Is Ethereum's Price Rally Sustainable? Bulls Eye Further Gains

Table of Contents

Factors Driving the Current Ethereum Price Rally

Several key factors contribute to the current Ethereum price rally. Understanding these elements is crucial for assessing the sustainability of this growth.

The Ethereum Merge and its Impact

The successful transition to Proof-of-Stake (PoS) via the Ethereum Merge represents a monumental achievement for the network. This upgrade has profoundly impacted ETH's value proposition:

- Reduced energy consumption and environmental benefits: The shift from energy-intensive Proof-of-Work to the more environmentally friendly PoS has significantly reduced Ethereum's carbon footprint, attracting environmentally conscious investors.

- Increased staking rewards and network security: Staking ETH now allows users to earn rewards, further incentivizing participation and bolstering network security. This increased participation strengthens the network's resilience against attacks.

- Potential for enhanced scalability and transaction speed: While scalability remains a challenge, the Merge laid the groundwork for future upgrades aimed at improving transaction speeds and reducing congestion, making Ethereum more attractive for users and developers.

Growing DeFi Ecosystem and Demand

Ethereum's dominance in the Decentralized Finance (DeFi) space is a major driver of its price appreciation.

- Increased usage of decentralized applications (dApps): The Ethereum network hosts a vast and rapidly expanding ecosystem of dApps, ranging from lending and borrowing platforms to decentralized exchanges (DEXs) and NFT marketplaces. This increased usage drives demand for ETH.

- Growing demand for ETH in DeFi lending, borrowing, and trading: ETH is frequently used as collateral in DeFi lending protocols and is a central asset in many DEXs, increasing its demand within the DeFi ecosystem.

- High transaction volume contributing to price appreciation: The substantial volume of transactions on the Ethereum network contributes to higher gas fees, which in turn can influence ETH's price.

Institutional Investment and Adoption

The growing interest from institutional investors is a significant factor boosting Ethereum's price.

- Increased investment from hedge funds and large corporations: Major financial institutions are increasingly allocating assets to Ethereum, viewing it as a valuable addition to their portfolios.

- Growing acceptance of ETH as a store of value and investment asset: Ethereum is gaining recognition as a digital asset with long-term potential, attracting both short-term traders and long-term investors.

- Impact of regulatory clarity (or lack thereof) on institutional adoption: While regulatory uncertainty remains a concern, increasing clarity in some jurisdictions is encouraging institutional investment.

Potential Risks and Challenges to Sustained Growth

Despite the bullish factors, several challenges could hinder sustained growth in Ethereum's price.

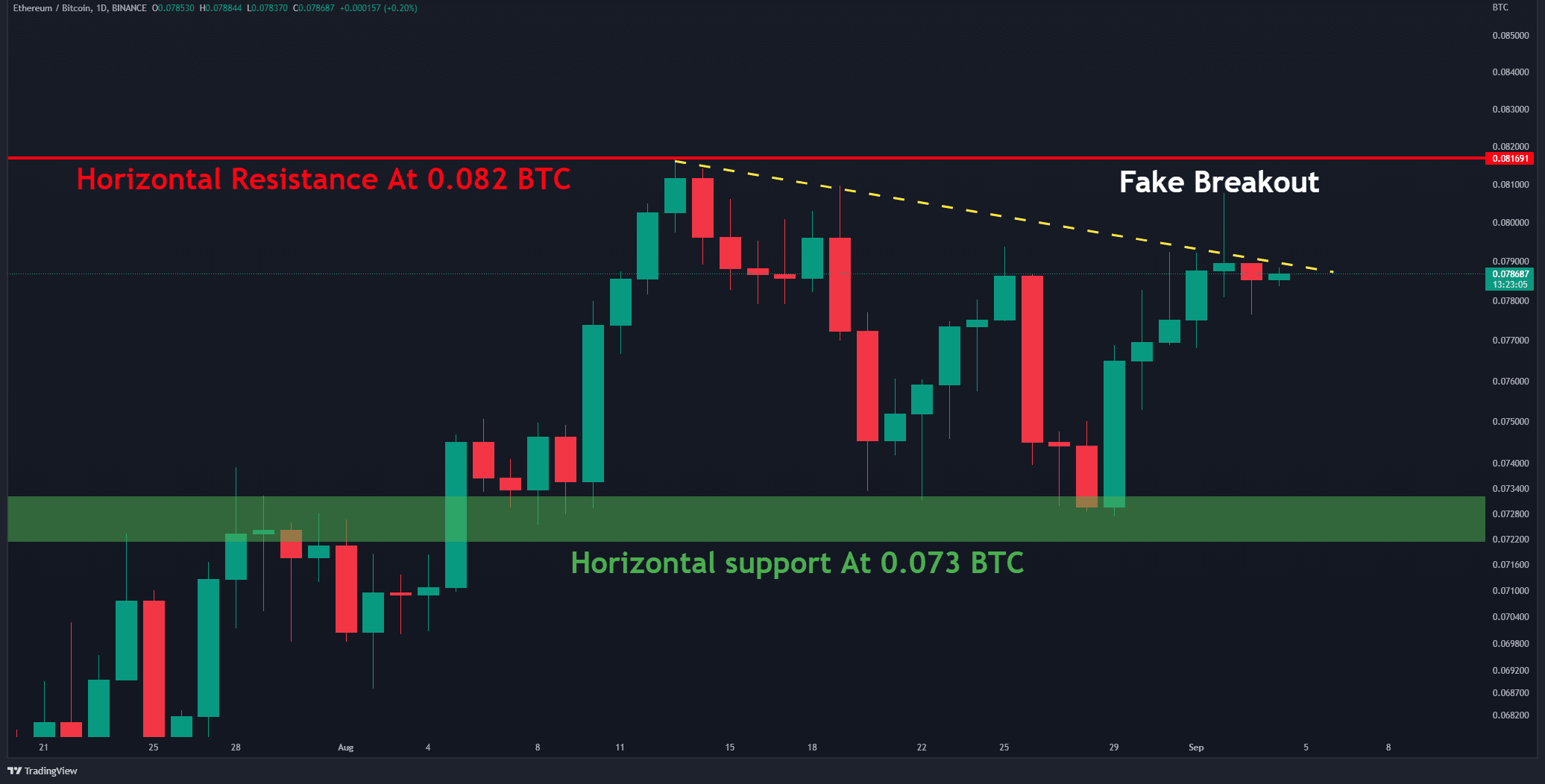

Market Volatility and Crypto Winter Concerns

The cryptocurrency market is inherently volatile, and Ethereum is no exception.

- Impact of macroeconomic factors on crypto prices (inflation, interest rates): Global economic conditions, including inflation and interest rate hikes, can significantly impact cryptocurrency prices.

- Risk of regulatory uncertainty and government intervention: Unpredictable regulatory actions by governments around the world could negatively affect the price of Ethereum.

- Potential for large-scale sell-offs and price corrections: Sudden market corrections and large sell-offs are common in the crypto market, posing a risk to Ethereum's price.

Competition from Other Layer-1 Blockchains

Ethereum faces competition from other Layer-1 blockchain platforms.

- Performance comparisons with competitors like Solana, Cardano, etc.: Rival blockchains are continuously improving their technology, offering potentially faster and cheaper transaction speeds.

- Technological advancements in competing networks: Innovation in competing networks can attract developers and users away from Ethereum.

- Potential market share erosion for Ethereum: The competitive landscape could lead to a decline in Ethereum's market share over time.

Scalability Issues and Transaction Fees

High transaction fees ("gas fees") and scalability issues remain challenges for Ethereum.

- Layer-2 solutions and their effectiveness in addressing scalability: Layer-2 scaling solutions are crucial for improving Ethereum's scalability but their adoption and effectiveness are still evolving.

- Impact of high gas fees on user experience and adoption: High gas fees can hinder user adoption and discourage the use of dApps.

- Ongoing development efforts to improve scalability and reduce costs: Continuous development efforts are aimed at reducing gas fees and improving the overall scalability of the Ethereum network.

Conclusion: Ethereum's Future: A Sustainable Rally or a Fleeting Boom?

The sustainability of Ethereum's price rally depends on a complex interplay of factors. While the Merge, the thriving DeFi ecosystem, and increasing institutional adoption paint a bullish picture, market volatility, competition, and scalability challenges pose significant risks. Predicting the future price of ETH with certainty is impossible. However, by understanding the factors influencing the Ethereum price rally, and carefully monitoring the Ethereum price prediction based on ongoing developments, investors can make more informed decisions. It’s crucial to conduct your own thorough research and assess the sustainability of the ETH price before making any investment choices. The cryptocurrency market is dynamic and unpredictable, highlighting the importance of informed investing. Remember, this analysis is not financial advice, and the future of Ethereum's price remains uncertain.

Featured Posts

-

Superman And Krypto Next Weeks Summer Of Superman Special

May 08, 2025

Superman And Krypto Next Weeks Summer Of Superman Special

May 08, 2025 -

Oklahoma City Thunder Vs Memphis Grizzlies A Crucial Matchup

May 08, 2025

Oklahoma City Thunder Vs Memphis Grizzlies A Crucial Matchup

May 08, 2025 -

Sno Og Vanskelige Kjoreforhold I Sor Norge Viktig Informasjon For Fjellturister

May 08, 2025

Sno Og Vanskelige Kjoreforhold I Sor Norge Viktig Informasjon For Fjellturister

May 08, 2025 -

222 Milione Euro Agjenti Zbulon Te Fshehta Nga Transferimi I Neymar Te Psg

May 08, 2025

222 Milione Euro Agjenti Zbulon Te Fshehta Nga Transferimi I Neymar Te Psg

May 08, 2025 -

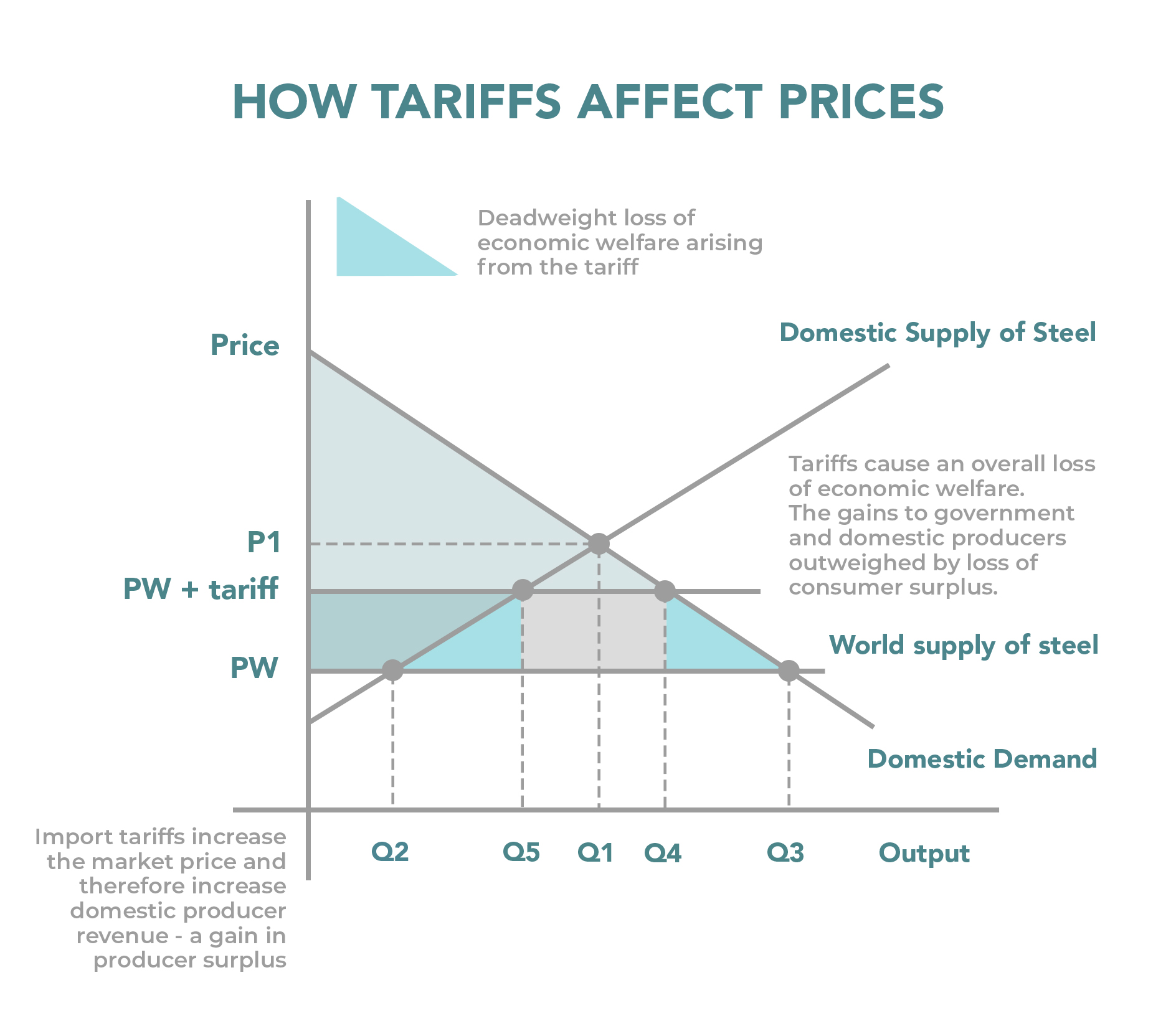

China Responds To Tariffs Lower Interest Rates And Increased Bank Lending

May 08, 2025

China Responds To Tariffs Lower Interest Rates And Increased Bank Lending

May 08, 2025