Is Lack Of Funds Holding You Back? Practical Strategies For Success

Table of Contents

Identifying and Prioritizing Your Financial Goals

Before tackling the challenge of lack of funds, it's crucial to understand your financial landscape. This involves defining clear financial goals and creating a realistic budget.

Defining Short-Term and Long-Term Objectives:

Setting SMART goals is paramount. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound.

- Short-term goals: Paying off high-interest debt, building a three-to-six-month emergency fund, saving for a down payment on a car.

- Long-term goals: Buying a house, starting a business, funding your children's education, securing a comfortable retirement.

Prioritizing goals based on urgency and impact is key. Addressing high-interest debt might be more urgent than saving for a long-term goal like retirement.

Creating a Realistic Budget:

A well-structured budget is fundamental to managing your finances effectively, even with limited funds.

- Track your expenses: Use budgeting apps (Mint, YNAB, Personal Capital) or spreadsheets to monitor where your money goes.

- Identify areas for savings: Analyze your spending habits and pinpoint areas where you can reduce expenses. This could involve canceling unused subscriptions, negotiating lower bills, or finding cheaper alternatives.

- Set a realistic spending plan: Allocate funds to different categories (housing, food, transportation, entertainment) based on your income and priorities.

Regularly monitoring and adjusting your budget is crucial to adapt to changing circumstances and stay on track.

Exploring Funding Options Beyond Traditional Loans

When facing lack of funds, traditional loans aren't always the answer. Let's explore alternative financing options:

Crowdfunding Platforms:

Crowdfunding leverages the power of the crowd to raise capital. Platforms like Kickstarter, GoFundMe, and Indiegogo offer different models, but all require a compelling campaign pitch to attract donors.

- Advantages: Access to capital without debt, community building around your project.

- Disadvantages: Requires significant marketing effort, no guarantee of success, potential for unmet funding goals.

Grants and Subsidies:

Grants and subsidies offer funding without requiring repayment. However, securing them often involves a competitive application process.

- Resources: Government websites, non-profit organizations, and industry-specific grant databases are valuable resources.

- Eligibility: Thorough research is essential to understand eligibility criteria and application requirements.

Seeking Investors and Angel Investors:

For businesses seeking significant capital, attracting investors or angel investors is a viable option. This typically involves creating a solid business plan and a strong investor pitch.

- Business Plan: A detailed business plan showcasing your market analysis, financial projections, and team expertise is crucial.

- Equity vs. Debt: Understand the implications of equity financing (giving up ownership) versus debt financing (taking on loans).

- Networking: Building relationships with potential investors through networking events and industry connections is vital.

Strategic Cost-Cutting and Resource Management

Effective resource management is key to overcoming lack of funds. This involves minimizing expenses and leveraging free or low-cost resources.

Minimizing Expenses:

Small changes can make a big difference.

- Negotiate bills: Contact your service providers (internet, phone, insurance) to negotiate lower rates.

- Reduce subscriptions: Cancel unused subscriptions and consolidate services where possible.

- Find cheaper alternatives: Look for affordable alternatives for groceries, entertainment, and transportation.

Tracking your spending habits helps identify areas for improvement and fosters mindful consumption. Adopting a frugal lifestyle can significantly reduce your expenses.

Leveraging Free and Low-Cost Resources:

There are numerous free or low-cost resources available.

- Online courses: Platforms like Coursera, edX, and Khan Academy offer free or low-cost courses on various topics.

- Free software: Open-source software provides cost-effective alternatives to expensive commercial software.

- Networking events: Attend industry events to connect with professionals, potential collaborators, and mentors.

- Bartering and skill-sharing: Explore opportunities to exchange skills or services with others.

Building a Strong Financial Foundation for Future Success

Addressing lack of funds isn't just about immediate solutions; it's about building a sustainable financial future.

Importance of Financial Literacy:

Continuous learning is crucial for long-term financial success.

- Resources: Explore books, workshops, and online courses to improve your financial literacy.

- Understanding Personal Finance: Gain a firm understanding of budgeting, investing, debt management, and financial planning.

Developing Multiple Income Streams:

Diversifying your income sources reduces reliance on a single income stream.

- Freelancing: Offer your skills on platforms like Upwork or Fiverr.

- Side hustles: Explore part-time jobs or gig work to supplement your income.

- Investing: Start small with investments that align with your risk tolerance and financial goals.

Long-term financial planning is essential for achieving financial stability and security.

Conclusion

Overcoming the challenge of lack of funds requires a multifaceted approach. By identifying and prioritizing your financial goals, exploring alternative funding options, strategically cutting costs, and building a strong financial foundation through improved financial literacy and multiple income streams, you can achieve your aspirations despite limited resources. Don't let lack of funds hold you back any longer! Start planning your financial future today by implementing these practical strategies and taking control of your financial destiny.

Featured Posts

-

El Regreso De Javier Baez Salud Y Rendimiento En El Campo

May 21, 2025

El Regreso De Javier Baez Salud Y Rendimiento En El Campo

May 21, 2025 -

Bolidul De Milioane De Euro Al Fratilor Tate Imagini De La Defilarea Prin Bucuresti

May 21, 2025

Bolidul De Milioane De Euro Al Fratilor Tate Imagini De La Defilarea Prin Bucuresti

May 21, 2025 -

Hellfest A Mulhouse Concert Exceptionnel Au Noumatrouff

May 21, 2025

Hellfest A Mulhouse Concert Exceptionnel Au Noumatrouff

May 21, 2025 -

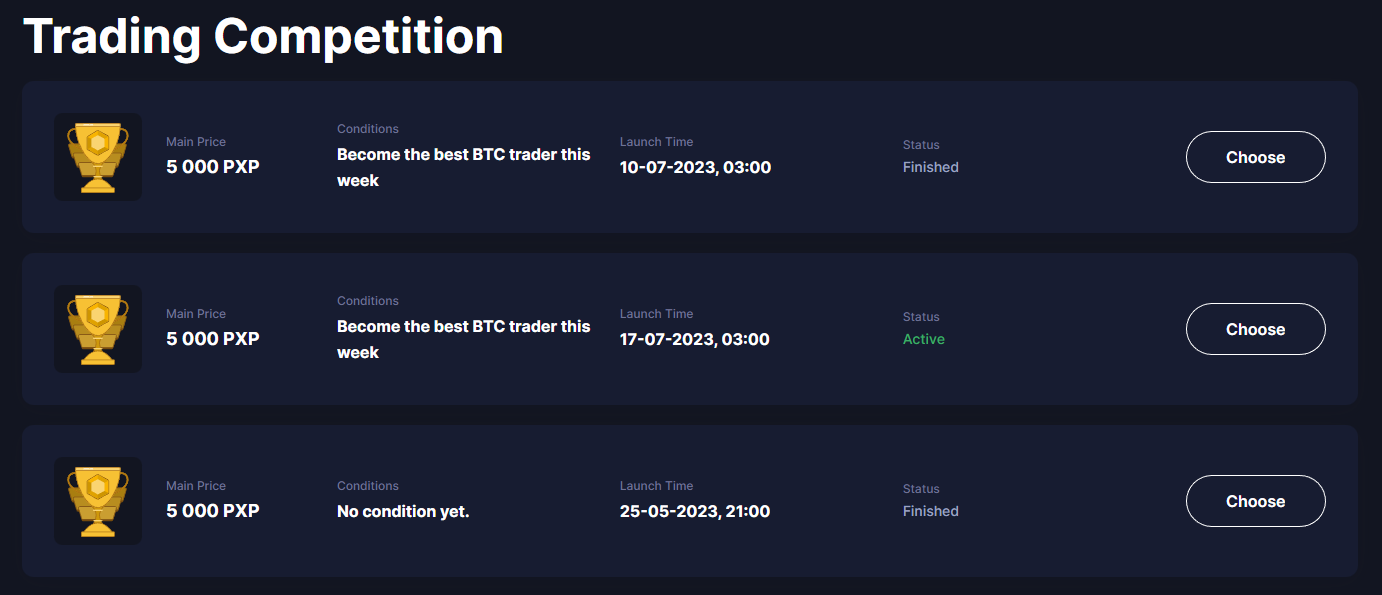

Analyzing Aimscaps Participation In The World Trading Tournament Wtt

May 21, 2025

Analyzing Aimscaps Participation In The World Trading Tournament Wtt

May 21, 2025 -

Finansoviy Reyting Ukrayini 2024 Uspikh Credit Kasa Finako Ukrfinzhitlo Atlani Ta Credit Plus

May 21, 2025

Finansoviy Reyting Ukrayini 2024 Uspikh Credit Kasa Finako Ukrfinzhitlo Atlani Ta Credit Plus

May 21, 2025

Latest Posts

-

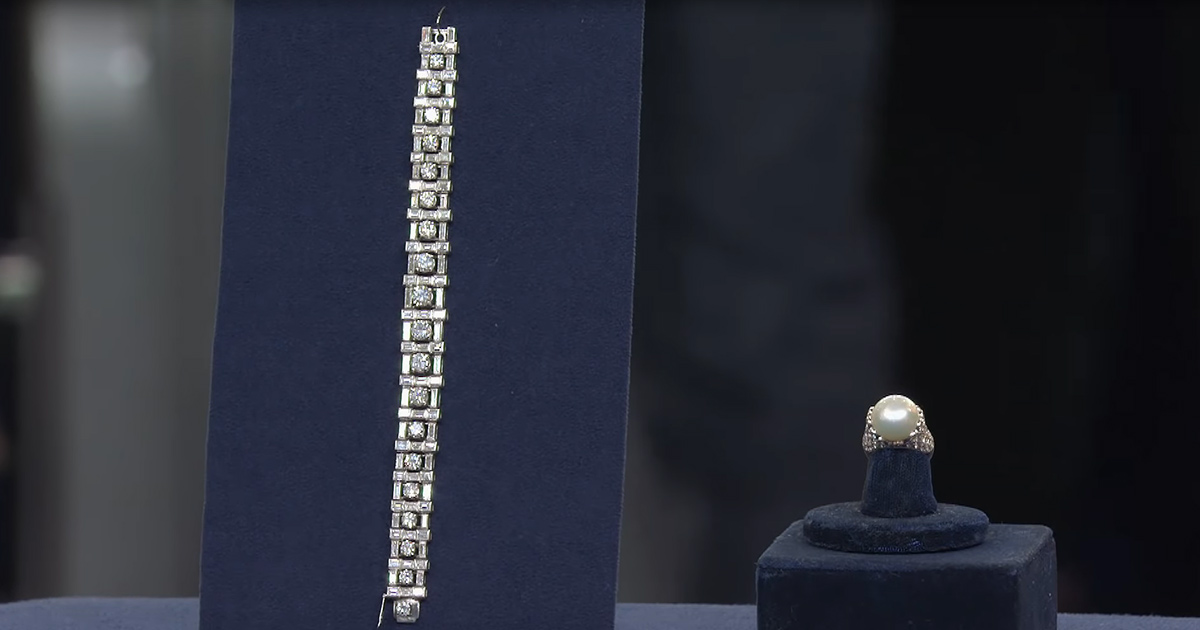

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025 -

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025 -

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025 -

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025 -

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025