Land Your Dream Private Credit Role: 5 Key Do's And Don'ts

Table of Contents

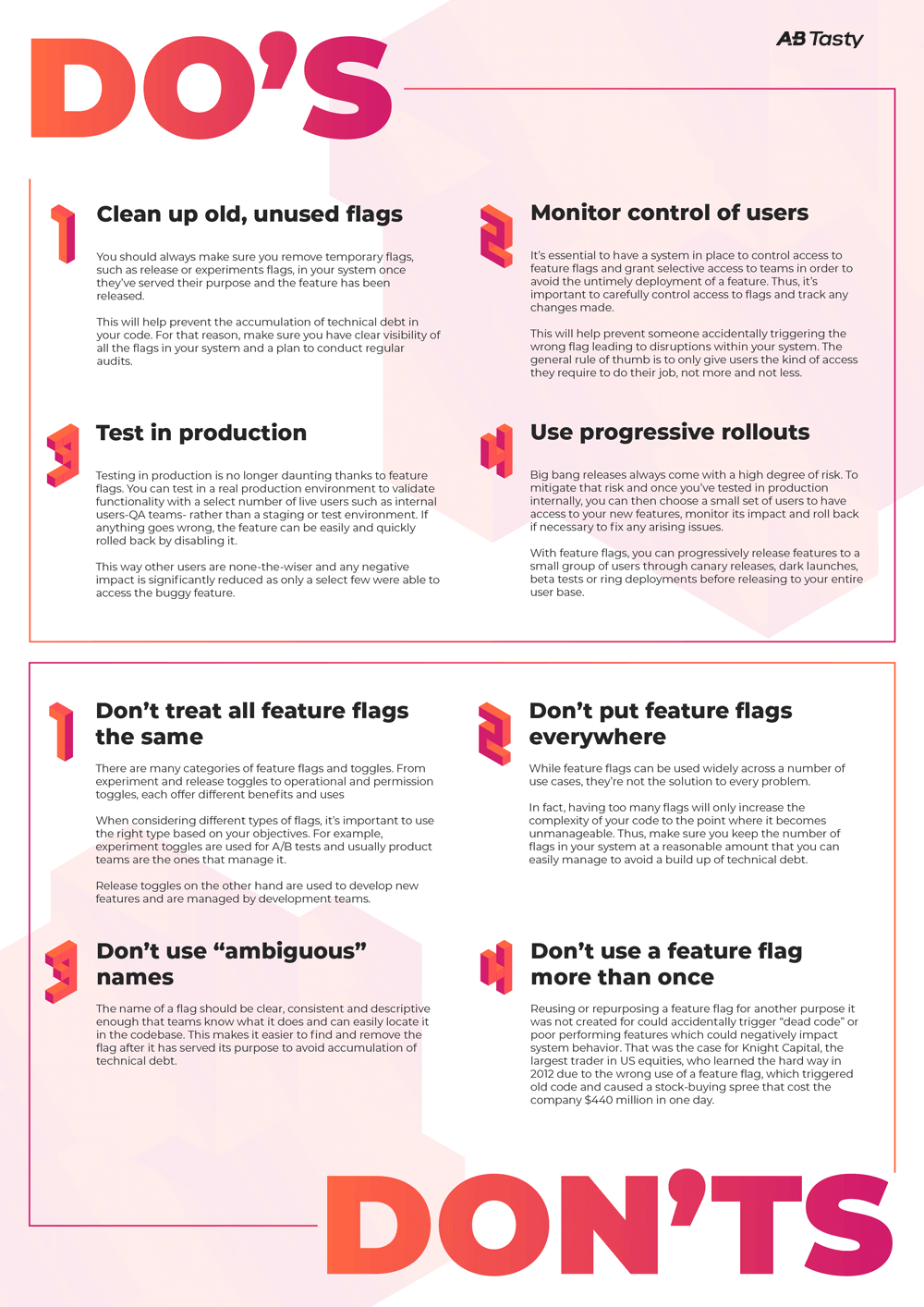

Do's: Maximize Your Chances of Success in Private Credit

1. Network Strategically: Build Your Private Credit Connections

Building a strong network is paramount in the private credit industry. It's not just about collecting business cards; it's about cultivating meaningful relationships.

- Attend industry events and conferences: Private credit networking events and conferences, such as those hosted by industry associations, provide invaluable opportunities to meet key players and learn about the latest trends. Actively participate in discussions and engage with attendees.

- Leverage LinkedIn to connect with professionals: LinkedIn is a powerful tool for connecting with private credit professionals. Research firms and individuals you admire, personalize your connection requests, and engage with their content. Use relevant keywords like private credit networking and private credit recruiting in your profile.

- Informational interviews are invaluable: Reaching out for informational interviews allows you to learn more about specific roles and firms, build relationships, and get your foot in the door. Prepare thoughtful questions beforehand.

- Target specific firms and individuals: Instead of a scattergun approach, focus on firms and individuals whose work aligns with your interests and goals. Research their investment strategies and recent deals to demonstrate your genuine interest.

2. Tailor Your Resume and Cover Letter: Showcasing Your Private Credit Expertise

Your resume and cover letter are your first impression. They need to showcase your skills and experience persuasively. Generic applications won't cut it in this competitive field.

- Quantify your accomplishments whenever possible: Instead of simply stating your responsibilities, use metrics to demonstrate your impact. For example, quantify your contributions to deal flow, portfolio management, or risk assessment. This is crucial for a private credit resume.

- Highlight skills relevant to private credit: Emphasize skills like financial modeling, due diligence, credit analysis, portfolio management, and credit risk assessment. These are core competencies highly valued in private credit.

- Use keywords from job descriptions: Carefully review the job description and incorporate relevant keywords throughout your resume and cover letter. This helps Applicant Tracking Systems (ATS) identify your application as a match.

- Tailor each application to the specific role and company: A generic private credit cover letter will likely be overlooked. Customize your application to highlight the skills and experiences most relevant to each specific role and company culture.

3. Master the Private Credit Interview: Preparing for Success

The interview stage is critical. You need to demonstrate your technical skills, your understanding of the industry, and your personality.

- Practice your answers to common interview questions: Prepare for behavioral questions ("Tell me about a time…"), technical questions about financial modeling and credit analysis, and case study questions requiring on-the-spot problem-solving. Practice with friends or mentors.

- Research the firm and the interviewers thoroughly: Understand the firm's investment strategy, recent deals, and the interviewers' backgrounds. This demonstrates your genuine interest and initiative.

- Demonstrate your understanding of private credit markets and investment strategies: Show your knowledge of different private credit strategies (e.g., direct lending, mezzanine debt, distressed debt) and market dynamics. Preparation for private credit interview questions is essential.

- Prepare insightful questions to ask the interviewer: Asking thoughtful questions demonstrates your engagement and initiative. Prepare questions about the firm's culture, investment strategy, and future plans. This is a key part of private credit interview tips.

- Prepare for private credit case study questions: Many interviews involve case studies assessing your analytical and problem-solving abilities.

4. Showcase Your Financial Acumen: Demonstrate Your Expertise

Private credit roles demand a strong foundation in financial analysis and modeling.

- Highlight experience with financial statements, valuation, and credit risk assessment: Detail your experience with analyzing financial statements, performing valuations (e.g., discounted cash flow, precedent transactions), and assessing credit risk.

- Develop strong Excel skills and familiarity with financial modeling software: Proficiency in Excel and financial modeling software (e.g., Bloomberg Terminal, Argus) is essential. Be prepared to demonstrate your skills during the interview. This is crucial for financial modeling private credit.

- Be prepared to discuss complex financial concepts clearly and concisely: You should be able to explain complex financial concepts in a clear and concise manner, even to those without a deep financial background.

5. Highlight Soft Skills: Teamwork and Communication are Key

Technical skills are important, but soft skills are equally vital in private credit.

- Private credit roles often involve collaborating with diverse teams: Highlight your experience working effectively in teams and contributing to a collaborative environment. Emphasize your private credit teamwork skills.

- Demonstrate your ability to communicate complex information effectively: Private credit involves communicating with investors, borrowers, and internal teams. Showcase your ability to communicate complex information clearly and concisely. Excellent communication skills private credit are highly sought after.

- Show examples of how you've solved challenging problems: Provide specific examples of how you've tackled difficult problems and overcome obstacles. Demonstrate your effective problem-solving skills.

Don'ts: Avoid These Common Mistakes in Your Private Credit Job Search

1. Don't Neglect Networking: The Importance of Connections

Networking is crucial; don't underestimate its power.

- Don't rely solely on online applications: Online applications are important, but networking significantly increases your chances of getting noticed.

- Don't underestimate the power of referrals: Referrals are highly effective. Leverage your network to find individuals who can refer you to relevant firms.

- Don't be afraid to reach out to people you don't know: Informational interviews and networking events are great ways to connect with people you don't know.

2. Don't Submit Generic Applications: Tailor Your Approach

Generic applications demonstrate a lack of effort and interest.

- Don't send the same materials to every firm: Customize your resume and cover letter for each application.

- Don't overlook the importance of tailoring your application to each specific role: Highlight the skills and experiences most relevant to the specific job description.

- Don't make grammatical errors or typos: Proofread carefully before submitting your application.

3. Don't Underprepare for Interviews: Preparation is Key

Insufficient preparation leads to poor interview performance.

- Don't go into an interview without researching the firm: Thoroughly research the firm's investment strategy, recent deals, and team members.

- Don't fail to practice your answers to common interview questions: Practice your responses to common interview questions, including behavioral, technical, and case study questions.

- Don't be unprepared to discuss your experience and skills in detail: Be prepared to articulate your experience and skills clearly and concisely.

4. Don't Downplay Your Skills: Showcase Your Accomplishments

Underselling your achievements can hurt your candidacy.

- Don't be afraid to showcase your accomplishments: Quantify your accomplishments and highlight your contributions.

- Don't be humble to the point of obscurity: Confidently present your skills and experience.

- Don't undervalue your experience: Clearly articulate the value you bring to a potential employer.

5. Don't Ignore Feedback: Learn and Grow

Ignoring feedback limits your learning and growth.

- Don't dismiss feedback from interviewers or mentors: Constructive criticism can help you improve.

- Don't be afraid to ask for clarification: If you don't understand feedback, ask for clarification.

- Don't be defensive when receiving criticism: Approach feedback with an open mind and a willingness to learn.

Conclusion: Land Your Dream Private Credit Role

Landing your dream private credit role requires dedication, preparation, and a strategic approach. By following these "do's" and avoiding the "don'ts," you can significantly increase your chances of success. Remember to network effectively, tailor your applications, master the interview process, showcase your financial acumen, and highlight your soft skills. Start actively implementing these strategies today and take a significant step towards landing your dream private credit role!

Featured Posts

-

Warrens Defense Of Bidens Mental Capacity Falls Short

May 16, 2025

Warrens Defense Of Bidens Mental Capacity Falls Short

May 16, 2025 -

Rapids Defeat Exposes Earthquakes Goalkeeping Vulnerability Steffens Performance Under Scrutiny

May 16, 2025

Rapids Defeat Exposes Earthquakes Goalkeeping Vulnerability Steffens Performance Under Scrutiny

May 16, 2025 -

Gurriels Pinch Hit Rbi Single Secures Padres Victory Over Braves

May 16, 2025

Gurriels Pinch Hit Rbi Single Secures Padres Victory Over Braves

May 16, 2025 -

300 000 Za Vistup Dzho Baydena Chi Varto

May 16, 2025

300 000 Za Vistup Dzho Baydena Chi Varto

May 16, 2025 -

Berlin Public Transport Bvg Strike Conclusion And S Bahn Service Impacts

May 16, 2025

Berlin Public Transport Bvg Strike Conclusion And S Bahn Service Impacts

May 16, 2025

Latest Posts

-

Boston Celtics Ownership Change Analyzing The 6 1 Billion Private Equity Acquisition

May 16, 2025

Boston Celtics Ownership Change Analyzing The 6 1 Billion Private Equity Acquisition

May 16, 2025 -

Celtics At Pistons Expert Prediction And Analysis

May 16, 2025

Celtics At Pistons Expert Prediction And Analysis

May 16, 2025 -

Nba Prediction Celtics At Pistons Who Will Win

May 16, 2025

Nba Prediction Celtics At Pistons Who Will Win

May 16, 2025 -

Boston Celtics Vs Detroit Pistons A Preview And Prediction

May 16, 2025

Boston Celtics Vs Detroit Pistons A Preview And Prediction

May 16, 2025 -

76ers Vs Celtics Game Prediction Breaking Down The Eastern Conference Rivalry

May 16, 2025

76ers Vs Celtics Game Prediction Breaking Down The Eastern Conference Rivalry

May 16, 2025