LVMH Stock Drops After Missing Q1 Sales Targets

Table of Contents

Q1 Sales Figures and Market Expectations

LVMH reported Q1 sales figures [Insert Actual Q1 Sales Figures Here], significantly lower than the analyst consensus forecast of [Insert Analyst Forecast Here]. This represents a [Insert Percentage Difference]% shortfall, a substantial deviation that immediately impacted investor sentiment and the LVMH stock price.

- Specific brand performance: While Louis Vuitton continues to be a strong performer, [Insert Specific Sales Data for Louis Vuitton], Dior's performance was less robust, showing [Insert Specific Sales Data for Dior]. Other brands within the LVMH portfolio also experienced varying degrees of success.

- Regional breakdown: Asia, typically a key growth driver for LVMH, showed [Insert Sales Data and Analysis for Asia]. Europe registered [Insert Sales Data and Analysis for Europe], while North America saw [Insert Sales Data and Analysis for North America]. These regional differences highlight the impact of varying economic conditions and consumer behavior patterns.

- Significant surprises: [Mention any unexpected positive or negative surprises in specific product categories or regions].

Factors Contributing to the Sales Miss

Several factors contributed to LVMH's disappointing Q1 performance. The current macroeconomic environment plays a crucial role.

- Inflation and interest rates: Rising inflation and interest rates are impacting consumer spending, particularly in the luxury goods sector, where discretionary purchases are most vulnerable. Consumers are becoming more cautious, leading to reduced demand for high-end products.

- Supply chain disruptions: Although less impactful than in previous years, lingering supply chain issues and logistical challenges may have contributed to some delays and reduced availability of certain products.

- Changing consumer behavior: A shift in consumer preferences towards experiences over material goods, coupled with a growing focus on sustainability, might be affecting the demand for certain LVMH products.

- Intense competition: The luxury goods market is fiercely competitive. The success of competitors like Kering and Richemont puts pressure on LVMH to maintain its market share and innovate consistently.

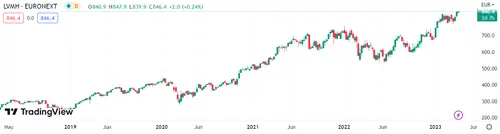

Stock Market Reaction and Investor Sentiment

The announcement of the disappointing Q1 sales figures immediately triggered a drop in LVMH stock price.

- Stock price impact: LVMH's stock price fell by [Insert Percentage Change]% following the release of the Q1 sales data.

- Trading volume: Trading volume significantly increased compared to previous periods, indicating heightened investor activity and concern.

- Analyst reactions: Analysts expressed varied opinions, with some lowering their target price for LVMH stock while others maintained a more optimistic outlook, citing the brand's long-term strength and resilience. [Include quotes from key analysts if available].

- Updated target prices: Several financial institutions have revised their target prices for LVMH stock, reflecting the uncertainty surrounding the company's future performance. [Mention specific examples].

Impact on the Broader Luxury Goods Sector

LVMH's underperformance raises questions about the overall health of the luxury goods market.

- Comparison with competitors: The performance of other major luxury conglomerates like Kering (owner of Gucci and Yves Saint Laurent) and Richemont (owner of Cartier and Van Cleef & Arpels) should be analyzed to determine whether this is an isolated incident or a broader trend. [Insert comparison data and analysis].

- Future market predictions: The current economic climate presents challenges for the entire luxury sector. The LVMH sales figures signal potential headwinds for the luxury goods market in the coming quarters.

- Implications for consumers: While high-net-worth individuals may continue to purchase luxury goods, the broader luxury consumer base might show greater price sensitivity in the current economic environment.

Conclusion

LVMH's unexpected Q1 sales miss and subsequent stock drop highlight the challenges facing the luxury goods sector. Factors such as inflation, changing consumer behavior, and intense competition all played a role. While LVMH remains a powerful brand with a strong portfolio, the current situation warrants close monitoring. The impact on the broader luxury market remains to be seen. It’s crucial for investors to closely observe the coming quarters to understand the long-term implications for LVMH stock and the luxury goods sector as a whole. Stay informed about the evolving situation with LVMH and the luxury goods market. Follow our website for the latest updates on LVMH stock, its performance and analysis of future market trends affecting LVMH sales and its overall stock price. Continue to monitor the LVMH stock performance closely for insights into the future of this iconic luxury brand.

Featured Posts

-

Successful Agm For Imcd N V Shareholders Approve All Proposals

May 24, 2025

Successful Agm For Imcd N V Shareholders Approve All Proposals

May 24, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc A Comprehensive Guide To Net Asset Value

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc A Comprehensive Guide To Net Asset Value

May 24, 2025 -

M56 Closed Serious Crash Causes Major Traffic Disruption Live M56 Traffic Updates

May 24, 2025

M56 Closed Serious Crash Causes Major Traffic Disruption Live M56 Traffic Updates

May 24, 2025 -

The Annie Kilner Kyle Walker Situation A Breakdown Of Recent Events And Allegations

May 24, 2025

The Annie Kilner Kyle Walker Situation A Breakdown Of Recent Events And Allegations

May 24, 2025 -

Euronext Amsterdam Stocks Jump 8 Following Trumps Tariff Decision

May 24, 2025

Euronext Amsterdam Stocks Jump 8 Following Trumps Tariff Decision

May 24, 2025

Latest Posts

-

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025 -

Past Florida Film Festival Guests Mia Farrow Christina Ricci And Other Notable Stars

May 24, 2025

Past Florida Film Festival Guests Mia Farrow Christina Ricci And Other Notable Stars

May 24, 2025 -

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025 -

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025 -

Sadie Sink And Mia Farrow A Broadway Encounter Image 5162787

May 24, 2025

Sadie Sink And Mia Farrow A Broadway Encounter Image 5162787

May 24, 2025