Japan's Economy Faces Headwinds: The Steepening Government Bond Yield Curve

Table of Contents

The Mechanics of a Steepening Yield Curve in Japan

A steepening yield curve refers to an increase in the difference between long-term and short-term government bond yields. In Japan, this means the yield on longer-maturity Japanese Government Bonds (JGBs) is rising faster than the yield on shorter-term JGBs. This difference is significant because it reflects market expectations about future interest rates and inflation.

Short-term government bonds, typically maturing within a year, offer lower yields, reflecting the lower perceived risk associated with their shorter maturity. Long-term government bonds, with maturities of 10 years or more, carry higher yields to compensate investors for the increased risk associated with longer holding periods and potential shifts in interest rates.

- Rising long-term yields reflect increased expectations of future inflation or higher interest rates. Investors demand higher returns to compensate for the erosion of purchasing power caused by inflation.

- A steeper curve can indicate investor confidence (or lack thereof) in the future of the Japanese economy. A steepening curve often signals increased investor confidence in future economic growth, leading to higher demand for long-term bonds and thus higher yields. Conversely, a flattening curve can signal uncertainty or pessimism.

- The Bank of Japan's (BOJ) monetary policy plays a crucial role in shaping the yield curve. The BOJ's actions, such as its recent adjustments to yield curve control (YCC), directly impact JGB yields and the shape of the curve.

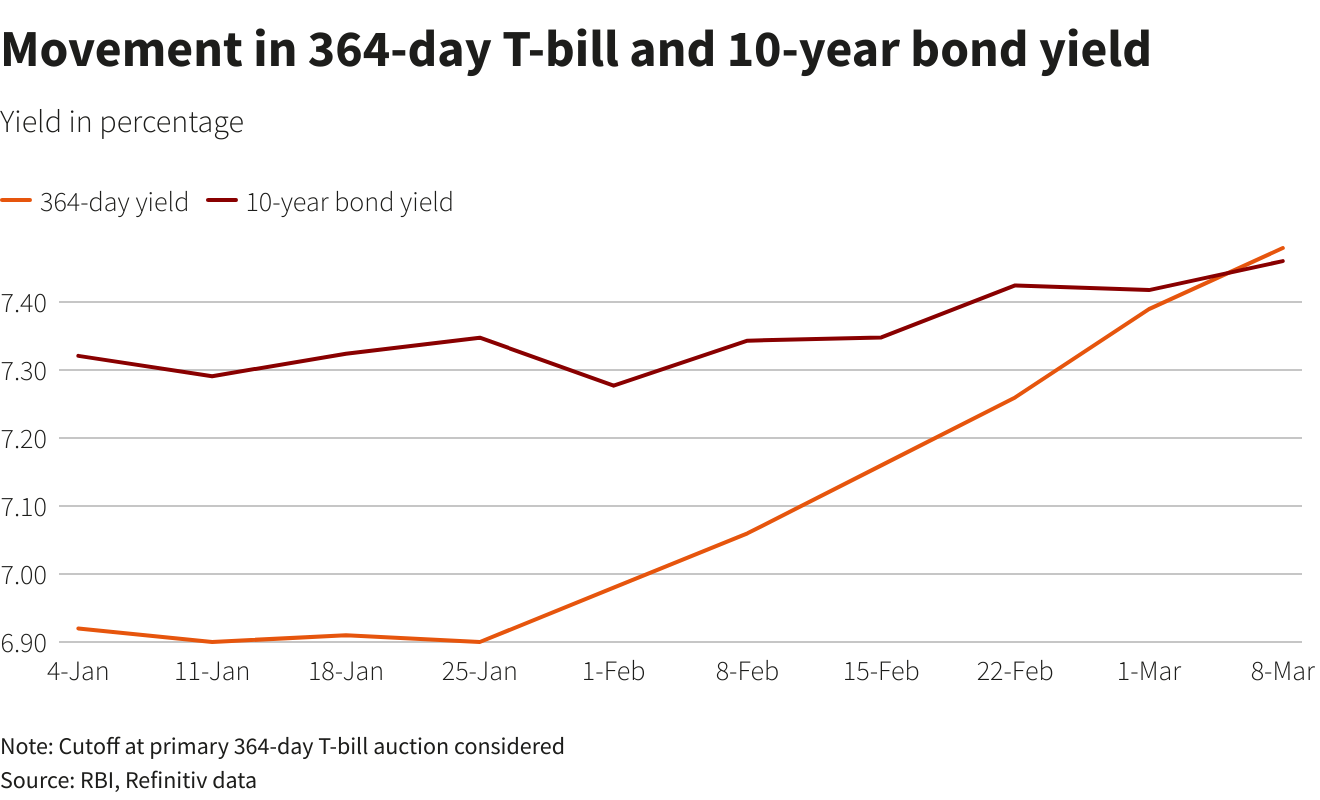

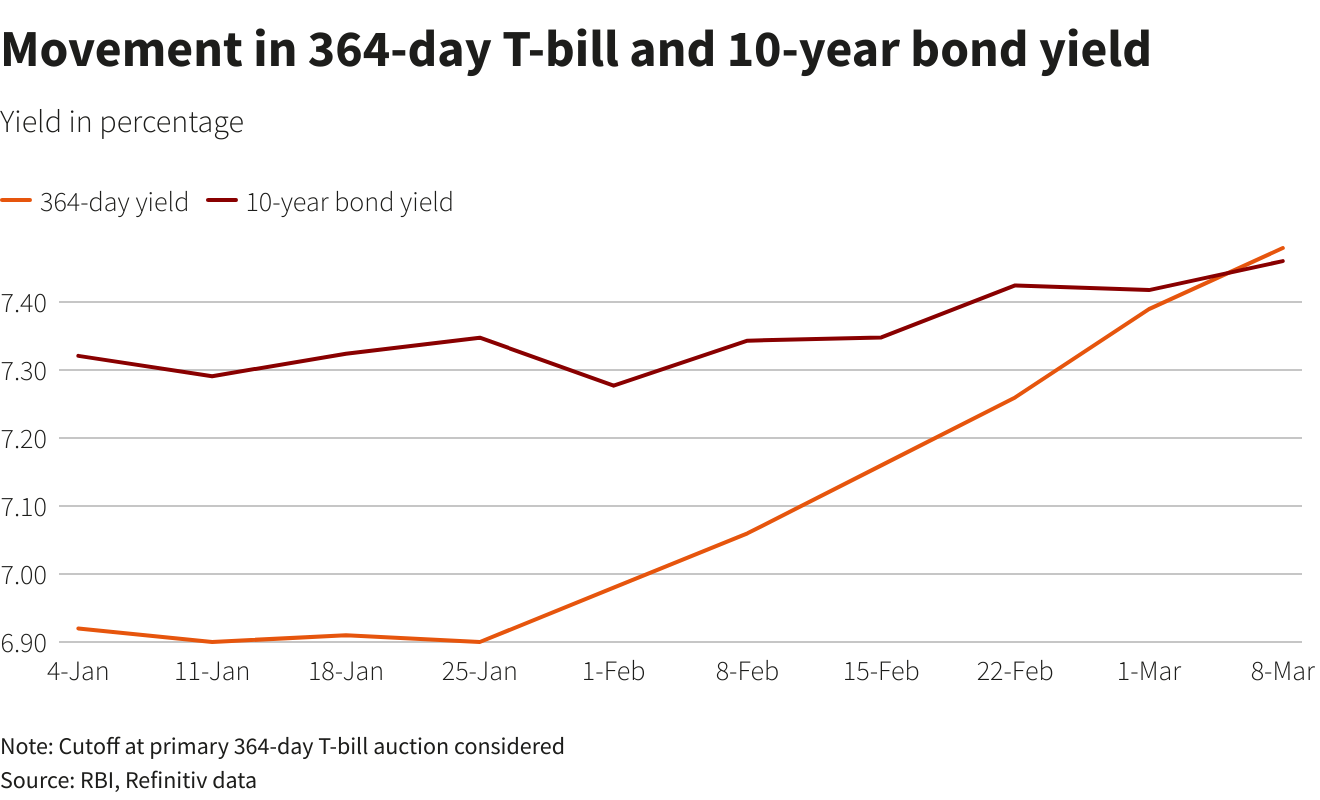

[Insert simple graph here illustrating a steepening yield curve. X-axis: Time to Maturity; Y-axis: Yield. Show two curves, one flatter representing a previous period and one steeper representing the current situation.]

Factors Contributing to the Steepening Curve

Several factors are contributing to the steepening government bond yield curve in Japan. These can be broadly categorized into global and domestic influences.

Global factors include:

- Global inflationary pressures spilling over into Japan. High inflation in the US and Europe, driven by supply chain disruptions and increased energy costs, is impacting Japan through imported inflation.

- The BOJ's gradual shift away from yield curve control (YCC). The BOJ's previous policy of controlling long-term JGB yields has been adjusted, allowing yields to rise more freely.

Domestic factors include:

- Rising energy prices and supply chain disruptions. These factors are contributing to increased production costs and inflationary pressures within Japan.

- Increased government borrowing. Japan's high public debt necessitates significant government borrowing, increasing the supply of JGBs and potentially affecting yields.

Economic Implications of a Steepening Yield Curve

The steepening yield curve has several important economic implications for Japan:

- Higher borrowing costs can stifle economic growth. Increased yields make it more expensive for businesses to borrow money for investment and expansion, potentially slowing economic growth.

- Increased government debt servicing costs. Higher JGB yields mean the Japanese government faces higher interest payments on its substantial debt, putting pressure on government finances.

- Potential for increased inflation if borrowing costs are passed on to consumers. Businesses might pass increased borrowing costs onto consumers in the form of higher prices, further fueling inflation.

- Impact on foreign investment in Japanese government bonds. Changes in JGB yields can impact the attractiveness of JGBs to foreign investors, influencing capital flows into and out of Japan.

Potential Government Responses and Future Outlook

The Japanese government and the BOJ are likely to respond to the steepening yield curve through various policy measures.

- Further adjustments to the BOJ's monetary policy. The BOJ might fine-tune its monetary policy tools to manage inflation and yield curve dynamics.

- Government spending cuts or tax increases to manage debt. Fiscal policy adjustments might be implemented to control government debt and reduce borrowing needs.

The long-term outlook remains uncertain. The effectiveness of these policy responses will depend on various factors, including the persistence of global inflation, the resilience of the Japanese economy, and the success of government efforts to manage its debt. The ongoing debate on the effectiveness of different policy responses highlights the complexity of the situation. Increased economic volatility is a potential outcome.

Conclusion

The steepening government bond yield curve in Japan is a complex issue driven by a combination of global inflationary pressures, the BOJ's policy adjustments, and domestic economic conditions. This steepening curve carries significant economic implications, including higher borrowing costs for businesses and the government, potential inflationary pressures, and impacts on foreign investment. Understanding the dynamics of the steepening government bond yield curve in Japan is crucial for investors and policymakers alike. Staying informed on this critical economic indicator is essential to making informed decisions and navigating the evolving landscape of the Japanese economy. Keep an eye on further developments regarding the Japanese government bond yield curve and its influence on the Japanese economy.

Featured Posts

-

Investigating Red Carpet Infractions Guest Behavior Patterns

May 17, 2025

Investigating Red Carpet Infractions Guest Behavior Patterns

May 17, 2025 -

Hailey Van Lith And Angel Reese A Chicago Reunion Amidst Past Tensions

May 17, 2025

Hailey Van Lith And Angel Reese A Chicago Reunion Amidst Past Tensions

May 17, 2025 -

Analysis Of Japans Economic Contraction Before Trump Tariffs Hit

May 17, 2025

Analysis Of Japans Economic Contraction Before Trump Tariffs Hit

May 17, 2025 -

All Conference Track Athletes A Complete Roundup

May 17, 2025

All Conference Track Athletes A Complete Roundup

May 17, 2025 -

Trumps Middle East Trip On May 15 2025 Implications For His Presidency

May 17, 2025

Trumps Middle East Trip On May 15 2025 Implications For His Presidency

May 17, 2025

Latest Posts

-

2025s Top Rated Crypto Casinos Bitcoin Casinos With Fast Withdrawals And Exclusive Bonuses

May 17, 2025

2025s Top Rated Crypto Casinos Bitcoin Casinos With Fast Withdrawals And Exclusive Bonuses

May 17, 2025 -

Top Bitcoin Casinos 2025 Easy Withdrawals Exclusive Bonuses And Best Crypto Gambling Sites

May 17, 2025

Top Bitcoin Casinos 2025 Easy Withdrawals Exclusive Bonuses And Best Crypto Gambling Sites

May 17, 2025 -

Best Crypto Casinos 2025 Top Bitcoin Casinos With Easy Withdrawals And Exclusive Bonuses

May 17, 2025

Best Crypto Casinos 2025 Top Bitcoin Casinos With Easy Withdrawals And Exclusive Bonuses

May 17, 2025 -

Jackbit Your Best Crypto Casino Choice In 2025

May 17, 2025

Jackbit Your Best Crypto Casino Choice In 2025

May 17, 2025 -

Review Of Jackbit A Top Bitcoin Casino With Fast Withdrawals

May 17, 2025

Review Of Jackbit A Top Bitcoin Casino With Fast Withdrawals

May 17, 2025