Live Stock Market Updates: Dow Futures, Earnings, And Market Analysis

Table of Contents

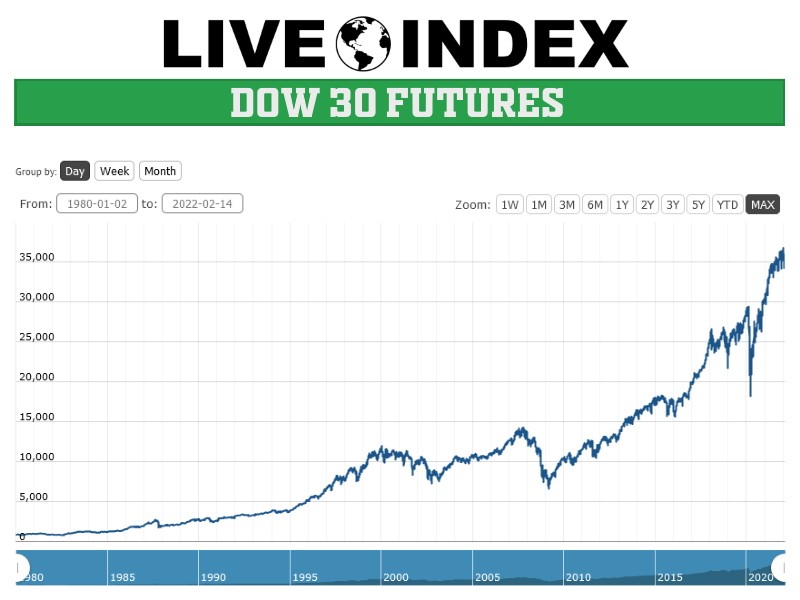

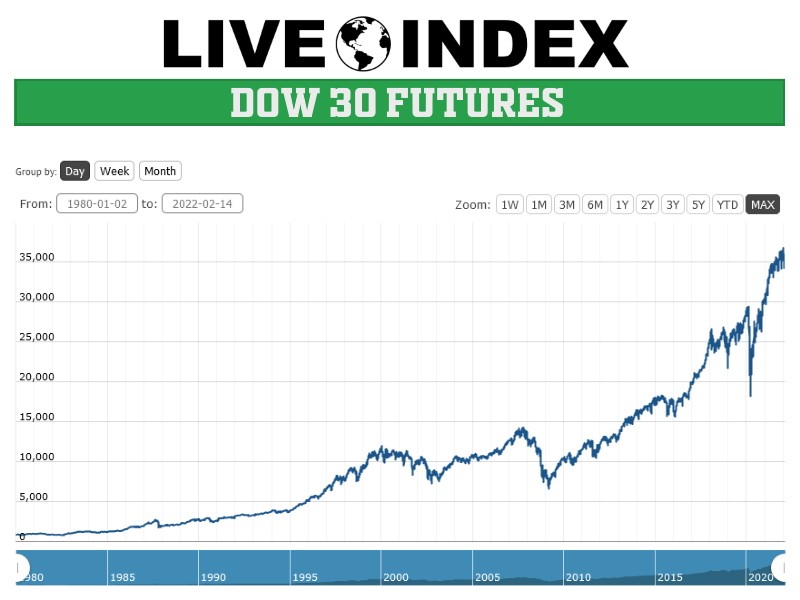

Understanding Dow Futures: A Key Indicator

Dow Futures contracts represent an agreement to buy or sell the Dow Jones Industrial Average (DJIA) at a specific price on a future date. They act as a leading indicator, often reflecting investor sentiment and predicting potential market movements before they actually occur in the cash market. Analyzing Dow Futures data allows investors to anticipate market trends and adjust their strategies accordingly. A significant jump in Dow Futures, for example, might suggest a positive outlook for the broader market, while a sharp decline could signal impending downward pressure.

- Relationship between Dow Futures and the actual Dow Jones Industrial Average: Dow Futures prices generally track the cash price of the DJIA closely, but they can sometimes diverge due to factors like speculation and hedging activities.

- Factors influencing Dow Futures prices: Economic data releases (like GDP, inflation, and employment reports), geopolitical events (wars, trade disputes), and unexpected news all significantly affect Dow Futures prices.

- Using Dow Futures for hedging and speculation: Traders utilize Dow Futures to hedge against potential losses in their stock portfolios or to speculate on future price movements of the DJIA.

Impact of Earnings Reports on Stock Prices

Quarterly earnings reports provide a crucial snapshot of a company's financial health and performance. These reports reveal key metrics that significantly influence investor perception and, subsequently, stock prices. Positive earnings surprises – where a company surpasses analysts' expectations – often lead to a surge in the stock price. Conversely, negative surprises can trigger significant price drops.

- Key metrics to focus on in earnings reports: Earnings Per Share (EPS), revenue growth, profit margins, and future guidance are critical metrics to analyze.

- Interpreting earnings calls and conference transcripts: Listening to earnings calls and reading transcripts offers valuable insights into management's outlook, strategy, and challenges.

- Identifying potential investment opportunities based on earnings reports: By carefully analyzing earnings reports, investors can identify undervalued companies poised for growth or companies facing challenges requiring further investigation.

Comprehensive Market Analysis: Techniques and Tools

Effective market analysis involves employing various techniques and tools to understand market trends and identify potential investment opportunities. Fundamental analysis focuses on evaluating a company's intrinsic value based on its financial statements and economic factors. Technical analysis, on the other hand, uses historical price and volume data to predict future price movements.

- Advantages and disadvantages of fundamental vs. technical analysis: Fundamental analysis provides a long-term perspective, while technical analysis focuses on short-to-medium-term trends. Both have their strengths and weaknesses and are often used in conjunction.

- Essential tools for market analysis: Platforms like Bloomberg Terminal, TradingView, and various financial news websites offer charting tools, real-time data, and analytical resources.

- Importance of diversifying investment portfolio based on market analysis: Market analysis helps investors construct diversified portfolios that align with their risk tolerance and financial goals.

Harnessing Live Stock Market Updates for Success

Staying informed about live stock market updates, particularly regarding Dow Futures, earnings reports, and market analysis, is paramount for successful investing. By understanding these elements and using the appropriate tools, investors can make more informed decisions, mitigate risks, and potentially enhance their returns. Regularly monitoring Dow Futures provides insights into market sentiment, while analyzing earnings reports helps evaluate individual company performance. Mastering market analysis techniques empowers you to identify opportunities and build a robust investment strategy.

Stay informed with our daily live stock market updates and improve your investment decisions with regular access to live stock market analysis. [Link to a relevant resource, e.g., a subscription service or further reading].

Featured Posts

-

Xrp Price Surge 400 In 3 Months Is It Time To Buy

May 01, 2025

Xrp Price Surge 400 In 3 Months Is It Time To Buy

May 01, 2025 -

Foodie Adventures Await Your Next Windstar Cruise

May 01, 2025

Foodie Adventures Await Your Next Windstar Cruise

May 01, 2025 -

Six Nations Takeaways Frances Victory And Lions Squad Selection

May 01, 2025

Six Nations Takeaways Frances Victory And Lions Squad Selection

May 01, 2025 -

Capital Breakfast Reveals Remember Mondays Eurovision 2025 Song

May 01, 2025

Capital Breakfast Reveals Remember Mondays Eurovision 2025 Song

May 01, 2025 -

Kyf Yezz Alteawn Slslth Almmyzt Fy Mwajht Alshbab

May 01, 2025

Kyf Yezz Alteawn Slslth Almmyzt Fy Mwajht Alshbab

May 01, 2025