Understanding The Relationship Between Dangote, NNPC, And Petrol Prices

Table of Contents

Dangote Refinery's Potential Impact on Petrol Prices

The Dangote refinery, upon reaching full operational capacity, is poised to significantly alter Nigeria's fuel landscape and potentially impact petrol prices.

Increased Domestic Refining Capacity

The refinery, touted as Africa's largest, is projected to process 650,000 barrels of crude oil per day. This substantial increase in domestic refining capacity promises several key benefits:

- Significant Reduction in Fuel Importation: Nigeria currently relies heavily on imported refined petroleum products, making it vulnerable to global price fluctuations. The Dangote refinery aims to drastically reduce this dependence.

- Potential for Price Stabilization: By reducing reliance on imports, the refinery could mitigate the impact of international market volatility on domestic petrol prices. Stable local production could lead to more predictable and potentially lower prices.

- Increased Energy Security: Reduced reliance on foreign sources enhances Nigeria's energy independence and resilience to global supply chain disruptions.

- Challenges to Full Operational Capacity: Reaching and maintaining full operational capacity presents a significant challenge. Technical issues, logistical hurdles, and skilled labor availability could impact the refinery's output and its effect on petrol prices.

Competition and Market Dynamics

The entry of the Dangote refinery into the Nigerian petroleum market introduces a new dynamic, fostering competition with existing players, primarily NNPC.

- Market Share Impact: Dangote's substantial refining capacity has the potential to significantly alter the market share distribution, potentially challenging NNPC's dominant position.

- Potential Price Wars: Increased competition could lead to price wars, benefiting consumers through lower prices in the short term. However, sustainability of such price wars remains a question.

- Increased Bargaining Power for Consumers: Greater competition can empower consumers with increased bargaining power, giving them more choices and potentially influencing prices.

- Challenges to Existing Market Structures: The disruption to existing market structures could lead to adjustments and adaptations from both NNPC and other private players, potentially impacting pricing strategies.

NNPC's Role in Petrol Pricing and Subsidies

The Nigerian National Petroleum Company (NNPC) plays a pivotal role in determining petrol prices, heavily influenced by government policy and its own market dominance.

Government Subsidies and their Impact

For years, the Nigerian government has implemented fuel subsidies, artificially lowering petrol prices to ease the burden on consumers. However, this policy has significant implications:

- Cost of Subsidies: Fuel subsidies represent a substantial drain on the national budget, diverting resources from other crucial sectors.

- Budgetary Implications: The high cost of subsidies necessitates careful budgetary planning and often results in trade-offs with other essential public services.

- Transparency Issues: Concerns regarding transparency and accountability in subsidy management have raised questions about efficiency and potential misuse of funds.

- Impact on Consumer Prices: While subsidies keep prices artificially low, they also mask the true cost of fuel, potentially hindering investment in alternative energy sources.

- Subsidy Removal Effects: The removal or reduction of subsidies can lead to immediate and significant increases in petrol prices, resulting in potential social and economic unrest.

NNPC's Dominance in the Fuel Market

NNPC's extensive involvement in petrol importation and distribution grants it significant influence over price setting.

- Market Share: NNPC holds a substantial market share, giving it considerable pricing power.

- Pricing Power: This dominant position allows NNPC to influence petrol prices significantly, either directly or indirectly.

- Regulatory Influence: As a state-owned enterprise, NNPC's actions are closely linked to government regulations and policies, further shaping petrol prices.

- Potential for Price Manipulation (Addressing Potential Concerns): Concerns exist about potential price manipulation due to NNPC's market dominance. However, regulatory oversight and market forces can help mitigate these risks.

- Relationship with Private Players: NNPC's relationship with private sector players in the fuel market can affect pricing strategies and competition.

Interplay Between Dangote, NNPC, and Petrol Prices

The relationship between Dangote and NNPC will be crucial in shaping the future of petrol prices in Nigeria.

Potential Synergies and Conflicts

The presence of both Dangote and NNPC in the refined petroleum products market presents both opportunities for collaboration and potential conflicts.

- Potential Partnerships: Synergies could emerge through partnerships, such as joint ventures or supply agreements, leveraging each entity's strengths.

- Competition for Market Share: However, competition for market share is inevitable, potentially influencing price negotiations and consumer choices.

- Impact on Price Negotiations: The dynamics of competition and potential partnerships will influence price negotiations, ultimately affecting petrol prices for consumers.

- Implications for Consumers: The outcome of this interplay will significantly impact consumers through variations in petrol prices and availability.

- Government Policy Influence: Government policies and regulations will play a crucial role in shaping the competitive landscape and interactions between these two key players.

The Future of Petrol Pricing in Nigeria

The long-term implications of the relationship between Dangote, NNPC, and government policies will determine the trajectory of petrol prices.

- Forecasting Price Trends: Predicting future price trends requires considering various factors, including global oil prices, refinery output, government regulations, and market dynamics.

- Impact of Policy Changes: Government policies regarding subsidies, deregulation, and competition will significantly shape future petrol prices.

- Role of Technological Advancements: Technological advancements in refining processes and alternative energy sources could impact the fuel market and price dynamics.

- Challenges and Opportunities: The Nigerian energy sector faces significant challenges, but the interplay between Dangote and NNPC also presents opportunities for greater energy security and price stability.

Conclusion

This article highlighted the intricate relationship between Dangote Group, NNPC, and the ever-fluctuating petrol prices in Nigeria. The Dangote refinery holds immense potential for price stabilization through increased domestic refining, but the interplay with NNPC's existing market dominance and government policies will significantly shape the future of fuel costs. Understanding the complexities surrounding Dangote, NNPC, and petrol prices is crucial for informed discussions about Nigeria's energy future. Continue your research and stay informed about developments in the Nigerian fuel market to better understand the factors influencing your petrol prices.

Featured Posts

-

Samuel Dickson Industrialist And Pioneer Of The Canadian Lumber Industry

May 09, 2025

Samuel Dickson Industrialist And Pioneer Of The Canadian Lumber Industry

May 09, 2025 -

Dakota Johnsons Role Selection Chris Martins Potential Impact

May 09, 2025

Dakota Johnsons Role Selection Chris Martins Potential Impact

May 09, 2025 -

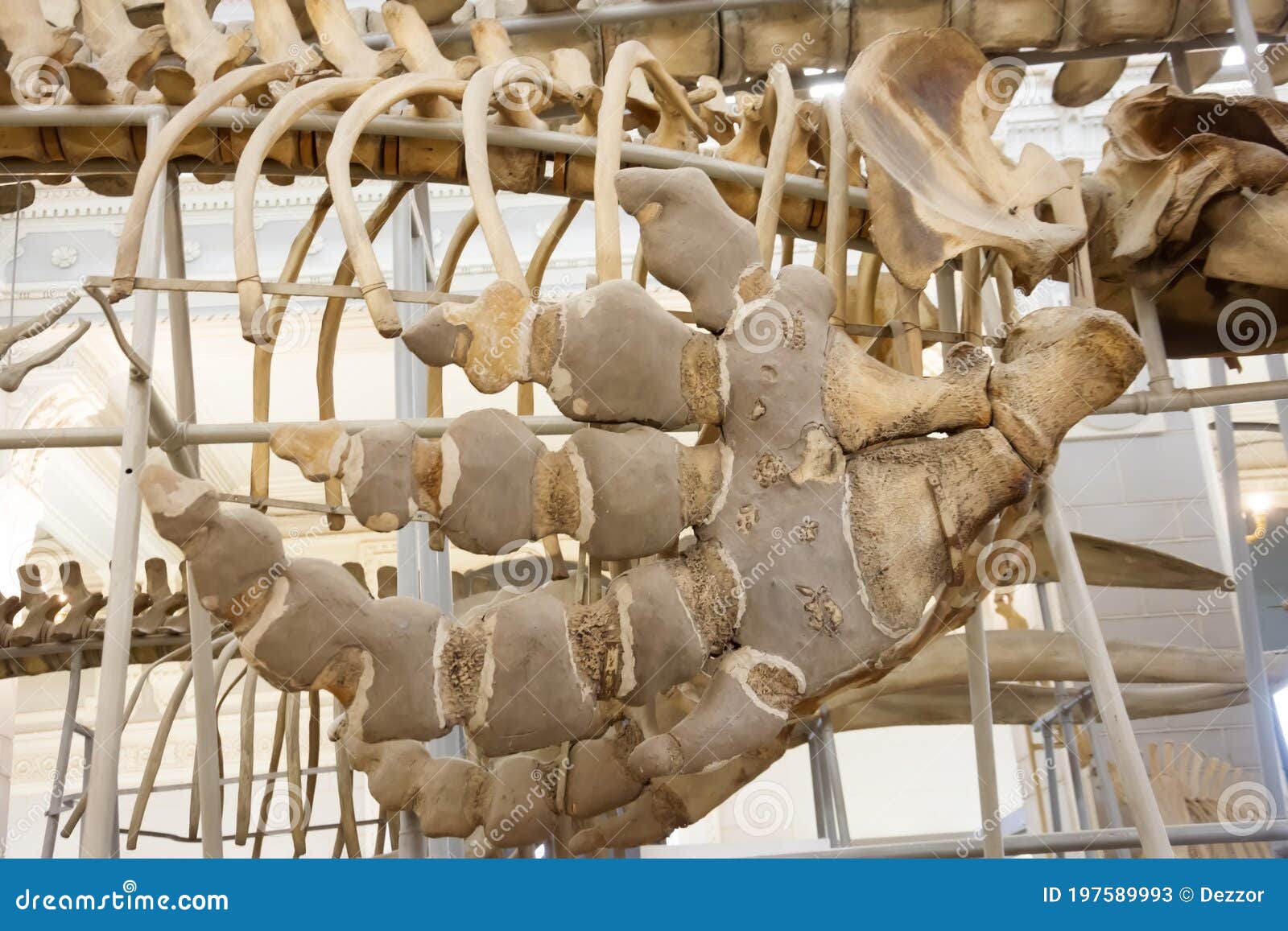

Anchorage Fin Whale Skeleton Recovery Impact Of Warming Weather And Soft Mudflats

May 09, 2025

Anchorage Fin Whale Skeleton Recovery Impact Of Warming Weather And Soft Mudflats

May 09, 2025 -

Fox News Hosts Sharp Rebuttal To Colleagues Trump Tariff Comments

May 09, 2025

Fox News Hosts Sharp Rebuttal To Colleagues Trump Tariff Comments

May 09, 2025 -

Should You Invest In This Spac Challenging Micro Strategys Dominance

May 09, 2025

Should You Invest In This Spac Challenging Micro Strategys Dominance

May 09, 2025