Ryanair's Growth Threatened By Tariff War, Company Announces Buyback

Table of Contents

The Impact of the Tariff War on Ryanair's Operations

The escalating tariff war has far-reaching consequences for Ryanair, impacting several key areas of its business.

Increased Fuel Costs

Tariffs significantly influence fuel prices, a major operating expense for airlines. Increased tariffs on imported crude oil and refined petroleum products directly translate to higher fuel costs for Ryanair.

- Specific Tariffs: Tariffs imposed by certain countries on oil imports from key producing regions have driven up global prices.

- Price Increases: Estimates suggest that these tariffs could increase Ryanair's fuel bill by X% (insert realistic percentage based on research), significantly impacting profitability margins.

- Impact on Profitability: Higher fuel costs inevitably squeeze profit margins, forcing Ryanair to consider cost-cutting measures or price adjustments to maintain profitability. This directly affects Ryanair fuel costs and overall airline fuel prices.

Disrupted Supply Chains

The tariff war also disrupts global supply chains, affecting Ryanair's procurement of aircraft parts and maintenance services.

- Affected Parts & Services: Tariffs on imported aircraft components, particularly those from specific countries, can lead to delays and increased costs. Maintenance services, often outsourced internationally, are also susceptible to disruptions.

- Maintenance Delays: Supply chain disruptions can cause delays in aircraft maintenance, potentially leading to flight cancellations and increased operational costs.

- Impact on Customer Satisfaction: Delays and disruptions directly impact customer satisfaction, potentially leading to negative reviews and reputational damage. This is a significant challenge for Ryanair's supply chain and overall aircraft maintenance strategy.

Weakening Consumer Demand

Economic uncertainty fueled by tariff wars can negatively impact consumer spending, including on discretionary items like air travel.

- Decreased Bookings: Data suggests a decline in air travel bookings in certain regions affected by the tariff war.

- Impact on Load Factors: Lower demand translates to lower load factors (the percentage of seats filled on flights), directly affecting Ryanair's revenue.

- Mitigation Strategies: Ryanair might respond by offering price discounts, expanding to new routes with higher demand, or focusing on cost-cutting measures to remain competitive. The impact on Ryanair passenger numbers needs to be carefully monitored.

Ryanair's Buyback Program: A Defensive Strategy?

Ryanair's announcement of a share buyback program comes amidst these challenges, sparking considerable discussion about its motives and potential effectiveness.

Details of the Buyback

Ryanair plans to repurchase approximately [insert number] of its own shares, representing a total investment of approximately [insert amount]. The buyback is expected to be completed within [insert timeframe].

- Share Repurchases: The magnitude of the buyback indicates a significant commitment of capital.

- Total Investment: The size of the investment signals a belief that shares are undervalued.

- Buyback Timeline: The timeframe will influence the market's perception and the impact on the stock price. Keywords include Ryanair share buyback and Ryanair stock.

Motivations Behind the Buyback

Ryanair's decision to repurchase its shares can be interpreted as a multi-faceted strategy.

- Signal of Confidence: The buyback may signal management's confidence in the company's long-term prospects, despite the current challenges.

- Return to Shareholders: It's a mechanism to return value to existing shareholders, potentially increasing investor confidence.

- Addressing Undervaluation: The repurchase could be an attempt to counter what management views as an undervaluation of the company's stock in the market. Keywords relevant here include Ryanair stock price and investor relations.

Effectiveness of the Buyback

The success of the buyback will depend on several factors.

- Impact on EPS: The buyback could increase earnings per share (EPS) by reducing the number of outstanding shares, potentially boosting the stock price.

- Market Reaction: The market's reaction to the announcement is crucial. A positive response suggests confidence in Ryanair's strategy.

- Industry Comparison: Comparing this buyback to similar initiatives undertaken by other airlines will provide valuable insights into its potential effectiveness. Keywords include Ryanair financial performance and stock market analysis.

Future Outlook for Ryanair's Growth

The future of Ryanair's growth trajectory hinges on its ability to navigate the challenges posed by the tariff war.

Potential Mitigation Strategies

Ryanair can adopt various strategies to mitigate the impact of the tariff war.

- Cost-Cutting Measures: Implementing stringent cost-cutting measures across all aspects of the business is crucial.

- Route Optimization: Analyzing and optimizing flight routes to maximize efficiency and minimize fuel consumption.

- Hedging Strategies: Employing hedging strategies to mitigate risks associated with fuel price volatility.

- Supplier Diversification: Diversifying suppliers to reduce reliance on any single source and mitigate supply chain disruptions. Keywords: Ryanair cost reduction, route planning, and risk management.

Long-Term Growth Prospects

Despite the current challenges, Ryanair's long-term growth prospects remain promising.

- Factors Influencing Growth: Factors like sustained low-cost operations, expansion into new markets, and the overall growth of the European air travel market will play a role.

- Market Opportunities: Identifying and capitalizing on emerging market opportunities in Eastern Europe and beyond.

- Long-Term Competitiveness: Maintaining its position as a low-cost leader and adapting to changing industry trends will be crucial for long-term success. Keywords: Ryanair future and airline industry trends.

Conclusion: Navigating the Challenges to Ryanair's Growth

The tariff war presents a significant challenge to Ryanair's growth, impacting fuel costs, supply chains, and consumer demand. The company's share buyback program represents a strategic response, aimed at bolstering investor confidence and potentially enhancing shareholder value. However, the long-term success of this strategy and Ryanair's overall ability to navigate these challenges remains to be seen. To stay updated on how Ryanair addresses these issues and the evolution of its growth trajectory, subscribe to our newsletter for regular updates and insightful analysis on Ryanair's growth and the broader airline industry.

Featured Posts

-

L Affaire Jaminet Un Accord Financier Trouve Avec Le Stade Toulousain

May 20, 2025

L Affaire Jaminet Un Accord Financier Trouve Avec Le Stade Toulousain

May 20, 2025 -

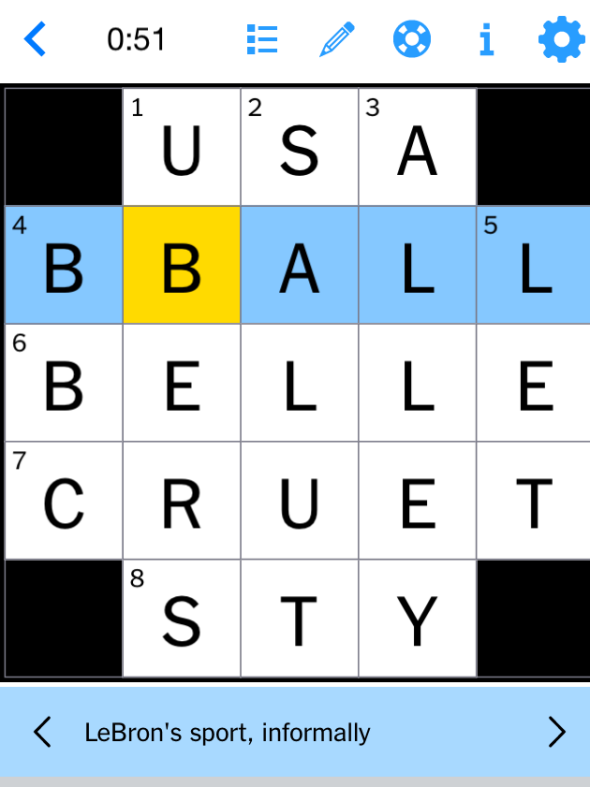

Solve The Nyt Mini Crossword April 13th Answers

May 20, 2025

Solve The Nyt Mini Crossword April 13th Answers

May 20, 2025 -

Biarritz Le Guide Complet Du Mercato Gastronomique Nouveaux Chefs Et Adresses

May 20, 2025

Biarritz Le Guide Complet Du Mercato Gastronomique Nouveaux Chefs Et Adresses

May 20, 2025 -

Broadcoms Proposed V Mware Price Hike A 1 050 Increase According To At And T

May 20, 2025

Broadcoms Proposed V Mware Price Hike A 1 050 Increase According To At And T

May 20, 2025 -

Biarritz Le Guide Complet Du Mercato Gastronomique

May 20, 2025

Biarritz Le Guide Complet Du Mercato Gastronomique

May 20, 2025

Latest Posts

-

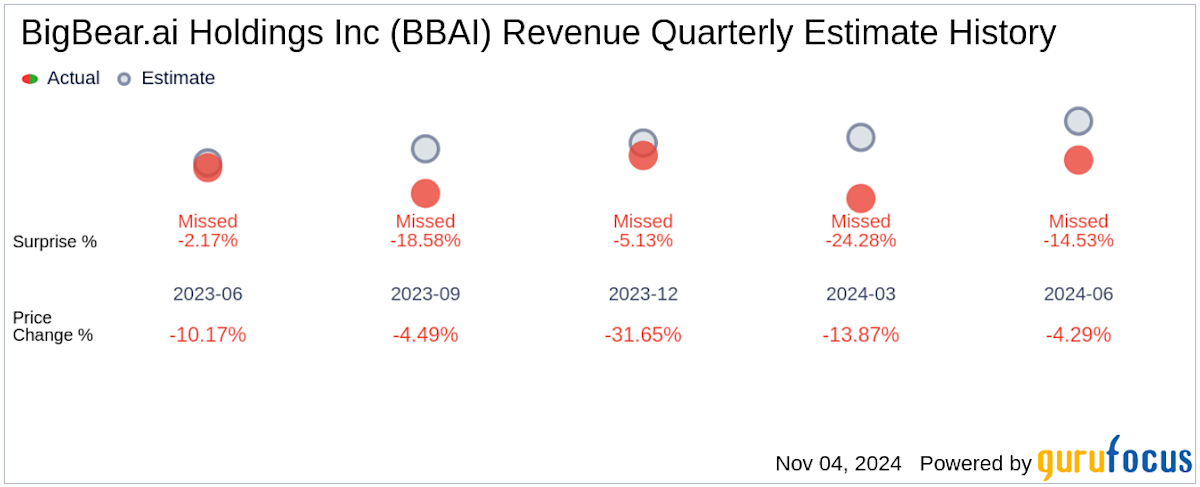

Big Bear Ai Holdings Inc Sued Implications For Investors

May 20, 2025

Big Bear Ai Holdings Inc Sued Implications For Investors

May 20, 2025 -

Gross Law Firm Represents Big Bear Ai Bbai Investors June 10 2025 Deadline

May 20, 2025

Gross Law Firm Represents Big Bear Ai Bbai Investors June 10 2025 Deadline

May 20, 2025 -

Potential Legal Action For Big Bear Ai Bbai Investors Contact Gross Law Firm

May 20, 2025

Potential Legal Action For Big Bear Ai Bbai Investors Contact Gross Law Firm

May 20, 2025 -

Bbai Stock Dips Following Below Forecast Q1 Earnings Report

May 20, 2025

Bbai Stock Dips Following Below Forecast Q1 Earnings Report

May 20, 2025 -

Bbai Stock Investors Important Information Regarding Legal Action Deadline June 10 2025

May 20, 2025

Bbai Stock Investors Important Information Regarding Legal Action Deadline June 10 2025

May 20, 2025