Is A Place In The Sun Right For You? A Realistic Look At Overseas Property Ownership

Table of Contents

The Allure of Overseas Property: Why People Buy Abroad

The dream of owning a holiday home, a retirement home abroad, or simply an investment property overseas is powerful. Many people are drawn to the prospect of owning a "place in the sun" for a variety of compelling reasons:

-

Lifestyle benefits: Imagine escaping the everyday grind to enjoy a slower pace of life, exploring a new culture, and basking in sunshine. Owning property abroad provides easy access to a different lifestyle, potentially offering better weather, diverse culinary experiences, and exciting new adventures. A second home abroad can become a regular escape, improving overall well-being.

-

Financial benefits: Overseas property investment offers several potential financial advantages. Rental income can help offset costs, and in certain locations, property values can appreciate significantly. Furthermore, depending on your location and circumstances (always consult a tax advisor!), there may be tax benefits associated with owning property abroad. These benefits can vary greatly by country. However, it's important to remember that property investments also carry inherent risks.

-

Retirement planning: Securing a cost-effective and comfortable retirement location is a major draw for many. Owning a retirement home abroad allows you to live in a more desirable climate, be closer to family who have also relocated, or simply enjoy a lower cost of living. This can be a significant factor in long-term financial planning.

The Realities of Overseas Property Ownership: Challenges and Considerations

While the allure of overseas property is undeniable, it's essential to acknowledge the potential challenges and complexities involved. Buying property abroad isn't just about finding the perfect villa; it's a significant undertaking with several potential hurdles.

-

Hidden costs: Be prepared for unexpected expenses. Legal fees, agent fees, property taxes, insurance premiums, and ongoing maintenance and repairs can quickly add up, particularly as these costs are often higher and more challenging to manage remotely. Factor in potential emergency repairs, particularly for older properties.

-

Language and cultural barriers: Navigating the legal processes and communicating effectively with local professionals can be a significant challenge if you don't speak the local language. Understanding local customs and business practices is also crucial for a smooth transaction. Engaging a translator or a local expert who understands the nuances of the local legal system can be invaluable.

-

Distance and accessibility: Managing your overseas property from a distance requires meticulous planning and potentially employing local property managers or maintenance services. This can involve additional costs and the reliance on others to ensure the property is well-maintained. Regular trips to oversee upkeep are often necessary.

-

Currency fluctuations: Exchange rate volatility between your home currency and the local currency can significantly impact both the initial purchase price and ongoing costs. These fluctuations can increase or decrease the overall value of your investment, adding a layer of uncertainty.

-

Legal and regulatory complexities: Thoroughly research and understand the local laws and regulations concerning property ownership, inheritance, and taxation. These can differ significantly from your home country, creating potential legal and financial ramifications. Seeking legal counsel specializing in international property law is highly recommended.

Due Diligence: Essential Steps Before Buying Overseas Property

Before you sign on the dotted line, conducting thorough due diligence is paramount. This involves several crucial steps:

-

Conduct thorough research on the specific location and its market: Analyze property prices, rental yields, and the overall economic stability of the region. Look for areas with strong potential for property appreciation and high rental demand.

-

Engage a reputable local lawyer and estate agent: Their expertise in local laws, regulations, and market conditions is invaluable. A local estate agent will also have a greater understanding of the local nuances that may affect the value of the property over time.

-

Obtain a professional property survey: This is crucial to identify any potential structural problems or hidden defects before you complete the purchase. This is particularly important for older properties or those in areas prone to specific types of damage.

-

Understand the local tax system and implications: Research property taxes, capital gains tax, and any other relevant taxes that will apply to your ownership. Tax laws can be complex and vary significantly from one country to another.

-

Factor in potential rental management costs: If you plan to rent out your property, consider the costs of employing a local property management company to handle tenant relations, maintenance, and rent collection. This can affect the overall profitability of your investment.

Financing Your Overseas Property Purchase

Securing financing for your overseas property purchase requires careful planning.

-

Secure financing from an international lender or local bank: Compare interest rates, loan terms, and repayment options offered by various lenders to find the best fit for your financial situation.

-

Compare mortgage options and interest rates: Interest rates and mortgage options can vary significantly based on location and the lender. Be sure to get several quotes from multiple lenders, both local and international.

-

Consider the implications of currency fluctuations on your mortgage payments: Fluctuations in exchange rates can impact the affordability of your mortgage payments over time. Assess these potential risks in conjunction with your lender.

-

Explore alternative financing options: If you don't want a mortgage, consider alternative options, such as a cash purchase or joint ventures with other investors.

Conclusion

Buying a "place in the sun" can be a rewarding experience, but it's crucial to approach it with careful consideration of the potential challenges as well as the allure. Thorough research, professional advice, and realistic expectations are key to making a successful investment. Remember to weigh the pros and cons carefully, focusing on the long-term implications of owning international property.

Before you take the plunge and pursue your dream of overseas property ownership, ensure you fully understand the implications. Weigh the pros and cons carefully, and remember that seeking professional advice is paramount. Is a place in the sun right for you? Conduct thorough due diligence to make an informed decision about your overseas property investment.

Featured Posts

-

Mental Healthcare Access The Challenges Of Cost And Stigma

May 03, 2025

Mental Healthcare Access The Challenges Of Cost And Stigma

May 03, 2025 -

Fortnite Developer Epic Games Accused Of Widespread Deceptive Practices

May 03, 2025

Fortnite Developer Epic Games Accused Of Widespread Deceptive Practices

May 03, 2025 -

Survey 93 Of South Carolinians Trust Their Elections

May 03, 2025

Survey 93 Of South Carolinians Trust Their Elections

May 03, 2025 -

Tulsas Winter Storm Response A Fleet Of 66 Salt Spreaders

May 03, 2025

Tulsas Winter Storm Response A Fleet Of 66 Salt Spreaders

May 03, 2025 -

Tulsa Homeless Crisis The Tulsa Day Centers Observations

May 03, 2025

Tulsa Homeless Crisis The Tulsa Day Centers Observations

May 03, 2025

Latest Posts

-

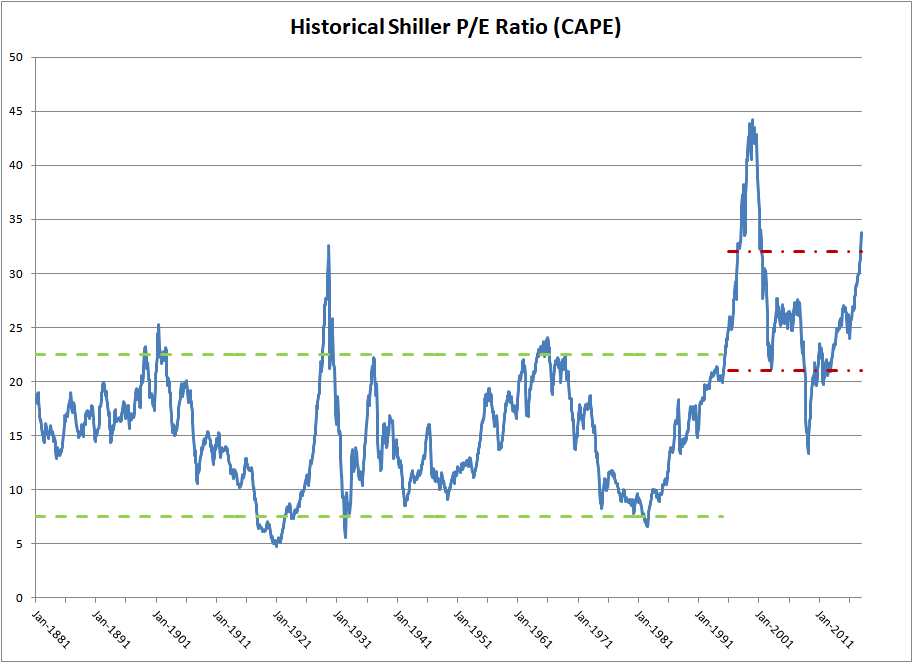

Addressing Investor Concerns Bof As View On High Stock Market Valuations

May 04, 2025

Addressing Investor Concerns Bof As View On High Stock Market Valuations

May 04, 2025 -

Effective Middle Management Key To A Thriving Company Culture

May 04, 2025

Effective Middle Management Key To A Thriving Company Culture

May 04, 2025 -

The Untapped Potential Of Middle Management Fostering Growth And Productivity

May 04, 2025

The Untapped Potential Of Middle Management Fostering Growth And Productivity

May 04, 2025 -

The Impact Of Opt Outs On Googles Search Ai Training With Web Content

May 04, 2025

The Impact Of Opt Outs On Googles Search Ai Training With Web Content

May 04, 2025 -

Los Angeles Wildfires A New Frontier For Disaster Betting

May 04, 2025

Los Angeles Wildfires A New Frontier For Disaster Betting

May 04, 2025