Investment In D-Wave Quantum (QBTS): Understanding The Recent Stock Price Spike

Table of Contents

D-Wave Quantum's Technological Advancements and Market Position

D-Wave Quantum employs a unique approach to quantum computing, focusing on quantum annealing. Unlike gate-based quantum computers pursued by competitors like IBM and Google, D-Wave's technology is specifically designed to tackle optimization problems – finding the best solution among many possibilities. This specialization gives them a niche advantage in certain markets. Recent breakthroughs have significantly enhanced their capabilities:

- New processor releases and their improved capabilities: D-Wave has consistently released new generations of its quantum annealers, each boasting increased qubit count and improved connectivity, leading to faster and more accurate solutions for complex optimization problems. The latest advancements in qubit coherence and control have significantly expanded the scope of solvable problems.

- Expansion of their customer base and partnerships: D-Wave has secured partnerships with major players across diverse industries, including logistics, finance, and materials science. This growing customer base demonstrates a burgeoning demand for their quantum annealing technology and validates the practical applications of their approach.

- Key applications showing promising results: D-Wave's technology is showing promising results in various applications, such as traffic optimization, financial modeling, and drug discovery. These real-world applications showcase the potential of quantum annealing to deliver tangible benefits across various sectors.

- Competitive landscape analysis: While facing competition from gate-based quantum computing companies like IBM, Google, and IonQ, D-Wave occupies a unique space. Its focus on optimization problems, coupled with its established customer base and track record, positions it as a significant player in the quantum computing ecosystem. The future likely involves a multi-faceted quantum computing landscape where different approaches, including annealing, coexist and serve unique purposes.

Analyzing the Recent Stock Price Spike: Factors Contributing to the Rise

The recent rise in D-Wave Quantum (QBTS) stock price is a multifaceted phenomenon with several contributing factors:

- Increased investor interest in quantum computing as a whole: The quantum computing sector is attracting significant investment as its potential to revolutionize various industries becomes increasingly apparent. This overall positive sentiment spills over into individual companies like D-Wave.

- Specific news or announcements from D-Wave: Positive news releases, such as announcements of new partnerships, significant technological breakthroughs, or successful customer implementations, can trigger substantial stock price increases. Investors closely monitor such announcements for indicators of future growth.

- Market speculation and overall positive sentiment towards the tech sector: Broad market trends and positive sentiment towards the technology sector often influence individual stock prices, including D-Wave Quantum (QBTS).

- Short squeezes or other market manipulations: While less likely to be the primary driver, short squeezes or other market manipulations can temporarily inflate stock prices. It's crucial to carefully consider all contributing factors when analyzing price movements.

Risks and Opportunities Associated with Investing in D-Wave Quantum (QBTS) Stock

Investing in D-Wave Quantum (QBTS) stock presents both significant risks and substantial long-term opportunities:

- High volatility of the stock market, especially in the tech sector: The technology sector is inherently volatile, and D-Wave, as a relatively young company in a nascent industry, is subject to significant price fluctuations.

- The long-term nature of the quantum computing industry and potential for delays in realizing returns: Quantum computing is still an emerging technology, and it may take years, even decades, before widespread commercial adoption and significant returns on investment are realized.

- Competition from other companies in the quantum computing space: D-Wave faces strong competition from established tech giants and other emerging players in the quantum computing field.

- Potential for future technological breakthroughs that could disrupt D-Wave's position: Rapid advancements in quantum computing could render D-Wave's technology less competitive in the future.

- Long-term growth potential driven by adoption in various industries: The long-term potential for quantum computing is immense, and D-Wave's position as a key player in this field offers significant growth opportunities.

Due Diligence Before Investing in QBTS

Before investing in D-Wave Quantum (QBTS) stock, thorough due diligence is paramount:

- Review D-Wave's financial reports and investor presentations: Analyze the company's financial performance, growth trajectory, and strategic plans to assess its financial health and future prospects.

- Analyze industry reports and expert opinions on quantum computing's future: Gain a comprehensive understanding of the industry landscape, competitive dynamics, and the future potential of quantum computing.

- Assess your personal risk tolerance and investment goals: Investing in D-Wave Quantum (QBTS) stock involves significant risk. Ensure your investment aligns with your risk tolerance and long-term investment objectives.

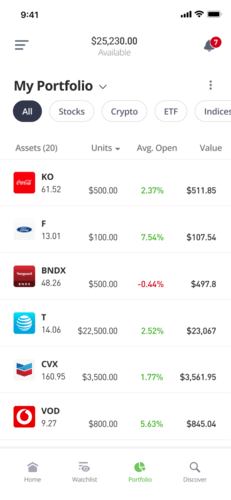

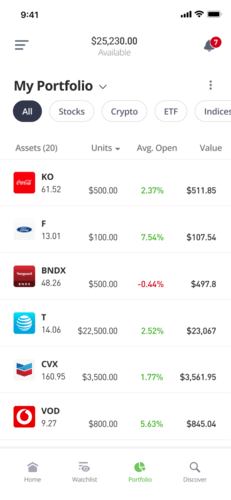

- Diversify your portfolio to mitigate risk: Don't put all your eggs in one basket. Diversifying your investment portfolio across different asset classes can help mitigate the risks associated with investing in a single, potentially volatile stock.

Conclusion

This article explored the recent spike in D-Wave Quantum (QBTS) stock price, examining technological advancements, market influences, and the inherent risks and opportunities. Investing in D-Wave Quantum (QBTS) stock requires a careful assessment of the company's progress, the competitive landscape, and your individual risk tolerance. The potential for long-term growth in the quantum computing sector is undeniable, but the inherent risks associated with investing in this relatively new and volatile area cannot be ignored.

Call to Action: Before making any investment decisions regarding D-Wave Quantum (QBTS) stock, conduct thorough due diligence and consider consulting with a qualified financial advisor. Understanding the factors driving the D-Wave Quantum (QBTS) stock price and the broader quantum computing market is crucial for informed investment in this exciting but potentially volatile sector. Remember to carefully weigh the risks and rewards of D-Wave Quantum (QBTS) stock before making any investment decisions.

Featured Posts

-

Jennifer Lawrences Uitbreidende Familie Een Tweede Kind

May 20, 2025

Jennifer Lawrences Uitbreidende Familie Een Tweede Kind

May 20, 2025 -

Tea Break Tensions Hamilton And Ferrari Clash At Miami Gp

May 20, 2025

Tea Break Tensions Hamilton And Ferrari Clash At Miami Gp

May 20, 2025 -

Michael Schumachers Comeback A Pointless Pursuit Red Bulls Ignored Advice

May 20, 2025

Michael Schumachers Comeback A Pointless Pursuit Red Bulls Ignored Advice

May 20, 2025 -

Ryanairs Growth Threatened By Tariff War Company Announces Buyback

May 20, 2025

Ryanairs Growth Threatened By Tariff War Company Announces Buyback

May 20, 2025 -

Delving Into The World Of Agatha Christies Poirot

May 20, 2025

Delving Into The World Of Agatha Christies Poirot

May 20, 2025

Latest Posts

-

Prokrisi Ston Teliko Champions League I Kroyz Azoyl Toy Giakoymaki

May 20, 2025

Prokrisi Ston Teliko Champions League I Kroyz Azoyl Toy Giakoymaki

May 20, 2025 -

Eksereynontas To Oropedio Evdomos Tin Protomagia

May 20, 2025

Eksereynontas To Oropedio Evdomos Tin Protomagia

May 20, 2025 -

Champions League I Kroyz Azoyl Kai O Giakoymakis Diekdikoyn Tin Prokrisi Ston Teliko

May 20, 2025

Champions League I Kroyz Azoyl Kai O Giakoymakis Diekdikoyn Tin Prokrisi Ston Teliko

May 20, 2025 -

Protomagia Oropedio Evdomos Idaniki Eksormisi Gia Tin Anoiksi

May 20, 2025

Protomagia Oropedio Evdomos Idaniki Eksormisi Gia Tin Anoiksi

May 20, 2025 -

Giakoymakis Odigei Tin Kroyz Azoyl Ston Teliko Toy Champions League

May 20, 2025

Giakoymakis Odigei Tin Kroyz Azoyl Ston Teliko Toy Champions League

May 20, 2025