Is Bitcoin Poised For A Rally? Analyst's May 6 Chart Prediction

Table of Contents

The Analyst's May 6th Bitcoin Price Prediction

The prediction comes from [Analyst's Name], a well-respected figure in the cryptocurrency analysis community known for their accurate Bitcoin chart analysis and insightful Bitcoin market commentary. [Analyst's Name] has a proven track record, accurately predicting [mention a past successful prediction, if any, and cite the source]. On May 6th, [Analyst's Name] predicted a Bitcoin price of [predicted price] within a [timeframe, e.g., 3-month] period.

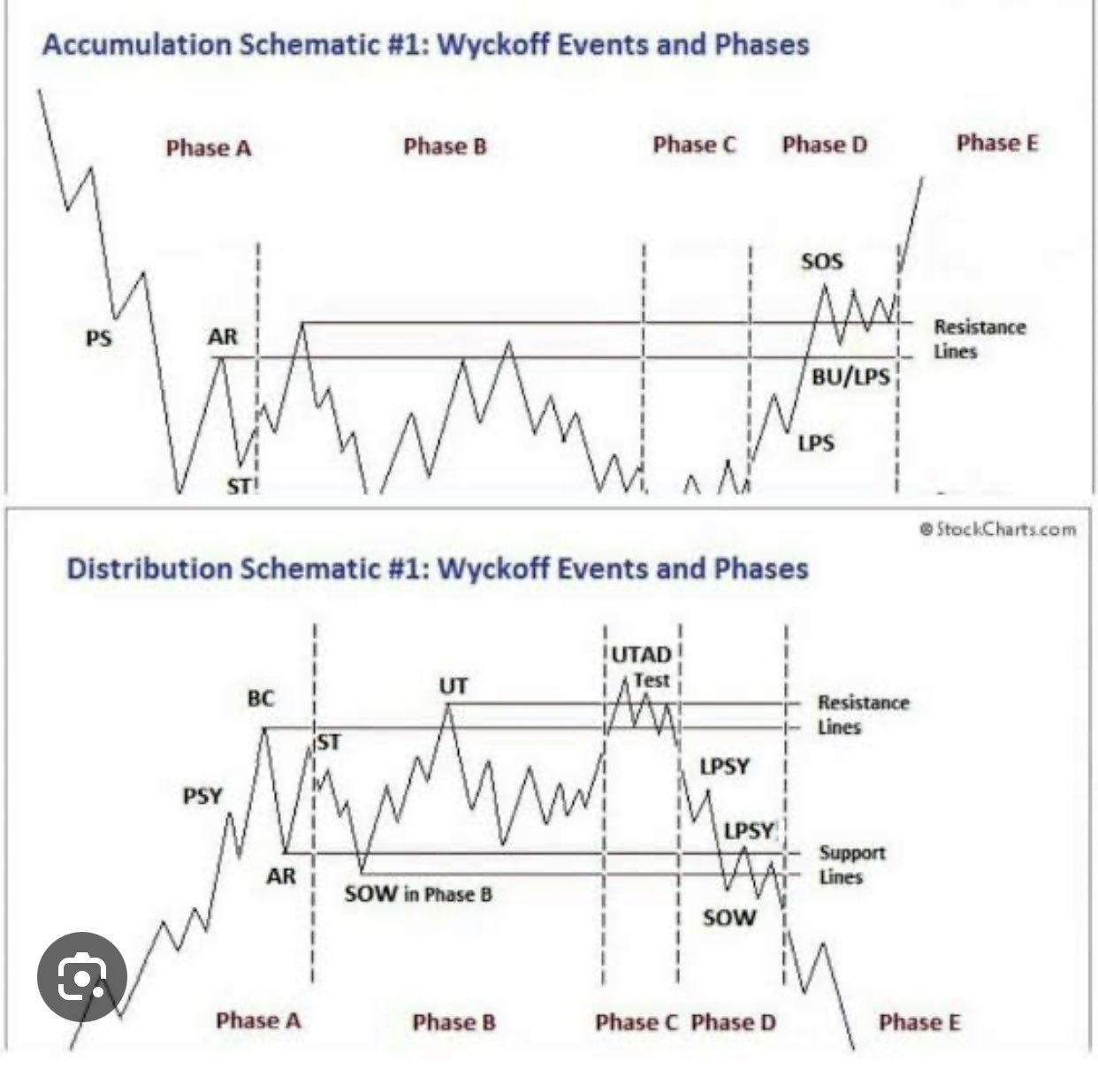

Their methodology involved a combination of technical and fundamental analysis. Technically, the analyst identified a bullish head and shoulders pattern on the Bitcoin daily chart, coupled with a positive RSI reading, suggesting a potential upward price movement. Fundamentally, [Analyst's Name] considered increasing institutional adoption and the growing interest in Bitcoin as a hedge against inflation.

[Insert image of the analyst's chart here. Alt text: "Bitcoin Daily Chart showing a bullish head and shoulders pattern as predicted by [Analyst's Name] on May 6th."]

Supporting Factors for a Potential Bitcoin Rally

Several factors could support a Bitcoin rally, bolstering the analyst's May 6th Bitcoin price prediction.

Macroeconomic Factors

Global macroeconomic conditions play a significant role in Bitcoin's price. Rising inflation, geopolitical instability, and a weakening US dollar could drive investors towards Bitcoin as a safe-haven asset and a store of value.

- High Inflation: Persistent inflation erodes the purchasing power of fiat currencies, making Bitcoin, with its fixed supply, an attractive alternative.

- Geopolitical Uncertainty: Global conflicts and economic uncertainty often lead to increased demand for Bitcoin, perceived as a decentralized and less vulnerable asset.

- Weakening Dollar: A decline in the US dollar's value often correlates with an increase in Bitcoin's price, as investors seek diversification.

Bitcoin Network Fundamentals

On-chain metrics provide valuable insights into Bitcoin's network health and potential for growth. Positive indicators suggest a healthy ecosystem and increased demand.

- Rising Transaction Volume: An increase in the number of Bitcoin transactions suggests growing adoption and usage.

- Increased Active Addresses: A higher number of unique Bitcoin addresses indicates broader participation in the network.

- Stable Hash Rate: A consistently high hash rate demonstrates the network's resilience and security.

Regulatory Developments (Positive and Negative)

Regulatory clarity and acceptance can significantly impact Bitcoin's price. Positive developments can fuel adoption, while negative ones can trigger sell-offs.

- Positive: Regulatory frameworks that provide clarity and legal certainty could attract institutional investors.

- Negative: Increased scrutiny or restrictive regulations could dampen investor enthusiasm and potentially lead to price corrections.

Potential Risks and Challenges to a Bitcoin Rally

While the analyst's May 6th Bitcoin chart prediction suggests a potential rally, several factors could hinder the upward momentum. It's crucial to maintain a balanced perspective and consider the potential downsides.

- Negative Macroeconomic News: Unexpected economic downturns or negative geopolitical events could trigger a sell-off in the cryptocurrency market.

- Increased Regulatory Scrutiny: Stringent regulations or bans could negatively impact Bitcoin's price and adoption rate.

- Large Institutional Sell-offs: Major institutional investors could trigger a price drop if they decide to liquidate their Bitcoin holdings.

- Security Breaches or Hacks: Major security incidents affecting exchanges or wallets could erode investor confidence and lead to price volatility.

Conclusion: Is a Bitcoin Rally on the Cards?

[Analyst's Name]'s May 6th Bitcoin chart prediction, supported by several positive macroeconomic factors and healthy network fundamentals, suggests a potential Bitcoin rally. However, significant risks remain. Increased regulatory scrutiny, negative macroeconomic events, and security breaches could hinder price growth. While no one can predict the future with certainty, understanding this Bitcoin price prediction and the various factors influencing Bitcoin's price can help you make more informed decisions about your Bitcoin investments. Stay informed and continue researching the potential for a Bitcoin rally, and consider diversifying your portfolio.

Featured Posts

-

Andor Cast A Behind The Scenes Look At The Rogue One Prequel Series Finale

May 08, 2025

Andor Cast A Behind The Scenes Look At The Rogue One Prequel Series Finale

May 08, 2025 -

Superior To Saving Private Ryan Military Historians Rate The Best Realistic Wwii Movies

May 08, 2025

Superior To Saving Private Ryan Military Historians Rate The Best Realistic Wwii Movies

May 08, 2025 -

Dwp Breaks Silence On Six Month Universal Credit Changes

May 08, 2025

Dwp Breaks Silence On Six Month Universal Credit Changes

May 08, 2025 -

Ethereum Price 2 700 Within Reach As Wyckoff Accumulation Nears Completion

May 08, 2025

Ethereum Price 2 700 Within Reach As Wyckoff Accumulation Nears Completion

May 08, 2025 -

Uber One Rides And Deliveries Just Got Cheaper In Kenya

May 08, 2025

Uber One Rides And Deliveries Just Got Cheaper In Kenya

May 08, 2025