Is Palantir Stock A Buy Right Now? A Comprehensive Analysis

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's revenue streams are multifaceted, relying on a blend of government contracts and expanding commercial partnerships, all underpinned by its powerful Foundry platform. Understanding these revenue streams is crucial for assessing the PLTR stock price's potential.

Palantir Government Contracts: A Foundation of Revenue

Palantir's initial success was built on substantial government contracts, particularly within the defense and intelligence sectors. These contracts provide a stable, albeit sometimes unpredictable, revenue stream.

- Breakdown of Government Revenue: A significant portion of Palantir's revenue historically came from government contracts. While the exact breakdown fluctuates, analyzing the quarterly reports reveals the continued importance of this sector.

- Key Government Clients: Palantir boasts a roster of high-profile government clients, both domestically and internationally, contributing to the perceived stability of this revenue stream. However, reliance on a limited number of large clients presents inherent risks.

- Potential Risks: Government contracts are subject to budgetary constraints, political changes, and shifts in national priorities. Budget cuts or changes in administration could impact future contract awards, thus affecting Palantir's revenue and ultimately, the Palantir stock price.

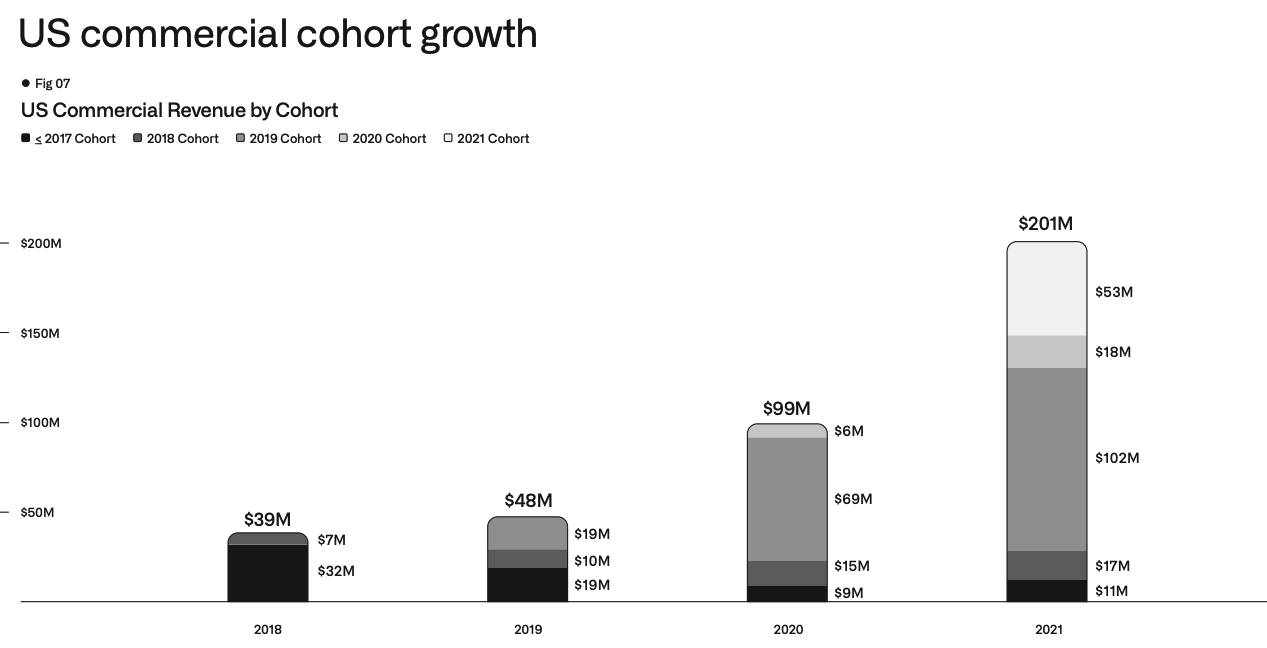

Palantir Commercial Partnerships: Driving Future Growth

While government contracts form a substantial base, Palantir's long-term growth hinges on its success in the commercial market. Expanding into this sector presents significant opportunities but also introduces new challenges.

- Key Commercial Clients: Palantir is progressively securing contracts with major corporations across various industries, showcasing its platform's adaptability and scalability. These commercial clients diversify Palantir's revenue streams, mitigating the risk associated with over-reliance on government contracts.

- Success Stories: Several successful implementations of Palantir's solutions within the commercial sector demonstrate its potential to transform business operations and drive efficiency gains for its clients. These case studies highlight the value proposition of Palantir's technology.

- Challenges in the Commercial Market: Competition in the commercial data analytics market is fierce. Palantir faces challenges in securing and retaining clients against established players with broader market reach and potentially lower pricing strategies.

Palantir Foundry: The Core of Palantir's Strategy

Palantir Foundry is the company's flagship platform, a data integration and analytics solution designed to streamline operations and enhance decision-making. Its success is inextricably linked to Palantir's overall growth.

- Description of Foundry: Foundry is a comprehensive platform offering data integration, processing, analysis, and visualization capabilities. Its key feature is its ability to integrate diverse data sources, providing a unified view of complex information.

- Unique Features: Foundry's unique features include its scalability, adaptability, and user-friendly interface, making it attractive to both government and commercial clients. This facilitates faster data processing and insight extraction.

- Adoption Rate and Competitive Advantages: The adoption rate of Foundry is a key indicator of Palantir's success. Its competitive advantages lie in its powerful analytics capabilities and its ability to handle exceptionally large and complex datasets.

Financial Performance and Valuation

Analyzing Palantir's financial performance and valuation is essential for evaluating the potential return on investment. Understanding its revenue growth, profitability, cash flow, and debt levels helps determine if the PLTR stock price accurately reflects its intrinsic value.

Revenue Growth and Profitability: A Key Indicator

Palantir's historical financial performance reveals its revenue growth trajectory and profitability margins. These metrics, when benchmarked against competitors, provide insight into the company's financial health.

- Revenue Growth Rate: Analyzing the company's quarterly and annual revenue growth reveals the rate at which Palantir is expanding its operations. Sustained high revenue growth is a positive indicator.

- Profitability Margins: Palantir's profitability margins, including gross and operating margins, are vital indicators of its financial efficiency. Improving margins suggest a stronger financial position.

- Key Financial Ratios: Analyzing key financial ratios such as the Price-to-Earnings (P/E) ratio and Price/Earnings to Growth (PEG) ratio allows for a comparison to industry peers and helps assess the current market valuation of PLTR stock.

Cash Flow and Debt: Assessing Long-Term Sustainability

Evaluating Palantir's cash flow generation and debt levels provides insights into its long-term financial sustainability and stability.

- Free Cash Flow: A strong positive free cash flow demonstrates the company's ability to generate cash from its operations, allowing for reinvestment in growth initiatives or debt reduction.

- Debt-to-Equity Ratio: This ratio indicates the level of financial leverage employed by Palantir. A high ratio implies increased financial risk, while a low ratio suggests greater financial stability.

- Cash Reserves: Sufficient cash reserves provide a buffer against economic downturns and unexpected expenses, adding to the long-term sustainability of the business.

Competitive Landscape and Future Outlook

Understanding Palantir's competitive landscape and future outlook is critical to making an informed investment decision. Analyzing its market position, growth opportunities, and potential risks paints a clearer picture of the PLTR stock price's potential trajectory.

Key Competitors and Market Share: Navigating a Crowded Field

Palantir operates in a competitive market with both direct and indirect competitors vying for market share.

- Direct and Indirect Competitors: Identifying Palantir's main competitors allows for a comparative analysis of their strengths and weaknesses. Direct competitors offer similar data analytics solutions, while indirect competitors might offer overlapping functionalities within broader software platforms.

- Market Share Analysis: Assessing Palantir's market share relative to its competitors provides insights into its competitive position and potential for future growth.

- Competitive Advantages and Disadvantages: Palantir's competitive advantages include its proprietary technology, strong government relationships, and a growing commercial client base. However, it faces challenges from larger, more established players with greater resources and broader market reach.

Growth Opportunities and Risks: Navigating the Path Ahead

Palantir's future growth hinges on several factors, including opportunities in emerging markets and technological advancements, as well as the potential for regulatory and geopolitical risks.

- Opportunities in Emerging Markets: Expansion into new geographical markets presents significant growth potential. However, this requires adapting its platform and business model to local needs and regulations.

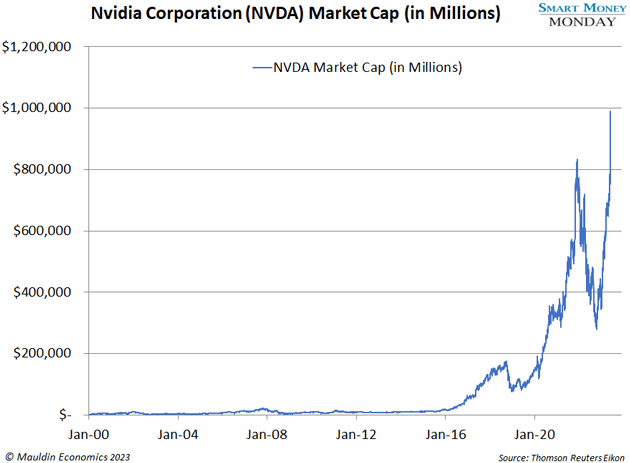

- Technological Advancements: Staying at the forefront of technological innovation is crucial for Palantir's continued success. Investment in research and development is essential for maintaining a competitive edge.

- Regulatory Risks: Navigating regulatory hurdles and compliance requirements, particularly in data privacy and security, is vital for sustained growth.

- Geopolitical Risks: Geopolitical instability and international relations can impact Palantir's operations and revenue streams, particularly within the government sector.

Conclusion

This comprehensive analysis of Palantir Technologies (PLTR) reveals a company with a powerful technology platform, strong government ties, and growing commercial momentum. However, the reliance on government contracts, a competitive market landscape, and the inherent volatility of the tech sector present significant risks. While Palantir's innovative solutions and expansion into the commercial market show promise, considerable uncertainty remains.

Investment Recommendation: Based on the analysis, the decision to buy, hold, or sell Palantir stock depends heavily on individual risk tolerance and investment horizon. A long-term investor with a high-risk tolerance might view the potential for significant growth as outweighing the risks, while a more conservative investor might prefer to wait for greater clarity regarding the company's financial performance and market position.

Call to Action: Is Palantir stock right for your investment strategy? Conduct thorough due diligence before investing and consult with a financial advisor if needed. Remember to carefully weigh the potential rewards against the inherent risks before making any investment decisions related to Palantir stock or other high-growth technology companies. Further research into Palantir's financials, competitor analysis, and industry trends is strongly recommended.

Featured Posts

-

Ftc Launches Probe Into Open Ai And Chat Gpt A Deep Dive

May 10, 2025

Ftc Launches Probe Into Open Ai And Chat Gpt A Deep Dive

May 10, 2025 -

Palantirs Path To A Trillion Dollar Market Cap A 2030 Forecast

May 10, 2025

Palantirs Path To A Trillion Dollar Market Cap A 2030 Forecast

May 10, 2025 -

Harry Styles Response To A Subpar Snl Impression

May 10, 2025

Harry Styles Response To A Subpar Snl Impression

May 10, 2025 -

Ftc Challenges Court Ruling On Microsofts Activision Blizzard Buyout

May 10, 2025

Ftc Challenges Court Ruling On Microsofts Activision Blizzard Buyout

May 10, 2025 -

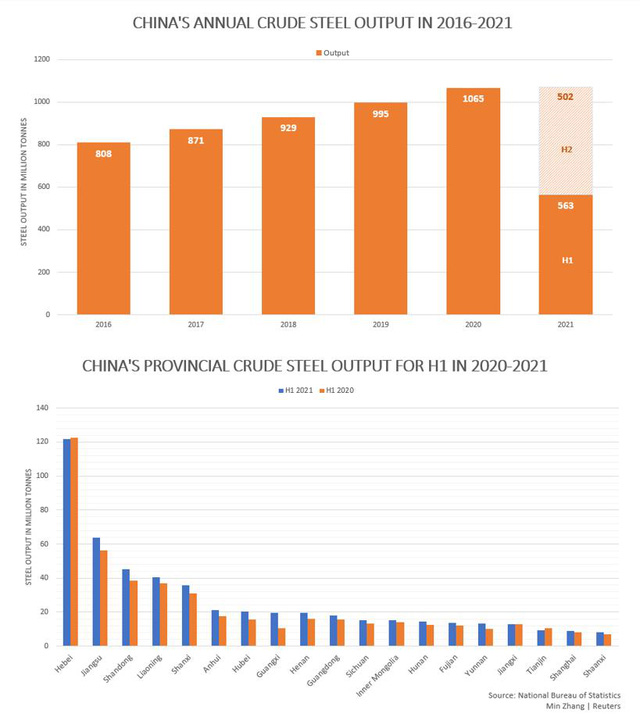

Falling Iron Ore Prices Impact Of Chinese Steel Production Cuts

May 10, 2025

Falling Iron Ore Prices Impact Of Chinese Steel Production Cuts

May 10, 2025