Lack Of Funds: Overcoming Financial Barriers

Table of Contents

Identifying the Root Causes of Your Lack of Funds

Before you can effectively address your lack of funds, you must understand its source. A thorough analysis of your financial situation is crucial. This involves a deep dive into your spending habits, income sources, and hidden expenses.

-

Analyze Spending Habits: Tracking your expenses is the first step towards understanding where your money goes. Use budgeting apps, spreadsheets, or even a simple notebook to record every transaction for a month. This detailed record will highlight areas of overspending.

- Examples of overspending:

- Eating out frequently.

- Unnecessary subscription services.

- Impulse purchases.

- High-interest debt payments.

- Examples of overspending:

-

Assess Income Sources: Evaluate your current income streams. Are you maximizing your earning potential? Are there opportunities to increase your income through a part-time job, freelance work, or a side hustle? Exploring options to increase income is key to overcoming a lack of funds.

- Income evaluation points:

- Current salary.

- Passive income streams (e.g., rental properties).

- Any potential for raises or promotions.

- Income evaluation points:

-

Uncover Hidden Expenses: Many recurring costs go unnoticed. Identifying and reducing these hidden expenses can free up significant funds.

- Examples of hidden expenses:

- Monthly subscription boxes.

- Unused gym memberships.

- Automatic payments for services you no longer use.

- Examples of hidden expenses:

Creating a Realistic Budget and Sticking to It

Once you understand where your money is going, creating a realistic budget is essential. Several methods can help you effectively manage your finances and overcome your lack of funds.

-

The 50/30/20 Budgeting Rule: This simple rule suggests allocating 50% of your after-tax income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

- Pros: Easy to understand and implement.

- Cons: May not be suitable for everyone, especially those with high debt.

-

Zero-Based Budgeting: This method requires you to allocate every dollar of your income to a specific expense category. Any remaining funds are saved or used to pay down debt.

- Pros: Promotes mindful spending and helps identify areas for savings.

- Cons: Requires more detailed planning and tracking.

-

Budgeting Apps and Tools: Numerous budgeting apps (Mint, YNAB, Personal Capital) offer features like automated expense tracking, budgeting tools, and financial goal setting, making budget planning and sticking to it easier.

- Examples: Mint, YNAB (You Need A Budget), Personal Capital.

Exploring Options to Increase Income

Increasing your income is a powerful strategy to combat a lack of funds. Explore diverse avenues to boost your earnings.

-

Part-Time Jobs or Freelance Work: Consider taking on a part-time job or freelancing in your spare time. Identify skills you can monetize and find opportunities through online platforms.

- Examples: Driving for a ride-sharing service, tutoring, freelance writing or graphic design.

-

Selling Unused Possessions: Declutter your home and sell unwanted items online (eBay, Craigslist, Facebook Marketplace) or at consignment shops.

- Tips for maximizing returns: Clean and photograph items well; accurately describe the condition.

-

Negotiating a Raise: If you feel undervalued at your current job, research industry salaries and prepare a case for a raise.

-

Investing Wisely (if applicable): If you have some savings, consider investing in low-risk options like high-yield savings accounts or government bonds to grow your money over time.

Managing Debt and Reducing Expenses

Addressing debt and cutting unnecessary expenses are crucial steps in overcoming a lack of funds.

-

Debt Consolidation: Combining multiple debts into a single loan can simplify repayment and potentially lower interest rates.

- Pros: Simplified payments, potential for lower interest rates.

- Cons: May require a good credit score; longer repayment terms.

-

Negotiating with Creditors: Contact your creditors directly to negotiate lower interest rates or more manageable payment plans.

-

Cutting Unnecessary Expenses: Identify areas where you can immediately cut back on spending.

- Examples: Cancel unused subscriptions, reduce dining out, shop for groceries strategically.

-

Prioritizing Essential Expenses: Focus on necessities while cutting back on non-essentials.

- Examples: Prioritize rent/mortgage, utilities, groceries before entertainment.

Overcoming Lack of Funds and Building a Secure Financial Future

Overcoming a lack of funds requires a multifaceted approach. By identifying the root causes, creating a realistic budget, exploring income-boosting opportunities, and actively managing debt, you can significantly improve your financial situation. Proactive budgeting and financial planning are essential for long-term financial stability. Remember, effective money management is a journey, not a destination. Take control of your finances, implement the strategies discussed, and build a secure financial future for yourself. For further assistance, explore resources like online financial literacy websites or consult with a financial advisor. Don't let financial difficulties define you; take action today to overcome your lack of funds and achieve financial freedom.

Featured Posts

-

Racial Hatred Tweet Ex Councillors Wifes Appeal Hearing

May 21, 2025

Racial Hatred Tweet Ex Councillors Wifes Appeal Hearing

May 21, 2025 -

Provence Hiking Adventure A Self Guided Walk From Mountains To Mediterranean

May 21, 2025

Provence Hiking Adventure A Self Guided Walk From Mountains To Mediterranean

May 21, 2025 -

Gbr Highlights Best Grocery Deals Lucky Quarter And Doge Poll Update

May 21, 2025

Gbr Highlights Best Grocery Deals Lucky Quarter And Doge Poll Update

May 21, 2025 -

Film Po Reddit Prici Sydney Sweeney U Glavnoj Ulozi

May 21, 2025

Film Po Reddit Prici Sydney Sweeney U Glavnoj Ulozi

May 21, 2025 -

Gender Reveal Peppa Pigs Parents Announce Babys Sex

May 21, 2025

Gender Reveal Peppa Pigs Parents Announce Babys Sex

May 21, 2025

Latest Posts

-

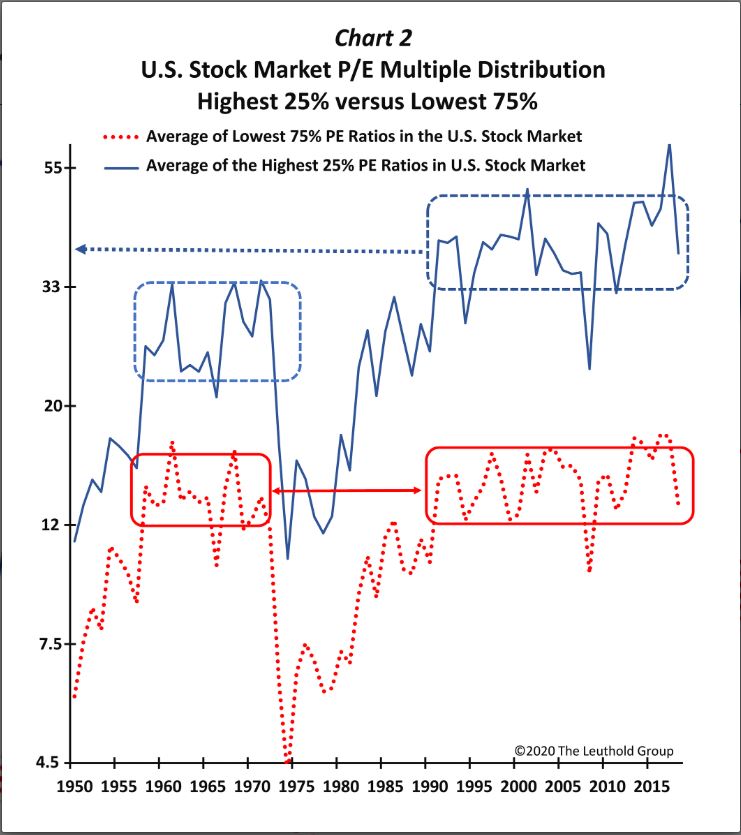

Uk Luxury Brands Face Export Challenges Post Brexit

May 21, 2025

Uk Luxury Brands Face Export Challenges Post Brexit

May 21, 2025 -

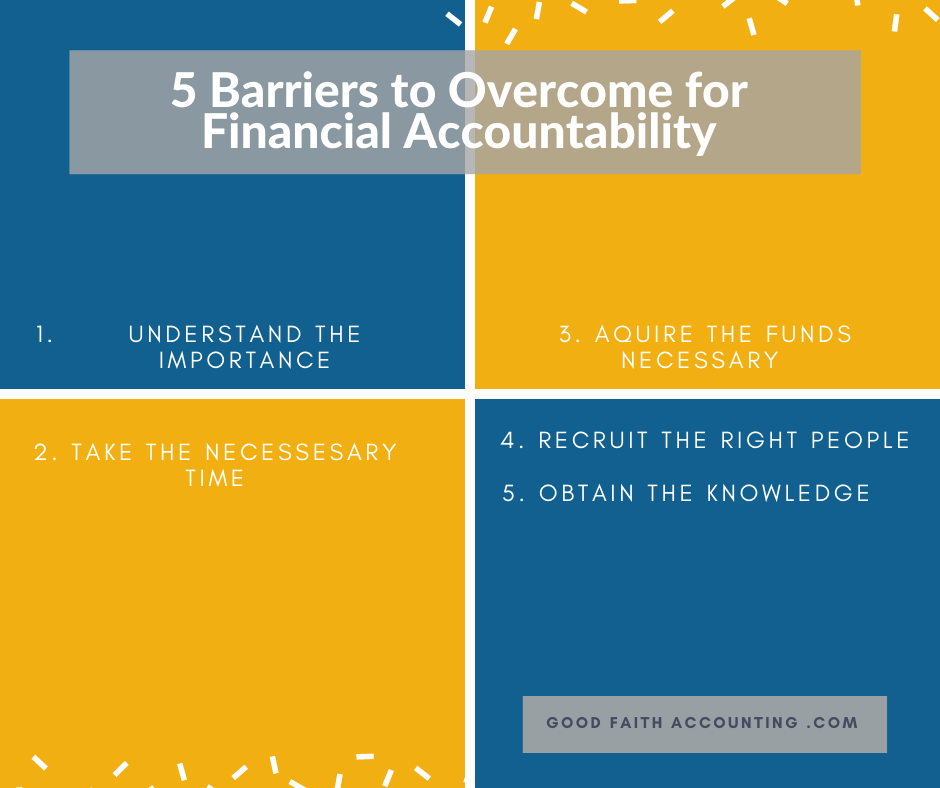

High Stock Valuations Bof As Rationale For Investor Calm

May 21, 2025

High Stock Valuations Bof As Rationale For Investor Calm

May 21, 2025 -

The Brexit Effect Uk Luxury Brands Struggle With Eu Trade

May 21, 2025

The Brexit Effect Uk Luxury Brands Struggle With Eu Trade

May 21, 2025 -

Chinas Auto Market Headwinds For Luxury Brands Like Bmw And Porsche

May 21, 2025

Chinas Auto Market Headwinds For Luxury Brands Like Bmw And Porsche

May 21, 2025 -

Eu Market Access The Brexit Challenge For Uk Luxury Brands

May 21, 2025

Eu Market Access The Brexit Challenge For Uk Luxury Brands

May 21, 2025