Oil Market Update: Prices, Trends, And Analysis For May 16

Table of Contents

Current Oil Prices and Volatility

As of May 16th, the oil market showed considerable volatility. Brent crude, the global benchmark, traded around [Insert Brent Crude Price for May 16th] per barrel, while West Texas Intermediate (WTI) crude, the US benchmark, was priced at approximately [Insert WTI Crude Price for May 16th] per barrel. This represents a [Percentage Change] change compared to the previous week's closing prices. A quick glance at the oil price chart reveals significant price swings throughout the week, reaching a high of [Insert High] and a low of [Insert Low].

- Specific price figures for Brent and WTI: [Insert precise figures as of market close on May 16th]

- Percentage change compared to previous days/weeks: [Insert precise percentage change – positive or negative]

- Highs and lows for the day/week: [Insert high and low prices for both Brent and WTI for the relevant period]

- Significant price swings and their potential causes: The volatility is primarily attributed to [Explain specific factors, e.g., unexpected OPEC+ decisions, concerns about global demand, geopolitical instability]. Analyzing the daily oil price chart helps illustrate these fluctuations.

Impact of Geopolitical Events on Oil Prices

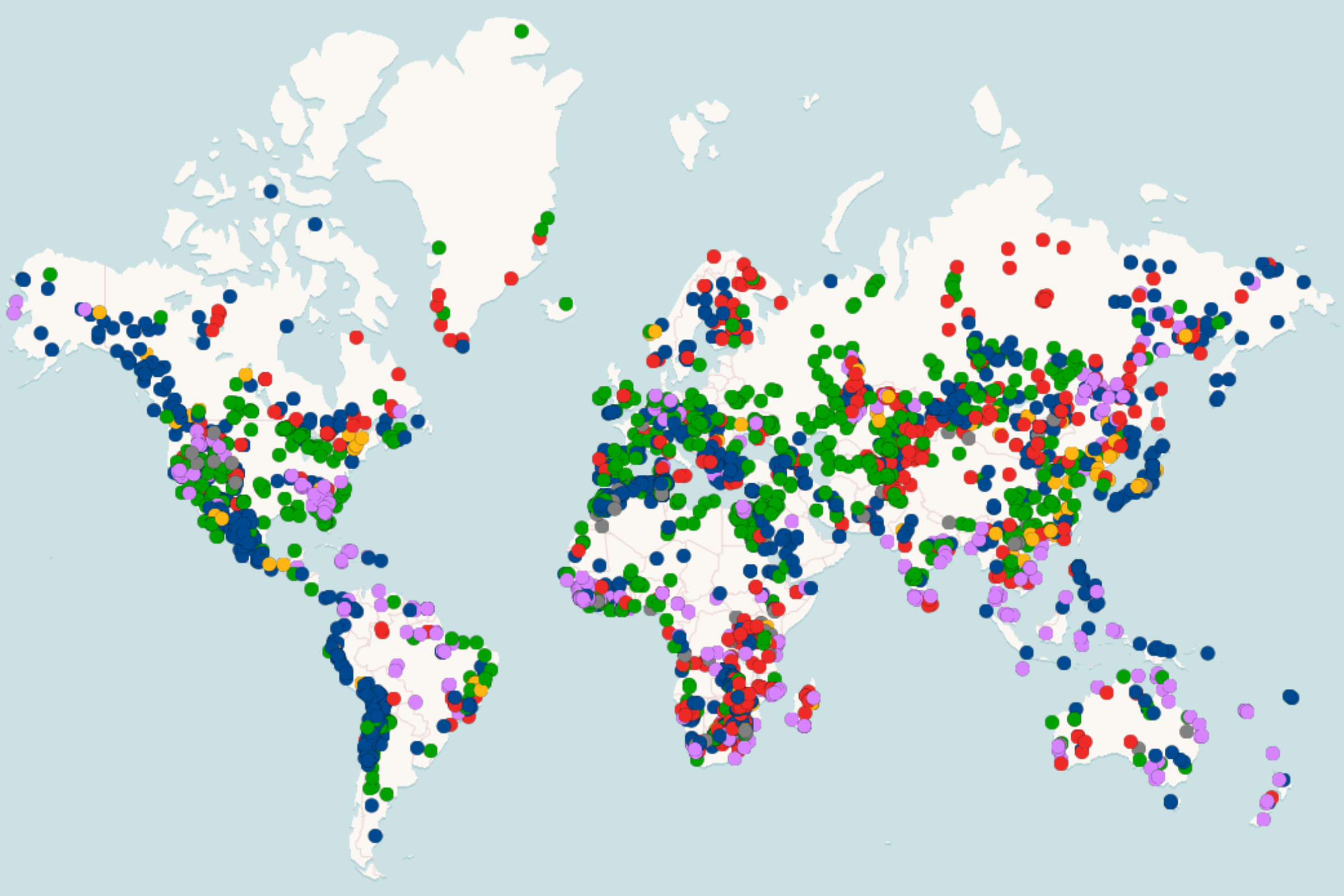

Geopolitical risk remains a significant driver of oil price fluctuations. The ongoing conflict in Ukraine continues to disrupt global oil supply chains, creating uncertainty about future production levels. Sanctions imposed on Russia, a major oil producer, have further tightened the global oil supply. Tensions in other regions, such as [Mention specific regions], also contribute to the volatile oil market environment.

- Specific geopolitical events and their influence on oil prices: The war in Ukraine has been a major factor, causing significant upward pressure on crude oil prices. [Mention other specific events and their impact].

- Potential supply disruptions: The conflict in Ukraine has already led to significant supply disruptions, and further escalations could exacerbate these issues. [Quantify the disruption if possible using data].

- Analysis of OPEC+ actions and their market impact: OPEC+ decisions, regarding production quotas, significantly influence global supply and prices. Recent actions by OPEC+ have [Explain the actions and their impact on prices].

- Sanctions or embargoes and their consequences: Sanctions on Russian oil exports have reduced the global supply of crude oil, contributing to higher prices and creating uncertainty in the market.

Economic Indicators and Demand Outlook

Macroeconomic factors also play a crucial role in shaping oil demand and, consequently, oil prices. Global economic growth, inflation rates, and interest rate policies all influence energy consumption patterns. Currently, [Explain the current state of the global economy – growth or slowdown, inflation rate etc.]. The International Energy Agency (IEA) and OPEC have recently published their oil demand forecasts for [Year], and these projects [Summarize their projections, mentioning expected growth or decline].

- Key economic indicators influencing oil demand: Global GDP growth, inflation rates, and interest rates are primary drivers of energy consumption.

- Predictions for future oil demand: [Summarize predictions from reputable sources, highlighting any divergence in forecasts].

- Potential shifts in energy consumption patterns: The global transition to cleaner energy sources could impact future oil demand in the long term, but this shift is gradual and unlikely to significantly alter the market in the short term.

Analysis of Oil Inventory Levels

Global oil inventory levels are a key indicator of market supply and demand dynamics. Current crude oil storage levels are [Insert data on current inventory levels], compared to [Comparison with previous periods – e.g., same period last year or the average for the past five years]. The drawdowns/build-ups in the Strategic Petroleum Reserve (SPR) in various countries also impact market sentiment. [Explain the implications of the current inventory levels].

Future Oil Price Predictions and Market Outlook

Predicting future oil prices is inherently challenging due to the multitude of interacting factors. However, based on our analysis, a cautious outlook for the coming months is warranted.

- Short-term price predictions (next few weeks/months): Oil prices are likely to remain volatile in the short term, influenced by ongoing geopolitical uncertainty and fluctuations in global economic activity. Expect prices to range between [Price Range].

- Long-term price predictions (next few years): The long-term outlook depends on several factors, including the pace of global economic recovery, the effectiveness of OPEC+ policies, and the ongoing transition towards renewable energy sources. Prices are likely to stabilize eventually around [Price Range], but significant variations are still possible.

- Potential upside and downside risks: Upside risks include further geopolitical escalations and unexpected supply disruptions. Downside risks include a sharper-than-expected global economic slowdown and a faster-than-anticipated transition to renewable energy.

Conclusion

This oil market update for May 16th highlighted the continued volatility in oil prices, driven by a complex interplay of geopolitical risks, macroeconomic indicators, and supply-demand dynamics. Current oil prices reflect this uncertainty, with both Brent and WTI crude showing significant fluctuations. Inventory levels and OPEC+ policies continue to play a major role in shaping market trends. The outlook remains uncertain, with significant upside and downside risks to consider.

Stay informed on the ever-changing dynamics of the oil market with regular updates. Follow [Your Website/Platform] for more in-depth oil market analysis and timely oil price updates. Subscribe to our newsletter for the latest oil market insights and oil price forecasts.

Featured Posts

-

T Mobile Data Breaches Result In 16 Million Fine

May 17, 2025

T Mobile Data Breaches Result In 16 Million Fine

May 17, 2025 -

Securing Rare Earth Minerals Avoiding A New Cold War

May 17, 2025

Securing Rare Earth Minerals Avoiding A New Cold War

May 17, 2025 -

Breaking Moto News Gncc Mx Sx Flat Track And Enduro

May 17, 2025

Breaking Moto News Gncc Mx Sx Flat Track And Enduro

May 17, 2025 -

Todays Mlb Matchup Yankees Vs Mariners Predictions And Best Odds

May 17, 2025

Todays Mlb Matchup Yankees Vs Mariners Predictions And Best Odds

May 17, 2025 -

Kupovina Stanova U Inostranstvu Popularnost Medu Srbima

May 17, 2025

Kupovina Stanova U Inostranstvu Popularnost Medu Srbima

May 17, 2025

Latest Posts

-

Valerio Therapeutics Update On 2024 Financial Statement Approval

May 17, 2025

Valerio Therapeutics Update On 2024 Financial Statement Approval

May 17, 2025 -

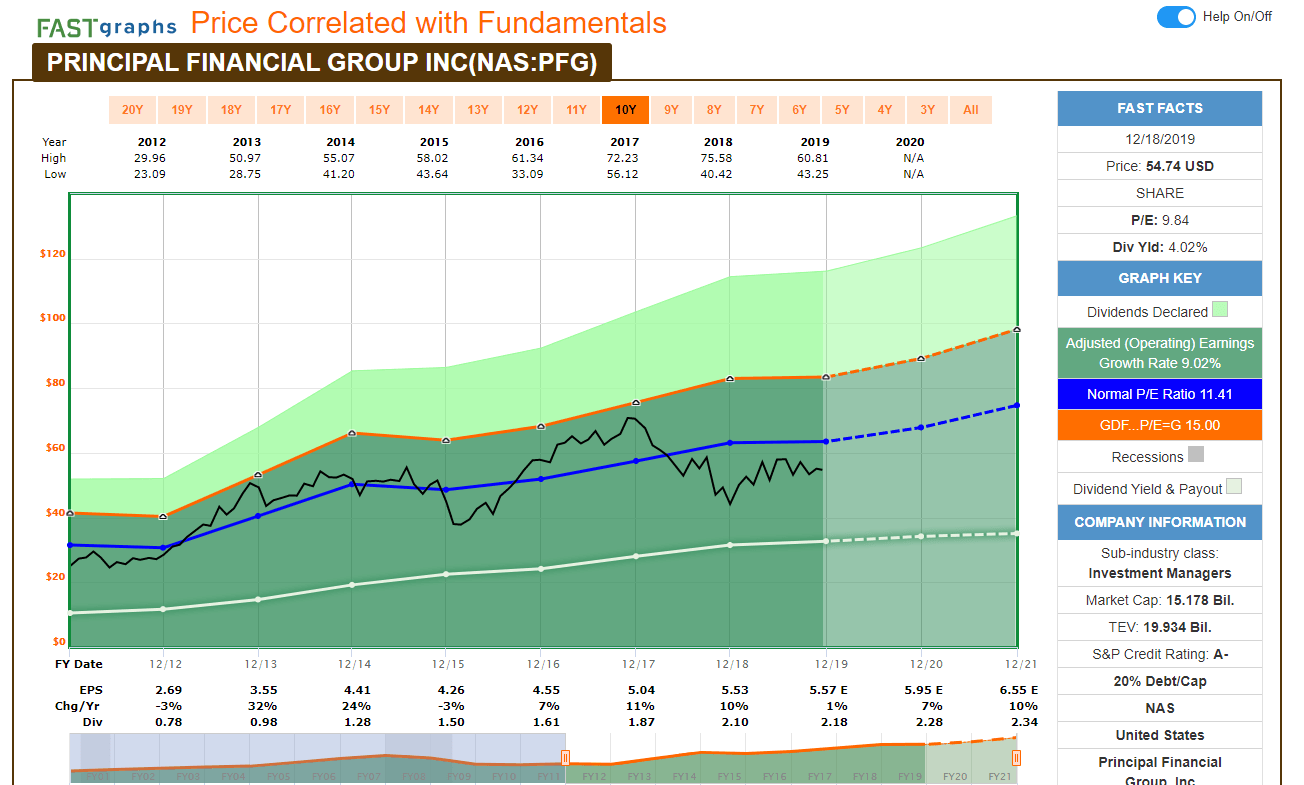

13 Analysts Weigh In A Comprehensive Look At Principal Financial Group Pfg

May 17, 2025

13 Analysts Weigh In A Comprehensive Look At Principal Financial Group Pfg

May 17, 2025 -

Valerio Therapeutics 2024 Annual Financial Report Publication Delayed

May 17, 2025

Valerio Therapeutics 2024 Annual Financial Report Publication Delayed

May 17, 2025 -

Principal Financial Group Nasdaq Pfg 13 Analyst Ratings And Outlook

May 17, 2025

Principal Financial Group Nasdaq Pfg 13 Analyst Ratings And Outlook

May 17, 2025 -

Wednesdays Market Winners Rockwell Automation Among Top Performers

May 17, 2025

Wednesdays Market Winners Rockwell Automation Among Top Performers

May 17, 2025