Is Posthaste Trouble Brewing In The World's Largest Bond Market?

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The relationship between interest rates and bond prices is inversely proportional. When interest rates rise, bond prices fall, and vice-versa. This fundamental principle is currently playing out dramatically in the US Treasury bond market.

- The Federal Reserve's aggressive interest rate hikes and their effect on bond yields: The Federal Reserve's efforts to combat inflation have led to a series of aggressive interest rate hikes. This has directly increased bond yields, making newly issued bonds more attractive and putting downward pressure on the prices of existing bonds.

- The impact of higher rates on existing bond investments: Investors holding existing bonds with lower coupon rates are experiencing capital losses as their bond values decline in response to higher interest rates. This is particularly true for long-term bonds.

- Analysis of potential further rate increases and their implications for the bond market: The Federal Reserve's future actions remain uncertain. Further rate increases could exacerbate the downward pressure on bond prices, leading to increased bond price volatility.

- Discussion of the flight to safety and its impact: While typically a safe haven, the rising yields on US Treasury bonds may be lessening their appeal as a "flight to safety" investment. Investors may seek higher returns elsewhere, even if it involves higher risk.

Increased Inflation and its Role in Market Instability

Inflation erodes the purchasing power of fixed-income investments like bonds. High and persistent inflation directly impacts the real return on bonds, making them less attractive to investors.

- The current inflation rate and its projected trajectory: The current inflation rate remains a significant concern, exceeding the Federal Reserve's target. Projections for its future trajectory vary, adding to the uncertainty in the bond market.

- The impact of persistent inflation on bond investor confidence: Persistent inflation weakens investor confidence, leading to a reduced demand for bonds and further downward pressure on prices.

- Analysis of how inflation affects the real return on bonds: High inflation significantly reduces the real return on bonds, meaning investors receive less purchasing power than the nominal return suggests.

- Discussion of strategies to mitigate inflation risk in bond portfolios: Investors can mitigate inflation risk by diversifying their portfolios, including inflation-protected securities (TIPS) and assets that tend to perform well during inflationary periods.

Geopolitical Risks and their Influence on the Bond Market

Global events significantly influence investor sentiment and bond market performance. Geopolitical instability creates uncertainty, often leading to increased demand for safe-haven assets.

- The impact of the war in Ukraine on global markets and investor sentiment: The war in Ukraine has created significant uncertainty in global energy markets and supply chains, impacting investor confidence and increasing demand for safe-haven assets like US Treasury bonds (although this effect might be muted by rising yields).

- The effect of rising energy prices and supply chain disruptions: Rising energy prices and supply chain disruptions contribute to inflation and fuel economic uncertainty, further impacting the bond market.

- Analysis of how geopolitical uncertainty influences risk aversion and bond demand: Geopolitical uncertainty increases risk aversion, leading some investors to seek the perceived safety of US Treasury bonds, while others might flee to other perceived safe havens.

- Discussion of safe-haven assets and their role during times of geopolitical stress: During times of geopolitical stress, investors often flock to safe-haven assets perceived as less vulnerable to market fluctuations, although the current environment challenges this traditional view.

The Potential for a Posthaste Market Correction

A posthaste market correction in this context refers to a rapid and significant decline in bond prices. Several factors suggest the possibility of such an event.

- Signs of potential overvaluation in the bond market: Some analysts argue that certain segments of the bond market might be overvalued, increasing the risk of a sharp correction.

- Technical analysis suggesting a potential correction: Technical analysis, using indicators such as moving averages and relative strength index (RSI), may suggest a potential downturn in the bond market.

- Historical precedents for similar market events: History offers examples of rapid corrections in bond markets, although each event has unique circumstances.

- Discussion of potential scenarios and their implications: Different scenarios are possible, ranging from a moderate correction to a more severe market crash. The implications for investors would vary depending on the severity and speed of the correction.

Conclusion

The US Treasury bond market, while historically stable, is facing a confluence of factors that could lead to significant and rapid changes. Rising interest rates, persistent inflation, and geopolitical uncertainties all contribute to a heightened sense of instability. The potential for a posthaste market correction is a serious concern that demands careful consideration from investors. Understanding the potential for trouble in the world's largest bond market is crucial for informed investment decisions. Stay informed on market trends, diversify your portfolio, and seek professional advice to navigate the complexities of this potentially volatile environment. Monitor the situation closely for signs of a posthaste market shift.

Featured Posts

-

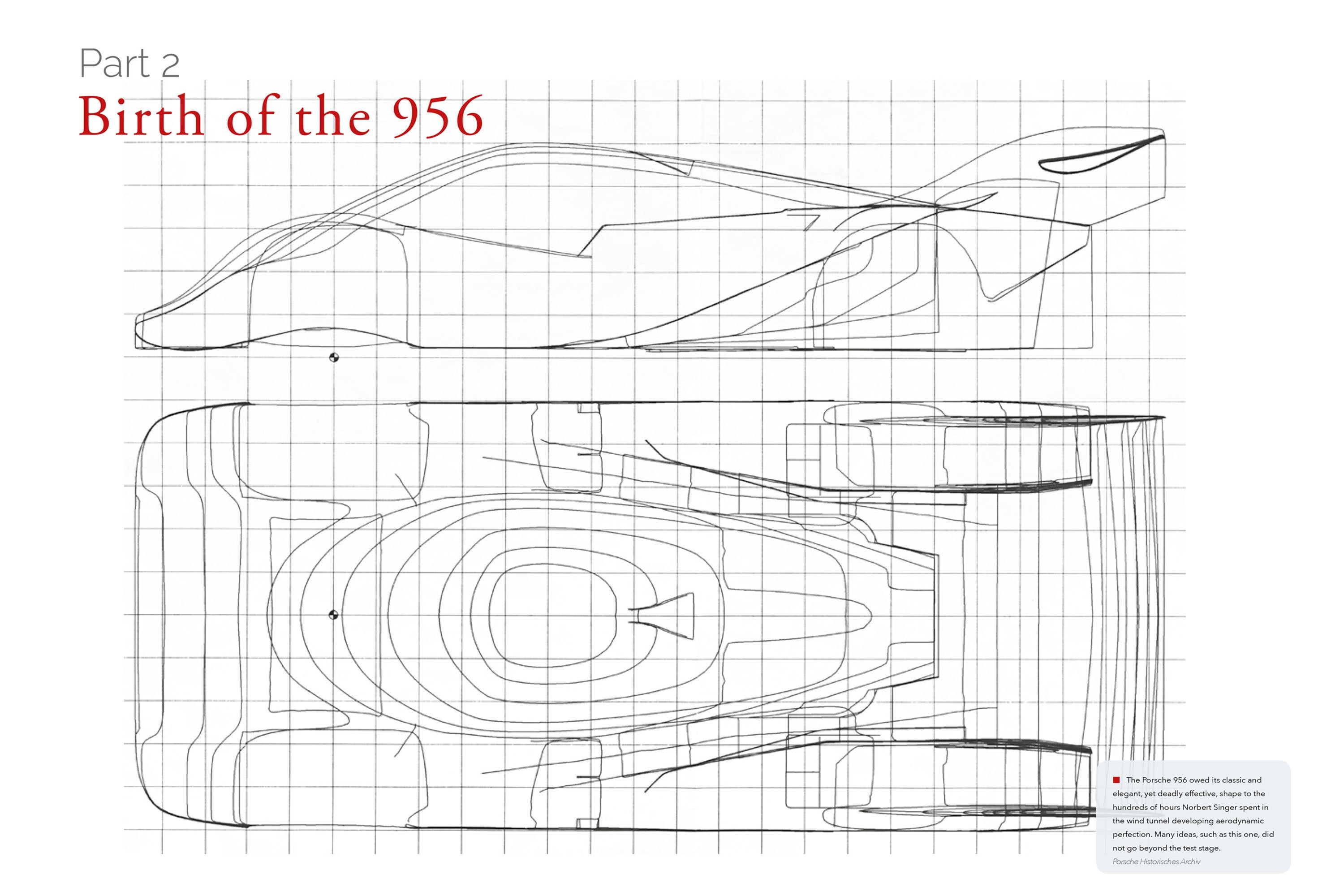

Porsche 956 Nin Muezede Tavan Asili Sergileme Sebepleri

May 24, 2025

Porsche 956 Nin Muezede Tavan Asili Sergileme Sebepleri

May 24, 2025 -

Rybakina Ya Vsyo Eschyo Ne V Luchshey Forme Chestniy Kommentariy Tennisistki

May 24, 2025

Rybakina Ya Vsyo Eschyo Ne V Luchshey Forme Chestniy Kommentariy Tennisistki

May 24, 2025 -

Extreme Price Hike Broadcoms V Mware Deal Costs At And T 1 050 More

May 24, 2025

Extreme Price Hike Broadcoms V Mware Deal Costs At And T 1 050 More

May 24, 2025 -

Memorial Day 2025 In Florida Publix Grocery Store Hours

May 24, 2025

Memorial Day 2025 In Florida Publix Grocery Store Hours

May 24, 2025 -

Annie Kilner Steps Out Following Kyle Walkers Night Out With Mystery Women

May 24, 2025

Annie Kilner Steps Out Following Kyle Walkers Night Out With Mystery Women

May 24, 2025

Latest Posts

-

Jonathan Groffs Just In Time Celebrity Support At Broadway Opening

May 24, 2025

Jonathan Groffs Just In Time Celebrity Support At Broadway Opening

May 24, 2025 -

Jonathan Groffs Broadway Opening Lea Michele And Co Stars Show Support

May 24, 2025

Jonathan Groffs Broadway Opening Lea Michele And Co Stars Show Support

May 24, 2025 -

Jonathan Groffs Just In Time Broadway Show A Night Of Support From Famous Friends

May 24, 2025

Jonathan Groffs Just In Time Broadway Show A Night Of Support From Famous Friends

May 24, 2025 -

Broadways Best Jonathan Groffs Just In Time Opening Night With Celebrity Guests

May 24, 2025

Broadways Best Jonathan Groffs Just In Time Opening Night With Celebrity Guests

May 24, 2025 -

Jonathan Groffs Just In Time A Night Of Support From Famous Friends

May 24, 2025

Jonathan Groffs Just In Time A Night Of Support From Famous Friends

May 24, 2025