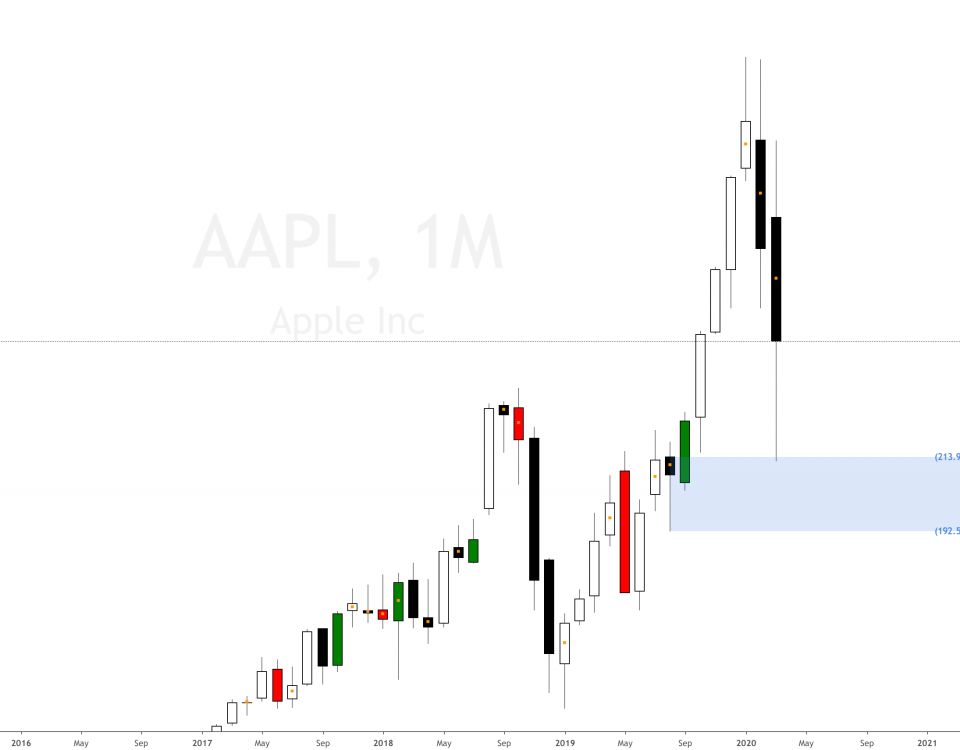

Is Apple Stock Headed To $254? Analyst Prediction And Investment Analysis

Table of Contents

Analyst Predictions and Their Rationale

Several reputable analysts have predicted Apple stock reaching $254, citing a variety of factors supporting their bullish outlook. These predictions aren't made in a vacuum; they're rooted in careful analysis of Apple's financial performance, product pipeline, and market dynamics.

-

Analyst 1: Morgan Stanley's Katy Huberty (example – replace with actual analyst and firm) recently predicted a $254 price target for Apple stock, primarily driven by her expectation of strong iPhone 15 sales and continued growth in Apple's services revenue. She points to increasing engagement with Apple's ecosystem and a robust upgrade cycle as key drivers.

-

Analyst 2: (Replace with actual analyst and firm) forecasts a $254 Apple stock price based on the anticipated success of its upcoming augmented reality (AR)/virtual reality (VR) headset, believing it will open a lucrative new revenue stream and expand Apple's reach into a rapidly growing market. Their analysis highlights the potential for disruptive innovation and first-mover advantage.

-

Analyst 3: (Replace with actual analyst and firm) sees a $254 Apple stock price as achievable due to a generally positive market sentiment and the projected resilience of the global economy. This analyst believes Apple's strong brand loyalty and diversified revenue streams will protect it from significant economic downturns.

Apple's Financial Performance and Future Outlook

Apple's recent financial results showcase a company with considerable strength. However, analyzing key performance indicators (KPIs) is crucial to assess the viability of the $254 prediction.

-

Revenue Growth: Consistent revenue growth across key segments like iPhone, Mac, Services, and Wearables is essential. Sustained growth in these areas indicates a healthy and expanding market share.

-

Profit Margins: Maintaining high profit margins is vital. Pressure on margins due to increased competition or rising production costs could impact profitability and, consequently, the stock price.

-

Future Product Launches: Apple's innovation pipeline is crucial. The success of new products such as the rumored AR/VR headset, improved Apple Silicon chips, and new iPhone models will play a significant role in future revenue growth and investor confidence. The impact of these new products on Apple's stock price is a major factor analysts consider.

Market Factors Influencing Apple Stock Price

Several macroeconomic factors and competitive dynamics influence Apple stock price. Understanding these influences is critical for evaluating the $254 prediction.

-

Macroeconomic Factors: Interest rate hikes, inflation, and global economic uncertainty can significantly affect consumer spending and investor sentiment. A recession, for instance, could negatively impact demand for Apple products.

-

Competitor Activity: Intense competition from Android manufacturers, particularly in emerging markets, poses a challenge to Apple's market share and revenue growth. Samsung, for example, is a major competitor in the smartphone market.

-

Regulatory Challenges: Growing regulatory scrutiny regarding antitrust concerns, data privacy, and app store policies could create headwinds for Apple's growth trajectory and potentially impact investor confidence.

Investment Strategies and Risk Assessment

Considering the $254 prediction, investors should consider various strategies and risk assessments.

-

Investment Approaches: A "buy" strategy might be considered if one believes the $254 prediction is achievable and the risk is acceptable. A "hold" strategy is suitable for those already invested and comfortable with the inherent risks. A "sell" strategy might be preferable for investors concerned about market volatility or potential overvaluation.

-

Risk Assessment: Investing in any stock carries risk, and Apple stock is no exception. The $254 prediction is speculative and depends on various factors beyond Apple's control. A significant drop in consumer spending, increased competition, or unforeseen regulatory challenges could negatively impact the stock price.

-

Diversification: Diversifying investments across various asset classes is crucial to mitigate risk. Relying solely on Apple stock, regardless of the $254 prediction, can expose an investor to significant losses if the stock underperforms.

Conclusion: Is $254 a Realistic Target for Apple Stock? Your Next Steps

Whether Apple stock reaches $254 is uncertain. While some analyst predictions point to this possibility, fueled by strong financial performance and anticipated product launches, significant market factors and inherent risks must be considered. The predicted growth hinges on several assumptions: sustained revenue growth, strong profit margins, successful new product launches, and a stable global economy. Economic downturns, intensified competition, and regulatory headwinds could all derail this projected growth.

While the prospect of Apple stock reaching $254 is exciting, remember that thorough due diligence is crucial. Conduct your own research, analyze financial reports, and consult a financial advisor before making any investment decisions regarding Apple stock. Don't solely rely on analyst predictions; build your own understanding of the company's performance and the market conditions influencing its stock price.

Featured Posts

-

Nicki Chapmans Smart Property Investment A 700 000 Return On Her Escape To The Country Home

May 25, 2025

Nicki Chapmans Smart Property Investment A 700 000 Return On Her Escape To The Country Home

May 25, 2025 -

The Crucial Role Of Middle Managers Bridging The Gap In Modern Businesses

May 25, 2025

The Crucial Role Of Middle Managers Bridging The Gap In Modern Businesses

May 25, 2025 -

Scrutinizing Opulence Presidential Seals 100 000 Watches And Exclusive Gatherings

May 25, 2025

Scrutinizing Opulence Presidential Seals 100 000 Watches And Exclusive Gatherings

May 25, 2025 -

Alartfae Alqyasy Ldks Dwr Atfaq Altjart Alamrykyt Alsynyt

May 25, 2025

Alartfae Alqyasy Ldks Dwr Atfaq Altjart Alamrykyt Alsynyt

May 25, 2025 -

Your Escape To The Country Choosing The Right Property And Lifestyle

May 25, 2025

Your Escape To The Country Choosing The Right Property And Lifestyle

May 25, 2025

Latest Posts

-

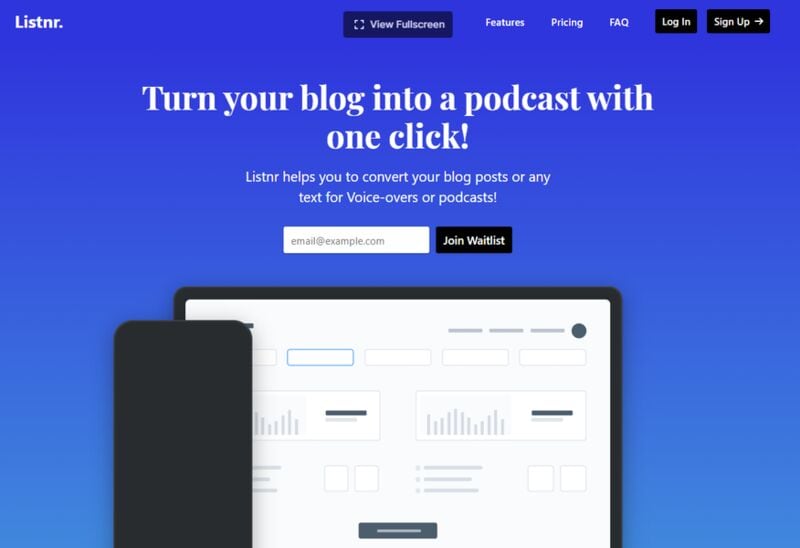

From Scatological Documents To Engaging Podcasts An Ai Solution

May 25, 2025

From Scatological Documents To Engaging Podcasts An Ai Solution

May 25, 2025 -

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025 -

Turning Poop Into Podcast Gold Ai Digest For Repetitive Documents

May 25, 2025

Turning Poop Into Podcast Gold Ai Digest For Repetitive Documents

May 25, 2025 -

Dogecoin Price Prediction Considering Elon Musks Role

May 25, 2025

Dogecoin Price Prediction Considering Elon Musks Role

May 25, 2025 -

The Impact Of Elon Musks Actions On The Dogecoin Price

May 25, 2025

The Impact Of Elon Musks Actions On The Dogecoin Price

May 25, 2025