Is CoreWeave (CRWV) A Smart Investment? Jim Cramer Weighs In

Table of Contents

CoreWeave (CRWV): A Deep Dive into the Company and its Business Model

What is CoreWeave and what does it do?

CoreWeave is a leading provider of GPU cloud computing services. In simple terms, they rent out powerful graphics processing units (GPUs) to businesses and individuals needing high-performance computing power. This is particularly crucial for applications like artificial intelligence (AI), machine learning (ML), and high-performance computing (HPC) tasks that demand significant processing capabilities. CoreWeave differentiates itself through its scalable infrastructure and focus on delivering exceptional performance for demanding workloads. Their target market includes tech giants, researchers, and smaller companies leveraging AI and ML for various applications.

- High-performance computing capabilities: CoreWeave offers access to some of the most powerful GPUs available, allowing users to tackle complex computations efficiently.

- Scalable infrastructure: Their cloud infrastructure is designed to scale easily, meaning businesses can adjust their computing resources as needed, paying only for what they use.

- Focus on AI and machine learning workloads: CoreWeave's platform is optimized for the specific needs of AI and ML development and deployment, making it a preferred choice for companies in this rapidly growing sector.

Financial Performance and Growth Potential of CRWV

Analyzing CoreWeave's financial performance requires access to publicly available data such as financial statements and analyst reports. Revenue growth, profitability margins, and valuation metrics are key indicators of the company's financial health and future potential. A comparison to competitors in the GPU cloud computing space is essential to gauge its market position and growth trajectory. Factors like market share, customer acquisition, and technological advancements all contribute to its long-term growth potential. Currently, specific financial data may be limited due to the company's relatively recent entry into the public markets. However, as more data becomes available, a more comprehensive analysis can be performed.

Jim Cramer's Take on CoreWeave (CRWV) Stock

Analyzing Jim Cramer's past pronouncements on CRWV

While this article is being written, specific past comments by Jim Cramer on CoreWeave may not be readily available. However, once his opinions are publicly available through Mad Money or other media outlets, this section will be updated to analyze his past statements regarding CRWV stock. We will examine the context of his recommendations, considering the prevailing market conditions at the time of his pronouncements. Links to relevant video clips and articles will be provided for transparency and verification.

Weighing the Significance of Cramer's Opinion

Jim Cramer's opinions undoubtedly carry significant weight for many investors. His pronouncements can significantly impact investor sentiment and drive stock prices in the short term. However, it's crucial to remember that relying solely on one analyst's opinion, even a prominent one like Jim Cramer, is inherently risky. His perspective is just one piece of the puzzle. Independent research and due diligence are paramount before making any investment decision.

Assessing the Risks and Rewards of Investing in CoreWeave (CRWV)

Potential Risks Associated with CRWV

Investing in CoreWeave, like any other stock, carries inherent risks. A thorough understanding of these potential downsides is critical before committing capital.

- Competition from established cloud providers: CoreWeave faces fierce competition from established giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP).

- Dependence on specific technologies: CoreWeave's success hinges on the continued relevance and performance of its chosen technologies. Any technological disruption could negatively impact its business.

- Market volatility: The technology sector is known for its volatility. Market fluctuations can significantly impact CoreWeave's stock price.

Potential Rewards and Returns

Despite the risks, CoreWeave presents significant potential rewards. The company operates in a high-growth sector with immense potential for long-term expansion.

- Long-term growth potential: The increasing demand for high-performance computing and the burgeoning AI/ML markets offer substantial growth opportunities for CoreWeave.

- Potential for high returns: Successful companies in the technology sector often deliver exceptionally high returns for their investors. CoreWeave has the potential to be one of them.

- Risk-Reward Profile: Investors need to carefully assess the risk-reward profile of a CoreWeave investment, balancing the potential for high returns against the inherent risks involved.

Conclusion: Should You Invest in CoreWeave (CRWV)?

Investing in CoreWeave (CRWV) presents a complex scenario. While the company operates in a promising sector and displays potential for growth, significant risks are present, including intense competition and market volatility. While Jim Cramer’s opinions can influence investor sentiment, they shouldn't be the sole basis for an investment decision.

Final Verdict: Whether CoreWeave is a "smart investment" ultimately depends on an investor's individual risk tolerance, investment horizon, and thorough due diligence.

Call to Action: Before making any decisions regarding a CoreWeave investment or CRWV stock, conduct your own comprehensive research, analyze the latest financial data, and consider seeking advice from a qualified financial advisor. Remember, responsible investing requires careful consideration of all available information and a clear understanding of your own investment goals. A smart CoreWeave investment hinges on informed decision-making.

Featured Posts

-

Global Forest Destruction A Crisis Fueled By Record Wildfires

May 22, 2025

Global Forest Destruction A Crisis Fueled By Record Wildfires

May 22, 2025 -

Steelers 2024 Schedule A Deep Dive Into The Key Takeaways

May 22, 2025

Steelers 2024 Schedule A Deep Dive Into The Key Takeaways

May 22, 2025 -

Milly Alcock And Her House Of The Dragon Acting Coach Experience

May 22, 2025

Milly Alcock And Her House Of The Dragon Acting Coach Experience

May 22, 2025 -

Accenture To Promote 50 000 Employees After Six Month Delay

May 22, 2025

Accenture To Promote 50 000 Employees After Six Month Delay

May 22, 2025 -

The Core Weave Inc Crwv Stock Dip On Thursday What Happened

May 22, 2025

The Core Weave Inc Crwv Stock Dip On Thursday What Happened

May 22, 2025

Latest Posts

-

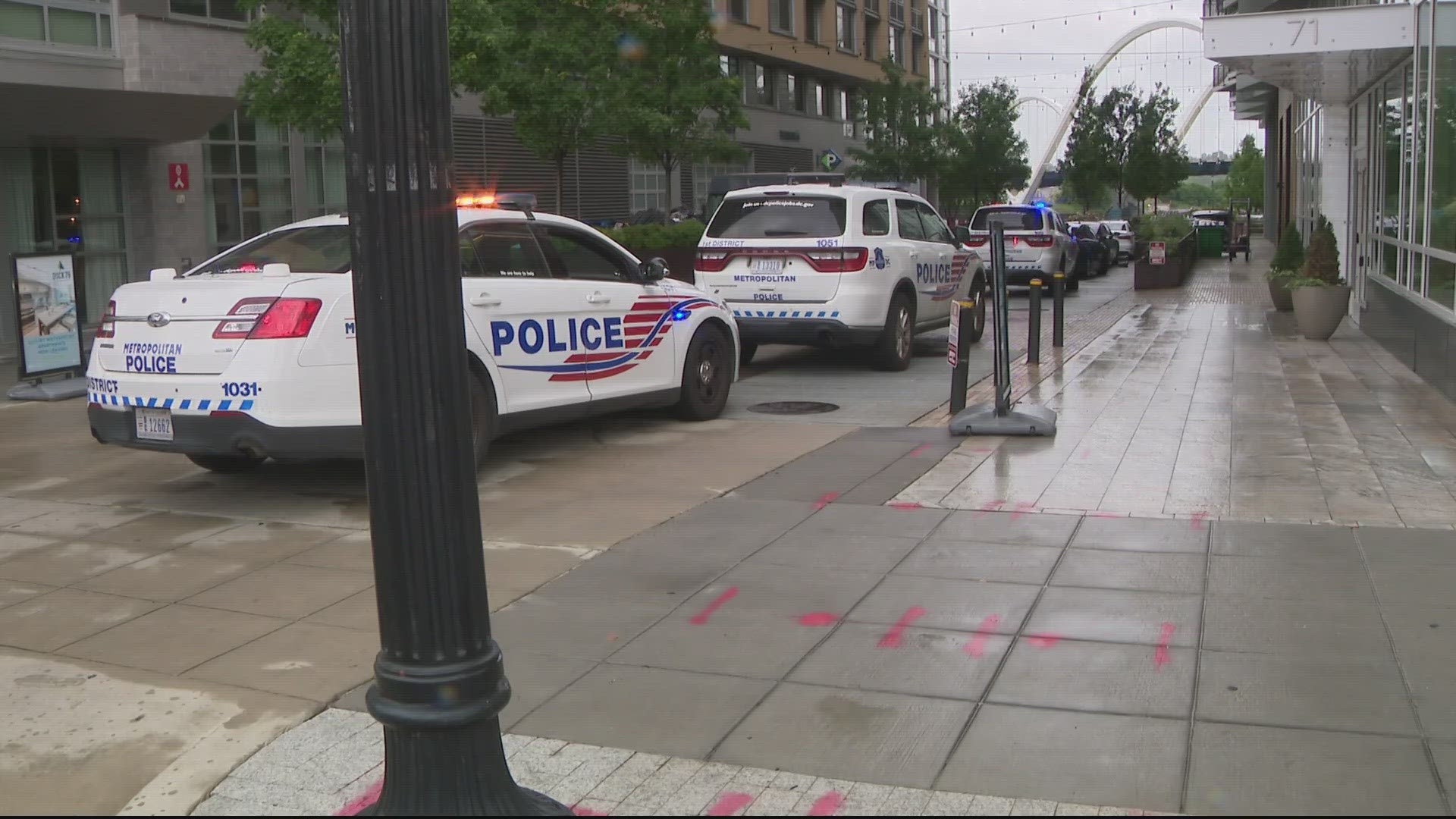

Israeli Embassy Attack Young Couples Names Revealed Days Before Planned Wedding

May 22, 2025

Israeli Embassy Attack Young Couples Names Revealed Days Before Planned Wedding

May 22, 2025 -

German Chancellor Merz Denounces Abhorrent Washington Attack

May 22, 2025

German Chancellor Merz Denounces Abhorrent Washington Attack

May 22, 2025 -

Dc Terrorist Attack Victims Identified As Yaron Lischinsky And Sarah Milgrim

May 22, 2025

Dc Terrorist Attack Victims Identified As Yaron Lischinsky And Sarah Milgrim

May 22, 2025 -

Couple Slain In Dc Terror Attack Identified

May 22, 2025

Couple Slain In Dc Terror Attack Identified

May 22, 2025 -

Israeli Embassy Victims Identified Young Couple Days From Engagement

May 22, 2025

Israeli Embassy Victims Identified Young Couple Days From Engagement

May 22, 2025