Kering's Financial Report: Sales Down, Gucci's New Era Begins

Table of Contents

Deconstructing Kering's Financial Performance: A Detailed Analysis

Overall Sales Decline and Contributing Factors

Kering's recent financial report revealed a concerning percentage decrease in overall sales. While the exact figures require further scrutiny, several contributing factors likely played a role. The global economic slowdown, marked by persistent inflation and rising interest rates, significantly impacted consumer spending on luxury goods. Furthermore, geopolitical instability and ongoing conflicts continue to disrupt supply chains and influence consumer confidence. Changes in consumer behavior, with a shift towards experiences over material possessions for some segments, also contributed to the decline.

- Specific Brand Performance: While some brands within the Kering portfolio may have experienced modest growth, the report highlighted underperformance in key areas, necessitating a deeper analysis of individual brand strategies.

- Impact of Luxury Market Trends: The overall performance reflects broader trends within the luxury market, indicating the need for adaptive strategies to counter the challenges posed by a less buoyant global economy. Kering revenue figures provide a crucial benchmark for understanding the extent of this impact. A thorough financial performance analysis is essential for navigating this challenging landscape.

Regional Performance Variations

The impact of the sales decline wasn't uniform across all regions. Some key markets, particularly those experiencing stronger economic resilience, showed more modest decreases, while others faced more significant challenges. Analyzing regional performance reveals valuable insights into the nuances of the global luxury market and the effectiveness of targeted marketing strategies.

- Asia-Pacific Performance: This region, typically a significant contributor to Kering's revenue, experienced varied performance depending on specific countries. Understanding the factors driving this variation is crucial for future strategy.

- Europe and North America: These mature markets faced their own unique challenges, reflecting the diverse economic conditions and shifting consumer preferences within these regions. This highlights the importance of market segmentation in adapting marketing strategies for optimal performance. Analyzing regional sales performance in detail is critical to understanding these variations.

Impact on Kering's Stock Price

The release of the Kering financial report immediately impacted investor sentiment. The initial market reaction reflected concerns about the sales decline and its potential long-term implications. This resulted in fluctuations in Kering's stock price, with a noticeable decrease observed in the short term.

- Investor Outlook: Analysts are carefully assessing the company's response to the challenges, considering the potential for recovery and the overall investor outlook. Further analysis of the report is required to gauge the long-term impact on market capitalization.

- Stock Price Fluctuations: Tracking Kering stock price movements provides a real-time indication of investor confidence and market sentiment, offering a crucial barometer of the company's financial health and future prospects.

Gucci's New Era: A Strategy for Revival

The Appointment of Sabato De Sarno and its Implications

The appointment of Sabato De Sarno as Gucci's new CEO marks a significant turning point. His extensive experience in the luxury fashion industry, coupled with his proven creative vision, suggests a strategic shift for Gucci. His leadership is anticipated to significantly influence Gucci's creative direction and overall brand strategy.

- Previous Experience: De Sarno's track record provides valuable insights into his management style and his potential to revitalize Gucci's brand image.

- Initial Strategies: Any immediate changes or innovative strategies implemented by De Sarno will be crucial in shaping Gucci's short-term trajectory and long-term success. This includes the potential for brand repositioning.

Shifting Brand Strategy and Marketing Initiatives

Gucci's marketing approach and brand messaging are undergoing a transformation. This includes evaluating and potentially adjusting existing product lines and exploring new collaborations to enhance its appeal to a broader consumer base.

- New Product Lines and Collaborations: The introduction of innovative product lines and carefully selected collaborations is key to stimulating growth.

- Impact on Brand Perception: These changes aim to redefine Gucci's brand identity and enhance its brand awareness in the luxury market. A well-executed Gucci marketing strategy is pivotal to this transformation. Successful luxury branding demands a dynamic and adaptive approach.

Long-Term Outlook for Gucci's Growth

The Gucci future outlook depends on the effectiveness of its revitalization strategy. De Sarno's leadership will be vital in navigating the challenges within the competitive luxury market and capitalizing on opportunities for luxury market growth.

- Long-Term Strategies: The sustainability of Gucci's long-term growth strategies will determine its resilience in the face of economic fluctuations and shifting consumer trends.

- Potential Challenges and Risks: Factors such as maintaining brand exclusivity, managing supply chain complexities, and navigating geopolitical uncertainties remain significant risks. Understanding and mitigating these risks is crucial for brand sustainability.

Conclusion: Analyzing Kering's Future Based on the Report and Gucci's Transformation

Kering's financial report reveals a challenging period, marked by a decline in overall sales. However, the appointment of Sabato De Sarno at Gucci presents a significant opportunity for strategic repositioning and revitalization. Gucci's new era, characterized by evolving brand strategies and marketing initiatives, holds the key to boosting Kering revenue and improving the Kering stock price. The success of this transformation will be a determining factor in Kering's future performance. Stay informed about future Kering financial reports and Gucci's progress for further insights into their journey and the broader luxury market. Follow Kering's and Gucci's activities for further insights into the future of luxury brands.

Featured Posts

-

O Bednom Gusare Zamolvite Slovo Vozrastnye Kharakteristiki Personazhey I Ikh Vliyanie Na Syuzhet

May 24, 2025

O Bednom Gusare Zamolvite Slovo Vozrastnye Kharakteristiki Personazhey I Ikh Vliyanie Na Syuzhet

May 24, 2025 -

10 Fastest Stock Ferraris Official Track Data Analysis

May 24, 2025

10 Fastest Stock Ferraris Official Track Data Analysis

May 24, 2025 -

New 2026 Porsche Cayenne Ev Spy Photos Offer Early Glimpse

May 24, 2025

New 2026 Porsche Cayenne Ev Spy Photos Offer Early Glimpse

May 24, 2025 -

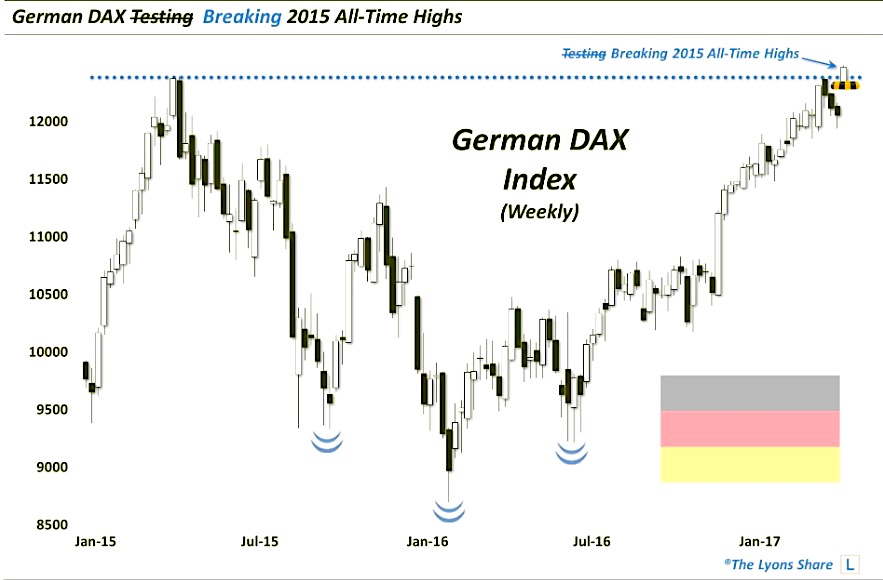

Will A Resurgent Wall Street Undermine The German Daxs Rise

May 24, 2025

Will A Resurgent Wall Street Undermine The German Daxs Rise

May 24, 2025 -

Pobediteli Evrovideniya 2025 Prognoz Konchity Vurst

May 24, 2025

Pobediteli Evrovideniya 2025 Prognoz Konchity Vurst

May 24, 2025

Latest Posts

-

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025 -

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025