Success

While direct investing in Elon Musk's private ventures is difficult, alternative approaches can provide indirect exposure to his success:

Investing in Publicly Traded Companies Connected to Musk

Investing in companies that supply components to Tesla or benefit from SpaceX's technological advancements provides a less risky path to participate in the broader ecosystem.

- Examples: Companies that produce batteries, electric vehicle components, or satellite technology.

Indirect Exposure Through ETFs and Mutual Funds

Diversified ETFs and mutual funds focused on technology, aerospace, or renewable energy can offer indirect exposure to the industries where Musk's companies operate. This strategy reduces risk through diversification, though it lacks the concentrated exposure of direct investment.

- Examples: Tech-heavy ETFs or mutual funds with holdings in companies benefiting from technological advancements.

Conclusion

Investing in Elon Musk's private ventures presents a high-risk, high-reward proposition. The potential for substantial returns is alluring, but the illiquidity of private investments and the significant risk of total loss cannot be overlooked. Thorough due diligence is paramount. Before pursuing investing in Elon Musk's private ventures, carefully consider alternative strategies such as investing in related publicly traded companies or diversified funds. Always seek professional financial advice before making any investment decisions.

Featured Posts

-

Europe Rejects Trump Administrations Push For Relaxed Ai Rules

Apr 26, 2025

Europe Rejects Trump Administrations Push For Relaxed Ai Rules

Apr 26, 2025 -

Open Ai Unveils New Tools For Voice Assistant Development

Apr 26, 2025

Open Ai Unveils New Tools For Voice Assistant Development

Apr 26, 2025 -

Nintendo Switch 2 Preorder My Game Stop Line Experience

Apr 26, 2025

Nintendo Switch 2 Preorder My Game Stop Line Experience

Apr 26, 2025 -

Getting My Hands On A Switch 2 The Game Stop Line Experience

Apr 26, 2025

Getting My Hands On A Switch 2 The Game Stop Line Experience

Apr 26, 2025 -

The Ahmed Hassanein Story An Egyptians Path To The Nfl

Apr 26, 2025

The Ahmed Hassanein Story An Egyptians Path To The Nfl

Apr 26, 2025

Latest Posts

-

The China Factor Analyzing The Automotive Challenges Faced By Bmw Porsche And Competitors

Apr 27, 2025

The China Factor Analyzing The Automotive Challenges Faced By Bmw Porsche And Competitors

Apr 27, 2025 -

Chinas Auto Market The Struggles Of Bmw Porsche And Others

Apr 27, 2025

Chinas Auto Market The Struggles Of Bmw Porsche And Others

Apr 27, 2025 -

Bmw And Porsche In China Market Headwinds And Strategic Adjustments

Apr 27, 2025

Bmw And Porsche In China Market Headwinds And Strategic Adjustments

Apr 27, 2025 -

Los Angeles Wildfires A Reflection Of Our Times Through Disaster Betting

Apr 27, 2025

Los Angeles Wildfires A Reflection Of Our Times Through Disaster Betting

Apr 27, 2025 -

Wildfire Wagers Examining The Implications Of Betting On The La Fires

Apr 27, 2025

Wildfire Wagers Examining The Implications Of Betting On The La Fires

Apr 27, 2025