Is A Place In The Sun Right For You? Assessing Overseas Property Ownership

Table of Contents

Financial Considerations: Budgeting for Your Place in the Sun

Owning a property abroad involves far more than just the purchase price. Thorough financial planning is paramount to avoid unforeseen difficulties.

Purchase Costs:

The initial outlay for your Place in the Sun will encompass several key costs:

- Down Payment: Typically ranging from 10% to 30% of the property's value, depending on the country and lender.

- Closing Costs: These include legal fees, registration fees, and transfer taxes, which can vary significantly between countries. Expect these to add a substantial percentage to the overall purchase price.

- Legal Fees: Engaging a solicitor experienced in international property transactions is crucial and will add to your costs.

- Agent Fees: Real estate agent commissions are another significant expense.

Examples of typical costs: In Spain, closing costs can reach 10-15% of the purchase price. In France, notary fees can add 7-8%. In Portugal, stamp duty and other taxes can represent a similar percentage.

Mortgage options are available in many countries, but interest rates and lending criteria may differ substantially from your home country. Always compare mortgage offers carefully, considering both the interest rate and any associated fees.

Ongoing Costs:

Beyond the initial investment, be prepared for ongoing expenses:

- Property Taxes: These vary drastically between countries and are often based on the property's value or size.

- Insurance: Building and contents insurance are essential, protecting your investment against damage or theft.

- Maintenance: Regular upkeep, repairs, and potential renovations will add to your yearly budget.

- Utilities: Water, electricity, gas, and internet bills will need to be factored into your ongoing expenses.

Examples of ongoing costs: Annual property taxes in some parts of Italy can be relatively high. Insurance premiums will vary based on the property's location and value. Maintenance costs are influenced by the age and condition of the property.

Rental income can potentially offset some of these ongoing costs, but this requires careful market research and consideration of vacancy periods.

Currency Exchange Risks:

Fluctuations in exchange rates can significantly impact your investment. A weakening of your home currency against the local currency can make your mortgage payments more expensive and decrease the value of your investment when you decide to sell.

- Strategies for mitigating currency risk: Consider using currency hedging strategies or locking in exchange rates to protect against major fluctuations.

- Financial Planning: Thorough financial planning, ideally with professional advice, is essential to navigate these risks effectively.

Legal and Administrative Aspects of Owning a Place in the Sun

Navigating the legal aspects of buying overseas property requires meticulous attention to detail.

Due Diligence:

Thorough property checks are paramount to avoid potential problems. This includes:

- Title Deeds: Verifying the ownership and ensuring there are no encumbrances on the property.

- Building Permits: Confirming that all construction and renovations are legally compliant.

- Local Regulations: Understanding local building codes, planning regulations, and any restrictions on property use.

It's strongly advised to engage a solicitor who specializes in international property transactions. They can guide you through the legal intricacies and protect your interests.

Taxation and Residency:

Tax implications can be complex. Understand the tax laws of both your home country and the country where the property is located.

- Tax Laws: Tax rules on capital gains, rental income, and inheritance can vary dramatically.

- Residency Requirements: Owning a property abroad may have implications for your residency status, impacting your tax liability in both countries.

Inheritance and Probate:

Inheritance laws differ significantly between countries. Careful planning is essential to ensure a smooth transfer of ownership to your heirs.

- Succession Planning: Draw up a will that specifically addresses your overseas property to avoid potential disputes and lengthy legal processes.

Lifestyle and Practical Considerations for Your Place in the Sun

Beyond the financial and legal aspects, lifestyle factors are crucial.

Location, Location, Location:

Choosing the right location is paramount. Consider:

- Climate: Does the climate suit your preferences year-round?

- Culture: Are you comfortable with the local culture and language?

- Proximity to Amenities: How close are you to essential services, healthcare, and transportation?

Language and Cultural Differences:

Living in a foreign country presents unique challenges.

- Language Barriers: Consider your language skills and the availability of translation services.

- Cultural Adaptation: Be prepared to adapt to different customs and social norms.

Property Maintenance and Management:

Owning a property abroad requires ongoing management.

- Self-Management: Requires regular visits and a good understanding of local tradespeople.

- Property Management Companies: A cost-effective option, but you'll need to carefully vet potential companies.

Making the Right Choice for Your Place in the Sun

Buying a Place in the Sun is a significant undertaking requiring careful planning and due diligence. This involves a thorough assessment of the financial implications, navigating the legal and administrative aspects, and considering the lifestyle implications. Remember to seek professional advice from financial advisors, solicitors specializing in international property, and reputable real estate agents. Start planning your dream Place in the Sun today by researching thoroughly and seeking expert guidance to ensure a smooth and successful overseas property purchase.

Featured Posts

-

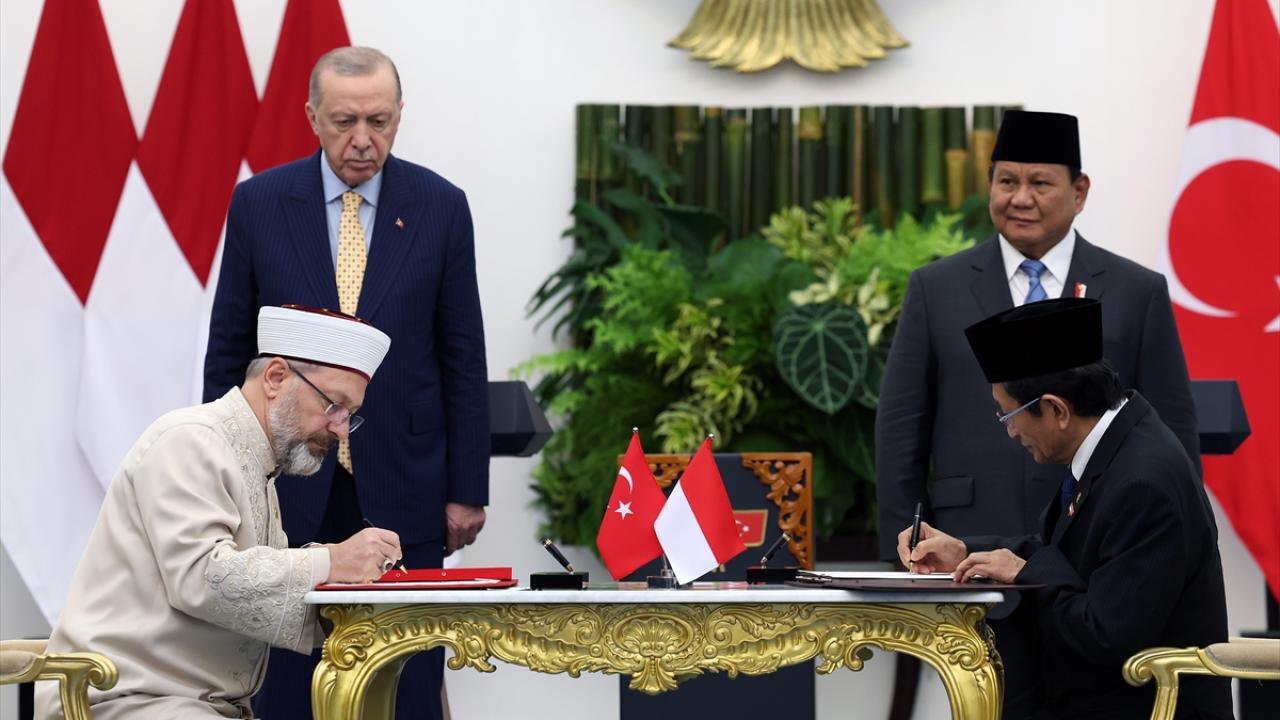

Endonezya Ve Tuerkiye Oenemli Ortak Anlasmalar Imzalandi

May 03, 2025

Endonezya Ve Tuerkiye Oenemli Ortak Anlasmalar Imzalandi

May 03, 2025 -

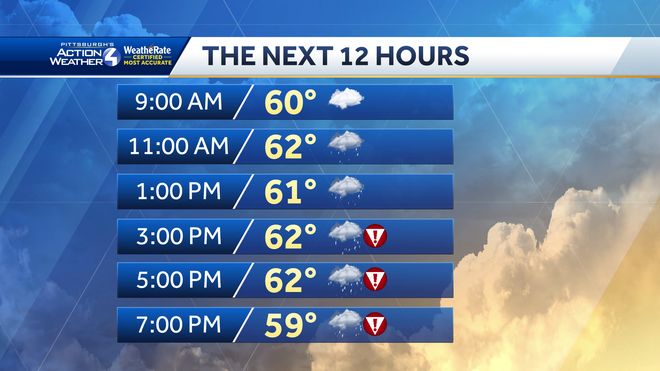

Oklahoma Severe Weather Timeline Strong Winds Forecast

May 03, 2025

Oklahoma Severe Weather Timeline Strong Winds Forecast

May 03, 2025 -

Nigel Farages Reform Party A Crucial Uk Local Election Test

May 03, 2025

Nigel Farages Reform Party A Crucial Uk Local Election Test

May 03, 2025 -

Lotto 6aus49 Gewinnzahlen Vom Mittwoch 9 4 2025

May 03, 2025

Lotto 6aus49 Gewinnzahlen Vom Mittwoch 9 4 2025

May 03, 2025 -

Tulsa Firefighters Battle 800 Winter Weather Calls

May 03, 2025

Tulsa Firefighters Battle 800 Winter Weather Calls

May 03, 2025

Latest Posts

-

Long Term Effects Of Toxic Chemicals From Ohio Train Derailment On Building Structures

May 04, 2025

Long Term Effects Of Toxic Chemicals From Ohio Train Derailment On Building Structures

May 04, 2025 -

Open Ai Unveils Streamlined Voice Assistant Creation At 2024 Event

May 04, 2025

Open Ai Unveils Streamlined Voice Assistant Creation At 2024 Event

May 04, 2025 -

16 Million Fine For T Mobile A Three Year Data Breach Investigation

May 04, 2025

16 Million Fine For T Mobile A Three Year Data Breach Investigation

May 04, 2025 -

Massive Office365 Data Breach Nets Hacker Millions Authorities Reveal

May 04, 2025

Massive Office365 Data Breach Nets Hacker Millions Authorities Reveal

May 04, 2025 -

Revolutionizing Voice Assistant Development Open Ais 2024 Announcement

May 04, 2025

Revolutionizing Voice Assistant Development Open Ais 2024 Announcement

May 04, 2025