LVMH's Q1 Results Send Shares Down 8.2%

Table of Contents

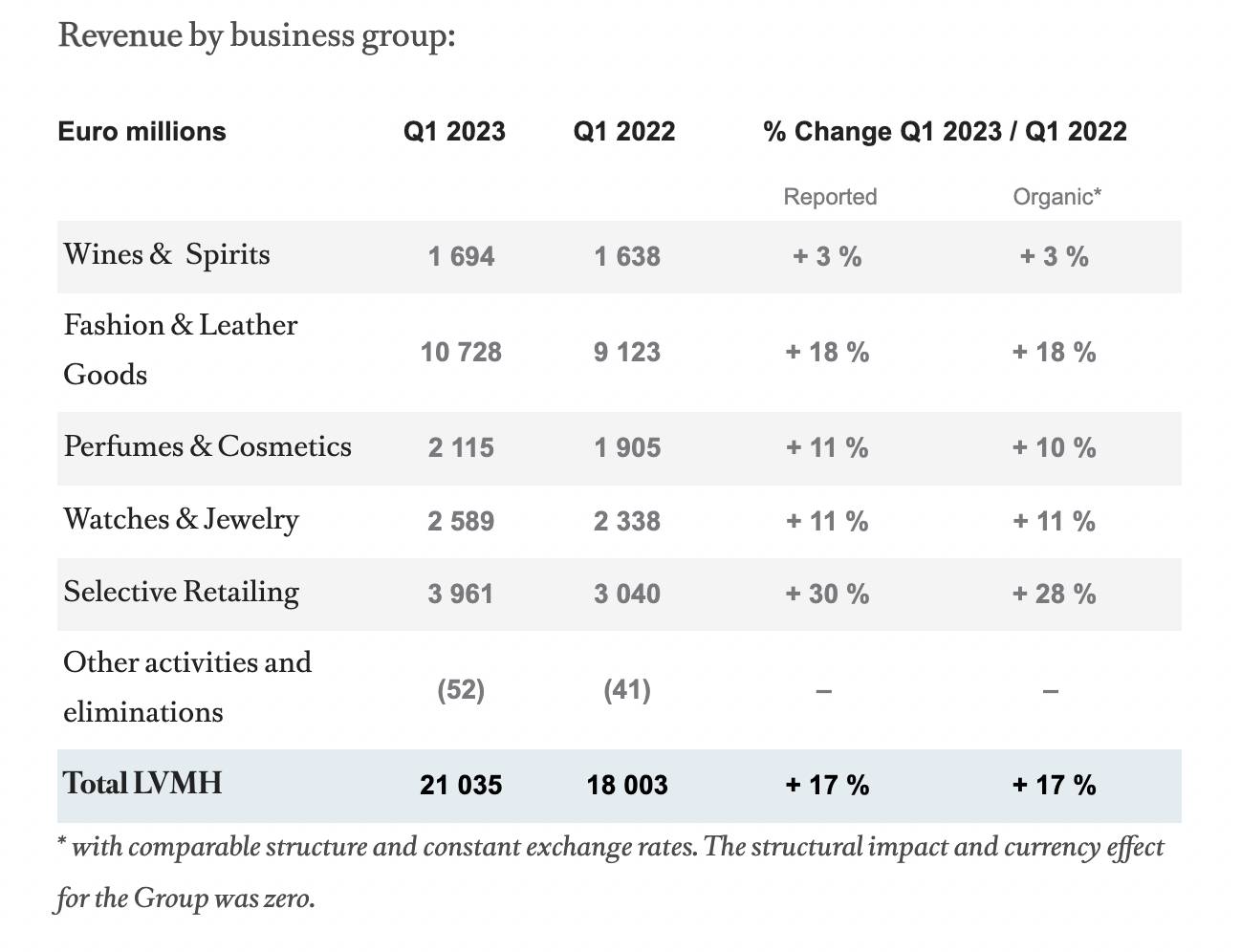

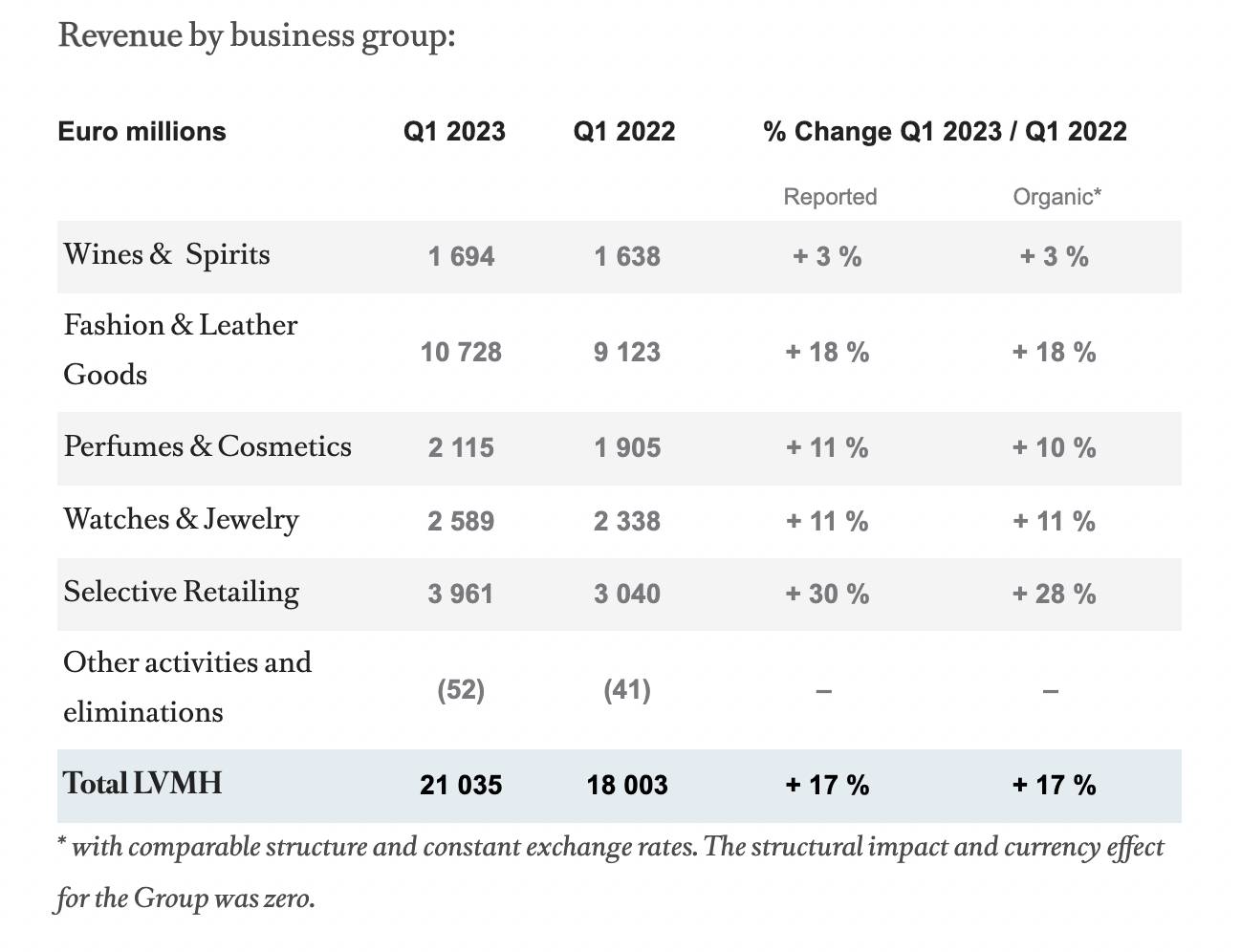

Key Figures from LVMH's Q1 2024 Earnings Report

LVMH's Q1 2024 earnings report revealed a more complex picture than the headline-grabbing share price drop initially suggested. While the overall financial performance fell short of expectations, a deeper dive into the numbers provides crucial context. Let's examine the key financial metrics:

- Revenue Growth: LVMH reported a revenue decline of [Insert Percentage]% compared to Q1 2023, significantly lower than the projected growth of [Insert Percentage] by analysts. This represents a considerable miss and fueled investor concern.

- Profit Margin Changes: Operating profit margins experienced a [Insert Percentage]% decrease, highlighting the pressure on profitability despite attempts to maintain pricing power.

- Earnings Per Share (EPS): EPS fell to [Insert Number], below the anticipated [Insert Number] and marking a substantial decrease compared to the previous year's [Insert Number].

- Comparison to Analyst Expectations: The overall results significantly missed analyst consensus expectations, contributing to the negative market reaction and the subsequent share price decline.

- Specific Financial Data for Key Brands: While Louis Vuitton maintained relatively strong performance, other brands within the LVMH portfolio, like [mention specific underperforming brand(s) and their performance], experienced more pronounced declines, indicating a diversified but uneven impact across the group's luxury offerings.

Factors Contributing to the Decline in LVMH's Share Price

The 8.2% drop in LVMH's share price wasn't solely attributable to internal factors. A confluence of macroeconomic headwinds and industry-specific challenges played a significant role:

- Slowdown in Chinese Consumer Spending: A notable slowdown in Chinese consumer spending, a key driver of luxury goods sales, significantly impacted LVMH's revenue. The reduced purchasing power of Chinese consumers, both domestically and internationally, contributed to lower than expected sales figures.

- Impact of Inflation and Rising Interest Rates: Global inflation and rising interest rates have dampened consumer sentiment, leading to reduced discretionary spending, including luxury purchases. This macroeconomic pressure impacted demand across various LVMH brands.

- Geopolitical Uncertainties: The ongoing geopolitical uncertainties, including the war in Ukraine and various trade tensions, created an atmosphere of economic instability, further affecting consumer confidence and impacting luxury goods sales.

- Supply Chain Disruptions: While not a major factor in this specific quarter, lingering supply chain disruptions from previous periods could have contributed to increased costs and limited the company's ability to fully meet demand.

- Changes in Consumer Preferences: Evolving consumer preferences and the rise of more sustainable and ethical brands may also have played a minor role in influencing demand for some of LVMH's products.

Performance of Individual LVMH Brands

The performance of individual LVMH brands painted a mixed picture, highlighting the varied impact of the aforementioned factors across the portfolio.

- Strong Performers: Louis Vuitton, despite the overall downturn, remains a strong performer, showcasing its resilience in the luxury market. Its consistent brand recognition and strong global presence helped mitigate some of the negative impacts.

- Underperforming Brands: [Mention specific underperforming brands and their reasons for struggle, e.g., "Sephora experienced a decline due to increased competition in the beauty retail sector"]. This highlights the need for brand-specific strategies to address individual challenges.

- Regional Variations: Performance varied significantly across different regions. While certain markets showed resilience, others, particularly in Asia, experienced more pronounced slowdowns.

- Marketing Strategy Effectiveness: The effectiveness of marketing strategies for individual brands needs further scrutiny. While some brands successfully adapted to changing consumer preferences, others may require revised strategies to regain lost momentum.

Market Reaction and Investor Sentiment

The market reacted swiftly and negatively to LVMH's Q1 results. The 8.2% share price drop reflects a considerable loss of investor confidence.

- Immediate Impact on Share Price and Trading Volume: The immediate impact was a sharp decline in the share price and increased trading volume, indicating significant investor activity triggered by the disappointing earnings report.

- Analyst Ratings and Recommendations: Many analysts downgraded their ratings and price targets for LVMH shares following the release of the Q1 report, further contributing to the negative sentiment.

- Investor Commentary and Predictions: Investor commentary expressed concerns about the sustainability of luxury goods growth in the current economic climate and the potential for further declines in future quarters.

- Comparison to Competitors: A comparison with the performance of other luxury goods companies will provide valuable insights into the sector's overall health and identify if the LVMH decline is an industry-wide trend or specific to the company.

Conclusion

LVMH's Q1 2024 results revealed a significant decline, marked by an 8.2% share price drop. This downturn stems from a combination of factors, including a slowdown in Chinese consumer spending, the impact of inflation and rising interest rates, geopolitical uncertainties, and varied performances across individual brands. The market reacted negatively, reflecting concerns about the company's future performance and the overall health of the luxury sector.

Call to Action: Understanding the intricacies of LVMH's Q1 results is crucial for investors and industry observers alike. Stay informed about the evolving situation with LVMH and the luxury goods market by monitoring future LVMH financial reports and market analysis for further insights into the company's performance and recovery strategies. Continue to follow future updates on LVMH's Q1 results and their impact on the broader luxury goods market for a comprehensive understanding of this significant event.

Featured Posts

-

Porsche 956 Nin Tavani Neden Asili Sergi Tasariminin Arkasindaki Sebepler

May 24, 2025

Porsche 956 Nin Tavani Neden Asili Sergi Tasariminin Arkasindaki Sebepler

May 24, 2025 -

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 24, 2025

Despite Apple Price Target Cut Wedbush Remains Bullish Should You

May 24, 2025 -

The Future Of Berkshire Hathaways Apple Investment A Post Buffett Analysis

May 24, 2025

The Future Of Berkshire Hathaways Apple Investment A Post Buffett Analysis

May 24, 2025 -

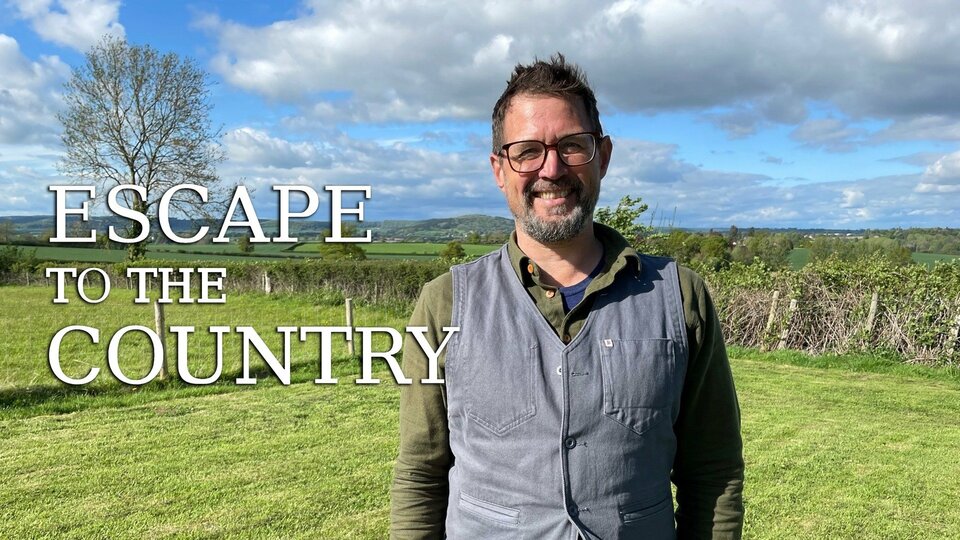

Escape To The Country Your Guide To A Peaceful Retreat

May 24, 2025

Escape To The Country Your Guide To A Peaceful Retreat

May 24, 2025 -

Explore The 2025 Porsche Cayenne High Resolution Interior And Exterior Images

May 24, 2025

Explore The 2025 Porsche Cayenne High Resolution Interior And Exterior Images

May 24, 2025

Latest Posts

-

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025 -

Sadie Sink And Mia Farrow A Broadway Encounter Image 5162787

May 24, 2025

Sadie Sink And Mia Farrow A Broadway Encounter Image 5162787

May 24, 2025 -

Mia Farrow And Christina Ricci At The Florida Film Festival

May 24, 2025

Mia Farrow And Christina Ricci At The Florida Film Festival

May 24, 2025 -

Broadways Photo 5162787 Mia Farrow Supports Fellow Nominee Sadie Sink

May 24, 2025

Broadways Photo 5162787 Mia Farrow Supports Fellow Nominee Sadie Sink

May 24, 2025 -

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025

Mia Farrow On Trumps Address A 3 4 Month Deadline For American Democracy

May 24, 2025