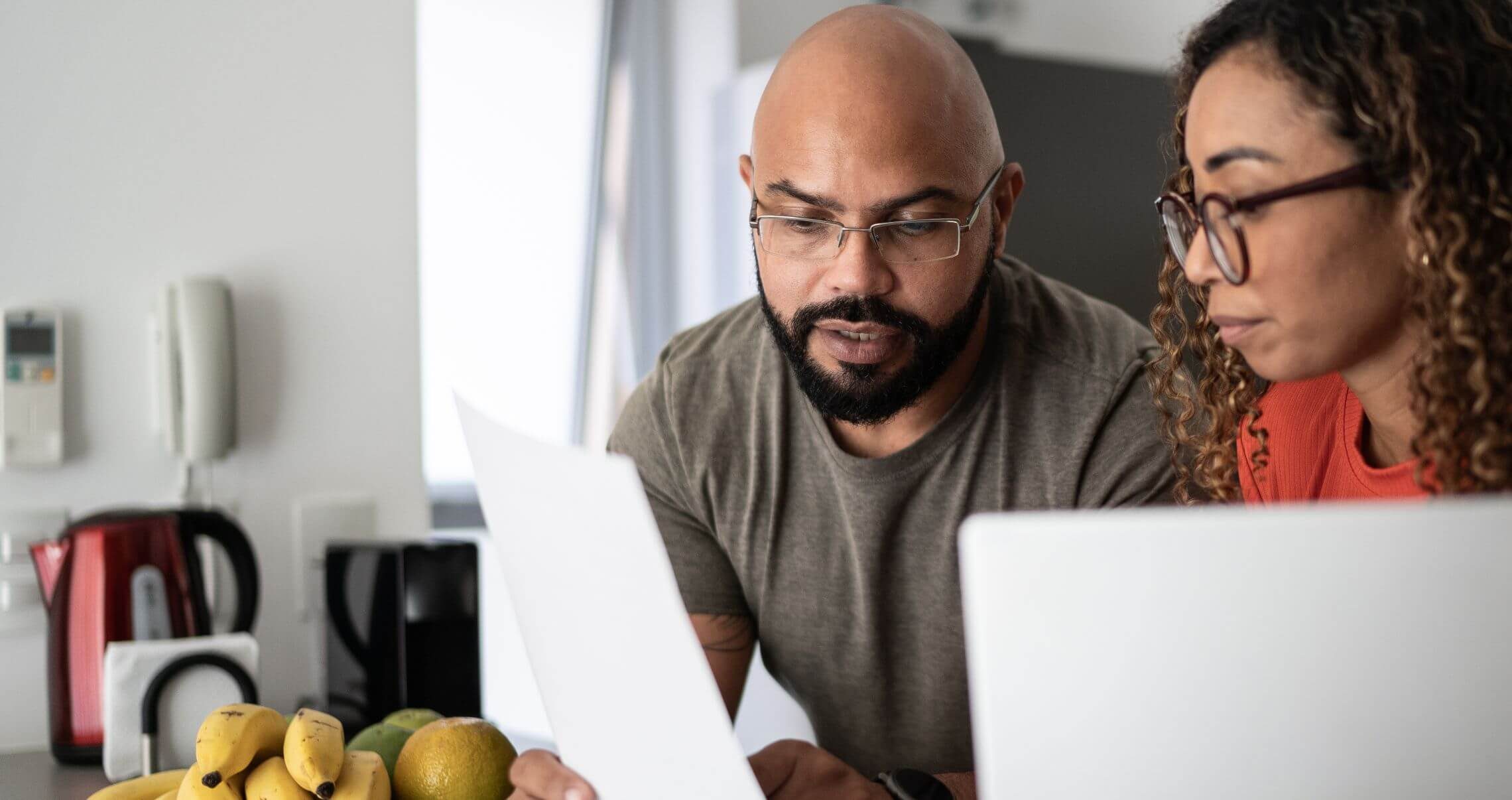

Managing Student Loan Debt To Buy Your First Home

Table of Contents

Assessing Your Financial Situation

Before you even begin dreaming of open houses, you need a clear picture of your current financial situation. This involves understanding your student loan debt and creating a realistic budget.

Understanding Your Student Loan Debt

The first step is to fully grasp the extent of your student loan debt. This means understanding the types of loans you have (federal loans, private loans), their interest rates, and your repayment plan (standard repayment, income-driven repayment). Different loan types have different repayment options and interest rates, significantly impacting your overall debt and monthly payments.

- Consolidating Loans: Explore the possibility of consolidating your federal student loans. This can simplify repayment by combining multiple loans into a single monthly payment. However, carefully weigh the pros and cons as consolidation may affect your interest rate.

- Locating Your Loan Servicer: Knowing who your loan servicer is crucial. They're responsible for processing your payments and answering your questions about your student loan repayment.

- Understanding Your Repayment Schedule: Familiarize yourself with your repayment schedule – the length of the repayment period and your monthly payment amount. This information is vital for budgeting effectively. Knowing your repayment schedule and the total cost of your student loan repayment is a cornerstone of financial planning.

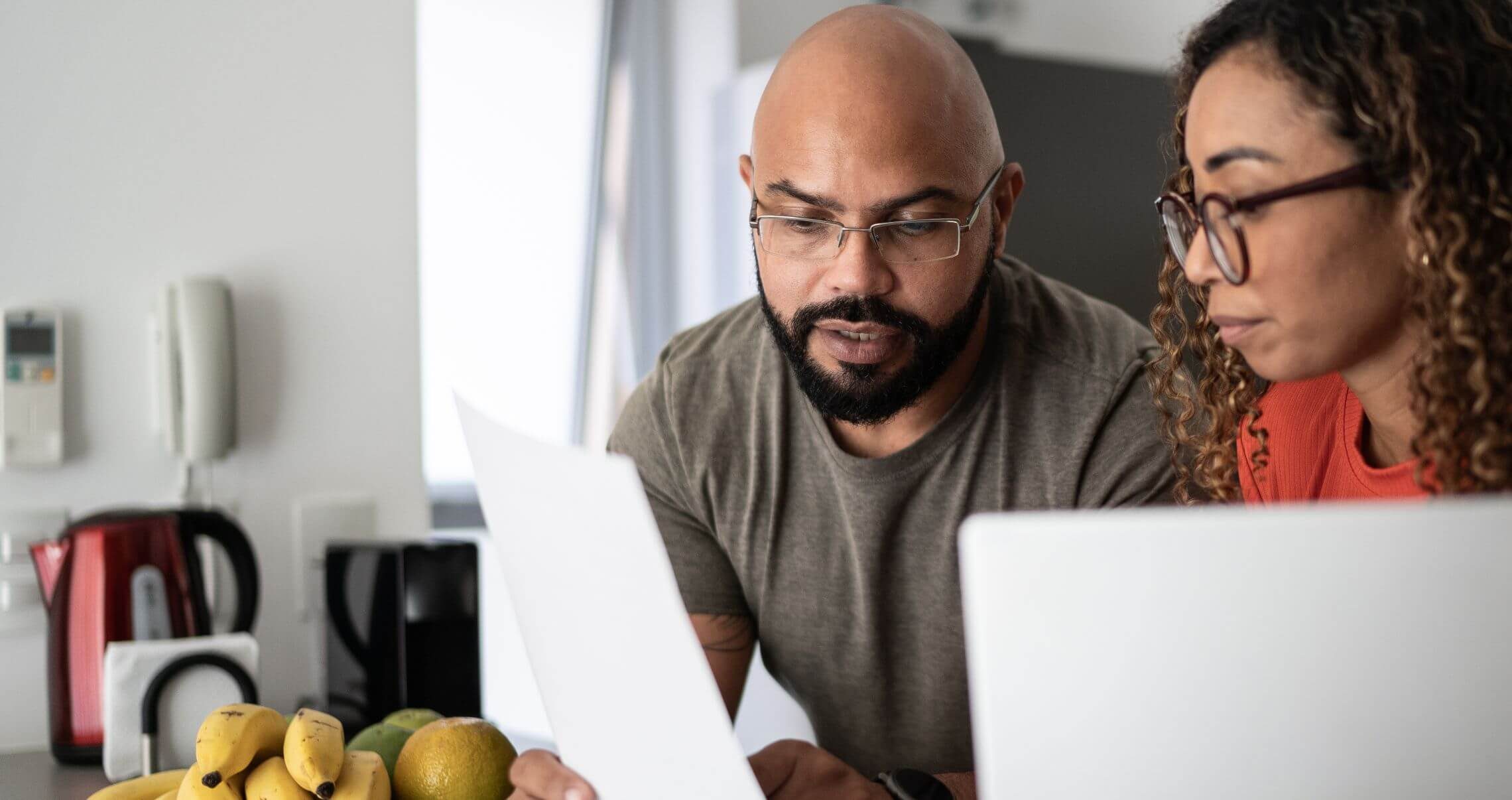

Creating a Realistic Budget

Creating a realistic budget is essential for both managing your student loan debt and saving for a down payment. Popular methods include the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment) and zero-based budgeting (allocating every dollar to a specific purpose).

- Utilizing Budgeting Apps: Many budgeting apps (Mint, YNAB, Personal Capital) can automate expense tracking and help you visualize your spending habits. These tools can be invaluable for identifying areas where you can cut back.

- Identifying Areas for Savings: Analyze your expenses and identify areas where you can reduce spending. This might involve cutting back on dining out, entertainment, or subscriptions. Even small savings can add up significantly over time, significantly contributing to your down payment savings.

- Saving for a Down Payment: A crucial part of budgeting for a home is dedicating a portion of your income to saving for a down payment. The larger your down payment, the lower your monthly mortgage payments will be.

Strategies for Reducing Student Loan Debt

Once you have a firm grasp of your finances, you can implement strategies to reduce your student loan debt and improve your creditworthiness.

Debt Reduction Methods

Two popular debt reduction methods are the debt avalanche and the debt snowball method.

- Debt Avalanche: This method focuses on paying off the loan with the highest interest rate first, minimizing the total interest paid over time.

- Debt Snowball: This method prioritizes paying off the smallest debt first, providing psychological motivation and faster feelings of progress.

Consider the following:

- Extra Principal Payments: Making extra payments towards your student loan principal can significantly reduce the amount of interest you pay and shorten your repayment period.

- Refinancing Options: Refinancing your student loans might lower your monthly payments or interest rate. However, be aware of the risks, such as losing federal loan protections. Always compare offers and understand the terms before refinancing.

Improving Your Credit Score

A good credit score is vital for securing a mortgage at a favorable interest rate. Your credit score directly impacts your eligibility for a home loan and the interest rate you'll receive.

- Paying Bills on Time: Consistent on-time payments are the most significant factor influencing your credit score.

- Keeping Credit Utilization Low: Maintain a low credit utilization ratio (the percentage of available credit you're using). Aim to keep it below 30%.

- Regularly Checking Your Credit Report: Regularly check your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) to identify and address any errors.

Navigating the Home Buying Process with Student Loan Debt

With a plan for managing your student loan debt in place, you can start to navigate the home buying process.

Saving for a Down Payment

Saving for a down payment is a crucial step. Even a small down payment can help you get into a home sooner.

- High-Yield Savings Accounts: Utilize high-yield savings accounts to maximize your interest earnings on your down payment savings.

- Down Payment Assistance Programs: Explore down payment assistance programs offered by government agencies or non-profit organizations. These programs can significantly reduce the amount you need to save for your down payment.

- Understanding Closing Costs: Be prepared for closing costs—fees associated with finalizing the home purchase. These can add up, so factor them into your budget.

Choosing the Right Mortgage

Choosing the right mortgage is a key step. Student loan debt will affect your eligibility for a loan, so careful planning is crucial.

- Mortgage Types: Research different mortgage types, such as conventional mortgages, FHA loans (Federal Housing Administration), and VA loans (Department of Veterans Affairs). Each has its own requirements and eligibility criteria.

- Comparing Interest Rates and Loan Terms: Compare interest rates and loan terms from different lenders to find the best deal. Your student loan debt may affect your approval chances, so it's essential to obtain mortgage pre-approval to understand the amount you can borrow.

- Pre-Approval Process: Getting pre-approved for a mortgage will help you understand how much you can afford and demonstrate your financial stability to potential sellers.

Conclusion

Successfully managing your student loan debt doesn't have to derail your dream of owning a home. By following these strategies—assessing your financial situation, employing effective debt reduction strategies, improving your credit score, and carefully navigating the home-buying process—you can achieve your goal of buying your first home. Start planning your financial future today and begin your journey towards managing your student loan debt to buy your first home. Seek professional financial advice if needed to create a personalized plan to achieve your homeownership goals and effectively manage your student loan debt.

Featured Posts

-

Could These Etfs Profit From Ubers Autonomous Vehicle Push

May 17, 2025

Could These Etfs Profit From Ubers Autonomous Vehicle Push

May 17, 2025 -

Nekretnine U Inostranstvu Gde Srbi Najvise Kupuju Stanove

May 17, 2025

Nekretnine U Inostranstvu Gde Srbi Najvise Kupuju Stanove

May 17, 2025 -

Pga Championship Struggles For Golfing Elite In First Round

May 17, 2025

Pga Championship Struggles For Golfing Elite In First Round

May 17, 2025 -

From Disaster To Success Thibodeaus Coaching Evolution And The Knicks Turnaround

May 17, 2025

From Disaster To Success Thibodeaus Coaching Evolution And The Knicks Turnaround

May 17, 2025 -

Ralph Lauren Fall 2025 The Riser Collections Impact On Fashion

May 17, 2025

Ralph Lauren Fall 2025 The Riser Collections Impact On Fashion

May 17, 2025

Latest Posts

-

Investing In The Future Of Transportation Uber And Driverless Etfs

May 17, 2025

Investing In The Future Of Transportation Uber And Driverless Etfs

May 17, 2025 -

Delhi And Mumbai Get Pet Friendly Uber Rides New Partnership With Heads Up For Tails

May 17, 2025

Delhi And Mumbai Get Pet Friendly Uber Rides New Partnership With Heads Up For Tails

May 17, 2025 -

Will Autonomous Vehicles Drive Etf Returns The Uber Case

May 17, 2025

Will Autonomous Vehicles Drive Etf Returns The Uber Case

May 17, 2025 -

Pet Friendly Uber Rides Now Available In Delhi And Mumbai A Partnership With Heads Up For Tails

May 17, 2025

Pet Friendly Uber Rides Now Available In Delhi And Mumbai A Partnership With Heads Up For Tails

May 17, 2025 -

Etfs And The Future Of Uber A Driverless Investment Strategy

May 17, 2025

Etfs And The Future Of Uber A Driverless Investment Strategy

May 17, 2025