Live Nation Entertainment (LYV): Investor Strategies And Stock Outlook

Table of Contents

Understanding Live Nation Entertainment's Business Model

Live Nation Entertainment's success hinges on its unique business model, offering a vertically integrated approach to the live music industry. This allows for significant control and optimization across various segments.

Dominance in the Live Music Industry

Live Nation enjoys a near-monopoly in many aspects of the live music business, creating a powerful competitive advantage.

- Ticketmaster Monopoly: Ticketmaster, a subsidiary of Live Nation, controls a substantial portion of the global ticketing market. This provides significant pricing power and data access.

- Diverse Revenue Streams: LYV's revenue isn't solely dependent on ticketing. It also generates significant income from venue operations (owning and operating numerous amphitheaters and arenas), artist management, and sponsorship deals. This diversification mitigates risk.

- Global Reach: Live Nation's global presence extends its reach to a massive audience, enabling it to capitalize on diverse musical tastes and geographic markets. This international expansion is a key driver of growth.

- Network Effect: The scale of Live Nation's operations creates a powerful network effect. Artists prefer venues with proven audience reach, and fans gravitate towards platforms with the broadest selection of events. This strengthens the company's position.

- Key Acquisitions: Strategic acquisitions over the years have further cemented Live Nation's dominance and expanded its reach into new markets and segments.

Financial Performance Analysis of LYV

Analyzing Live Nation's financial health is crucial for assessing its investment potential. Key performance indicators (KPIs) offer insights into the company's financial strength and profitability.

- Historical Financial Statements: Reviewing LYV's past financial performance, including revenue growth, operating margin, net income, and cash flow, paints a picture of its historical financial health and stability.

- Key Performance Indicators (KPIs): Analyzing KPIs such as revenue growth rate, operating margin, debt-to-equity ratio, and return on equity provides valuable insights into profitability, efficiency, and financial risk.

- Seasonal Factors: Live Nation's performance is influenced by seasonality, with higher revenues during warmer months and concert seasons. Investors should account for these cyclical fluctuations.

- Macroeconomic Conditions: Broader economic factors, such as consumer spending, inflation, and interest rates, significantly impact ticket sales and overall profitability. Economic downturns may lead to reduced discretionary spending on entertainment.

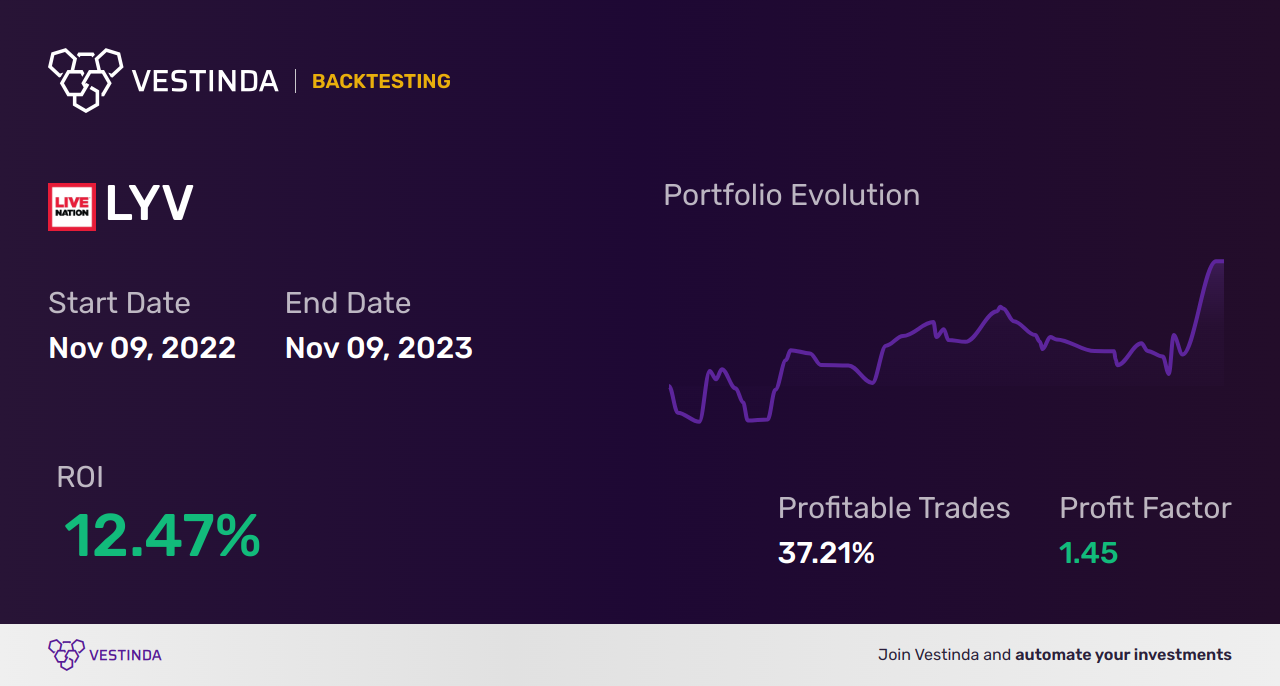

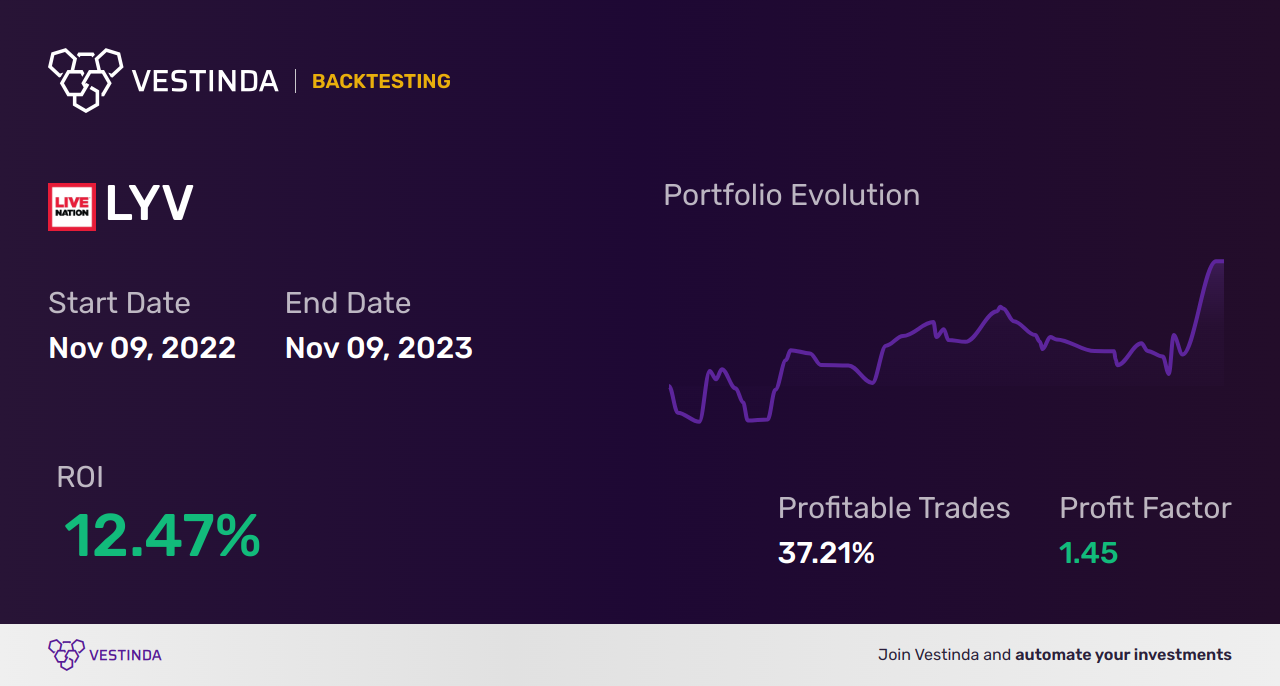

- Visual Representation: Charts and graphs illustrating revenue trends, profitability, and key ratios help visualize the financial performance and make it easier to understand the underlying trends.

Evaluating Investment Strategies for Live Nation Entertainment Stock

Assessing the investment potential of Live Nation Entertainment (LYV) stock requires a careful evaluation of its growth prospects and associated risks.

Long-Term Growth Potential

Live Nation's long-term growth prospects appear promising, driven by several factors:

- International Expansion: Expanding into new international markets presents significant growth opportunities, tapping into untapped audiences and revenue streams.

- Technological Innovation: Investments in new ticketing technologies, digital platforms, and data analytics can enhance efficiency, revenue generation, and customer engagement.

- Market Diversification: Exploring adjacent markets, such as streaming services or merchandise sales, can provide additional revenue streams and reduce reliance on core business segments.

- Demographic Trends: The demand for live music experiences remains strong, especially among younger generations. This demographic trend supports continued growth in the live music industry.

- Strategic Initiatives: Analyzing Live Nation's strategic plans, such as investments in new venues or partnerships with artists, can provide insights into potential future growth.

Risk Assessment for LYV Stock

While promising, investing in Live Nation stock involves inherent risks:

- Economic Downturns: Economic recessions and reduced consumer spending significantly impact discretionary spending on entertainment, directly affecting ticket sales.

- Competition: Smaller players and emerging competitors challenge Live Nation's market dominance, impacting its pricing power and market share.

- Regulatory Scrutiny: Antitrust concerns and regulatory investigations can pose legal and financial risks, especially concerning Ticketmaster's market share.

- Dependence on Large-Scale Events: Live Nation's revenue is concentrated on large-scale events; cancellations due to unforeseen circumstances (pandemics, natural disasters) can significantly impact performance.

- Geopolitical Events: Global instability and geopolitical events can also impact the availability and demand for live music events, influencing revenue and profitability.

Determining the Fair Value of LYV Stock

Multiple valuation methods can help determine the fair value of Live Nation Entertainment stock:

- Discounted Cash Flow (DCF) Analysis: Projecting future cash flows and discounting them back to present value provides an intrinsic value estimate.

- Comparable Company Analysis: Comparing LYV's valuation multiples (e.g., P/E ratio) to those of similar companies in the entertainment industry offers a benchmark.

- Price-to-Earnings (P/E) Ratio Analysis: Analyzing the P/E ratio helps assess whether the stock is trading at a premium or discount relative to its earnings and industry peers.

- Limitations of Valuation Models: Each valuation model has limitations. It's essential to consider multiple approaches and understand the assumptions underlying each model.

- Potential Price Targets: Based on various scenarios and assumptions, a range of potential price targets can be generated, providing a framework for evaluating potential returns.

Live Nation Entertainment (LYV) Stock Outlook and Predictions

The future performance of Live Nation Entertainment stock depends on several interwoven factors.

Analyst Ratings and Price Targets

Financial analysts provide ratings and price targets for LYV stock, offering insights into market sentiment.

- Consensus View: A summary table showing analyst ratings (buy, hold, sell) and their corresponding price targets reveals the overall market sentiment towards LYV.

- Sentiment Changes: Tracking changes in analyst sentiment over time can help identify shifts in market expectations and potential catalysts.

Factors Influencing Future Stock Performance

Several factors influence future stock performance:

- Macroeconomic Conditions: Inflation, interest rates, and consumer confidence significantly impact disposable income and demand for entertainment.

- Industry Trends: Emerging trends in the music industry, such as new genres, technological advancements, and changing consumption patterns, influence LYV's performance.

- Company-Specific Factors: Live Nation's strategic initiatives, operational efficiency, and management effectiveness directly impact its future prospects.

- Significant Announcements: Major announcements regarding acquisitions, partnerships, or new strategies can move the stock price significantly.

Conclusion

Investing in Live Nation Entertainment (LYV) stock presents a unique opportunity within the live entertainment sector. While the company enjoys a strong market position and significant growth potential, investors should carefully consider the inherent risks associated with the industry and broader economic conditions. Our analysis suggests a cautiously optimistic outlook toward LYV, but further due diligence is crucial before making any investment decisions. Thoroughly research the company's financials and consider your personal risk tolerance before investing in Live Nation Entertainment (LYV) stock. Remember to consult with a financial advisor to develop a personalized investment strategy tailored to your goals. Careful consideration of Live Nation Entertainment (LYV) stock's performance indicators and future predictions is essential for informed investment choices.

Featured Posts

-

Does Jinx Die In Arcane A Definitive Answer

May 29, 2025

Does Jinx Die In Arcane A Definitive Answer

May 29, 2025 -

Dueling Paris Rallies Le Pen Faces Off Against Counter Protesters

May 29, 2025

Dueling Paris Rallies Le Pen Faces Off Against Counter Protesters

May 29, 2025 -

Joshlin Smith Trafficking Case Sentencing Date Announced

May 29, 2025

Joshlin Smith Trafficking Case Sentencing Date Announced

May 29, 2025 -

Morgan Wallens Grandmas Heartwarming Nickname Story

May 29, 2025

Morgan Wallens Grandmas Heartwarming Nickname Story

May 29, 2025 -

The Day I Was Fired An Australian Womans Story

May 29, 2025

The Day I Was Fired An Australian Womans Story

May 29, 2025

Latest Posts

-

Sparks Mad Album Review A Deep Dive Into The New Sounds

May 30, 2025

Sparks Mad Album Review A Deep Dive Into The New Sounds

May 30, 2025 -

Friday Forecast Continued Drop For Live Music Stocks

May 30, 2025

Friday Forecast Continued Drop For Live Music Stocks

May 30, 2025 -

Further Losses Predicted For Live Music Stocks On Friday

May 30, 2025

Further Losses Predicted For Live Music Stocks On Friday

May 30, 2025 -

Live Music Stock Slump To Continue Friday

May 30, 2025

Live Music Stock Slump To Continue Friday

May 30, 2025 -

Live Music Stocks Fridays Expected Decline

May 30, 2025

Live Music Stocks Fridays Expected Decline

May 30, 2025