Is Palantir Stock A Buy In 2024? A 40% Growth Prediction Analyzed

Table of Contents

Palantir's Growth Potential in 2024: The Bull Case

The bullish outlook on Palantir stock rests on several key pillars, suggesting substantial growth potential in the coming year.

Government Contracts and Expanding Partnerships

Palantir boasts a significant presence in government contracts, both domestically in the US and internationally. These contracts form a bedrock of its revenue streams and provide a level of stability often lacking in purely commercial ventures. The company's ability to secure and expand these partnerships is crucial to its continued success.

- Recent Contract Wins and Expansions:

- Secured a multi-year contract with the Department of Defense, significantly bolstering its defense portfolio.

- Expanded its partnership with a major intelligence agency, leading to increased market penetration and revenue streams.

- Successfully integrated its platform with existing government systems, streamlining data analysis and improving operational efficiency for key clients.

This sustained government presence, coupled with strategic partnerships, provides a strong foundation for Palantir's future growth. The ongoing need for advanced data analytics within government and defense sectors ensures a consistent pipeline of opportunities.

Commercial Sector Growth and Platform Adoption

Beyond its government contracts, Palantir's foray into the commercial sector is a major driver of its potential growth. The company's flagship product, Foundry, a data integration and analytics platform, is gaining traction across various industries.

- Successful Commercial Deployments:

- Significant growth in financial services sector adoption, with leading institutions leveraging Foundry for fraud detection and risk management.

- Successful implementation of Foundry in the healthcare industry, resulting in improved patient care and operational efficiency for hospitals and pharmaceutical companies.

- Expansion into the energy sector, assisting companies in optimizing resource management and improving operational safety.

The increasing adoption of Foundry across diverse sectors demonstrates the platform's versatility and scalability, fueling optimism for continued commercial growth. Positive client testimonials and case studies highlight the tangible benefits of using Palantir's technology.

Technological Innovation and Future Prospects

Palantir’s commitment to research and development, particularly in the realm of artificial intelligence (AI), positions it for future market expansion and the development of innovative products.

- Key Technological Advancements:

- Development of cutting-edge AI capabilities for data analysis, significantly improving the speed and accuracy of insights derived from Foundry.

- Investment in advanced data visualization tools, making complex data more accessible and understandable for a broader range of users.

- Exploration of new applications for its platform within emerging markets such as sustainable energy and supply chain optimization.

These ongoing investments ensure Palantir remains at the forefront of data analytics innovation, creating new opportunities for growth and market leadership.

Challenges and Risks Facing Palantir Stock in 2024: The Bear Case

Despite the bullish projections, several challenges and risks could potentially impede Palantir's growth trajectory.

Valuation Concerns and Profitability

Palantir's current valuation is a key concern for many investors. The company's high price-to-earnings (P/E) ratio, compared to its peers and historical performance, raises questions about its sustainability. Furthermore, achieving profitability remains a challenge.

- Potential Risks:

- High P/E ratio compared to industry averages, making the stock appear overvalued to some investors.

- Potential for slower-than-expected revenue growth, impacting the company's ability to justify its current valuation.

- Uncertainty surrounding the long-term path to consistent profitability.

Competition and Market Saturation

The data analytics market is fiercely competitive, with established players and emerging startups vying for market share. This intense competition could limit Palantir’s growth potential. Market saturation is another potential concern as the market matures.

- Competitive Landscape:

- Competition from established players such as Microsoft Azure and AWS, offering similar data analytics solutions.

- Increased price competition as new players enter the market.

- The need to continually innovate and adapt to stay ahead of the competition.

Geopolitical Risks and Regulatory Uncertainty

Palantir's business model is inherently linked to government contracts, making it susceptible to geopolitical events and regulatory changes. Budget cuts, shifts in government priorities, and evolving regulations could negatively impact its revenue stream.

- Potential Risks:

- Dependence on government contracts exposes the company to budget cuts and shifts in government priorities.

- Potential regulatory hurdles in new markets, particularly those with stringent data privacy regulations.

- Geopolitical instability could disrupt business operations in certain regions.

Conclusion

The prediction of a 40% surge in Palantir stock in 2024 is a compelling proposition, fueled by strong government contracts, expanding commercial adoption, and a commitment to technological innovation. However, investors must exercise caution, acknowledging the challenges posed by valuation concerns, stiff competition, and the inherent risks associated with operating in a volatile geopolitical environment. A thorough due diligence process, encompassing a careful review of Palantir's financial performance and market outlook, is paramount before making any investment decisions regarding Palantir stock. Consider consulting a financial advisor to assess the suitability of Palantir stock within your broader investment portfolio. Remember that past performance is not indicative of future results. Thoroughly research Palantir stock before making any investment choices.

Featured Posts

-

Mc Cann Parents Granted Police Protection Amid Stalking Fears At Upcoming Vigil

May 09, 2025

Mc Cann Parents Granted Police Protection Amid Stalking Fears At Upcoming Vigil

May 09, 2025 -

Psychologists Controversial Claim Is Daycare Harmful To Children

May 09, 2025

Psychologists Controversial Claim Is Daycare Harmful To Children

May 09, 2025 -

Understanding The Relationship Between Dangote Nnpc And Petrol Prices

May 09, 2025

Understanding The Relationship Between Dangote Nnpc And Petrol Prices

May 09, 2025 -

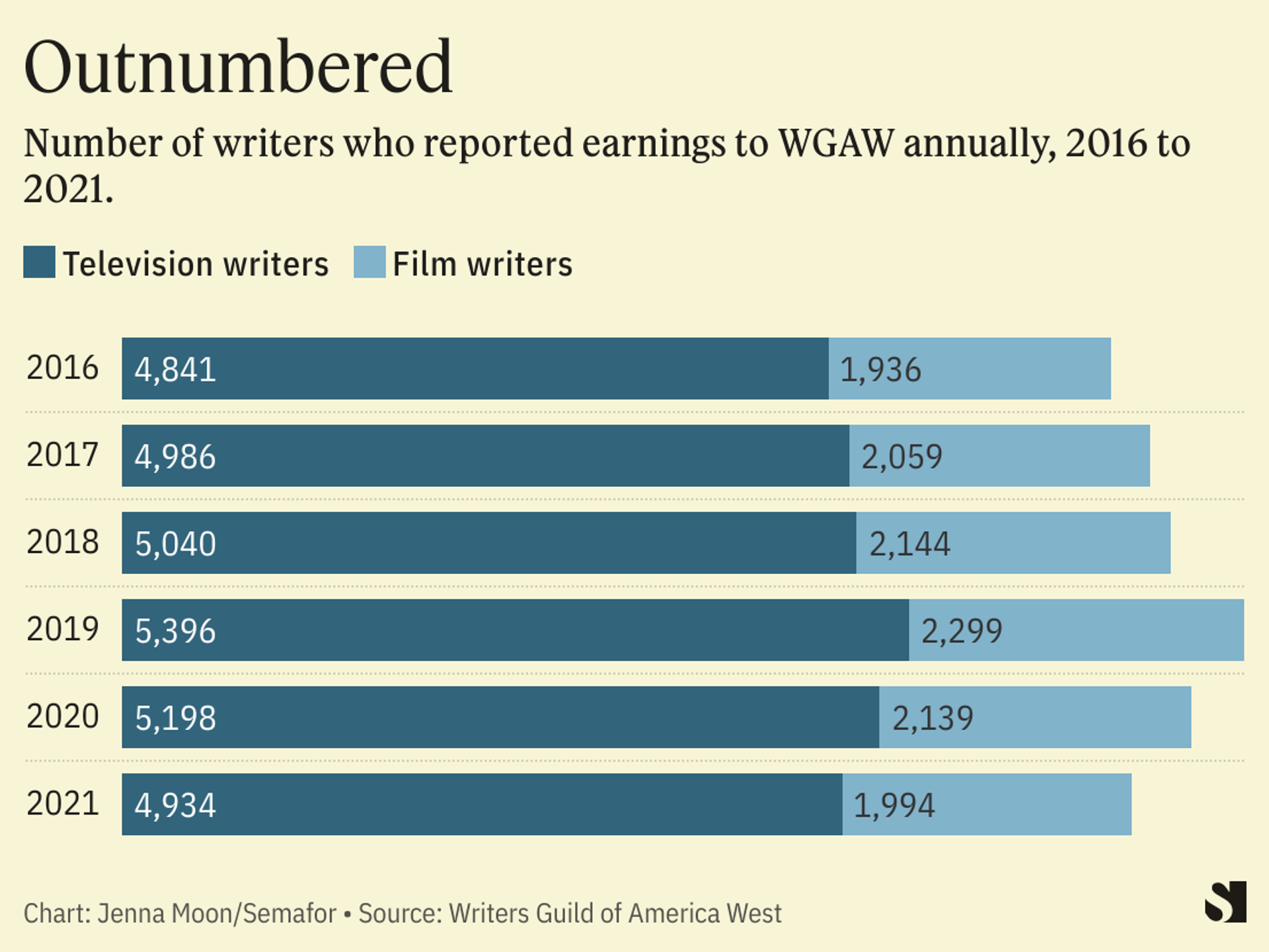

Double Trouble In Hollywood Writers And Actors Strike Impacts Production

May 09, 2025

Double Trouble In Hollywood Writers And Actors Strike Impacts Production

May 09, 2025 -

Nottingham Attack Survivors Speak Out A First Hand Account

May 09, 2025

Nottingham Attack Survivors Speak Out A First Hand Account

May 09, 2025