Sensex LIVE: Market Soars, Nifty Reclaims 23,800 - Sector-Wise Analysis

Table of Contents

Today's market witnessed a significant upswing, with the Sensex and Nifty50 indices posting impressive gains. The Nifty50 index successfully reclaimed the crucial 23,800 level, fueled by positive investor sentiment and strong performance across various sectors. This article delves into a sector-wise analysis of the market's performance, highlighting key drivers and providing insights into the day's trading activity. We'll examine which sectors led the charge and what factors contributed to this bullish trend.

Nifty50 Reclaims 23,800: Understanding the Surge

The Nifty50 reclaiming the 23,800 mark is a significant event, signifying a renewed bullish sentiment in the Indian stock market. This psychological level often acts as a key resistance point, and its breach suggests strong underlying momentum. The overall market sentiment was overwhelmingly positive, driven by several factors.

- Global Market Trends: Positive cues from global markets, particularly the US and European indices, contributed to the overall positive sentiment. Strong corporate earnings reports from multinational companies also boosted investor confidence.

- Domestic Economic Data: Recent positive economic indicators released by the Indian government, such as [insert specific example, e.g., improved manufacturing PMI or positive GDP growth projections], further fueled the market rally.

- Easing Inflation Concerns: Signs of easing inflation, both globally and domestically, reduced investor anxieties about interest rate hikes, leading to increased risk appetite.

Key Metrics:

- Percentage Increase: The Nifty50 index surged by [insert percentage]% today, closing at 23,815 (example).

- Resistance Level: The 23,800 level, a significant psychological and technical resistance, was decisively broken.

- Trade Volume: Trading volume was significantly higher than average, indicating strong participation from both domestic and foreign institutional investors.

Sector-Wise Performance Analysis: Identifying Top Performers

The market rally wasn't uniform across all sectors. Some sectors significantly outperformed others. Let's examine the key performers:

1. Banking Sector: The banking sector was a major contributor to the overall market surge. Positive regulatory announcements and strong quarterly earnings from several leading banks boosted investor confidence.

- Top Performing Stocks: HDFC Bank, ICICI Bank, SBI (Provide percentage changes for each)

- Reasons for Performance: Strong loan growth, improved asset quality, and positive outlook for future earnings.

- Percentage Change: [Insert Average Percentage Change for Banking Sector]

2. Information Technology (IT) Sector: The IT sector also witnessed robust gains, driven by positive global demand and strong order books.

- Top Performing Stocks: TCS, Infosys, HCL Tech (Provide percentage changes for each)

- Reasons for Performance: Strong deal wins, positive client outlook, and a weakening dollar (if applicable).

- Percentage Change: [Insert Average Percentage Change for IT Sector]

(Repeat this section for other key sectors like FMCG, Pharma, etc., providing similar details and analysis.)

Key Stocks Driving the Market Rally: Individual Stock Analysis

Several individual stocks played a crucial role in propelling the market higher. Let's look at a few examples:

- Stock: [Stock Ticker Symbol and Name, e.g., RELIANCE.NS]

- Percentage Change: [Percentage Change]

- Reason for Performance: [Reason, e.g., Strong Q2 earnings beat, new product launch]

(Repeat this section for 2-3 more significant stocks.)

Technical Indicators and Future Outlook: Predicting Market Trends

Analyzing key technical indicators provides further insights into the market's current strength and potential future direction.

- RSI: The Relative Strength Index (RSI) currently sits at [insert value], suggesting [interpretation, e.g., overbought or oversold conditions].

- MACD: The Moving Average Convergence Divergence (MACD) shows [interpretation, e.g., a bullish crossover].

Short-Term Outlook: Based on today's performance and technical analysis, the short-term outlook for the Sensex and Nifty50 appears positive. However, potential risks remain, including global geopolitical uncertainties and domestic inflationary pressures.

Potential Support and Resistance Levels: Support levels are expected around [insert levels], while resistance levels could be seen near [insert levels].

Conclusion:

Today's market surge saw the Nifty50 successfully reclaim the 23,800 mark, driven by strong performances across various sectors. Our sector-wise analysis revealed key drivers behind this positive trend, highlighting top performers and significant contributing factors. Understanding these market dynamics is crucial for informed investment decisions.

Call to Action: Stay tuned for more Sensex LIVE updates and in-depth market analysis. Follow us to stay informed about the latest movements in the Nifty50 and Sensex and make smarter investment choices based on accurate and timely information. Keep track of the Sensex LIVE data and plan your investments strategically!

Featured Posts

-

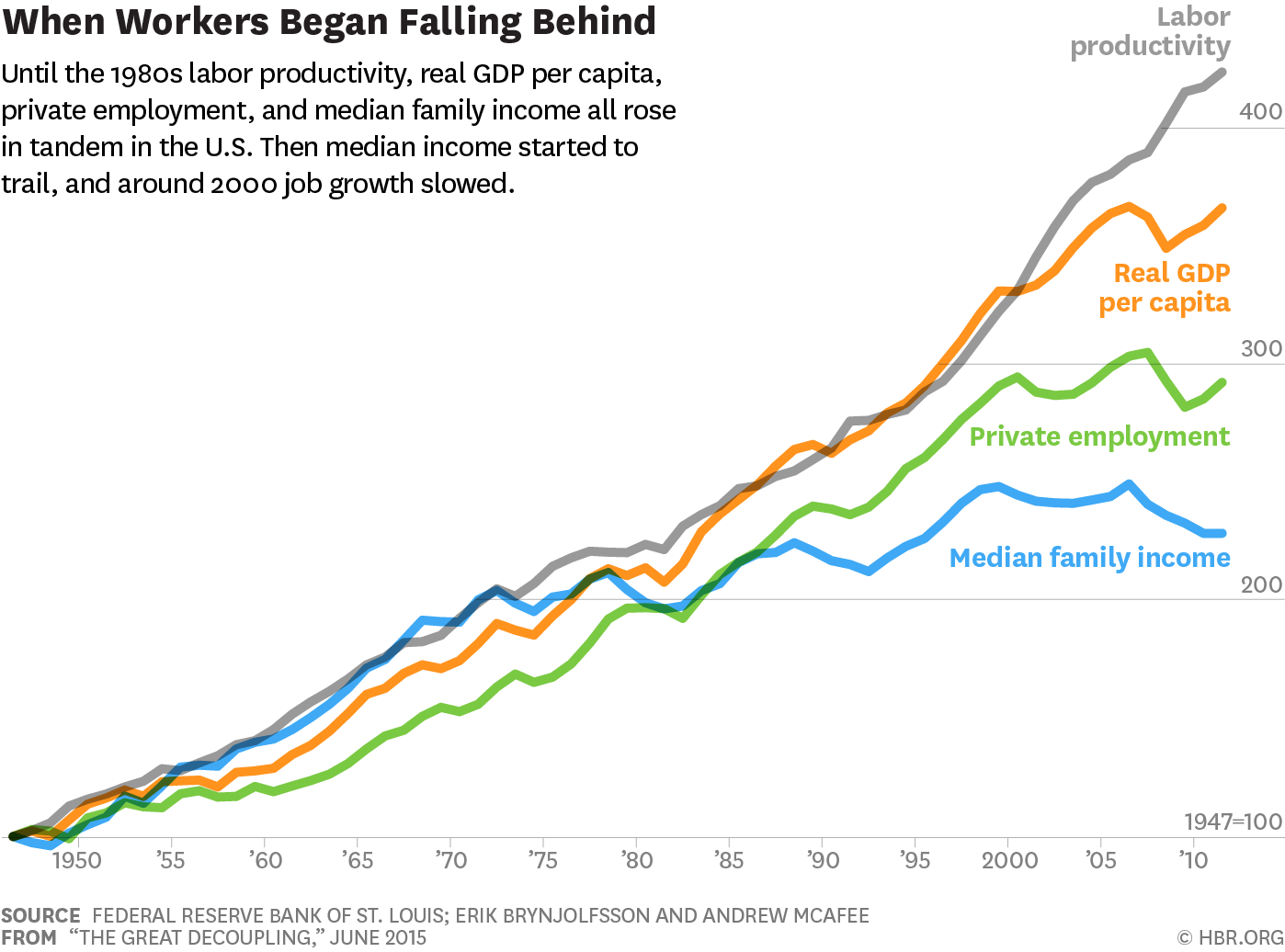

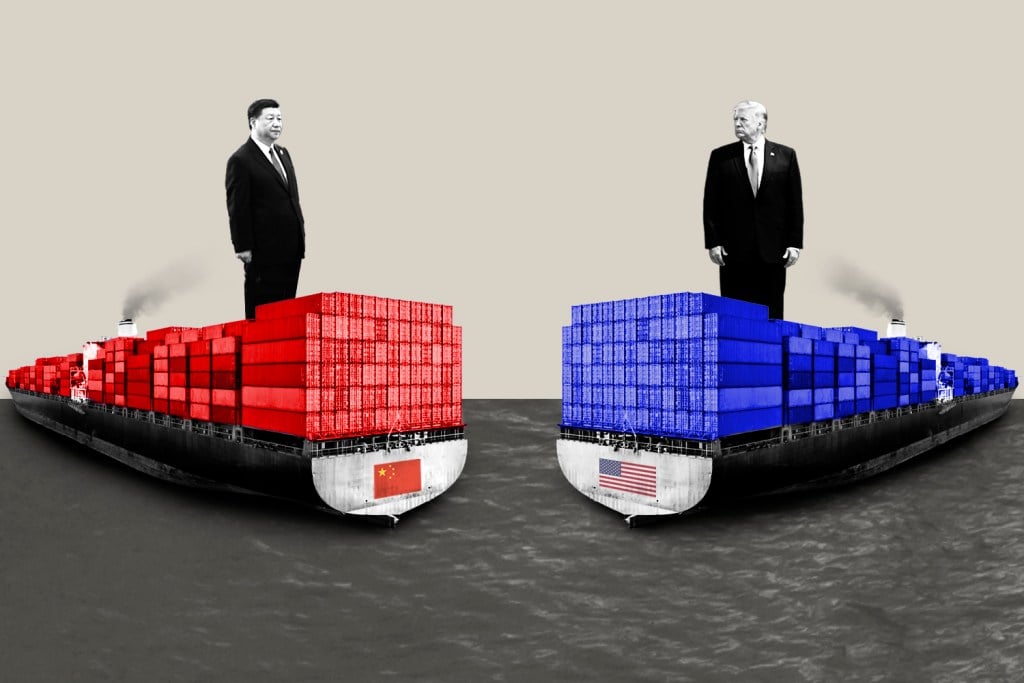

The Great Decoupling Reshaping Global Supply Chains And Trade

May 09, 2025

The Great Decoupling Reshaping Global Supply Chains And Trade

May 09, 2025 -

Bitcoin Madenciligi Sonu Mu Yaklasiyor Yeni Bir Doenem Mi Basliyor

May 09, 2025

Bitcoin Madenciligi Sonu Mu Yaklasiyor Yeni Bir Doenem Mi Basliyor

May 09, 2025 -

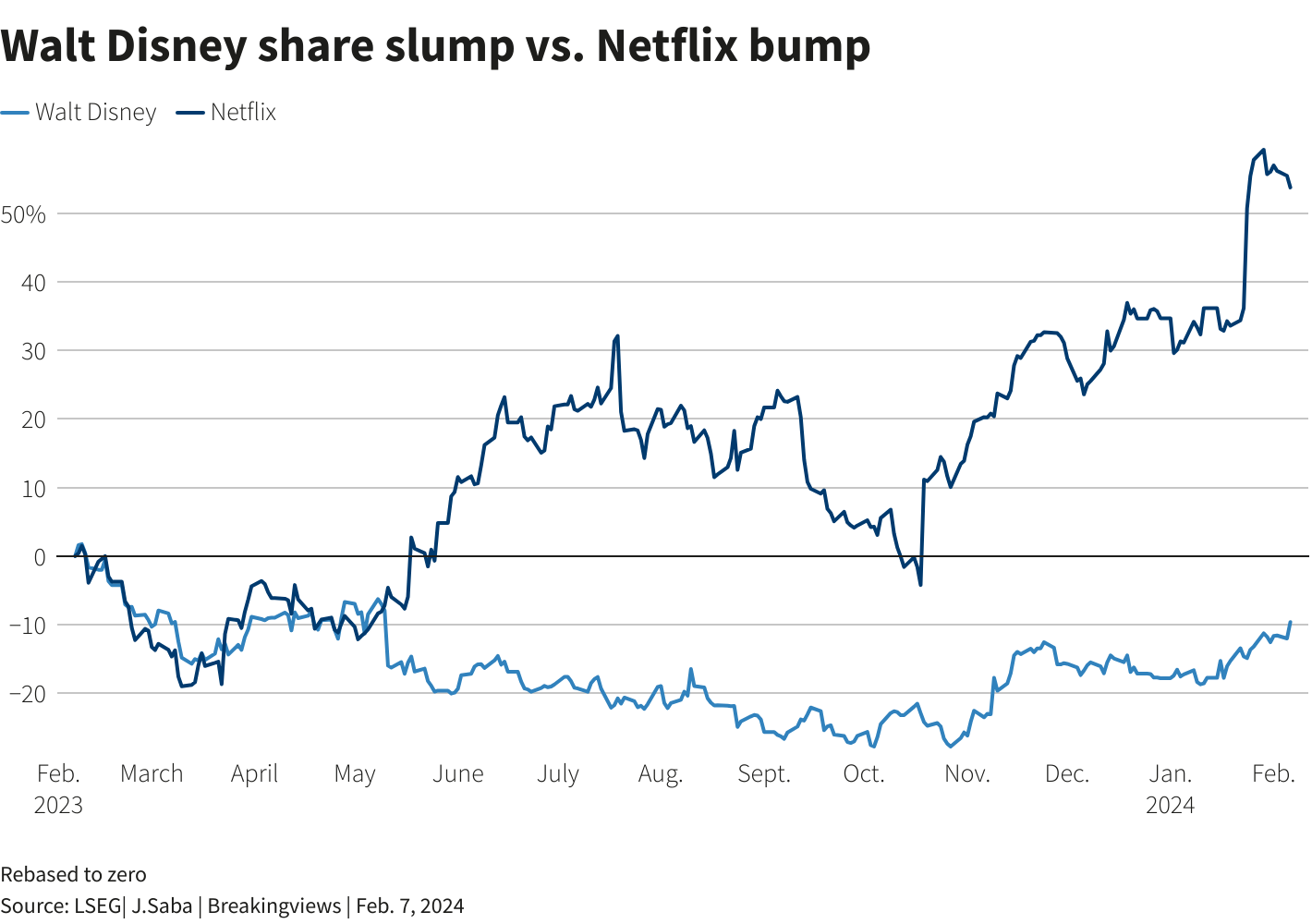

Strong Parks And Streaming Performance Boost Disneys Earnings Forecast

May 09, 2025

Strong Parks And Streaming Performance Boost Disneys Earnings Forecast

May 09, 2025 -

The Great Decoupling Implications For Global Economics And Geopolitics

May 09, 2025

The Great Decoupling Implications For Global Economics And Geopolitics

May 09, 2025 -

Bekam Zashto E Na Dobar Fudbaler Na Site Vreminja

May 09, 2025

Bekam Zashto E Na Dobar Fudbaler Na Site Vreminja

May 09, 2025