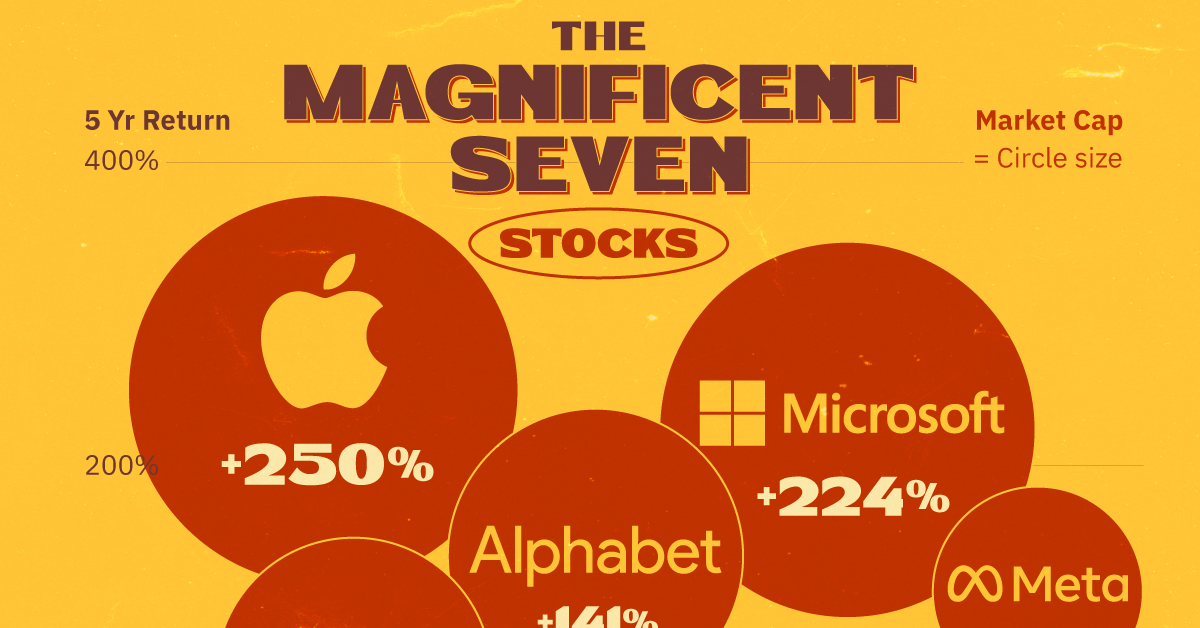

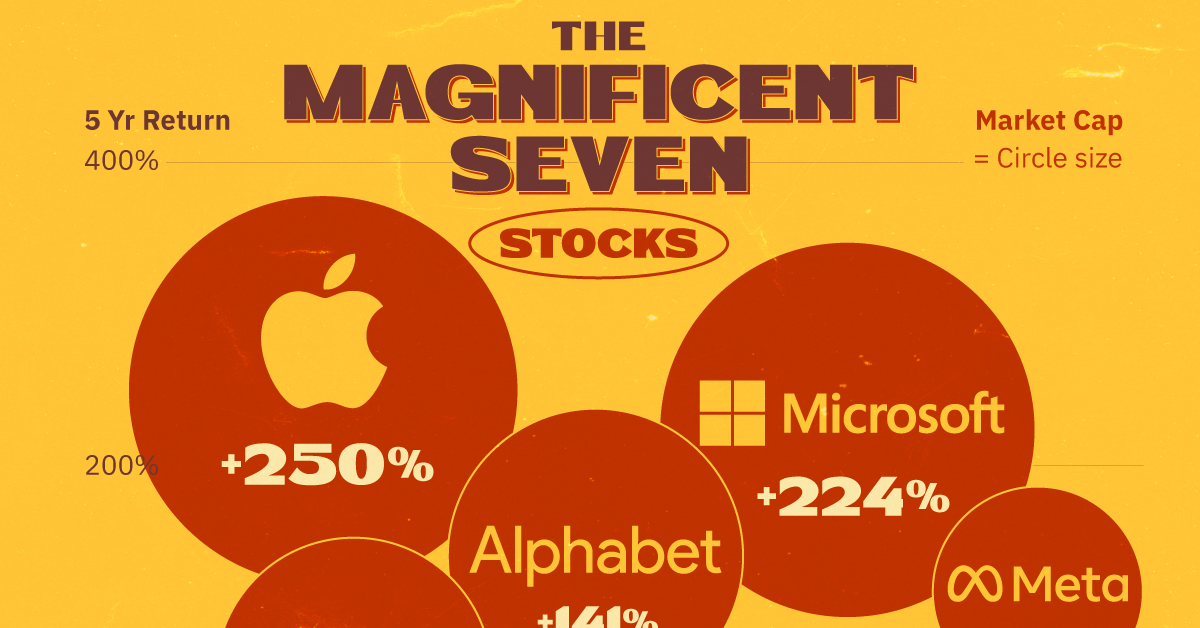

Magnificent Seven Stocks: $2.5 Trillion In Lost Market Value This Year

Table of Contents

The Role of Rising Interest Rates in the Magnificent Seven's Decline

Higher interest rates significantly impact the valuation of growth stocks, like those in the Magnificent Seven. These companies often rely on future earnings projections to justify their current high valuations. Rising interest rates increase the discount rate used in discounted cash flow (DCF) models, a common valuation method for growth stocks. This higher discount rate reduces the present value of future earnings, leading to lower valuations.

- Increased borrowing costs for tech companies: Higher interest rates make it more expensive for tech companies to borrow money for expansion, research and development, and acquisitions.

- Reduced investor appetite for high-growth, high-valuation stocks: Investors often shift their focus to more conservative investments with higher yields when interest rates rise. Growth stocks, typically characterized by high valuations and lower current profitability, become less attractive.

- Shift towards more conservative investments with higher yields: Bonds and other fixed-income securities become more appealing alternatives as their yields increase with rising interest rates, drawing capital away from riskier growth stocks.

Inflation's Impact on Consumer Spending and Tech Demand

Inflation's relentless march has significantly impacted consumer spending and, consequently, the demand for tech products and services. As prices rise, consumers tend to cut back on discretionary spending, including purchases of non-essential tech gadgets and subscriptions. This directly impacts the revenue streams of the Magnificent Seven.

- Decreased consumer discretionary spending: Inflation erodes purchasing power, forcing consumers to prioritize essential goods and services over luxury items like new smartphones or premium subscriptions.

- Reduced demand for non-essential tech products: Sales of non-essential tech products, such as smartwatches, gaming consoles, and high-end laptops, are particularly vulnerable during periods of high inflation.

- Impact on advertising revenue for companies like Alphabet and Meta: Reduced consumer spending also translates to lower advertising budgets for businesses, impacting the revenue of companies heavily reliant on advertising, such as Alphabet and Meta.

Geopolitical Uncertainty and Supply Chain Disruptions

Geopolitical instability, exemplified by the ongoing war in Ukraine, contributes significantly to market volatility. This uncertainty affects investor confidence, leading to sell-offs in riskier assets, including tech stocks. Furthermore, supply chain disruptions caused by geopolitical events and other factors impact the production and distribution of tech products, affecting profitability and growth projections.

- Increased uncertainty affecting investor confidence: Geopolitical events create a climate of uncertainty, leading to risk aversion and capital flight from volatile markets.

- Disruptions to manufacturing and distribution networks: Supply chain bottlenecks hinder the production and delivery of tech components and finished products, impacting the profitability of tech companies.

- Impact on component availability and production costs: Shortages of crucial components, coupled with increased transportation costs, drive up production expenses and squeeze profit margins.

Overvaluation Concerns and Market Corrections

Before the recent decline, concerns about overvaluation in the tech sector were prevalent. Many Magnificent Seven stocks traded at high price-to-earnings (P/E) ratios, suggesting potential overpricing relative to their earnings. Market corrections are a natural part of the market cycle. Periods of rapid growth often lead to speculative investment and the formation of bubbles, followed by a necessary correction to reflect more realistic valuations.

- High price-to-earnings ratios (P/E) before the decline: Many tech stocks were trading at significantly higher P/E ratios than their historical averages before the market downturn.

- Speculative investment and the resulting bubble: Excessive speculation and FOMO (fear of missing out) drove up the prices of some tech stocks beyond their intrinsic value.

- The natural correction process of the market: Market corrections are healthy mechanisms that adjust valuations based on fundamental factors and investor sentiment.

Individual Stock Performance Analysis Within the Magnificent Seven

Analyzing individual stock performance reveals unique factors affecting each company. While the overall market downturn impacted all seven, individual circumstances played a role:

- Apple: Concerns regarding slowing iPhone sales and increased competition impacted Apple's stock.

- Microsoft: Microsoft’s cloud business, Azure, continues to grow, providing some resilience against the market downturn.

- Alphabet: Reduced advertising revenue and antitrust concerns weighed on Alphabet's stock price.

- Amazon: Slowing e-commerce growth and increased operating costs affected Amazon's valuation.

- Nvidia: Demand for Nvidia's high-end graphics processing units (GPUs) remained strong, partially mitigating the overall market decline.

- Meta: Decreased advertising revenue and increased competition from TikTok heavily impacted Meta’s performance.

- Tesla: Production challenges, supply chain disruptions, and CEO Elon Musk's actions significantly influenced Tesla's stock price volatility.

Conclusion: Navigating the Future of the Magnificent Seven Stocks

The $2.5 trillion market value loss suffered by the Magnificent Seven highlights the impact of rising interest rates, inflation, geopolitical uncertainty, and potential overvaluation. While the future performance of these tech giants remains uncertain given the ongoing economic headwinds, understanding these factors is crucial. A cautious outlook is warranted, and continued monitoring of macroeconomic conditions, industry trends, and individual company performance is vital. Understanding the factors driving the decline of the Magnificent Seven stocks is crucial for informed investment decisions. Continue your research and make well-informed choices regarding your portfolio's exposure to these tech giants and other related investments.

Featured Posts

-

Exclusive Huawei Develops Advanced Ai Chip To Rival Nvidia

Apr 29, 2025

Exclusive Huawei Develops Advanced Ai Chip To Rival Nvidia

Apr 29, 2025 -

Trauerbeflaggung An Deutschen Ministerien Papst Tod

Apr 29, 2025

Trauerbeflaggung An Deutschen Ministerien Papst Tod

Apr 29, 2025 -

From Bathroom Reads To Broadcast Ais Role In Podcast Creation From Repetitive Texts

Apr 29, 2025

From Bathroom Reads To Broadcast Ais Role In Podcast Creation From Repetitive Texts

Apr 29, 2025 -

The Fight Within The Gop Trumps Tax Bill Under Threat

Apr 29, 2025

The Fight Within The Gop Trumps Tax Bill Under Threat

Apr 29, 2025 -

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 29, 2025

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 29, 2025

Latest Posts

-

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025 -

Willie Nelsons Life A Collection Of Fast Facts

Apr 29, 2025

Willie Nelsons Life A Collection Of Fast Facts

Apr 29, 2025 -

Quick Facts About Willie Nelsons Life And Career

Apr 29, 2025

Quick Facts About Willie Nelsons Life And Career

Apr 29, 2025 -

Listen Now Willie Nelsons 154th Album Oh What A Beautiful World

Apr 29, 2025

Listen Now Willie Nelsons 154th Album Oh What A Beautiful World

Apr 29, 2025 -

Examining The Post Debt Sale Financials Of Elon Musks X

Apr 29, 2025

Examining The Post Debt Sale Financials Of Elon Musks X

Apr 29, 2025