Live Music Stock Slump To Continue Friday

Table of Contents

Weakening Consumer Spending Power & Inflationary Pressures

Inflation is significantly impacting discretionary spending, and concert tickets and merchandise are no exception. The rising cost of living, fueled by increased energy prices and food costs, is leaving consumers with less disposable income for entertainment. The latest Consumer Price Index (CPI) shows inflation remaining stubbornly high, while consumer confidence indices reflect a decrease in spending on non-essential items. This translates directly into the live music sector.

- Rising ticket prices leading to decreased demand: Higher ticket costs, often passed on due to increased operational expenses, are deterring potential concertgoers.

- Reduced spending on merchandise and concessions: Consumers are cutting back on ancillary purchases at concerts, impacting venue revenue streams.

- Fewer impulsive concert purchases due to budget constraints: The "treat yourself" concert purchase is becoming less frequent as consumers prioritize essential spending. This decreased spontaneity negatively impacts ticket sales.

Impact of Rising Interest Rates on Live Music Investments

Increased interest rates significantly impact the live music sector's investment landscape. Higher borrowing costs make it more expensive for venues to finance upgrades, expansions, or even day-to-day operations. This financial strain trickles down, affecting artist tours and overall production capabilities.

- Higher borrowing costs for venue upgrades and expansion: Ambitious renovation or expansion projects become less financially viable with elevated interest rates.

- Reduced investor appetite for risky investments in the entertainment sector: Investors are shifting towards less volatile, higher-return investments in the current economic climate, leaving live music ventures with less capital.

- Potential delays or cancellations of upcoming tours due to funding challenges: Securing funding for large-scale tours becomes more difficult, potentially leading to postponements or cancellations.

Ongoing Uncertainty in the Post-Pandemic Live Music Landscape

The lingering effects of the pandemic continue to influence audience behavior and concert attendance. While live music has rebounded in some areas, uncertainty remains. Consumer preferences have shifted, and venues and artists are still adapting to a "new normal."

- Concerns about COVID-19 resurgence impacting attendance: The threat of future waves and stricter health measures creates hesitancy among concertgoers.

- Changes in booking strategies and ticketing models: Venues are adapting to fluctuating demand and exploring new ticketing strategies to mitigate risk.

- Increased competition from alternative entertainment options: Streaming services and other at-home entertainment options continue to offer compelling alternatives to live events.

Specific Stock Performances & Analyst Predictions for Friday

Several key players in the live music industry are predicted to experience further stock declines on Friday. Analysts at [insert reputable financial news source] predict a decrease in share prices for [Company A] and [Company B], citing concerns about weakened consumer spending and increased operating costs. [Link to financial news source].

- Stock price projections for key players in the live music industry: Specific projections from analysts provide a clearer picture of the potential market movements.

- Summary of analyst ratings and target prices: A synthesis of various analyst opinions offers a more nuanced view of the likely market behavior.

- Potential triggers for further stock decline: Identifying potential negative news or events that could further impact stock prices is crucial for investors.

Conclusion: Navigating the Live Music Stock Slump

The predicted continuation of the live music stock slump on Friday is primarily driven by a confluence of factors: inflationary pressures dampening consumer spending, rising interest rates impacting investment, and the ongoing uncertainties within the post-pandemic live music landscape. The near-term outlook for the live music industry remains cautious.

Stay informed about the ongoing live music stock slump and make informed investment decisions based on the latest market analysis. Conduct thorough research into individual live music investments and stay updated on relevant financial news concerning live entertainment stocks before making any investment choices.

Featured Posts

-

Gorillaz A 25 Year Retrospective Exhibition And Special Events

May 30, 2025

Gorillaz A 25 Year Retrospective Exhibition And Special Events

May 30, 2025 -

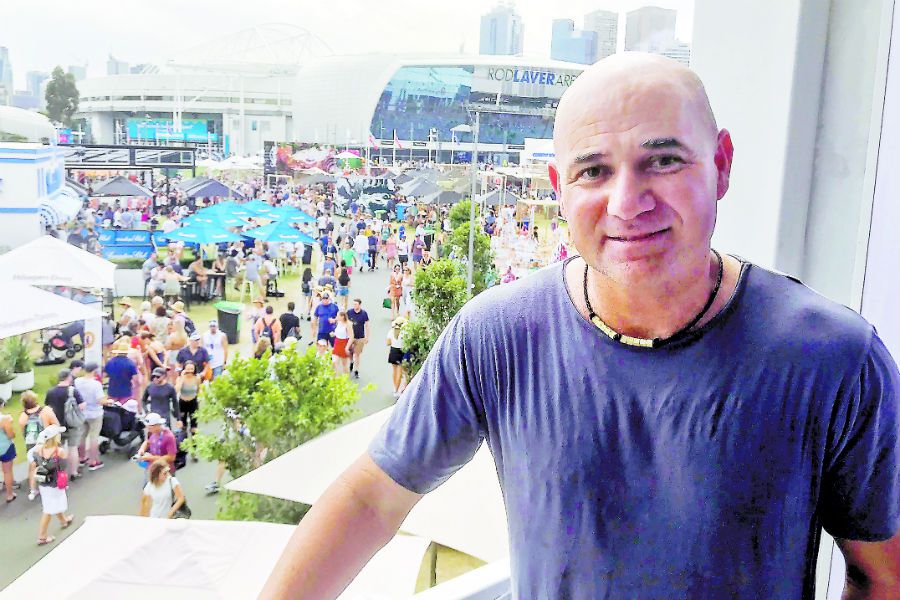

La Bestia Sudamericana Agassi Rememora A Rios

May 30, 2025

La Bestia Sudamericana Agassi Rememora A Rios

May 30, 2025 -

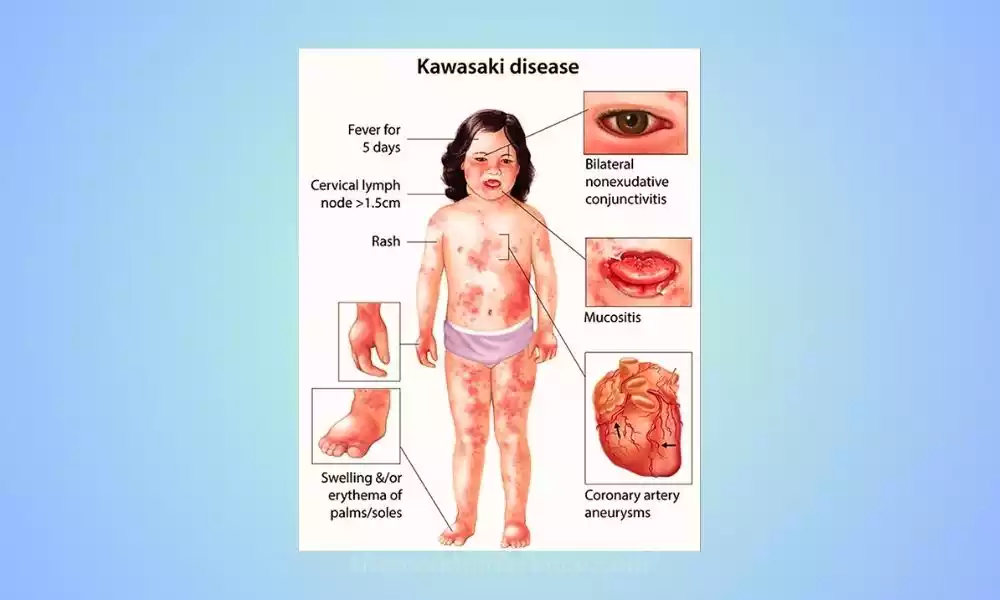

Kawasaki Disease A Novel Respiratory Virus As The Culprit

May 30, 2025

Kawasaki Disease A Novel Respiratory Virus As The Culprit

May 30, 2025 -

Vil Kasper Dolberg Na 35 Mal En Dybdegaende Diskussion

May 30, 2025

Vil Kasper Dolberg Na 35 Mal En Dybdegaende Diskussion

May 30, 2025 -

Complete Guide To Air Jordan Releases June 2025 Edition

May 30, 2025

Complete Guide To Air Jordan Releases June 2025 Edition

May 30, 2025