Investing In Ripple (XRP): Understanding The Risks And Rewards After A 15,000% Jump

Table of Contents

Ripple's Technological Advantages and Use Cases

Ripple's success stems from its innovative technology and practical applications within the financial sector. Understanding these advantages is crucial before considering an investment.

Understanding the XRP Ledger (XRPL)

The XRP Ledger (XRPL) is a distributed, open-source blockchain designed for speed, scalability, and efficiency. Unlike Bitcoin and Ethereum, which rely on energy-intensive proof-of-work consensus mechanisms, XRPL uses a more energy-efficient consensus mechanism, reducing its environmental footprint.

- Fast Transactions: XRPL boasts incredibly fast transaction speeds, processing transactions in just a few seconds, compared to minutes or even hours on other blockchains.

- Low Fees: Transaction fees on XRPL are significantly lower than those on other popular networks, making it a cost-effective solution for high-volume transactions.

- Scalability: The XRPL's architecture allows it to handle a large number of transactions simultaneously, making it scalable to meet the demands of a growing global payment network.

- Energy-Efficient Blockchain: The consensus mechanism used by XRPL drastically reduces energy consumption compared to proof-of-work systems, making it a more sustainable option.

RippleNet and its Global Reach

RippleNet is Ripple's global network of financial institutions that utilize the XRPL for cross-border payments. Its growing adoption rate demonstrates the increasing acceptance of Ripple's technology within the financial industry.

- Key Partnerships: Ripple has established partnerships with numerous major banks and financial institutions worldwide, including Santander, SBI Holdings, and MoneyGram. This institutional adoption is a significant factor driving XRP's value.

- Cross-Border Payments: RippleNet facilitates faster, cheaper, and more transparent cross-border payments, solving a major pain point for international transactions.

- Global Payments Network: RippleNet's global reach provides a vast network for facilitating transactions across borders, making it a compelling alternative to traditional payment systems.

- Institutional Adoption: The increasing adoption of RippleNet by financial institutions is a key indicator of its potential for long-term growth.

XRP's Role in RippleNet

XRP serves as a bridge currency within the RippleNet ecosystem, enabling faster and cheaper transactions between different currencies.

- Bridging Currencies: XRP facilitates the conversion of one currency to another, eliminating the need for intermediaries and reducing transaction times.

- Payment Facilitation: XRP acts as a liquidity provider, enabling instant settlement of payments and reducing counterparty risk.

- Improved Liquidity: The use of XRP improves liquidity within the RippleNet network, allowing for smoother and more efficient transactions.

- XRP Utility: The utility of XRP within the RippleNet ecosystem is a key driver of its demand and value.

The Risks Associated with Investing in XRP

Despite the potential rewards, investing in XRP carries substantial risks. Understanding these risks is crucial before committing any capital.

Regulatory Uncertainty and Legal Battles

The ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC) casts a significant shadow over XRP's future. The outcome of this case could significantly impact XRP's price and investor confidence.

- SEC Lawsuit: The SEC alleges that XRP is an unregistered security, which could lead to significant penalties for Ripple and potentially impact the usability of XRP.

- Regulatory Uncertainty: The lack of regulatory clarity surrounding XRP creates uncertainty for investors and hinders its wider adoption.

- Legal Risks: The legal battle poses a significant risk to XRP's value and future prospects.

- XRP Price Volatility: The uncertainty surrounding the SEC lawsuit contributes to significant price volatility for XRP.

Market Volatility and Price Fluctuations

The cryptocurrency market is inherently volatile, and XRP is no exception. Its price can experience dramatic swings, resulting in significant gains or losses.

- Cryptocurrency Volatility: The cryptocurrency market is known for its extreme volatility, with prices subject to sudden and unpredictable changes.

- Price Fluctuations: XRP's price has historically demonstrated considerable price fluctuations, making it a high-risk investment.

- Market Risk: Investing in XRP involves significant market risk, with the potential for substantial losses.

- High-Risk Investment: It is crucial to remember that XRP is a high-risk investment, and investors should only allocate capital they can afford to lose.

Competition in the Cryptocurrency Market

The cryptocurrency market is highly competitive, with numerous alternative payment solutions and cryptocurrencies vying for market share.

- Cryptocurrency Competition: Many other cryptocurrencies offer similar functionalities to XRP, creating competition in the market.

- Alternative Payment Solutions: Traditional payment systems and other emerging technologies also compete with RippleNet.

- Blockchain Technology Comparison: Investors should compare different blockchain technologies and their respective advantages and disadvantages before investing.

Future Outlook and Potential for Growth

Despite the risks, XRP's potential for future growth is linked to several factors.

Adoption by Financial Institutions

The continued adoption of RippleNet by financial institutions globally could significantly boost XRP's value and market share.

- Institutional Adoption: Further adoption by banks and financial institutions would solidify XRP's position in the global payments market.

- Global Expansion: The expansion of RippleNet into new markets could drive further demand for XRP.

- RippleNet Growth: The growth of RippleNet is directly correlated to the potential growth of XRP.

- Future Potential: The potential for widespread institutional adoption represents a significant opportunity for XRP's future growth.

Technological Advancements and Development

Future technological advancements and improvements within the XRPL and RippleNet could enhance its functionality and competitiveness.

- XRPL Upgrades: Ongoing development and upgrades to the XRPL could improve its performance, security, and scalability.

- Technological Advancements: Innovations within the XRPL could enhance its capabilities and attract new users.

- Future Development: Ripple's ongoing commitment to research and development suggests a potential for continued improvements.

- Innovation: Continued innovation within the Ripple ecosystem is crucial for maintaining its competitiveness.

The Impact of Regulatory Decisions

The outcome of the SEC lawsuit and future regulatory decisions will have a profound impact on XRP's price and future prospects.

- Regulatory Clarity: Clear regulatory guidelines would reduce uncertainty and potentially boost investor confidence.

- Future Regulations: The regulatory landscape for cryptocurrencies is constantly evolving, and future regulations could significantly affect XRP.

- Legal Implications: The legal implications of the SEC lawsuit and future regulatory actions will be crucial for XRP's future.

Conclusion

Investing in Ripple (XRP) presents a compelling but high-risk proposition. While its technological advantages and potential for growth are undeniable, the regulatory uncertainty and inherent market volatility cannot be ignored. The 15,000% jump highlights both its potential and its unpredictable nature. Before investing in XRP, carefully weigh the potential rewards against the significant risks involved. Conduct thorough research, understand your risk tolerance, and only invest what you can afford to lose. Remember, due diligence is crucial when considering investing in Ripple (XRP) or any other cryptocurrency.

Featured Posts

-

Cnns Misinformation Experts Why Facts Alone Dont Change Minds

May 02, 2025

Cnns Misinformation Experts Why Facts Alone Dont Change Minds

May 02, 2025 -

Six Nations Englands Daly Secures Last Minute Win Against France

May 02, 2025

Six Nations Englands Daly Secures Last Minute Win Against France

May 02, 2025 -

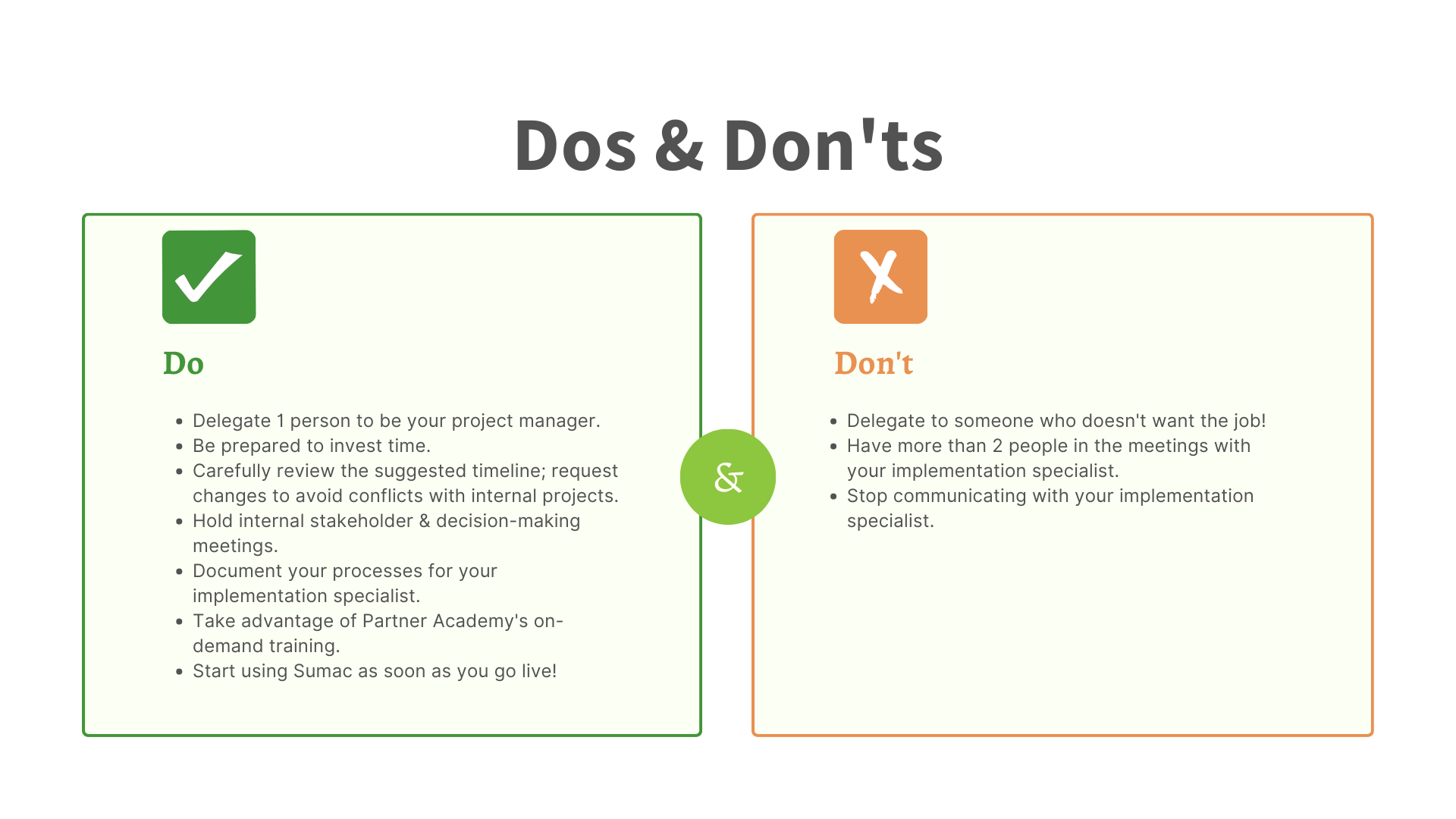

Land Your Dream Private Credit Job 5 Key Dos And Don Ts

May 02, 2025

Land Your Dream Private Credit Job 5 Key Dos And Don Ts

May 02, 2025 -

Bank Of Canadas April Interest Rate Decision Impact Of Trump Tariffs

May 02, 2025

Bank Of Canadas April Interest Rate Decision Impact Of Trump Tariffs

May 02, 2025 -

England Edges France In Thrilling Six Nations Clash Thanks To Daly

May 02, 2025

England Edges France In Thrilling Six Nations Clash Thanks To Daly

May 02, 2025