Land Your Dream Private Credit Job: 5 Essential Tips

Table of Contents

Master the Fundamentals of Private Credit

To succeed in the private credit world, a solid understanding of its intricacies is paramount. This encompasses not just theoretical knowledge but also practical application.

Understand the Private Credit Landscape

The private credit market is diverse. It's crucial to understand its various segments:

- Direct Lending: Providing loans directly to companies, often bypassing traditional banks.

- Fund Investing: Investing in private credit funds managed by specialized firms.

- Distressed Debt Investing: Investing in the debt of companies facing financial difficulties.

- Real Estate Debt: Financing real estate projects through various lending structures.

Beyond these categories, a deep understanding of credit analysis, financial modeling, and deal structuring is essential for any private credit job. This involves evaluating the creditworthiness of borrowers, predicting their future cash flows, and structuring transactions to mitigate risk and maximize returns. Relevant certifications, such as the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst), can significantly enhance your credentials and make you a more competitive applicant for a private credit analyst position or other roles.

Develop Strong Financial Modeling Skills

Proficiency in financial modeling is non-negotiable for a private credit career. This involves:

- Excel Mastery: Advanced Excel skills, including functions like LBO modeling, discounted cash flow (DCF) analysis, and scenario planning, are critical.

- Financial Modeling Software: Familiarity with specialized software like Argus, Bloomberg Terminal, or similar platforms is a significant advantage.

- Specific Modeling Techniques: Mastering techniques like LBO modeling (leveraged buyout), DCF analysis, and sensitivity analysis is crucial for evaluating investment opportunities in the private credit space.

To sharpen your skills, consider online courses (Coursera, edX), specialized training programs, or relevant textbooks focusing on financial modeling within the context of private credit investment.

Network Strategically within the Private Credit Industry

Networking is key to uncovering hidden job opportunities and building relationships within the private credit industry.

Attend Industry Events and Conferences

Actively participate in private credit conferences, seminars, and networking events. This provides invaluable opportunities to connect with professionals, learn about new trends, and potentially discover unadvertised job openings. Remember to:

- Prepare Talking Points: Have a concise and engaging introduction ready, highlighting your skills and interests.

- Follow Up: After meeting someone, send a personalized email reinforcing your connection and expressing your continued interest.

Leverage Your Professional Network (LinkedIn)

Optimize your LinkedIn profile to showcase your private credit-related experience and skills. Use relevant keywords like "private credit," "credit analyst," "leveraged finance," and "debt investing."

- Engage Actively: Participate in industry discussions, share relevant articles, and connect with professionals in private credit.

- Informational Interviews: Reach out to professionals for informational interviews to learn more about their roles and gain insights into the industry. This can be a powerful way to build connections and potentially uncover job opportunities.

Craft a Compelling Resume and Cover Letter Tailored to Private Credit Roles

Your resume and cover letter are your first impression. They must showcase your qualifications effectively and highlight your suitability for specific private credit roles.

Highlight Relevant Skills and Experience

Emphasize your quantitative skills, analytical abilities, and experience in financial modeling and credit analysis. Quantify your achievements whenever possible:

- "Increased portfolio returns by 15% through improved credit underwriting."

- "Developed and implemented a new financial model resulting in a 10% reduction in operational costs."

Target Specific Private Credit Job Descriptions

Don't use a generic resume and cover letter. Tailor each application to the specific job description:

- Keyword Optimization: Incorporate keywords directly from the job description into your resume and cover letter.

- Company Research: Demonstrate a thorough understanding of the firm's investment strategy and target market. Show that you've done your homework.

Ace the Private Credit Job Interview

The interview is your chance to shine. Thorough preparation is essential.

Prepare for Technical and Behavioral Questions

Expect technical questions about financial modeling, credit analysis, and current market trends within the private credit space. Prepare answers using the STAR method (Situation, Task, Action, Result) for behavioral questions.

- Technical Questions Examples: "Walk me through a DCF analysis," "How would you assess the creditworthiness of a borrower?", "What are the current challenges facing the private credit market?"

- Behavioral Questions Examples: "Tell me about a time you failed," "Describe a situation where you had to work under pressure," "Give an example of a time you had to resolve a conflict."

Showcase Your Passion for Private Credit

Demonstrate genuine enthusiasm for private credit investing. Ask insightful questions that demonstrate your understanding of the industry and the firm's investment strategy. This shows initiative and genuine interest.

Follow Up and Stay Persistent

Don't underestimate the power of follow-up.

Send Thank-You Notes After Interviews

Promptly send personalized thank-you notes reiterating your interest and highlighting key discussion points.

Maintain Consistent Follow-Up

Follow up with recruiters and hiring managers at appropriate intervals, but avoid being overly persistent. A polite and professional follow-up shows your continued interest and dedication.

Secure Your Ideal Private Credit Job

Landing your dream private credit job requires a multifaceted approach. By mastering the fundamentals, networking effectively, crafting a compelling application, acing the interview, and following up persistently, you significantly increase your chances of success. Ready to unlock your potential in the exciting world of private credit? Put these strategies into action now!

Featured Posts

-

The Dating Lives Of Twilight Actors Robert Pattinson Suki Waterhouse And More

May 20, 2025

The Dating Lives Of Twilight Actors Robert Pattinson Suki Waterhouse And More

May 20, 2025 -

Cin Grand Prix Soku Hamilton Ve Leclerc Diskalifiye Edildi

May 20, 2025

Cin Grand Prix Soku Hamilton Ve Leclerc Diskalifiye Edildi

May 20, 2025 -

Robert Pattinson And Suki Waterhouses Public Display Of Affection Amidst The Batman 2 Casting News

May 20, 2025

Robert Pattinson And Suki Waterhouses Public Display Of Affection Amidst The Batman 2 Casting News

May 20, 2025 -

Manilas Defiance No Surrender On Missile System To China

May 20, 2025

Manilas Defiance No Surrender On Missile System To China

May 20, 2025 -

Festival Da Cunha 90 Gratuito Maiara E Maraisa Convidadas

May 20, 2025

Festival Da Cunha 90 Gratuito Maiara E Maraisa Convidadas

May 20, 2025

Latest Posts

-

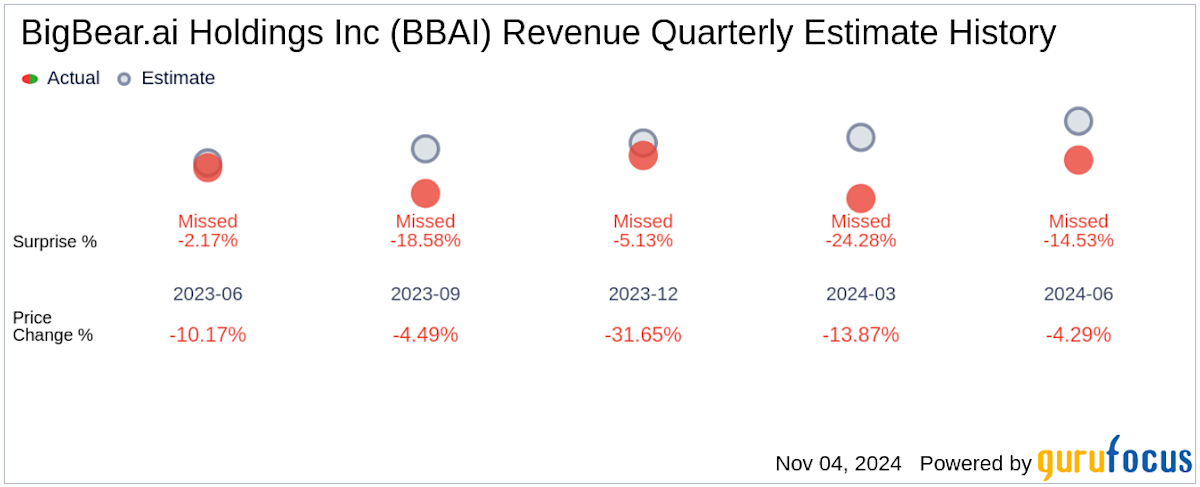

Big Bear Ai Holdings Inc Sued Implications For Investors

May 20, 2025

Big Bear Ai Holdings Inc Sued Implications For Investors

May 20, 2025 -

Gross Law Firm Represents Big Bear Ai Bbai Investors June 10 2025 Deadline

May 20, 2025

Gross Law Firm Represents Big Bear Ai Bbai Investors June 10 2025 Deadline

May 20, 2025 -

Potential Legal Action For Big Bear Ai Bbai Investors Contact Gross Law Firm

May 20, 2025

Potential Legal Action For Big Bear Ai Bbai Investors Contact Gross Law Firm

May 20, 2025 -

Bbai Stock Dips Following Below Forecast Q1 Earnings Report

May 20, 2025

Bbai Stock Dips Following Below Forecast Q1 Earnings Report

May 20, 2025 -

Bbai Stock Investors Important Information Regarding Legal Action Deadline June 10 2025

May 20, 2025

Bbai Stock Investors Important Information Regarding Legal Action Deadline June 10 2025

May 20, 2025