Investor Concerns About Stock Market Valuations: BofA's Rebuttal

Table of Contents

BofA's Core Argument Against Overvaluation

BofA's central thesis challenges the widespread belief that current stock market valuations are unsustainably high. Their argument rests on several key pillars, focusing less on short-term market fluctuations and more on long-term growth prospects and specific sector analyses. They argue that current valuations are justifiable given the anticipated future earnings growth and the current low-interest-rate environment.

- Strong Corporate Earnings Growth: BofA points to robust corporate earnings growth as a key factor supporting current valuations. They highlight specific sectors showing significant expansion, counteracting concerns about overvaluation across the board.

- Low Interest Rates: The persistently low interest rate environment makes equities a relatively attractive investment compared to bonds, influencing stock market valuations upward. This relative attractiveness, BofA suggests, helps to justify higher price-to-earnings ratios.

- Technological Innovation and Disruption: BofA acknowledges the impact of technological innovation and disruption, arguing that these forces will continue driving long-term growth and justifying higher valuations for certain sectors.

Analyzing BofA's Supporting Data and Metrics

To support their argument, BofA cites various data points and metrics. While specific figures may vary depending on the report, their analysis generally incorporates the following:

- Price-to-Earnings Ratio (P/E): BofA analyzes P/E ratios across different sectors, comparing them to historical averages and adjusting for expected future earnings growth. They argue that while some sectors may appear expensive based on current P/E, the projected growth justifies these valuations.

- Price/Earnings to Growth Ratio (PEG): Using the PEG ratio, which considers both P/E and earnings growth, BofA suggests that many stocks are fairly valued or even undervalued when considering future prospects.

- Economic Indicators: BofA incorporates relevant economic indicators such as inflation, interest rates, and GDP growth into their assessment. Their analysis suggests a supportive macroeconomic environment, despite near-term uncertainties.

- Discounted Cash Flow (DCF) Model: BofA likely employs DCF models and other alternative valuation models to arrive at a comprehensive assessment of market valuation, providing a more nuanced view than relying solely on simple P/E ratios.

Counterarguments and Potential Weaknesses in BofA's Analysis

While BofA's analysis presents a compelling counterargument, it's crucial to acknowledge potential weaknesses and counterpoints.

- Overreliance on Future Projections: A key criticism might be BofA's reliance on future earnings growth projections. These projections inherently involve uncertainty and could prove inaccurate, impacting the validity of their valuation assessment.

- Sectoral Bias: Some might argue that BofA's analysis may exhibit a sectoral bias, focusing on sectors with high growth potential while downplaying concerns in other areas potentially facing significant headwinds.

- Ignoring Geopolitical Risks: The analysis might not fully account for potential geopolitical risks, unforeseen economic shocks, or regulatory changes that could significantly impact stock market valuations.

- Dissenting Opinions: It's important to note that other financial analysts may hold differing views, and a comprehensive understanding requires considering multiple perspectives.

Implications for Investors: How to Interpret BofA's Rebuttal

BofA's rebuttal offers valuable insights, but investors should interpret it cautiously. It does not suggest ignoring risks but rather provides a counterbalance to the prevalent narrative of widespread overvaluation.

- Portfolio Diversification: Maintaining a diversified portfolio across different asset classes and sectors remains crucial to mitigating risk.

- Long-Term Investment Horizon: BofA’s argument emphasizes long-term growth; therefore, investors with a long-term investment horizon may find their assessment more reassuring.

- Risk Management Strategies: Implementing appropriate risk management strategies, such as stop-loss orders and diversification, remains crucial regardless of any specific analysis.

- Further Research: Investors should conduct their own thorough research, considering multiple perspectives and not relying solely on a single analysis.

Conclusion: Navigating Investor Concerns About Stock Market Valuations

BofA's analysis provides a counterpoint to the prevailing concerns surrounding high stock market valuations. While acknowledging potential weaknesses and counterarguments, their assessment suggests that current valuations may not be as excessive as some believe, particularly when considering long-term growth prospects and macroeconomic factors. However, investors must remain vigilant, considering diverse viewpoints, and employing robust risk management strategies. Understanding stock market valuations requires careful consideration of multiple analyses and a thorough understanding of market dynamics. To effectively assess stock market valuations, conduct thorough research, diversify your portfolio, and actively manage your risk.

Featured Posts

-

Tracking The Net Asset Value Nav Of The Amundi Msci World Ex Us Ucits Etf

May 24, 2025

Tracking The Net Asset Value Nav Of The Amundi Msci World Ex Us Ucits Etf

May 24, 2025 -

La Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo

May 24, 2025

La Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo

May 24, 2025 -

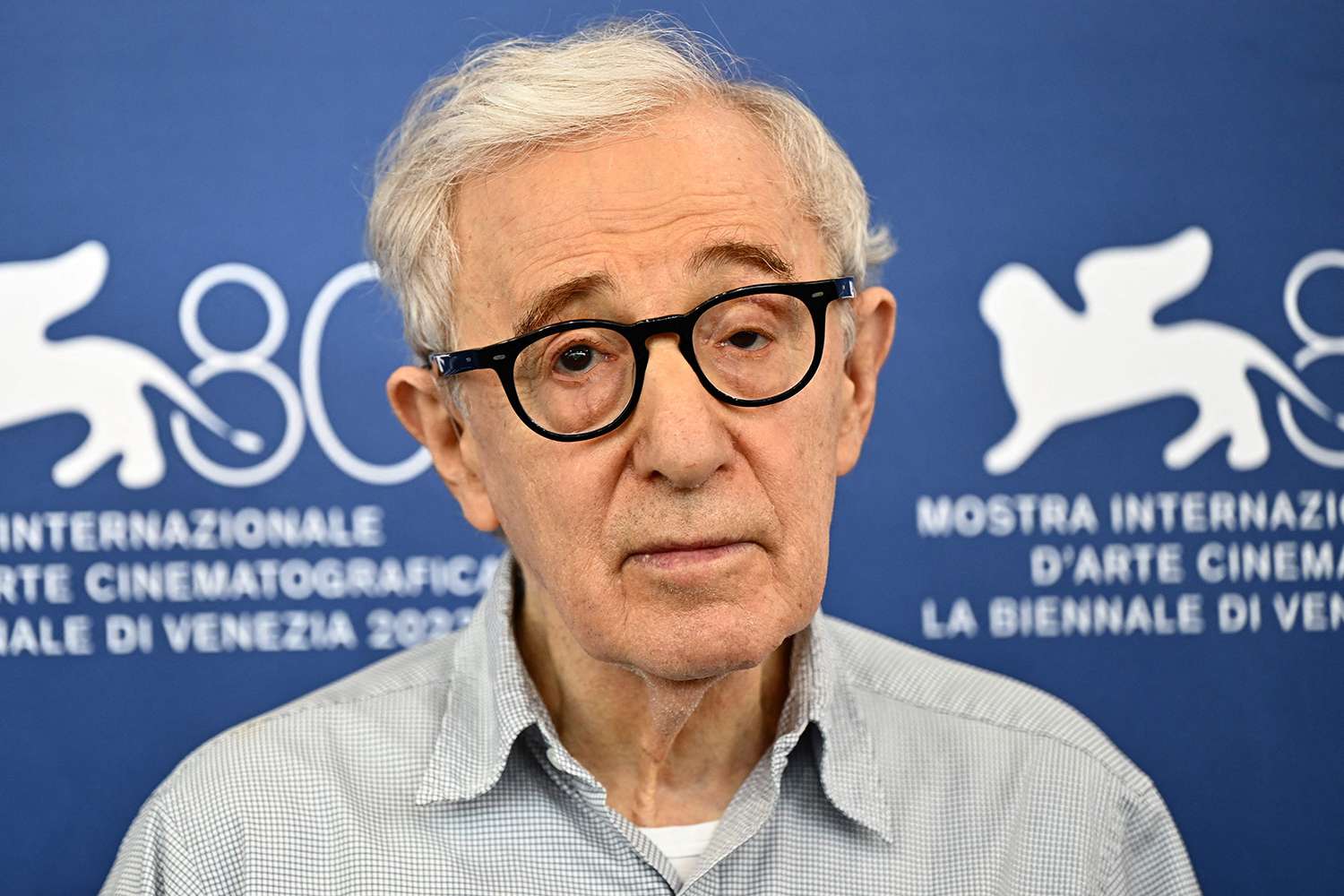

Sean Penns Doubts Re Examining The Woody Allen Dylan Farrow Allegations

May 24, 2025

Sean Penns Doubts Re Examining The Woody Allen Dylan Farrow Allegations

May 24, 2025 -

Refleksiya Na Temu Trillerov Fedor Lavrov O Pavle I I Chelovecheskoy Psikhologii

May 24, 2025

Refleksiya Na Temu Trillerov Fedor Lavrov O Pavle I I Chelovecheskoy Psikhologii

May 24, 2025 -

West Ham Targets Kyle Walker Peters Details Of The Transfer Offer

May 24, 2025

West Ham Targets Kyle Walker Peters Details Of The Transfer Offer

May 24, 2025

Latest Posts

-

Gas Prices To Hit Decade Lows For Memorial Day Weekend Travel

May 24, 2025

Gas Prices To Hit Decade Lows For Memorial Day Weekend Travel

May 24, 2025 -

Memorial Day Travel Gas Prices At Multi Decade Lows

May 24, 2025

Memorial Day Travel Gas Prices At Multi Decade Lows

May 24, 2025 -

Lowest Gas Prices In Decades Expected For Memorial Day Weekend

May 24, 2025

Lowest Gas Prices In Decades Expected For Memorial Day Weekend

May 24, 2025 -

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Beach Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Beach Sandy Point

May 24, 2025 -

Ocean City Rehoboth And Sandy Point Beach Weather Memorial Day Weekend 2025

May 24, 2025

Ocean City Rehoboth And Sandy Point Beach Weather Memorial Day Weekend 2025

May 24, 2025