Long-Term Outlook Positive: Berkshire's Stake In Japanese Trading Houses

Table of Contents

Why Did Berkshire Invest in Japanese Trading Houses?

Berkshire Hathaway's investment in five major Japanese trading houses – Itochu, Mitsubishi, Mitsui & Co., Sumitomo, and Marubeni – represents a significant departure from its traditional investment style, yet aligns perfectly with its long-term value investing philosophy.

Undervalued Assets and Growth Potential

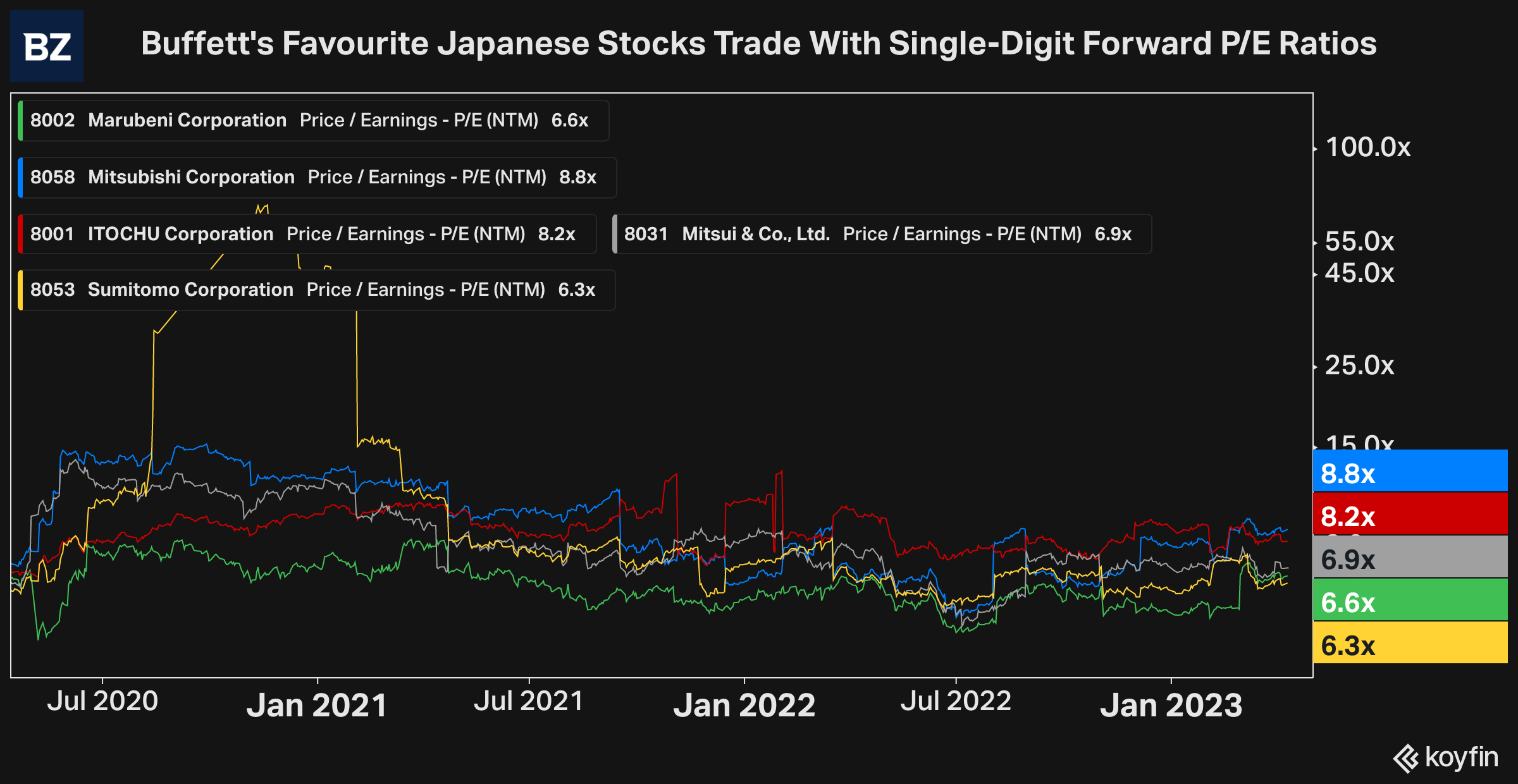

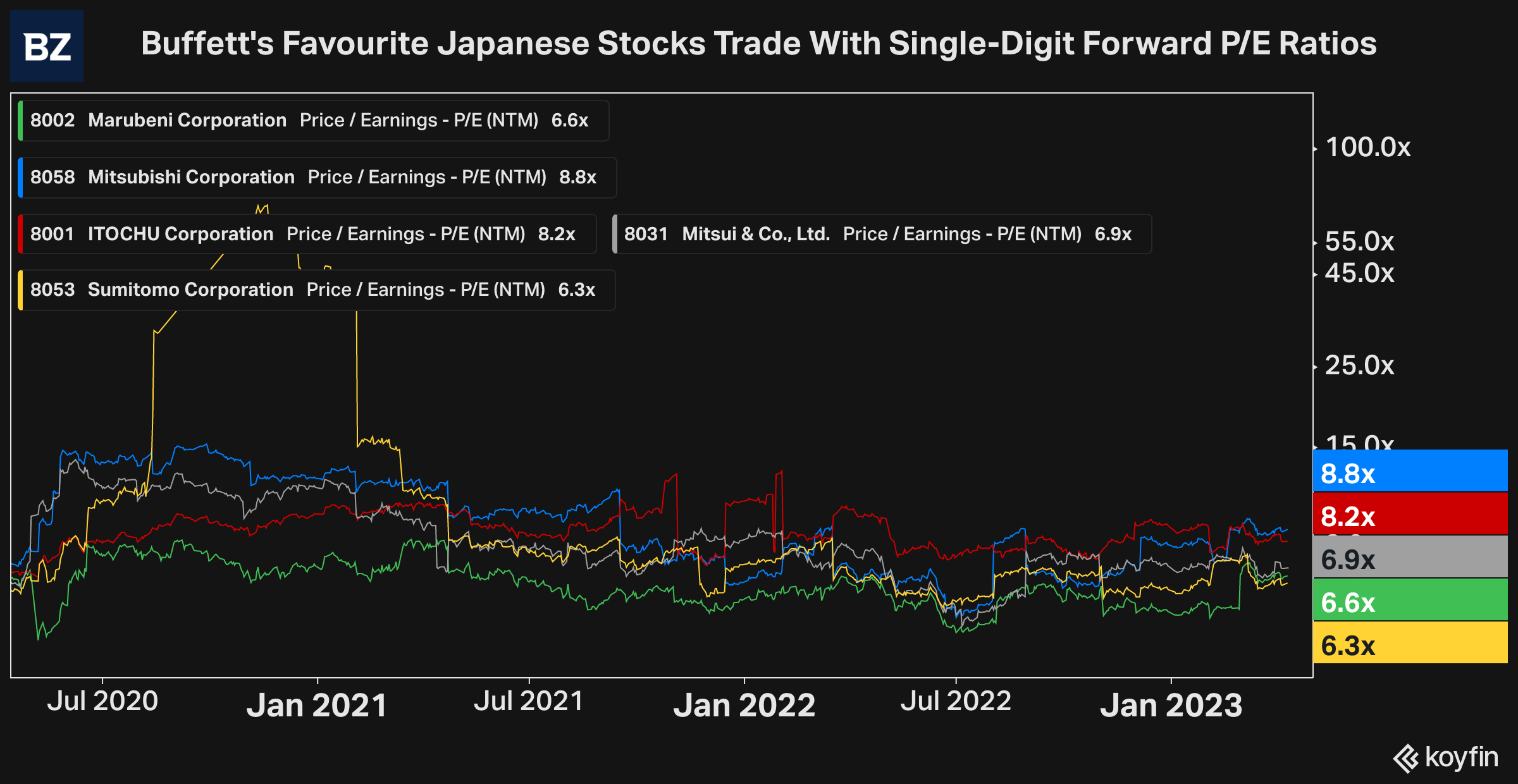

A primary driver behind this investment is the perceived undervaluation of these trading houses. These companies, often overlooked by Western investors, possess substantial assets and significant growth potential, particularly within the Japanese and increasingly the global markets.

- Itochu Corporation: A diversified conglomerate with strengths in the energy, machinery, and food sectors.

- Mitsubishi Corporation: A global leader in various industries including energy, metals, and chemicals.

- Mitsui & Co.: Another diversified giant with a strong presence in resources, infrastructure, and consumer goods.

- Sumitomo Corporation: Known for its expertise in metals, machinery, and infrastructure development.

- Marubeni Corporation: A key player in the energy, food, and textile industries.

These trading houses operate in several high-growth sectors including renewable energy, infrastructure development, and technology, positioning them for significant future expansion. Their relatively low Price-to-Earnings (P/E) ratios compared to their Western counterparts further support the undervaluation thesis. The market capitalization of these companies, while substantial, is believed to not fully reflect their underlying asset values and future earning potential.

Long-Term Investment Strategy

Warren Buffett's philosophy centers on long-term value investing, focusing on companies with strong fundamentals and sustainable competitive advantages. The Japanese market, known for its relative stability and long-term oriented business culture, aligns perfectly with this strategy. Berkshire's passive, long-term approach minimizes the impact of short-term market volatility, allowing the underlying value of the investment to appreciate over time. This investment showcases a belief in the resilient and undervalued nature of these Japanese trading houses for the long haul.

Strategic Partnerships and Synergies

Beyond the inherent value of the investments, there's potential for synergistic partnerships between Berkshire Hathaway and these Japanese trading houses. Berkshire's vast network and expertise in various industries could create mutually beneficial collaborations. These synergies might involve joint ventures, shared resources, or access to new markets, further enhancing the return on investment. While specific plans haven't been publicly disclosed, the potential for such collaborations adds another layer to the long-term appeal of Berkshire's stake in Japanese trading houses.

Analyzing the Risks and Potential Returns

While the long-term outlook for Berkshire's investment appears positive, it's crucial to acknowledge potential risks:

Geopolitical Risks

- Global economic slowdown: A worldwide recession could negatively impact the trading houses' performance.

- Trade wars and protectionism: Increased trade barriers could disrupt global supply chains and reduce profitability.

- Regional instability: Geopolitical tensions in Asia could impact business operations and investor sentiment.

Currency Fluctuations

Fluctuations in the Yen-US dollar exchange rate will directly impact the value of Berkshire's investment in Japanese trading houses. A weakening Yen against the dollar would reduce the value of the investment in US dollar terms, while a strengthening Yen would have the opposite effect.

Market Volatility

The Japanese stock market, while generally less volatile than some others, is still subject to fluctuations. Significant market downturns could temporarily depress the value of Berkshire's investment.

Potential for High Returns

Despite these risks, the potential for substantial returns remains significant. The long-term growth prospects of the Japanese trading houses, combined with Berkshire's proven ability to identify and capitalize on undervalued assets, suggest a strong likelihood of substantial returns over the long term. The steady, long-term growth potential of the Japanese market, especially in sectors where these trading houses operate, is a key driver for high potential returns.

The Broader Implications for Berkshire Hathaway and the Japanese Market

Berkshire Hathaway's investment holds significant implications for both the company and the Japanese market.

Increased Global Presence

This investment significantly expands Berkshire's global footprint, providing a strong foothold in the strategically important Japanese market. This diversification reduces reliance on the US market and opens doors to new investment opportunities in Asia.

Impact on Japanese Market Sentiment

Berkshire's investment has boosted investor confidence in the Japanese market, signaling to global investors the potential for strong returns in Japan. This could attract further foreign investment, stimulating economic growth.

Future Investment Opportunities

Berkshire's presence in Japan could pave the way for future investments in related sectors or companies. This could include further investments in Japanese infrastructure, technology, and renewable energy companies.

Conclusion: A Positive Long-Term Outlook for Berkshire's Stake in Japanese Trading Houses

Berkshire's stake in Japanese trading houses represents a strategic move with potentially high returns. While geopolitical risks and market volatility exist, the undervaluation of these companies, their growth potential, and Berkshire's long-term investment strategy paint a picture of substantial long-term gains. The investment enhances Berkshire's global presence, boosts Japanese market sentiment, and opens doors to future opportunities. Learn more about the potential of Berkshire's stake in Japanese trading houses and the implications for long-term investors by following our blog for further updates and analysis.

Featured Posts

-

Supermans Struggle Sneak Peek Highlights Kryptos Aggression

May 08, 2025

Supermans Struggle Sneak Peek Highlights Kryptos Aggression

May 08, 2025 -

Sudden Bitcoin Spike Trump Crypto Advisor Weighs In

May 08, 2025

Sudden Bitcoin Spike Trump Crypto Advisor Weighs In

May 08, 2025 -

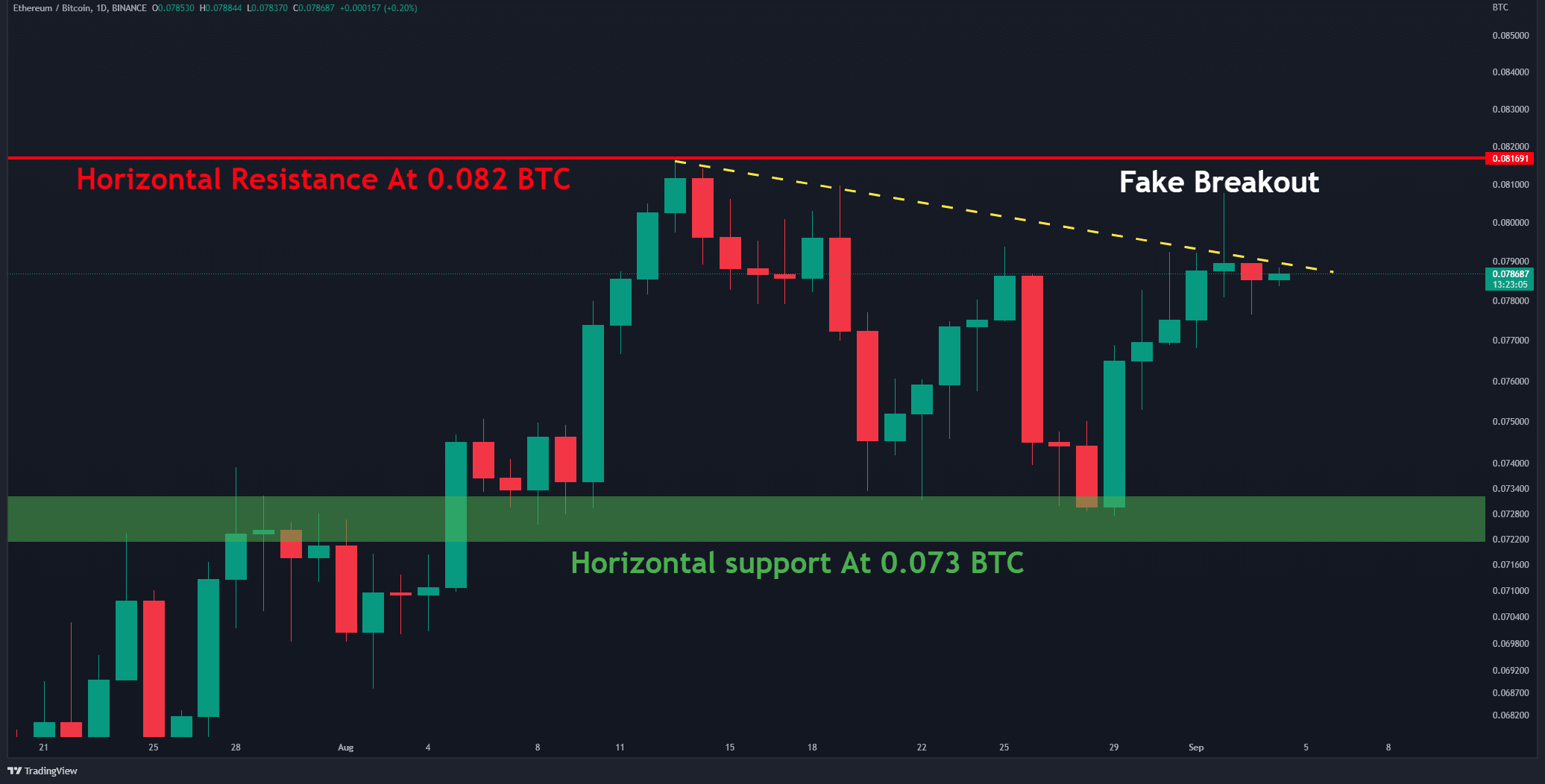

Is Ethereums Price Rally Sustainable Bulls Eye Further Gains

May 08, 2025

Is Ethereums Price Rally Sustainable Bulls Eye Further Gains

May 08, 2025 -

Rogue 2 Preview Ka Zars Fight For Survival In The Savage Land

May 08, 2025

Rogue 2 Preview Ka Zars Fight For Survival In The Savage Land

May 08, 2025 -

Andor Season 2 Delayed Trailer Ignites Fan Speculation And Anxiety

May 08, 2025

Andor Season 2 Delayed Trailer Ignites Fan Speculation And Anxiety

May 08, 2025