Is XRP's 400% 3-Month Rise Sustainable? Investment Analysis

Table of Contents

XRP, the cryptocurrency associated with Ripple Labs, has experienced a remarkable 400% surge in the last three months. This meteoric rise has captivated investors and sparked intense debate: Is this explosive growth sustainable, or is a correction imminent? This in-depth analysis examines the factors driving XRP's price increase, explores potential risks, and attempts to predict its future trajectory. We'll delve into the technical analysis, fundamental factors, and regulatory landscape to determine whether now is a good time to invest in XRP. Understanding the potential of XRP investment requires a nuanced look at both its strengths and weaknesses.

Factors Contributing to XRP's Recent Price Surge

Increased Institutional Adoption

Growing institutional interest is a significant factor boosting XRP's price. Financial institutions are increasingly exploring XRP's potential for efficient cross-border payments, attracted by its speed and low transaction costs. Several partnerships and collaborations have fueled this adoption.

- Example 1: Ripple's partnership with major banks like [insert example bank name] for utilizing its On-Demand Liquidity (ODL) solution, leveraging XRP for faster and cheaper international transfers.

- Example 2: Strategic alliances with payment processors enabling seamless integration of XRP into existing financial infrastructure.

- Example 3: Recent announcements of pilot programs and successful implementations of XRP-based payment solutions further solidify institutional confidence.

These developments signal a shift towards broader acceptance and integration of XRP within the established financial ecosystem, directly impacting XRP investment opportunities.

Positive Ripple Legal Developments

The ongoing Ripple vs. SEC lawsuit has significantly influenced XRP's price volatility. Positive developments in the case have boosted investor sentiment and fueled price increases.

- Key Legal Milestone 1: [Insert description of a positive legal development, e.g., a favorable court ruling or a significant procedural victory for Ripple].

- Key Legal Milestone 2: [Insert description of another positive legal development]

- Expert Opinion: Many legal experts believe [insert summary of expert opinion on the likely outcome and its impact on XRP's price].

A positive resolution to the lawsuit could remove a major obstacle for XRP adoption and potentially lead to substantial price appreciation, making it a crucial factor in any XRP price prediction.

Growing Demand for Cross-Border Payments

Ripple's technology addresses a critical need in the global financial system: efficient and cost-effective cross-border payments. XRP facilitates these transactions by providing a fast, secure, and affordable alternative to traditional methods.

- Statistic 1: The global cross-border payment market is valued at [insert market size data].

- Statistic 2: Ripple's market share in facilitating cross-border payments is [insert market share data, if available].

- Advantage 1: XRP's speed significantly reduces processing times compared to traditional banking systems.

- Advantage 2: Lower transaction fees make it a more attractive option for businesses and individuals.

This increasing demand creates a robust foundation for XRP's long-term growth and influences XRP investment strategies.

Market Speculation and FOMO

Market speculation and fear of missing out (FOMO) have undeniably contributed to XRP's price surge. Positive news coverage and social media hype have amplified investor enthusiasm, driving up demand.

- Social Media Trend 1: [Mention a specific social media trend that positively impacted XRP price, e.g., a viral tweet or a significant increase in positive posts].

- News Article Impact: [Mention a news article that positively influenced XRP's price].

However, this rapid price increase also raises concerns about the potential for a price bubble and the associated risks involved in XRP investment.

Potential Risks and Challenges Facing XRP

Regulatory Uncertainty

Regulatory uncertainty remains a significant risk for XRP and the cryptocurrency market as a whole. Future regulatory actions could significantly impact XRP's price and adoption.

- Regulatory Hurdle 1: The ongoing legal battle with the SEC highlights the uncertainties surrounding XRP's regulatory status.

- Regulatory Hurdle 2: Varying regulatory landscapes across different jurisdictions pose challenges for global adoption.

- Potential Risk: Stricter regulations could limit XRP's functionality and potentially depress its price.

Competition from Other Cryptocurrencies

XRP faces stiff competition from other cryptocurrencies in the market, each with its strengths and weaknesses.

- Competitor Analysis: [List key competitors and compare their features and market positioning with XRP].

- XRP's Advantages: Speed, low transaction fees, and focus on institutional adoption are key advantages.

- XRP's Disadvantages: Centralization concerns and dependence on Ripple Labs are potential drawbacks.

Technical Analysis of XRP Price Charts

[Insert relevant charts here, illustrating price movements, support/resistance levels, and key technical indicators like moving averages, RSI, etc. Analyze potential scenarios based on these charts.]

- Support Level: [Identify key support levels on the chart].

- Resistance Level: [Identify key resistance levels on the chart].

- Chart Pattern: [Analyze any notable chart patterns, e.g., head and shoulders, triangles, etc.]

Is XRP's 400% Rise Sustainable? A Prediction

Predicting the future of XRP's price is inherently challenging. While the 400% rise is impressive, its sustainability depends on several factors. A bullish scenario would involve a positive resolution to the SEC lawsuit, continued institutional adoption, and increasing demand for cross-border payments. A bearish scenario could involve unfavorable regulatory changes, increased competition, or a bursting of the speculative bubble. A neutral scenario suggests a period of consolidation before further price movements. However, it's crucial to remember that cryptocurrency markets are highly volatile, and any prediction carries significant uncertainty.

Conclusion

XRP's recent price surge is driven by factors like increased institutional adoption, positive legal developments, and growing demand for cross-border payments. However, regulatory uncertainty, competition, and market speculation pose significant risks. While the potential for further growth exists, investors should proceed with caution. Thorough research and a careful assessment of the risks are essential before investing in XRP. Conduct your own in-depth research on XRP investment, considering both the potential rewards and significant risks involved before making any investment decisions. Remember, this is not financial advice.

Featured Posts

-

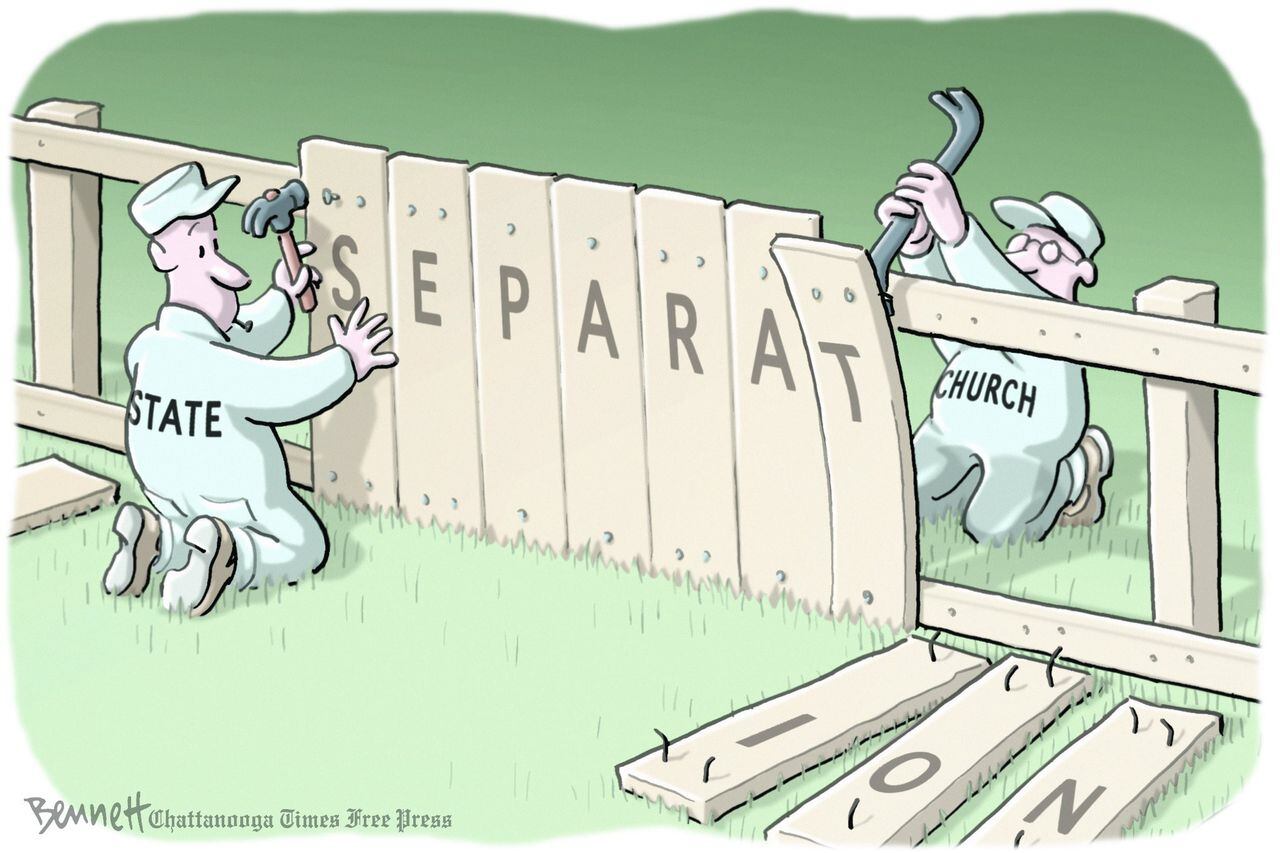

John Robertss Supreme Court Decisions A Threat To Church State Separation

May 02, 2025

John Robertss Supreme Court Decisions A Threat To Church State Separation

May 02, 2025 -

400 Xrp Increase Understanding The Recent Price Surge And Future Outlook

May 02, 2025

400 Xrp Increase Understanding The Recent Price Surge And Future Outlook

May 02, 2025 -

Ai Chip Export Rules Nvidia Ceos Appeal To Trump

May 02, 2025

Ai Chip Export Rules Nvidia Ceos Appeal To Trump

May 02, 2025 -

Trustcare Health Expands Adding Mental Health Treatment To Its Portfolio

May 02, 2025

Trustcare Health Expands Adding Mental Health Treatment To Its Portfolio

May 02, 2025 -

Cadeau Gourmand Une Boulangerie Normande Recompense Le Premier Bebe Ne En 2024

May 02, 2025

Cadeau Gourmand Une Boulangerie Normande Recompense Le Premier Bebe Ne En 2024

May 02, 2025