Is Palantir Stock A Good Investment? Evaluating The Risks And Rewards

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir Technologies operates in the lucrative big data analytics market, offering two primary software platforms: Gotham and Foundry. Gotham is primarily focused on government clients, providing advanced data integration and analysis capabilities for national security and intelligence applications. Foundry, on the other hand, targets commercial clients across diverse sectors, offering a platform for operational intelligence and data-driven decision-making.

Palantir's target customer base spans both the government and commercial sectors. The government sector, particularly in the US and allied nations, has historically been a major source of revenue, thanks to large, high-value contracts. However, Palantir is aggressively expanding its presence in the commercial sector, with clients in healthcare, finance, manufacturing, and other industries adopting Foundry to improve their operational efficiency and gain valuable insights from their data.

This dual approach contributes to Palantir's diverse revenue streams. A significant portion comes from long-term contracts with government agencies, providing a degree of revenue predictability. However, the increasing adoption of Foundry in the commercial sector is driving growth and fostering a subscription-based revenue model, further enhancing this predictability.

- High-value government contracts: These contracts often span several years, offering stability and predictable revenue streams for Palantir.

- Growing commercial client base in diverse industries: This diversification mitigates the risk associated with over-reliance on government contracts.

- Subscription-based revenue model for increased predictability: This recurring revenue stream offers greater financial stability and reduces reliance on one-off project sales.

- Strategic partnerships driving revenue growth: Collaborations with technology giants and industry leaders expand Palantir's reach and market penetration.

Financial Performance and Growth Potential

Analyzing Palantir's recent financial reports reveals a mixed bag. While the company has demonstrated substantial year-over-year revenue growth, profitability has been a fluctuating factor, impacted by substantial investments in research and development and sales and marketing. Investors should carefully scrutinize key metrics like revenue growth rates, operating margins, and cash flow generation.

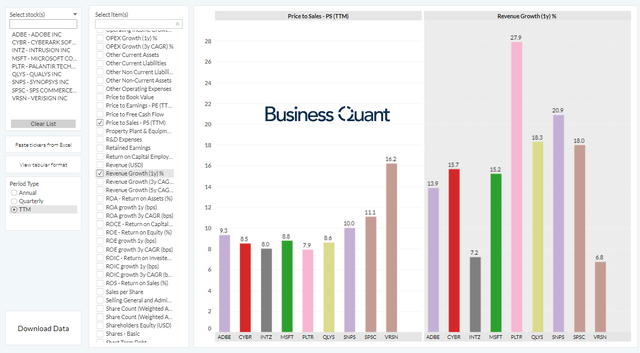

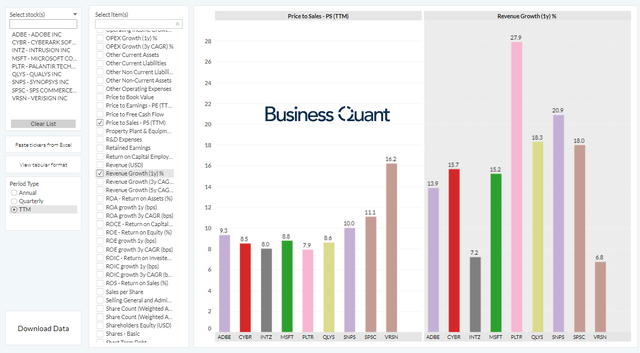

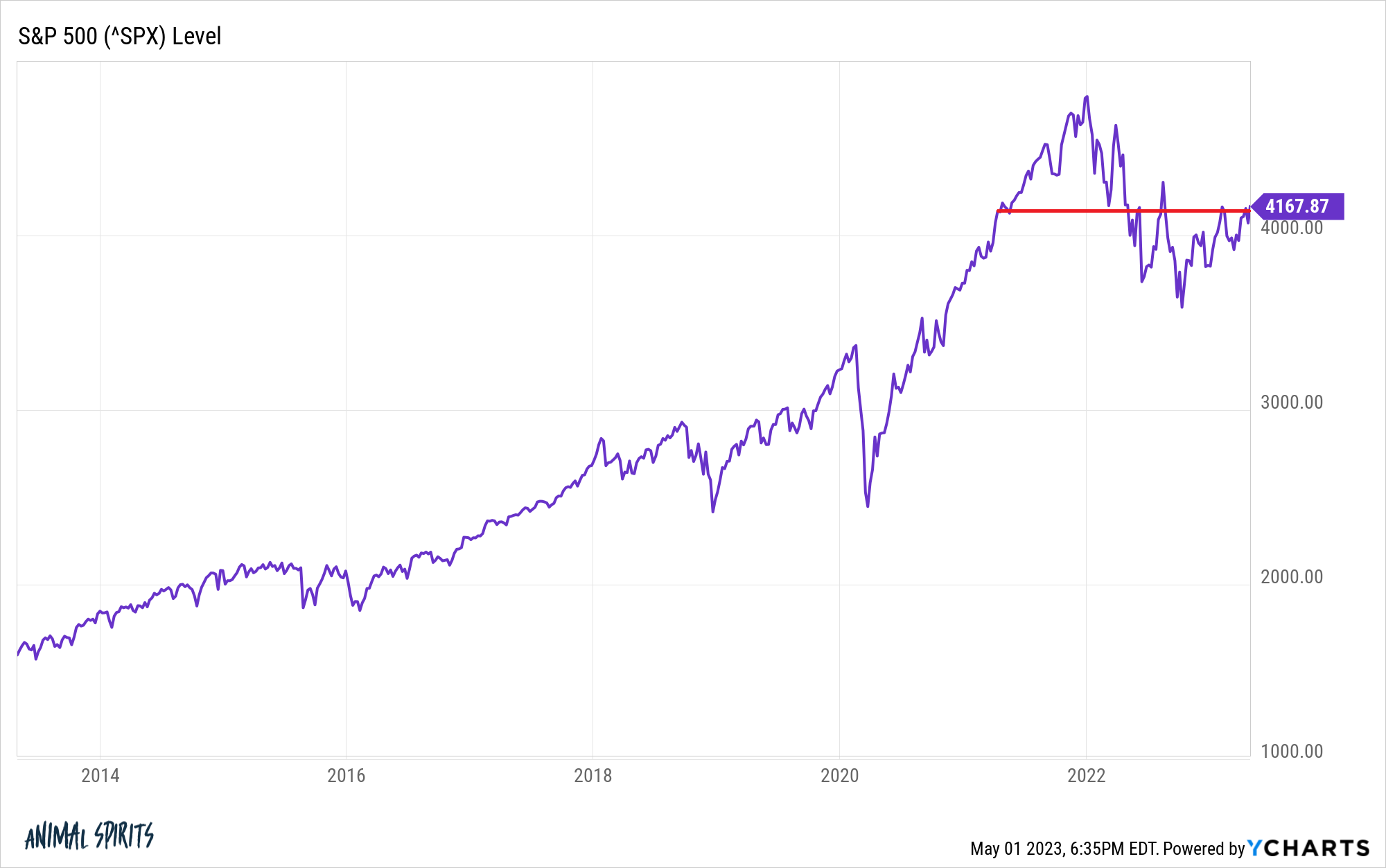

Historically, Palantir stock has shown significant volatility, reflecting the market's fluctuating assessment of its growth potential. Future growth projections vary widely among analysts, highlighting the inherent uncertainty in the market. It's crucial to compare Palantir's performance to its competitors, such as AWS, Microsoft Azure, and Google Cloud, to assess its relative market position and growth trajectory.

- Year-over-year revenue growth analysis: Consistent, strong revenue growth is a key indicator of a healthy and expanding business.

- Profitability margins and trends: Improving profit margins signal increasing operational efficiency and financial strength.

- Debt levels and financial stability: High debt levels can pose a risk, especially during economic downturns.

- Analyst estimates and future growth forecasts for Palantir stock: Consult multiple sources for a comprehensive understanding of future prospects.

Competitive Landscape and Market Position

Palantir faces stiff competition from established tech giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP), all of whom offer competing data analytics and cloud computing solutions. While Palantir boasts a strong reputation for its sophisticated data integration and analysis capabilities, particularly in the government sector, it must contend with the extensive resources and broader product portfolios of these larger competitors.

Palantir’s competitive advantages lie in its specialized expertise in data integration and its strong relationships with government agencies. However, disadvantages include its relatively smaller market share compared to its larger competitors and potential challenges in attracting and retaining top talent in a competitive tech market. The potential for future market growth in the big data analytics sector is significant, but Palantir’s ability to secure a substantial share of this growth depends on its ability to innovate and adapt to changing market dynamics.

- Comparison of Palantir's technology and offerings against competitors: Assess Palantir's unique selling propositions and potential advantages.

- Evaluation of Palantir’s brand recognition and market positioning: Understand its brand strength and its ability to attract new clients.

- Analysis of potential threats from established tech giants: Consider the competitive pressures from large, well-funded competitors.

- Assessment of Palantir’s ability to innovate and stay ahead of the competition: Evaluate its commitment to research and development and its capacity to adapt to evolving market trends.

Risks Associated with Investing in Palantir Stock

Investing in Palantir stock comes with inherent risks. The stock price has historically demonstrated significant volatility, making it a potentially high-risk investment. Furthermore, Palantir's substantial reliance on government contracts, particularly in the US, exposes it to the potential for budget cuts or changes in government priorities.

The intense competition in the data analytics market also presents a significant challenge. Palantir needs to continuously innovate and adapt to remain competitive against larger and more diversified companies. Regulatory scrutiny and potential changes in data privacy regulations could also impact its operations and profitability. Economic downturns, especially those affecting government spending, could negatively impact Palantir's revenue.

- High stock price volatility: Be prepared for significant price fluctuations.

- Dependence on large government contracts: This concentration of revenue creates vulnerability to changes in government policy.

- Intense competition in the data analytics market: Palantir faces significant competition from established tech giants.

- Potential for regulatory scrutiny: Changes in data privacy laws could impact Palantir's operations.

- Economic downturns impacting government spending: Reduced government spending could significantly impact Palantir's revenue.

Conclusion

Investing in Palantir stock presents a compelling opportunity for growth, driven by its innovative technology and expanding client base across the government and commercial sectors. However, significant risks exist, including high stock price volatility, dependence on government contracts, and intense competition. A thorough understanding of Palantir's financial performance, competitive landscape, and the inherent risks associated with its stock is crucial before making an investment decision.

Ultimately, the decision of whether Palantir stock is a good investment for you depends on your individual risk tolerance, investment goals, and a comprehensive understanding of the company’s financial performance and market position. Conduct your own research and consider consulting a financial advisor before investing in Palantir stock or any other security. This analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Izolyatsiya Zelenskogo Pochemu Nikto Ne Priekhal Na 9 Maya

May 10, 2025

Izolyatsiya Zelenskogo Pochemu Nikto Ne Priekhal Na 9 Maya

May 10, 2025 -

9 Maya Makron Starmer Merts I Tusk Ostanutsya V Svoikh Stolitsakh

May 10, 2025

9 Maya Makron Starmer Merts I Tusk Ostanutsya V Svoikh Stolitsakh

May 10, 2025 -

Wga And Sag Aftra Strike What It Means For Hollywoods Future

May 10, 2025

Wga And Sag Aftra Strike What It Means For Hollywoods Future

May 10, 2025 -

The Bof A View Why Current Stock Market Valuations Arent Necessarily A Problem

May 10, 2025

The Bof A View Why Current Stock Market Valuations Arent Necessarily A Problem

May 10, 2025 -

Coastal Erosion And Flooding The Impact Of Rising Sea Levels

May 10, 2025

Coastal Erosion And Flooding The Impact Of Rising Sea Levels

May 10, 2025