Will A Resurgent Wall Street Undermine The German DAX's Rise?

Table of Contents

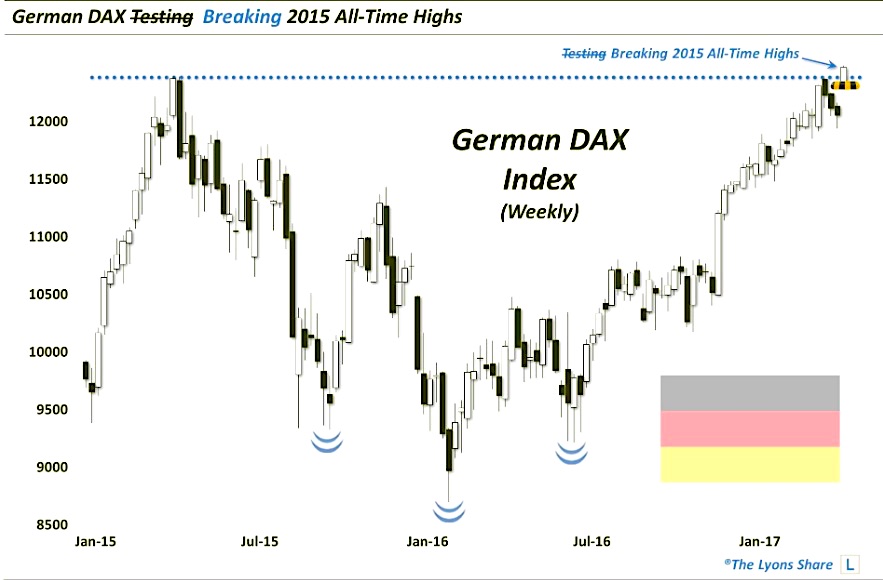

The German DAX, a key indicator of the German economy's health, has shown impressive growth recently. However, the robust resurgence of Wall Street presents a potential challenge. This article delves into the question of whether the strength of the US stock market could stifle the DAX's continued ascent, examining key factors and exploring various potential scenarios.

The Current State of the DAX and Wall Street

The DAX has enjoyed a period of significant growth, fueled by several factors. Germany's robust economic recovery post-pandemic, coupled with strong corporate earnings, particularly in the automotive and industrial sectors, has significantly boosted investor confidence. This is reflected in the index's performance, showcasing a steady climb in recent months.

Meanwhile, Wall Street has experienced a remarkable resurgence, driven by positive economic data, including lower-than-expected inflation figures, and the Federal Reserve's measured approach to interest rate hikes. This has led to increased investor optimism and a surge in major US stock market indices.

- DAX Recent Performance: The DAX has shown an X% increase over the past Y months (replace X and Y with actual figures). Key sectors contributing to this growth include automotive (Z%), technology (W%), and industrials (V%). (replace Z, W, and V with actual figures or ranges).

- Key Sectors Driving DAX Growth: The strong performance of German exporters, benefiting from global demand, has been a major contributor.

- Wall Street Indices Performance: The S&P 500 and Dow Jones Industrial Average have seen substantial gains, driven by strong corporate earnings and positive investor sentiment.

- Historical Correlation: Historically, there has been a moderate positive correlation between the DAX and US indices, suggesting that movements in one market often influence the other, though the strength of this correlation fluctuates.

The Interconnectedness of Global Markets

Global financial markets are intricately linked; events in one market inevitably impact others. Capital flows are a crucial element of this interconnectedness. When US markets perform exceptionally well, investors often shift their attention and capital towards US assets, potentially drawing investment away from other markets, including Germany. This shift in capital allocation can influence exchange rates and investor sentiment globally.

- Past Instances: Past instances, such as the 2008 financial crisis, demonstrated the ripple effect of events on Wall Street on the DAX. A sharp downturn in US markets often leads to a decline in the DAX.

- Investor Sentiment: Global risk appetite plays a critical role. If investors perceive increased risk in US markets, they may seek safer havens, potentially benefiting the DAX if it's perceived as more stable.

- Currency Exchange Rates (USD/EUR): Fluctuations in the USD/EUR exchange rate influence investment decisions. A strengthening dollar can make German assets less attractive to international investors.

Potential Factors Mitigating Wall Street's Impact

While a strong Wall Street could potentially divert investment from the DAX, several factors might mitigate this impact. The German economy possesses unique strengths that could buffer it from a weakening US market.

- Strong German Manufacturing: Germany's robust manufacturing sector, particularly in automotive and machinery, provides a strong foundation for the DAX's resilience.

- European Market Reliance: Many DAX companies derive significant revenue from European markets, lessening their dependence on the US economy.

- Unique Corporate Governance: German corporate governance structures, often characterized by long-term investment horizons, can offer more stability compared to the more short-term focused US markets.

- DAX Diversification: The DAX itself is relatively diversified across several sectors, reducing its vulnerability to shocks in any single sector. This internal diversification can lessen the overall impact of external factors.

Scenarios and Predictions

Several scenarios can illustrate the potential impact of Wall Street's performance on the DAX. These scenarios are not predictions but rather potential outcomes based on current market conditions.

- Scenario 1: Wall Street Remains Strong, Limited Impact on DAX: Continued strong growth on Wall Street might lead to a modest outflow of investment from the DAX, but the German economy’s underlying strength could offset this effect.

- Scenario 2: Wall Street Correction, Moderate Impact on DAX: A moderate correction on Wall Street could cause some downward pressure on the DAX, but the impact would likely be limited if the German economy remains robust.

- Scenario 3: Significant Wall Street Downturn, Substantial Impact on DAX: A significant downturn on Wall Street could trigger a more substantial decline in the DAX, mirroring the interconnectedness of global markets.

Disclaimer: Market predictions are inherently uncertain, and these scenarios are for illustrative purposes only. Various unforeseen economic and political factors could significantly influence the actual outcomes.

Conclusion

This analysis has examined the intricate relationship between a resurgent Wall Street and the German DAX. While a booming US market might attract investment away from Germany, several factors – including the strength of the German economy and its diverse market exposure – could cushion the DAX from significant negative impacts. The future performance of both markets hinges on numerous intertwined economic and geopolitical events.

Call to Action: Stay informed about the dynamic interplay between Wall Street and the German DAX. Continue to monitor market trends and news to make informed investment decisions regarding the German stock market and the influence of Wall Street's performance. Understanding the potential for a resurgent Wall Street to undermine the German DAX’s rise is vital for navigating the complexities of global finance.

Featured Posts

-

Nemecke Firmy A Hromadne Prepustanie Analyza Situacie Na H Nonline Sk

May 24, 2025

Nemecke Firmy A Hromadne Prepustanie Analyza Situacie Na H Nonline Sk

May 24, 2025 -

New Album Her In Deep Matt Maltese Talks Intimacy And Artistic Growth

May 24, 2025

New Album Her In Deep Matt Maltese Talks Intimacy And Artistic Growth

May 24, 2025 -

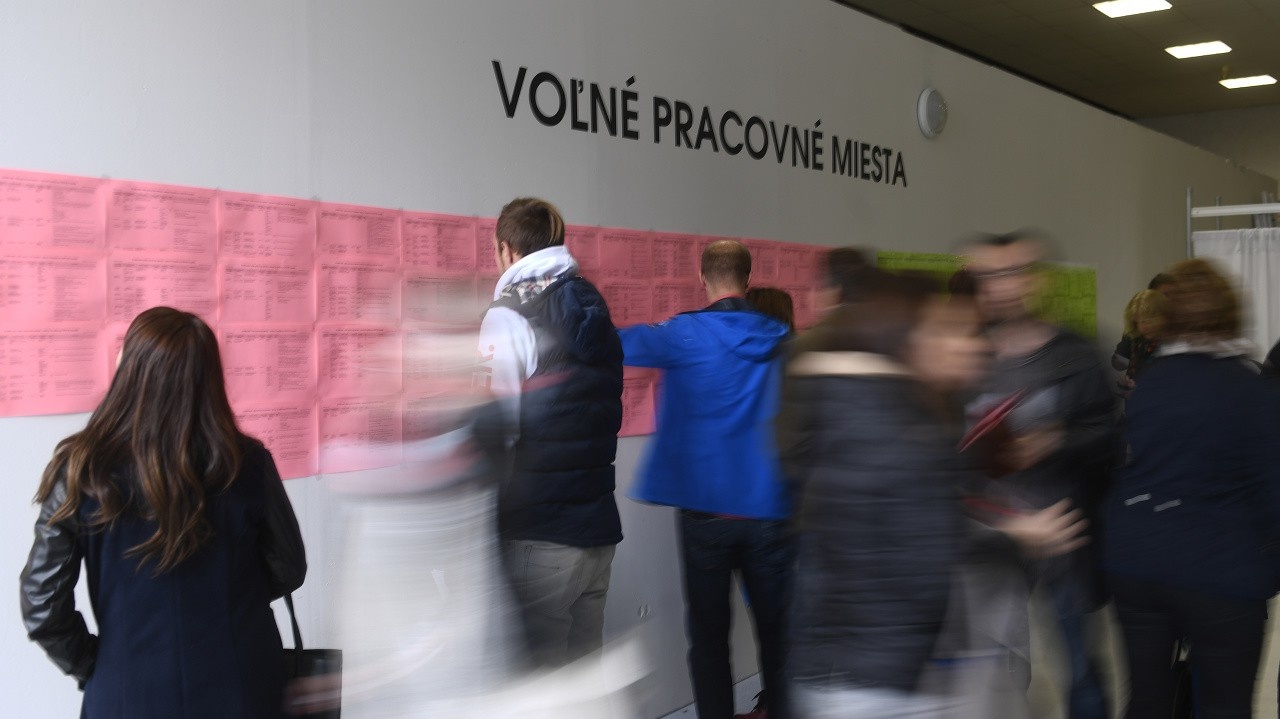

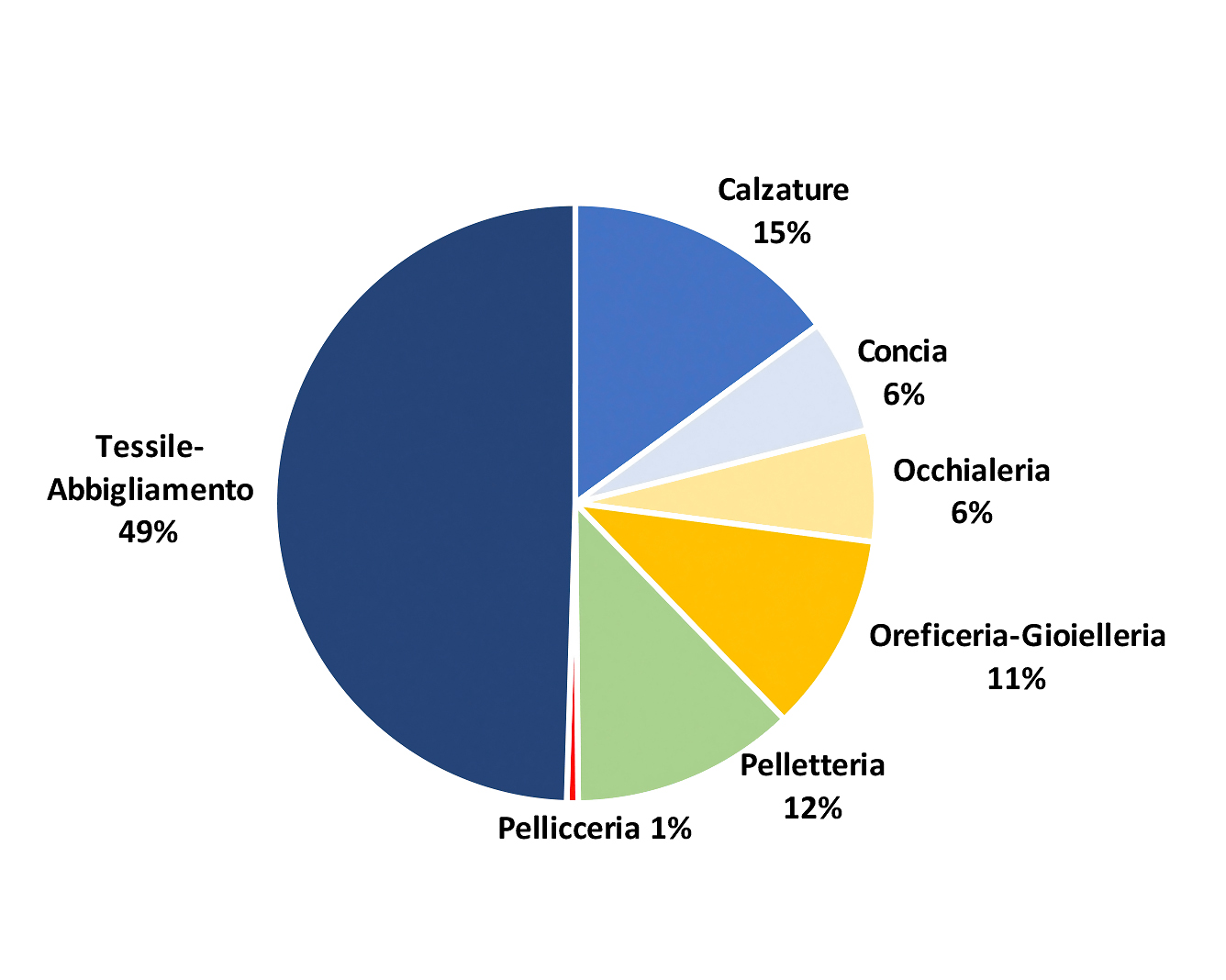

Dazi Trump Nike Lululemon E Le Perdite Nel Settore Moda

May 24, 2025

Dazi Trump Nike Lululemon E Le Perdite Nel Settore Moda

May 24, 2025 -

Frankfurt Stock Exchange Dax Remains Stable Following Record Performance

May 24, 2025

Frankfurt Stock Exchange Dax Remains Stable Following Record Performance

May 24, 2025 -

Ferrari Day In Bangkok Flagship Facility Unveiled

May 24, 2025

Ferrari Day In Bangkok Flagship Facility Unveiled

May 24, 2025

Latest Posts

-

The Impact Of La Fires On Rental Prices Price Gouging Allegations

May 24, 2025

The Impact Of La Fires On Rental Prices Price Gouging Allegations

May 24, 2025 -

Post Fire Price Gouging In La The Reality For Renters

May 24, 2025

Post Fire Price Gouging In La The Reality For Renters

May 24, 2025 -

Impact Of Economic Slowdown Sse Announces 3 Billion Spending Cut

May 24, 2025

Impact Of Economic Slowdown Sse Announces 3 Billion Spending Cut

May 24, 2025 -

La Fires Fuel Landlord Price Gouging Claims A Growing Concern

May 24, 2025

La Fires Fuel Landlord Price Gouging Claims A Growing Concern

May 24, 2025 -

Are Thames Waters Executive Bonuses Acceptable A Critical Examination

May 24, 2025

Are Thames Waters Executive Bonuses Acceptable A Critical Examination

May 24, 2025