Is Uber Stock Recession-Proof? Analyst Insights

Table of Contents

Uber's Business Model and Recession Resilience

Uber's success hinges on its unique two-sided marketplace. This platform connects riders needing transportation with drivers seeking work, creating a network effect that amplifies its value. This model possesses inherent strengths that contribute to its recession resilience.

The Two-Sided Marketplace

- Increased demand during peak times: Even during economic downturns, essential travel needs persist, leading to consistent demand during peak hours and for specific services.

- Cost-cutting measures: Uber can adjust driver incentives and operational costs to navigate economic challenges, potentially improving profit margins.

- Dynamic pricing: The platform's ability to adjust prices based on real-time demand helps maximize revenue during periods of fluctuating consumer spending.

However, the impact of fluctuating fuel prices significantly impacts driver costs and Uber's profitability. Increases in fuel costs can squeeze profit margins and potentially reduce driver availability, impacting the platform's overall service.

Diversification Beyond Ridesharing

Uber's diversification strategy extends beyond its core ridesharing business. Uber Eats, its food delivery service, and Uber Freight, its logistics platform, represent significant revenue streams that provide a buffer against economic shocks affecting any single sector.

- Growth potential: Food delivery and freight services demonstrate strong growth potential, particularly in urban areas and during periods of limited mobility. Essential services often see increased demand during economic hardship.

- Market share analysis: Uber's market share in each of these sectors needs ongoing scrutiny to assess its competitive standing and growth potential.

Analyzing the individual performance and market share of each business unit is crucial to evaluating the overall recession resilience of the Uber corporation.

Analyst Sentiment and Predictions

Understanding the outlook of financial analysts is vital when considering the recession-proof nature of Uber stock. Their predictions, while not definitive, provide valuable insights.

Examining Expert Opinions

Expert opinions on Uber's recession resistance are varied.

- Positive outlook: Some analysts highlight Uber's diversification and cost-cutting capabilities as key strengths during economic downturns.

- Negative outlook: Others express concern over the sensitivity of its business to economic fluctuations and increased competition.

- Neutral outlook: Many hold a more cautious outlook, emphasizing the uncertainties of the current economic environment. A thorough review of reports from firms like Morgan Stanley, Goldman Sachs, and JP Morgan would provide a balanced perspective.

It's essential to consider the full spectrum of expert views to form a comprehensive understanding.

Price-to-Earnings Ratio and Valuation

Uber's P/E ratio, along with other key valuation metrics, is a critical factor in assessing its risk profile.

- Current and historical P/E ratio: Comparing Uber's current P/E ratio to its historical performance and that of industry peers helps establish a benchmark for assessing its valuation.

- Impact of interest rate hikes: Rising interest rates can negatively impact Uber's valuation, especially if growth prospects are perceived as less certain.

- Inflationary pressures: Inflation can affect both consumer spending (reducing ride and delivery demand) and Uber's operational costs.

A thorough evaluation of these metrics is essential for making an informed investment decision.

Competitive Landscape and Market Share

Analyzing Uber's competitive landscape provides further insights into its recession resilience. The performance of key competitors influences its overall market position.

Key Competitors and Their Performance

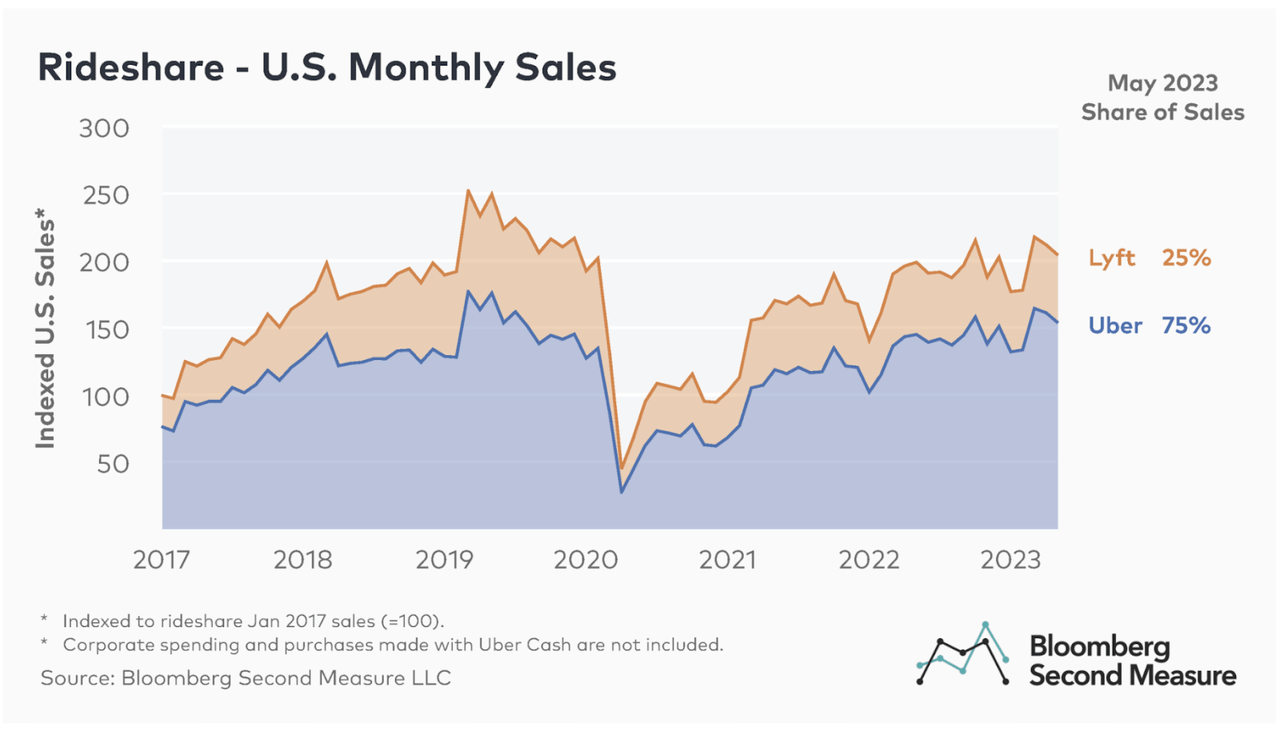

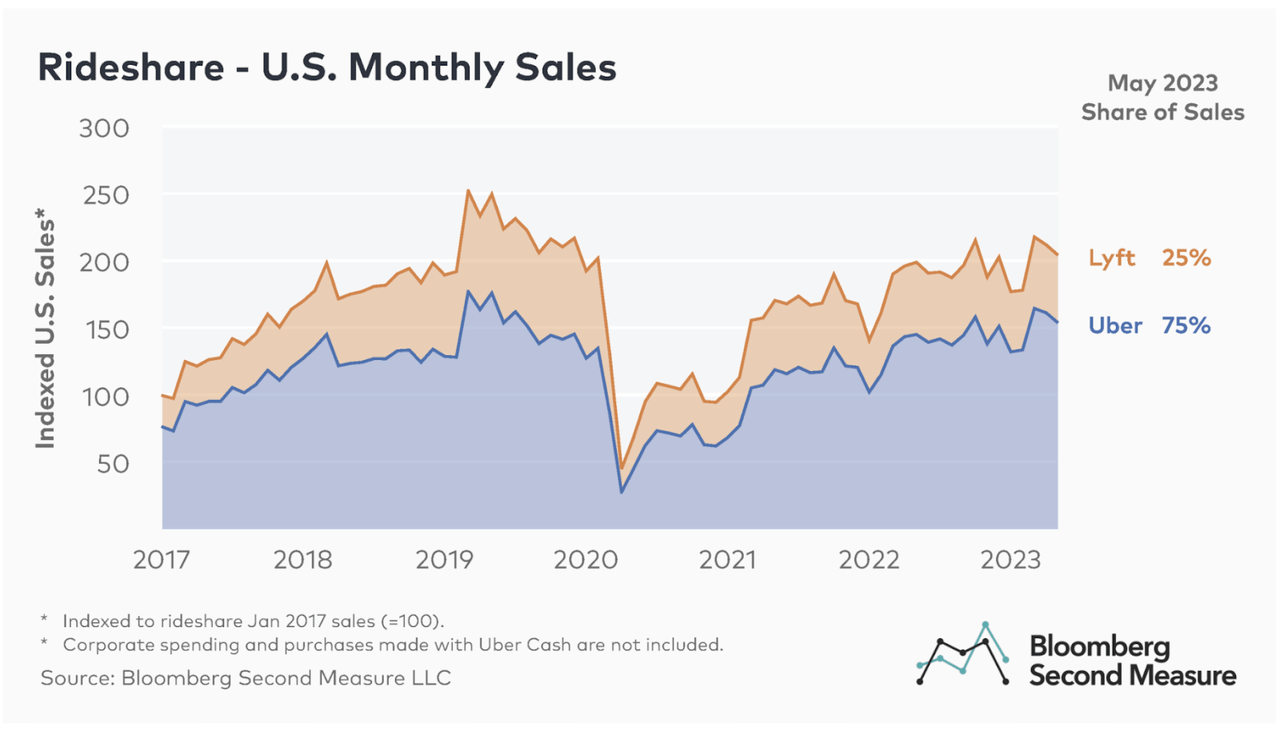

Uber's primary competitors, including Lyft and Didi (in specific regions), influence its ability to withstand economic pressure.

- Market share comparison: Tracking market share changes reveals the competitive intensity and Uber's ability to maintain its dominance.

- Competitive advantages/disadvantages: Analyzing its strengths and weaknesses compared to competitors helps determine its vulnerability during economic downturns.

- Regulatory impact: Regulatory changes and their impact on the ride-sharing industry can affect Uber's competitiveness and profitability.

Market Dominance and Pricing Power

Uber's market dominance and pricing power are key determinants of its ability to maintain profitability during economic slowdowns.

- Geographic dominance: Evaluating its market share in different geographic regions provides a nuanced understanding of its overall position.

- Pricing strategies: Uber's ability to adjust pricing strategically without significantly impacting demand is vital during economic uncertainty.

- Potential for price wars: Intense competition could trigger price wars, potentially squeezing profit margins and impacting long-term sustainability.

Conclusion: Investing in Uber During Economic Uncertainty

Is Uber stock recession-proof? Our analysis suggests a nuanced answer. While Uber's diversified business model, dynamic pricing, and cost-cutting capabilities offer some level of resilience, it's not immune to economic downturns. Fluctuating fuel prices, intense competition, and changing consumer spending habits pose significant risks. The varied opinions of financial analysts further highlight the uncertainties involved. Investing in any stock carries inherent risk, and Uber is no exception. Conduct thorough due diligence before investing in Uber stock, considering the factors discussed in this analysis of its recession-proof capabilities and your own risk tolerance and financial goals before making any investment decisions during a recession.

Featured Posts

-

Oil Market Update Prices Trends And Analysis For May 16

May 17, 2025

Oil Market Update Prices Trends And Analysis For May 16

May 17, 2025 -

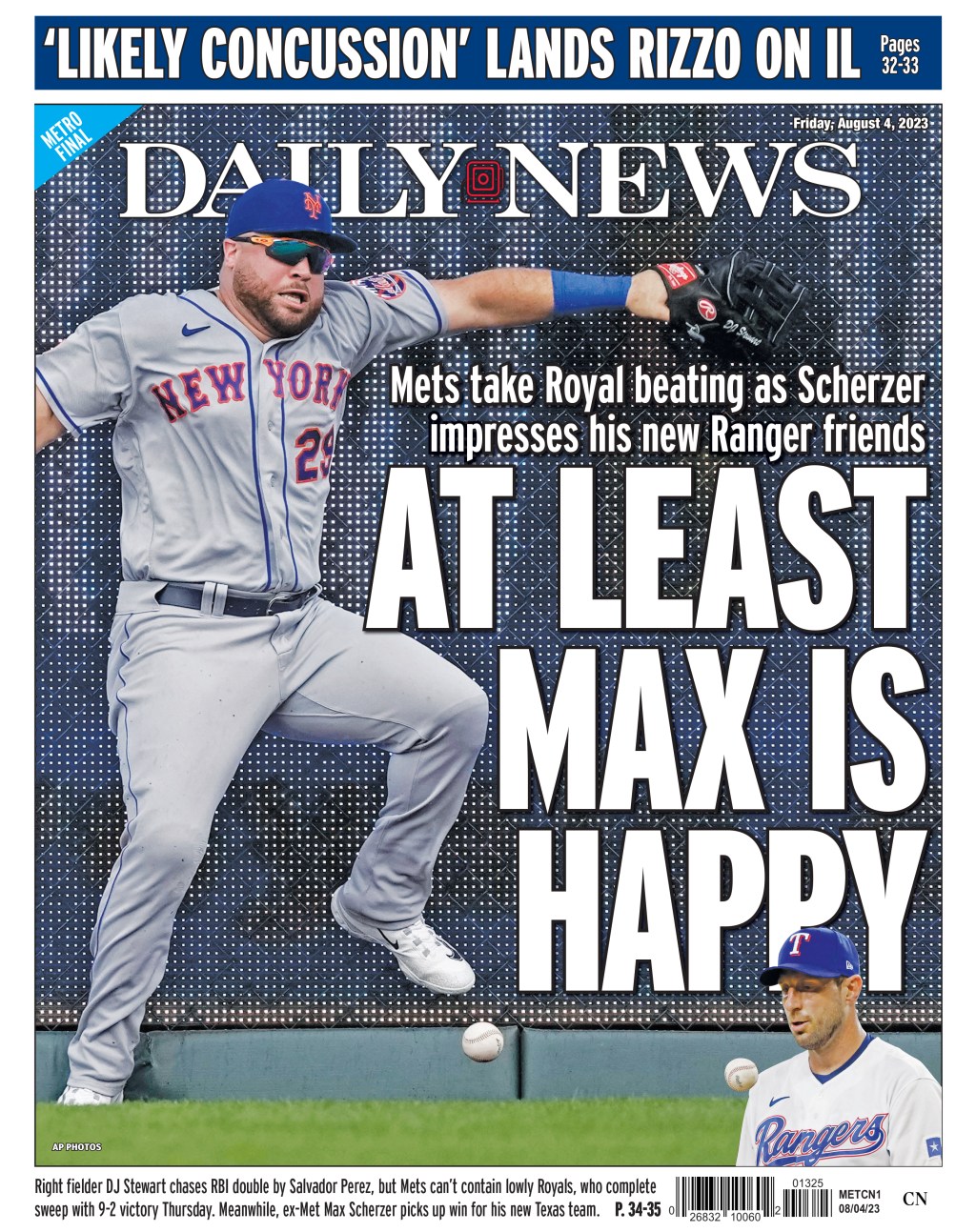

Where To Find New York Daily News Back Issues May 2025

May 17, 2025

Where To Find New York Daily News Back Issues May 2025

May 17, 2025 -

Jazz Fest New Orleans Your Guide To The Ultimate Music Experience

May 17, 2025

Jazz Fest New Orleans Your Guide To The Ultimate Music Experience

May 17, 2025 -

Donald Trumps Scandals How Multiple Affairs And Sexual Misconduct Accusations Failed To Prevent His Presidency

May 17, 2025

Donald Trumps Scandals How Multiple Affairs And Sexual Misconduct Accusations Failed To Prevent His Presidency

May 17, 2025 -

Josh Cavallos Courage Kicking Down Walls In Football

May 17, 2025

Josh Cavallos Courage Kicking Down Walls In Football

May 17, 2025

Latest Posts

-

Knicks News Jalen Brunson Injury Update Tyler Koleks Extended Role And Remaining Schedule Breakdown

May 17, 2025

Knicks News Jalen Brunson Injury Update Tyler Koleks Extended Role And Remaining Schedule Breakdown

May 17, 2025 -

Jalen Brunsons Ankle Knicks Suffer Overtime Loss To Lakers

May 17, 2025

Jalen Brunsons Ankle Knicks Suffer Overtime Loss To Lakers

May 17, 2025 -

Jalen Brunsons Return Knicks Playoff Push Intensifies

May 17, 2025

Jalen Brunsons Return Knicks Playoff Push Intensifies

May 17, 2025 -

New York Knicks Face Setback Jalen Brunsons Injury And Recovery

May 17, 2025

New York Knicks Face Setback Jalen Brunsons Injury And Recovery

May 17, 2025 -

Who Is Ali Marks Jalen Brunsons Wife And Life Partner

May 17, 2025

Who Is Ali Marks Jalen Brunsons Wife And Life Partner

May 17, 2025