Is The Venture Capital Secondary Market Overheated? A Current Analysis

Table of Contents

Increased Transaction Volume and Pricing

The surge in secondary market transactions is a key indicator fueling the overheating debate. We're seeing a dramatic increase in the number of deals, with transaction values exceeding historical averages in many cases. This unprecedented activity suggests a market potentially operating beyond sustainable levels.

- Rising transaction values exceeding historical averages: Data from [Source 1 – reputable market research firm] shows a [Percentage]% increase in average transaction value year-over-year, significantly outpacing the growth of the primary venture capital market.

- Increased competition among buyers driving up prices: The influx of new investors, including institutional investors and specialized secondary funds, has intensified competition, pushing up prices and creating a seller's market. This heightened competition is inflating valuations, potentially creating a bubble.

- A growing number of late-stage startups entering the secondary market: More mature startups are increasingly turning to the secondary market for liquidity events, further contributing to the increased transaction volume. This indicates a shift in the traditional venture capital exit strategy.

- Data points showing the rapid expansion of the market's size: Reports from [Source 2 – another reputable source] estimate the secondary market's size at [Dollar Amount], representing a [Percentage]% growth in [Time Period].

This rapid expansion raises concerns about the market's long-term health and sustainability. The current pace of growth may not be reflective of the underlying fundamentals of the companies being traded.

Impact of Macroeconomic Factors

Macroeconomic conditions play a significant role in shaping the venture capital secondary market's trajectory. Current economic trends exert considerable influence on investor behavior and market valuations.

- Rising interest rates making debt financing more expensive: Higher interest rates increase the cost of borrowing, making it more expensive for buyers to finance acquisitions, potentially dampening transaction activity. This can lead to a slowdown in the market.

- Inflation impacting investor valuations and risk tolerance: Inflation erodes purchasing power and increases uncertainty, causing investors to become more risk-averse and potentially reassess valuations in the secondary market.

- Economic slowdown potentially reducing demand for later-stage investments: A slowing economy can reduce demand for later-stage investments, as investors become more cautious about deploying capital in riskier assets. This could lead to a correction in the market.

- Correlation between macroeconomic indicators and secondary market activity: Historical data reveals a strong correlation between macroeconomic indicators like interest rates, inflation, and GDP growth, and the activity levels in the secondary market.

A significant economic downturn could trigger a substantial correction in the venture capital secondary market, leading to lower valuations and reduced transaction volume.

Liquidity Concerns and Exit Strategies

While the secondary market offers an alternative exit route for venture capital investors, concerns regarding liquidity remain. The ease of converting investments into cash is crucial for investors' overall returns.

- The challenge of finding buyers for less desirable assets: Not all startups are equally attractive to buyers in the secondary market. Finding buyers for less successful or less liquid assets can be challenging, potentially impacting investor returns.

- The impact of limited liquidity on overall investor returns: Limited liquidity can constrain investor returns, especially if they need to exit their investments quickly. This risk is heightened in a rapidly changing market environment.

- The increasing importance of diverse exit strategies for venture capital funds: Venture capital funds are increasingly relying on a diversified approach to exits, incorporating the secondary market as one of several options to manage liquidity and returns.

- Comparison of liquidity in the secondary market versus traditional IPOs: While the secondary market offers increased liquidity compared to holding investments until an IPO, it still carries liquidity risks, particularly for less attractive assets. IPOs, while less frequent, typically offer greater liquidity.

The potential for a liquidity crunch, especially in a downturn, represents a significant risk for investors in the venture capital secondary market.

The Role of Technology and Market Platforms

Technological advancements have dramatically reshaped the venture capital secondary market, increasing accessibility and efficiency. Online platforms have streamlined the transaction process and expanded access to a broader pool of investors.

- Increased transparency and efficiency through online platforms: Online platforms provide greater transparency in pricing and deal flow, making the market more efficient and accessible.

- Wider access to a larger pool of potential investors: These platforms connect buyers and sellers globally, expanding the pool of potential investors and increasing competition.

- The role of technology in driving up valuations: Increased transparency and efficiency can contribute to higher valuations, potentially exacerbating the overheating concerns.

- Potential risks associated with the increased reliance on technology: Over-reliance on technology introduces risks, including cybersecurity vulnerabilities and potential for manipulation.

While technology has undeniably improved the market, its impact on stability requires careful consideration. The long-term effect on market dynamics remains to be seen.

Conclusion

The question of whether the venture capital secondary market is overheated is complex. While increased transaction volumes and rising prices suggest potential overheating, macroeconomic factors and liquidity concerns introduce countervailing forces. Technology's impact, while transformative, also carries inherent risks. The evidence suggests a market exhibiting strong growth, but the sustainability of this growth remains uncertain. A correction is possible, depending on macroeconomic conditions and investor sentiment.

While the venture capital secondary market presents exciting opportunities, a careful and informed approach is crucial. Understanding the current dynamics and potential risks associated with the venture capital secondary market is paramount for investors. Further research and diligent due diligence are essential before making any investment decisions in this dynamic and potentially volatile market. Continue your research on the venture capital secondary market to make well-informed choices.

Featured Posts

-

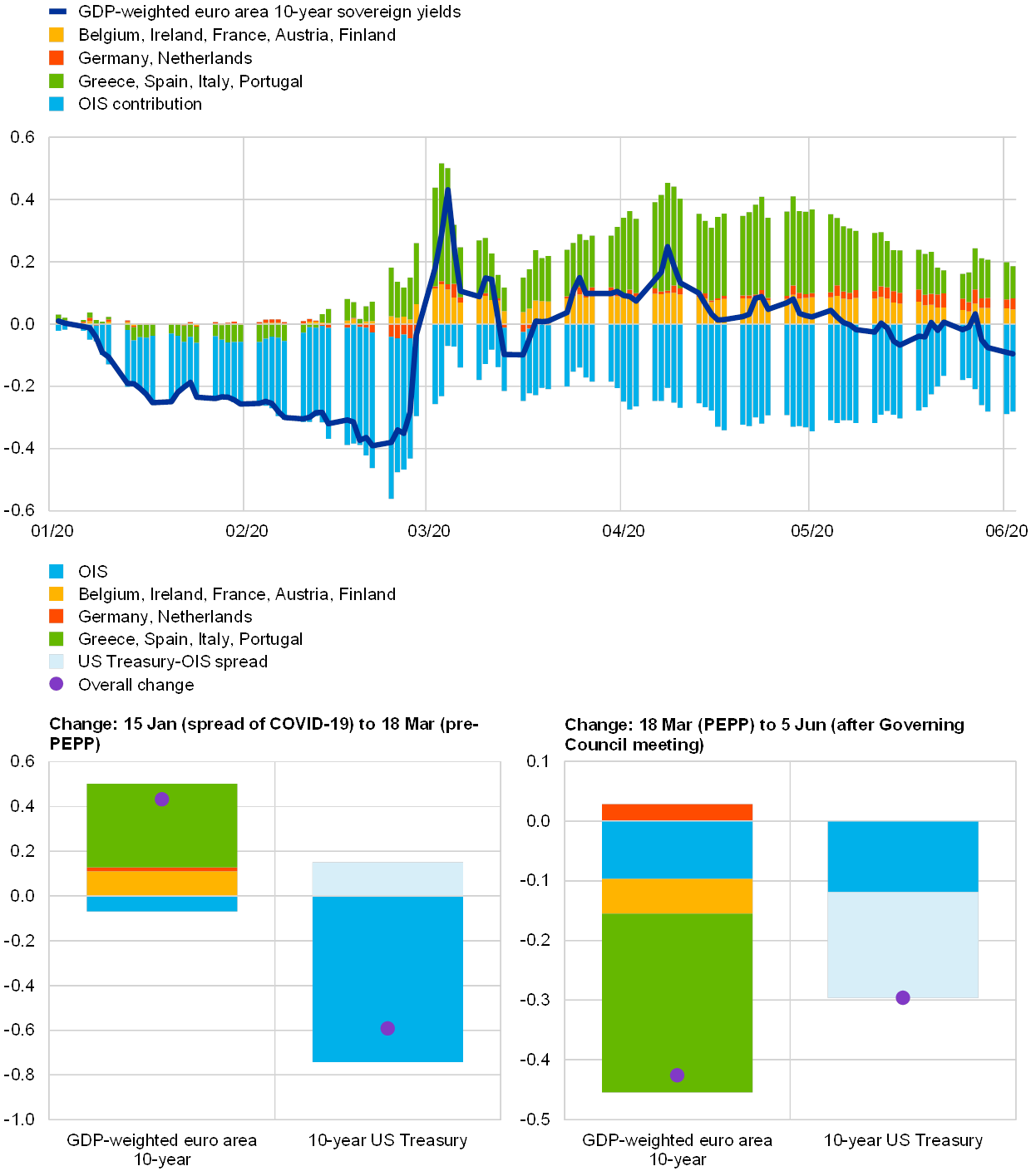

Fiscal Support And Inflation The Ecbs Assessment Of Post Pandemic Economic Effects

Apr 29, 2025

Fiscal Support And Inflation The Ecbs Assessment Of Post Pandemic Economic Effects

Apr 29, 2025 -

First Look Adidas Anthony Edwards 2 Basketball Shoes

Apr 29, 2025

First Look Adidas Anthony Edwards 2 Basketball Shoes

Apr 29, 2025 -

Black Hawk Crash Kills 67 In D C Pilots Failure To Follow Instructions

Apr 29, 2025

Black Hawk Crash Kills 67 In D C Pilots Failure To Follow Instructions

Apr 29, 2025 -

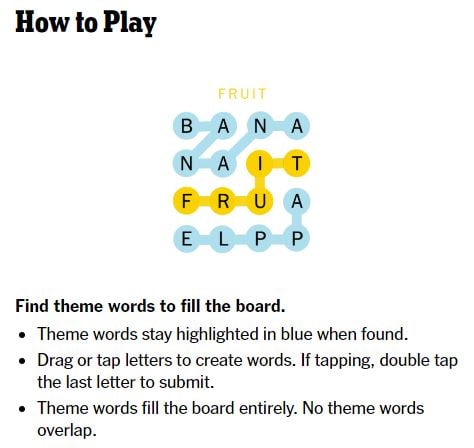

Nyt Strands Puzzle April 3 2025 Solutions And Spangram

Apr 29, 2025

Nyt Strands Puzzle April 3 2025 Solutions And Spangram

Apr 29, 2025 -

Why The Rest Of The World Prefers This Porsche To Australia

Apr 29, 2025

Why The Rest Of The World Prefers This Porsche To Australia

Apr 29, 2025

Latest Posts

-

Regionalliga Mitte Das Neue Trainerteam Des Dsv Leoben

Apr 29, 2025

Regionalliga Mitte Das Neue Trainerteam Des Dsv Leoben

Apr 29, 2025 -

Jancker Wird Neuer Austria Klagenfurt Coach

Apr 29, 2025

Jancker Wird Neuer Austria Klagenfurt Coach

Apr 29, 2025 -

Austria Klagenfurt Jancker Uebernimmt Traineramt

Apr 29, 2025

Austria Klagenfurt Jancker Uebernimmt Traineramt

Apr 29, 2025 -

Janckers Zukunft Nach Leoben Wohin Fuehrt Der Weg

Apr 29, 2025

Janckers Zukunft Nach Leoben Wohin Fuehrt Der Weg

Apr 29, 2025 -

Nyr Porsche Macan Allt Um Fyrstu Rafutgafuna

Apr 29, 2025

Nyr Porsche Macan Allt Um Fyrstu Rafutgafuna

Apr 29, 2025