Investing In Growth: Locating The Country's Promising Business Hotspots

Table of Contents

Imagine a return on investment exceeding market averages, fueled by the explosive growth of a burgeoning sector. This isn't a fantasy; it's the reality for savvy investors who successfully navigate the landscape of "Investing in Growth: Locating the Country's Promising Business Hotspots." Identifying these hotspots requires a keen eye for opportunity, a deep understanding of economic trends, and a strategic approach to risk assessment. This article will equip you with the tools and insights necessary to unlock the potential of these high-growth areas, while also acknowledging the challenges inherent in such ventures.

2. Main Points:

H2: Identifying Key Economic Indicators for Growth Potential:

To pinpoint promising business hotspots, we need to analyze robust economic indicators that point towards sustainable growth. This goes beyond simply looking at headline figures.

H3: Analyzing GDP Growth and Sectoral Contributions:

- Interpreting GDP Data: Gross Domestic Product (GDP) growth provides a broad overview of economic health. However, consistent year-on-year growth is crucial. Looking at GDP alone isn't sufficient; we need to delve into sectoral contributions. Is the growth driven by a single industry, or is it spread across multiple sectors, indicating more resilience?

- Focusing on High-Growth Sectors: Identifying sectors with the most significant growth trajectories is paramount. This could include technology, renewable energy, sustainable tourism, healthcare, or others depending on the country's specific context. Reliable sources for GDP data include government statistical agencies, international organizations like the World Bank and IMF, and reputable financial news outlets.

- Beyond the Numbers: Remember to look beyond the raw data. Analyze the quality of growth. Is it sustainable, or is it fueled by unsustainable practices? Is it inclusive, benefiting a broad range of the population?

H3: Assessing Infrastructure Development and Investment:

Robust infrastructure is the backbone of economic growth. A well-developed infrastructure attracts investment and facilitates business operations.

- Essential Infrastructure Components: This includes efficient transportation networks (roads, railways, ports, airports), reliable energy supplies (electricity, gas), and robust digital infrastructure (high-speed internet, telecommunications).

- Evaluating Infrastructure Quality: Assess infrastructure using publicly available data, government reports, and independent assessments. Look for ongoing investment in infrastructure projects. Positive infrastructure developments often correlate directly with increased economic activity. For example, the construction of a new port can stimulate related industries like logistics and manufacturing.

- Infrastructure Gaps as Opportunities: Sometimes, significant infrastructure gaps can present investment opportunities. Developing infrastructure in underserved areas can lead to substantial returns.

H3: Evaluating the Business-Friendly Regulatory Environment:

The regulatory environment significantly influences business growth. A predictable and transparent system fosters investor confidence.

- Key Regulatory Factors: Examine tax policies, ease of doing business rankings (e.g., World Bank's Doing Business report), and the overall regulatory burden. Excessive bureaucracy or unpredictable regulations can stifle economic activity.

- Transparency and Predictability: A transparent and predictable regulatory environment is essential for long-term investment. This ensures that businesses can plan and operate with confidence.

- Comparing Business Climates: Resources like the World Bank's Doing Business report allow for comparisons of business climates across different regions within a country.

H2: Analyzing Demographic Trends and Consumer Behavior:

Understanding population dynamics and consumer behavior is crucial for identifying profitable market segments.

H3: Understanding Population Growth and Age Distribution:

- Population Dynamics and Business Opportunities: Population growth rates, age demographics, and urbanization trends directly impact business opportunities. A growing young population might favor businesses in technology, entertainment, and fast-moving consumer goods. An aging population might create more opportunities in healthcare and senior care.

- Key Consumer Segments: Identify specific age groups or demographics that represent key consumer segments. Tailoring products and services to meet the needs of these groups is essential for success. For example, businesses targeting millennials might focus on digital marketing and online platforms.

- Urbanization Trends: Urban areas often concentrate economic activity and consumer spending. Understanding urbanization patterns can help target investments towards high-growth urban centers.

H3: Identifying Emerging Consumer Trends and Preferences:

- Market Research and Data Analytics: Market research and data analytics are invaluable for identifying emerging trends. Social media analytics, consumer surveys, and sales data can provide insights into changing consumer preferences.

- Adapting to Change: Successful businesses constantly adapt to evolving consumer preferences. Monitoring trends allows for proactive adjustments to product offerings, marketing strategies, and overall business models. For instance, a company might shift its focus to sustainable products in response to growing consumer interest in environmental responsibility.

H2: Leveraging Technological Advancements and Innovation:

Technology is a powerful driver of economic growth. Identifying regions with strong technological capabilities is crucial.

H3: Assessing the Technological Landscape and Innovation Hubs:

- Identifying Tech Hubs: Look for concentrations of tech companies, research institutions, and venture capital firms. These clusters often benefit from synergies and talent pools.

- Digital Infrastructure: Access to high-speed internet and robust digital infrastructure is essential for businesses in the digital economy.

- Examples of Successful Tech Hubs: Research successful tech hubs and study their impact on the surrounding economy. Their success often translates into related job creation, increased investment, and overall economic growth.

H3: Identifying Opportunities in Emerging Technologies:

- Promising Sectors: Invest in sectors like artificial intelligence, renewable energy, and biotechnology, which hold immense potential for growth. These are areas likely to see high investment and significant returns.

- Due Diligence and Risk Assessment: Due diligence and thorough risk assessment are crucial when investing in emerging technologies. The risks may be higher, but so is the potential reward.

3. Conclusion:

Successfully "Investing in Growth" requires a comprehensive approach that incorporates analysis of strong economic indicators (GDP growth, sectoral contributions, infrastructure development, and regulatory environment), favorable demographic trends and consumer behavior, and the leveraging of technological advancements. Thorough research and careful analysis are essential before making investment decisions. While risk is inherent, the potential for high returns in strategically selected locations is substantial. Begin your research today, utilizing available resources and perhaps consulting with experts to help you identify these promising business hotspots. Start actively pursuing opportunities in these dynamic areas and unlock the potential for significant growth in your investment portfolio.

Featured Posts

-

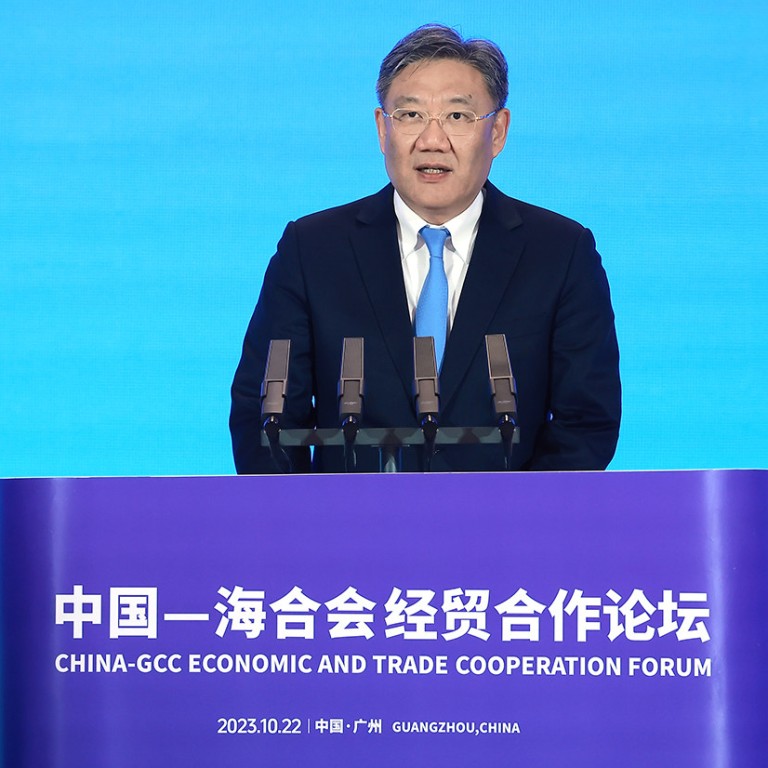

China Diversifies Lpg Supply Turning To Middle East Amidst Us Trade Wars

Apr 24, 2025

China Diversifies Lpg Supply Turning To Middle East Amidst Us Trade Wars

Apr 24, 2025 -

Instagram Launches Video Editing App To Poach Tik Tok Creators

Apr 24, 2025

Instagram Launches Video Editing App To Poach Tik Tok Creators

Apr 24, 2025 -

Bethesda Confirms Oblivion Remastered Release

Apr 24, 2025

Bethesda Confirms Oblivion Remastered Release

Apr 24, 2025 -

India Market Update Tailwinds Driving Nifty Gains

Apr 24, 2025

India Market Update Tailwinds Driving Nifty Gains

Apr 24, 2025 -

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir

Apr 24, 2025

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir

Apr 24, 2025

Latest Posts

-

Trumps Energy Policy Cheap Oil And Its Geopolitical Implications

May 12, 2025

Trumps Energy Policy Cheap Oil And Its Geopolitical Implications

May 12, 2025 -

The Impact Of Trumps Presidency On Cheap Oil And The Energy Industry

May 12, 2025

The Impact Of Trumps Presidency On Cheap Oil And The Energy Industry

May 12, 2025 -

Understanding The Dynamics Between Trumps Policies And Cheap Oil

May 12, 2025

Understanding The Dynamics Between Trumps Policies And Cheap Oil

May 12, 2025 -

Trumps Cheap Oil Policies An Assessment Of Their Success And Failures

May 12, 2025

Trumps Cheap Oil Policies An Assessment Of Their Success And Failures

May 12, 2025 -

Examining Trumps Actions And Their Effect On Cheap Oil Production

May 12, 2025

Examining Trumps Actions And Their Effect On Cheap Oil Production

May 12, 2025