Is This Canadian Billionaire The Next Warren Buffett? A Deep Dive Into Berkshire Hathaway's Future

Table of Contents

Comparing Investment Strategies: The Canadian Billionaire vs. Warren Buffett

H3: Investment Philosophies: Both Warren Buffett and the unnamed Canadian billionaire are often categorized as value investors, prioritizing companies undervalued by the market. However, subtle differences exist. Buffett is famously patient, holding onto winning investments for decades. While the Canadian billionaire also favors long-term holdings, their portfolio might show a slightly higher turnover rate, suggesting a potentially more active approach in certain market conditions.

- Buffett: Famous for long-term holdings in Coca-Cola, American Express, and Apple, showcasing his preference for established, fundamentally strong companies with durable competitive advantages.

- Canadian Billionaire: Their portfolio might include a mix of established companies and promising emerging businesses, reflecting a potentially more diversified approach across different market capitalizations and sectors.

Data Point: While Buffett's average annual returns over decades are legendary, a direct numerical comparison requires publicly available data on the Canadian billionaire's portfolio performance, which may be limited due to privacy concerns.

H3: Leadership Styles and Corporate Governance: Buffett is known for his collaborative and decentralized management style at Berkshire Hathaway, empowering subsidiary CEOs. The Canadian billionaire's leadership style might differ, potentially exhibiting a more hands-on approach depending on their business structure and investments. Analyzing their corporate governance practices – board composition, transparency, and shareholder relations – would shed light on potential parallels or contrasts with Berkshire Hathaway's model.

- Buffett: Emphasizes long-term value creation, patience, and a focus on ethical business practices.

- Canadian Billionaire: Information on their leadership style and corporate governance is crucial for a thorough comparative analysis, and might require research into their various business ventures and public statements.

Analyzing the Canadian Billionaire's Track Record: A Key Indicator

H3: Past Performance and Notable Investments: A thorough examination of the Canadian billionaire's investment history is paramount. What are their most significant investments? What were the underlying rationales? What metrics – ROI, total return, alpha generation – can demonstrate their skill in navigating diverse market cycles? Identifying both successful and unsuccessful ventures is essential for a comprehensive assessment.

- Successful Investments: Detailed examples, including the reasons for investment and the resulting returns, are needed for a robust evaluation. Quantifiable data such as ROI and total returns should be included where available.

- Unsuccessful Investments: Examining setbacks helps understand risk management strategies and the capacity to learn from mistakes. An analysis of the causes of underperformance is essential.

Data Point: Comparing the Canadian billionaire's investment performance against relevant market benchmarks (e.g., S&P 500, TSX Composite) is crucial for contextualizing their results.

H3: Risk Management and Market Volatility: How have they weathered market storms? What risk mitigation strategies are employed? Buffett's famous approach emphasizes downside protection and long-term perspective. Does the Canadian billionaire share this philosophy?

- Market Crash Response: How did their portfolio perform during previous market downturns? What adjustments, if any, were made to their strategy?

- Risk Mitigation: Do they use hedging strategies? What is their tolerance for risk in relation to their investment horizon?

Berkshire Hathaway's Future: The Role of Succession Planning

H3: Succession Challenges at Berkshire Hathaway: Replacing Warren Buffett is a daunting task. His unique blend of investment expertise, business acumen, and leadership is unparalleled. Finding a successor who can maintain Berkshire Hathaway's trajectory is a considerable challenge.

- Skillset Gap: Identifying someone with comparable investing skills and the ability to manage a vast and diverse portfolio of businesses is crucial.

- Performance Expectations: Investors will inevitably compare the successor’s performance to Buffett's remarkable track record, leading to potential short-term pressures.

H3: The Canadian Billionaire as a Potential Successor: Speculation surrounding the Canadian billionaire's potential role in Berkshire Hathaway's future is inevitable. Could they become a successor, either directly or through influence on investment strategies? A balanced analysis is vital, weighing potential advantages and disadvantages.

- Advantages: Alignment of investment philosophies, proven track record, and leadership experience could be beneficial.

- Disadvantages: Lack of experience in managing a conglomerate the size of Berkshire Hathaway, different leadership styles, and unforeseen challenges could hinder success.

Conclusion

Whether the Canadian billionaire is the "next Warren Buffett" remains a complex question. While both exhibit value investing principles, their approaches and investment styles might display notable differences. The Canadian billionaire’s track record, while potentially impressive, requires thorough analysis and comparison to Buffett's legendary achievements. Berkshire Hathaway’s succession planning remains a critical factor in determining its future. To form your own informed opinion on the future of Berkshire Hathaway and the potential role of this Canadian Billionaire, further research into their investment activities and Berkshire Hathaway's succession plans is strongly recommended. Continue your investigation into "Canadian Billionaire Investing," explore potential "Next Warren Buffett Candidate" profiles, and consider the complexities involved in ensuring a smooth transition for "Berkshire Hathaway's Future."

Featured Posts

-

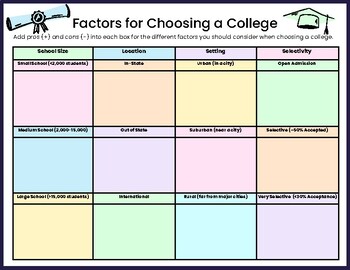

Choosing A College Town Why Consider City Name In Michigan

May 10, 2025

Choosing A College Town Why Consider City Name In Michigan

May 10, 2025 -

May 8th 2025 A Look Back At The Trump Administration Day 109

May 10, 2025

May 8th 2025 A Look Back At The Trump Administration Day 109

May 10, 2025 -

Elon Musk Net Worth Drops Below 300 Billion Tesla Tariffs And Market Volatility

May 10, 2025

Elon Musk Net Worth Drops Below 300 Billion Tesla Tariffs And Market Volatility

May 10, 2025 -

Elon Musk Net Worth A Deep Dive Into The Recent 300 Billion Drop

May 10, 2025

Elon Musk Net Worth A Deep Dive Into The Recent 300 Billion Drop

May 10, 2025 -

Trump Administration Weighs Curbing Migrant Detention Appeals

May 10, 2025

Trump Administration Weighs Curbing Migrant Detention Appeals

May 10, 2025