Is Refinancing Federal Student Loans Right For You?

Table of Contents

Millions of Americans are burdened by student loan debt. Refinancing federal student loans often presents itself as an appealing solution to lower monthly payments or shorten repayment timelines. But is refinancing federal student loans truly the right path for you? This comprehensive guide will delve into the advantages and disadvantages of refinancing federal student loans, empowering you to make a well-informed decision about your financial future.

Understanding Federal Student Loan Refinancing

Refinancing federal student loans involves replacing your existing federal loans with a new private loan from a private lender. This essentially means taking out a new loan to pay off your existing federal student loans. Unlike federal loans, which are backed by the government, private loans are offered by banks and credit unions. Understanding the differences is crucial.

Key terms to understand include:

- Interest rate: The percentage charged on the remaining loan balance. A lower interest rate means lower overall costs.

- Loan term: The length of time you have to repay the loan (e.g., 5 years, 10 years). Shorter terms mean higher monthly payments but lower overall interest paid.

- Principal: The original amount borrowed.

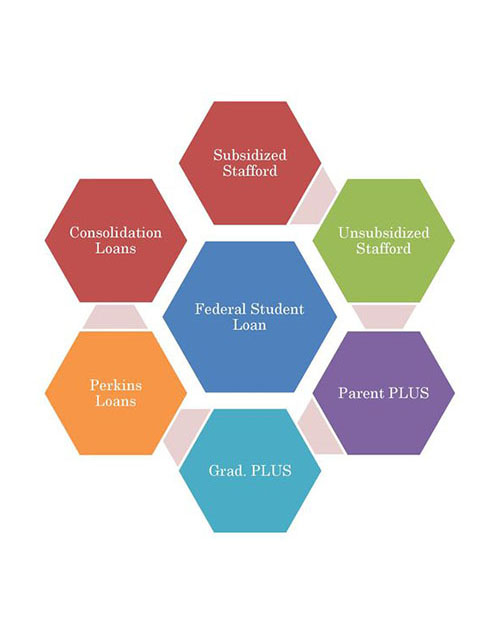

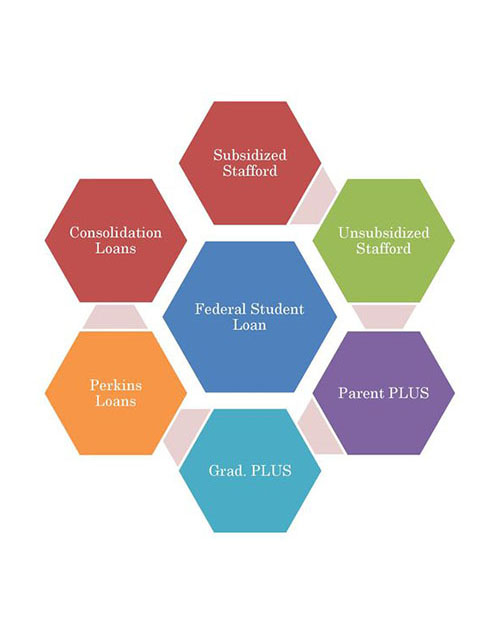

Here’s a breakdown:

- Definition of refinancing: Replacing an existing loan with a new one, often with different terms.

- Types of federal student loans that can be refinanced: Direct subsidized loans, Direct unsubsidized loans, Direct PLUS loans, and Direct Consolidation Loans can all be refinanced, but you'll lose the benefits associated with federal loans.

- How refinancing works: You apply with a private lender, who assesses your creditworthiness. If approved, they pay off your federal loans, and you begin making payments on the new private loan.

Potential Benefits of Refinancing Federal Student Loans

Refinancing your federal student loans can offer several potential advantages:

- Lower monthly payments: By extending the loan term, you can reduce your monthly payment amount, freeing up cash flow for other expenses. For example, a $50,000 loan with a 7% interest rate over 10 years has a monthly payment of around $550. Refinancing to a 15-year term might lower that to around $400.

- Shorter repayment term: Choosing a shorter repayment term means you'll pay off your loan faster, ultimately saving on total interest paid.

- Potential for a lower interest rate: If you have a good credit score, you may qualify for a lower interest rate than what you currently have on your federal loans, leading to substantial savings over the life of the loan. This significantly impacts your total interest paid.

Potential Drawbacks of Refinancing Federal Student Loans

While refinancing offers potential advantages, it's vital to consider the downsides:

- Loss of federal student loan benefits: Once you refinance your federal loans into a private loan, you lose access to crucial benefits, such as:

- Income-driven repayment plans (IDR)

- Deferment and forbearance options

- Public Service Loan Forgiveness (PSLF) programs

- Potential loan forgiveness programs.

- Risk of higher interest rates: If you have a low credit score or a high debt-to-income ratio, you might receive a higher interest rate than your current federal loans.

- Increased overall interest paid: Refinancing to a longer term might lower your monthly payments but could increase the total amount of interest paid over the life of the loan.

Eligibility Requirements for Refinancing

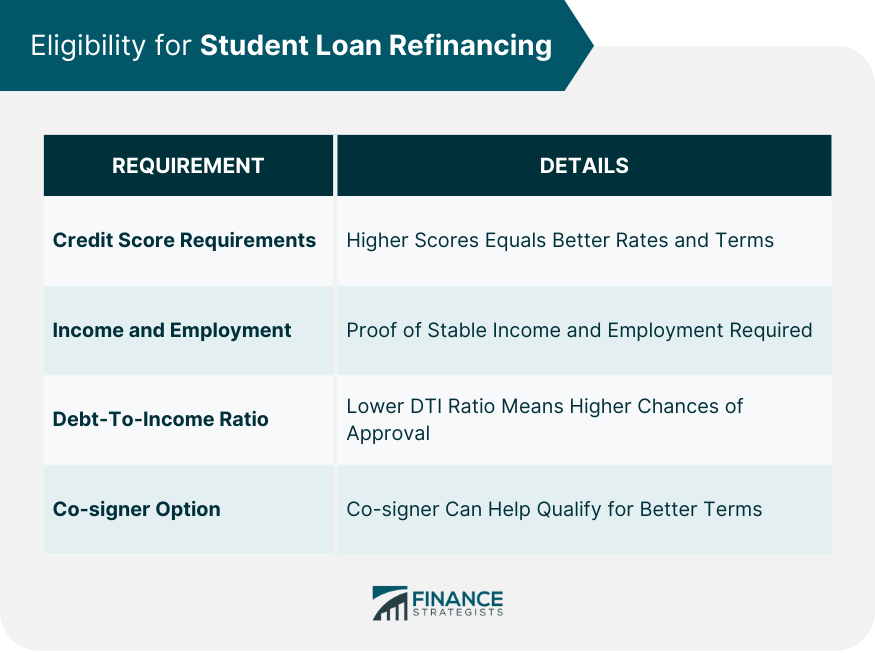

Lenders have specific criteria for approving refinancing applications:

- Credit score requirements: Most lenders require a minimum credit score, typically ranging from 660 to 700 or higher. The higher your credit score, the better interest rate you're likely to secure.

- Income verification processes: Lenders will assess your income to ensure you can afford the new monthly payments. You'll typically need to provide documentation like tax returns or pay stubs.

- Debt-to-income ratio considerations: Your debt-to-income ratio (DTI) – the proportion of your income used to pay debts – plays a significant role in approval. A lower DTI increases your chances of approval.

Finding the Right Refinancing Lender

Choosing the right lender is crucial for securing favorable terms:

- Compare interest rates and fees: Shop around and compare offers from multiple lenders. Don’t just look at the interest rate; consider origination fees, prepayment penalties, and other charges.

- Read the fine print: Carefully review the loan agreement before signing. Understand all terms and conditions, including the interest rate, fees, repayment terms, and any penalties.

- Apply for refinancing: Once you've chosen a lender, complete the application process, providing all the necessary documentation.

Conclusion

Refinancing federal student loans can offer considerable advantages, including reduced monthly payments and faster repayment. However, it's crucial to weigh these benefits against the potential loss of valuable federal loan benefits and the risk of higher interest rates. Carefully assess your financial situation, credit score, and long-term financial objectives before making a decision. Understanding the nuances of federal student loan refinancing is key to making a sound financial choice.

Call to Action: Ready to explore your options for federal student loan refinancing? Compare lenders, understand the potential risks and rewards, and make the best choice for your financial future. Start researching refinancing options today!

Featured Posts

-

Jim Morrison Sighting New York Maintenance Man Conspiracy

May 17, 2025

Jim Morrison Sighting New York Maintenance Man Conspiracy

May 17, 2025 -

Trumps F 55 And F 22 Upgrade Proposals Feasibility And Impact

May 17, 2025

Trumps F 55 And F 22 Upgrade Proposals Feasibility And Impact

May 17, 2025 -

Federal Student Loan Refinancing Should You Use A Private Lender

May 17, 2025

Federal Student Loan Refinancing Should You Use A Private Lender

May 17, 2025 -

Analysis Black Voices On Trumps Student Loan Decision

May 17, 2025

Analysis Black Voices On Trumps Student Loan Decision

May 17, 2025 -

Stream Seattle Mariners Vs Chicago Cubs Spring Training Game Today

May 17, 2025

Stream Seattle Mariners Vs Chicago Cubs Spring Training Game Today

May 17, 2025

Latest Posts

-

Nu Than Quan Vot 17 Tuoi Chien Thang Lich Su Tai Indian Wells

May 17, 2025

Nu Than Quan Vot 17 Tuoi Chien Thang Lich Su Tai Indian Wells

May 17, 2025 -

Svjontek Pobeduje Ukrajinku Detaljan Pregled Meca I Vesti

May 17, 2025

Svjontek Pobeduje Ukrajinku Detaljan Pregled Meca I Vesti

May 17, 2025 -

Rune Bolji Od Povredenog Alkarasa U Finalu Barcelone

May 17, 2025

Rune Bolji Od Povredenog Alkarasa U Finalu Barcelone

May 17, 2025 -

Vo Dich Indian Wells Co Gai 17 Tuoi Nguoi Nga Tao Nen Lich Su

May 17, 2025

Vo Dich Indian Wells Co Gai 17 Tuoi Nguoi Nga Tao Nen Lich Su

May 17, 2025 -

Iga Svjontek Dominira Pobeda Nad Ukrajinkom I Povezane Vesti

May 17, 2025

Iga Svjontek Dominira Pobeda Nad Ukrajinkom I Povezane Vesti

May 17, 2025