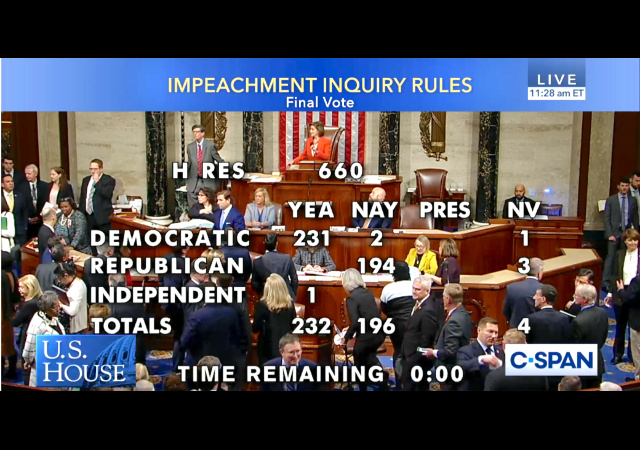

Last-Minute Adjustments: House Approves Trump Tax Legislation

Table of Contents

Key Changes Introduced by the Last-Minute Adjustments

The final version of the House tax bill includes several key amendments to the initially proposed Trump tax legislation. These revised tax code provisions significantly altered the initial proposal, impacting various aspects of tax law. These amendments represent compromises reached to secure the bill's passage.

-

Changes to Itemized Deductions: One significant change involved adjustments to itemized deductions. The original bill proposed stricter limits; however, the final version included some compromises, allowing certain deductions to remain, albeit potentially with modified caps. This affected many taxpayers who itemize instead of using the standard deduction.

-

Corporate Tax Rate Adjustments: The corporate tax rate was a central focus of negotiations. Last-minute adjustments may have slightly altered the final rate, impacting the profitability projections for many large corporations. These changes also likely influenced the projected revenue impacts of the entire legislation.

-

Compromises on Pass-Through Businesses: The treatment of pass-through businesses (S corporations, LLCs, partnerships) underwent significant revision. Initial proposals faced criticism, leading to amendments intended to provide more equitable tax treatment for these business structures, though the specifics remain complex.

-

Impact on Projected Revenue and Deficit: The last-minute changes inevitably altered projections regarding the legislation's impact on federal revenue and the national deficit. Analysts are carefully examining these revised projections to determine the long-term economic implications. These analyses consider various factors, including changes in investment, economic growth, and consumer behavior.

Impact on Individuals

The Trump tax legislation's last-minute adjustments significantly impact individual taxpayers. Understanding these changes is critical for accurate tax planning.

-

Individual Tax Rates and Brackets: While the overall structure of tax brackets might remain largely unchanged, the precise thresholds and rates may have been subtly adjusted by the last-minute amendments. This means individuals may find themselves in different tax brackets than initially anticipated.

-

Standard Deduction and Itemized Deductions: The increased standard deduction remains a key feature but the specifics of eligible itemized deductions (such as mortgage interest and state/local taxes) and their limits could have been altered by the final amendments, impacting many taxpayers’ choices.

-

Child Tax Credit: The child tax credit, a significant benefit for families, may have undergone modifications in the final bill. This could involve adjustments to the credit amount, eligibility requirements, or the phase-out thresholds.

-

Potential Tax Savings or Increased Tax Burdens: The net effect of these changes varies greatly depending on income level, family size, and individual circumstances. Some individuals will experience tax savings, while others may face increased tax burdens. Accurate calculation requires careful consideration of all changes introduced by the final bill.

Impact on Businesses

The Trump tax legislation also introduced significant changes for businesses of all sizes, particularly impacting corporate tax rates and small business tax relief.

-

Corporate Tax Rate: The reduction in the corporate tax rate is a central element of the tax reform. However, last-minute amendments may have slightly adjusted this rate, affecting corporate profit margins and investment decisions.

-

Pass-Through Businesses: Amendments made to the treatment of pass-through businesses aim to provide tax relief, potentially stimulating economic activity. However, the complexities of these changes necessitate careful examination by business owners and tax professionals.

-

Small Business Tax Relief: While significant tax cuts were planned, the specifics of how these would impact small businesses may have changed in the final version. The amendments might have focused on improving specific deductions or credits particularly relevant to small businesses.

-

Impact on Business Investment and Economic Growth: The anticipated impact of this legislation on business investment and overall economic growth is a subject of ongoing debate. Economists are analyzing the interplay of various factors, including the changes in corporate tax rates, and the effect on small businesses and entrepreneurial activity.

Political Ramifications and Future Outlook

The passing of the House tax bill has significant political ramifications and sets the stage for future developments regarding tax policy.

-

Senate Approval: The bill now faces consideration in the Senate. Further amendments are possible during this phase, leading to additional changes before the final version is signed into law.

-

Political Implications: The tax legislation's passage is a major political event, with long-term effects on the political landscape and upcoming elections. The public's reaction to the eventual impact of these tax changes is likely to be a key factor in future voting patterns.

-

Potential Challenges and Legal Hurdles: The legislation may face legal challenges once enacted. The interpretation of certain provisions and their constitutionality could lead to prolonged legal battles.

-

Long-Term Implications: The long-term effects of this tax reform on the US economy, including its impact on the national debt and fiscal policy, remain uncertain. This requires careful and ongoing analysis as the changes unfold over time.

Conclusion

This article detailed the key changes resulting from the last-minute adjustments to the Trump tax legislation, highlighting the impacts on both individuals and businesses. The passage of this bill marks a significant shift in US tax policy, with far-reaching consequences. Understanding the nuances of this revised tax code is critical for navigating this new landscape. Consult with a tax professional to discuss how these changes specifically impact your individual or business tax situation. Learn more about the intricacies of the Trump tax legislation and plan accordingly for the future.

Featured Posts

-

Aex Stijgt Terwijl Amerikaanse Beurs Daalt Analyse En Vooruitzichten

May 24, 2025

Aex Stijgt Terwijl Amerikaanse Beurs Daalt Analyse En Vooruitzichten

May 24, 2025 -

Jordan Bardella Leading The French National Rally Into The Next Election

May 24, 2025

Jordan Bardella Leading The French National Rally Into The Next Election

May 24, 2025 -

Dow Jones Steady Rise Positive Pmi Data Provides Support

May 24, 2025

Dow Jones Steady Rise Positive Pmi Data Provides Support

May 24, 2025 -

Europese Aandelen Vs Wall Street Doorzetting Van De Recente Marktdraai

May 24, 2025

Europese Aandelen Vs Wall Street Doorzetting Van De Recente Marktdraai

May 24, 2025 -

Get Your Wrestle Mania 41 Tickets Now Golden Belts Commemorative Sale

May 24, 2025

Get Your Wrestle Mania 41 Tickets Now Golden Belts Commemorative Sale

May 24, 2025

Latest Posts

-

Tulsa King Season 3 Set Photo Features Sylvester Stallone

May 24, 2025

Tulsa King Season 3 Set Photo Features Sylvester Stallone

May 24, 2025 -

Usa Film Festival Brings Free Films And Stars To Dallas

May 24, 2025

Usa Film Festival Brings Free Films And Stars To Dallas

May 24, 2025 -

Understanding Dc Legends Of Tomorrow A Beginners Guide

May 24, 2025

Understanding Dc Legends Of Tomorrow A Beginners Guide

May 24, 2025 -

First Look Sylvester Stallone In Tulsa King Season 3

May 24, 2025

First Look Sylvester Stallone In Tulsa King Season 3

May 24, 2025 -

Dc Legends Of Tomorrow How To Build The Perfect Team

May 24, 2025

Dc Legends Of Tomorrow How To Build The Perfect Team

May 24, 2025